DOUBLE TOPS AND BOTTOMS

How to trade with double top, bottom trading, Triple Top or bottom, W formation, M formation, Resistance leads downward

Course: [ Profitable Chart Patterns in Stock markets : Chapter 5. DOUBLE TOPS AND BOTTOMS ]

Among the most familiar chart patterns and yet among the most deceptive are the Double Tops and Bottoms. Experienced analysts have long recognized them as common patterns of market behavior at a turning point, or reversal, and therefore as highly valuable.

DOUBLE TOPS AND BOTTOMS

Among the

most familiar chart patterns and yet among the most deceptive are the Double

Tops and Bottoms. Experienced analysts have long recognized them as common

patterns of market behavior at a turning point, or reversal, and therefore as

highly valuable. Beginners love them because they tend to see Double Tops and

Bottoms everywhere.

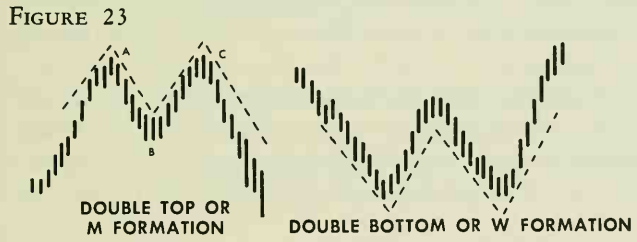

The Double

Top (Figure

23) resembles the letter M and is often called an M formation. Prices

rise sharply to a pivot A, fall back part way to B, rally to about the level of

A at point C, and then decline past the previous reaction low set by B.

Similarly, as might be expected, the Double Bottom is often called a W

formation.

Because

the normal movement of stocks on a daily chart takes the form of a zigzag line,

the beginning analyst may tend to read a Double Top or Bottom into every

movement. In actual practice, very few formations that start out looking

like Double Tops or Bottoms end up as true patterns. Furthermore, the true

ones are not easily diagnosed until the reversals in trend have become

pronounced and prices already have moved substantially.

One of

the main reasons for the trouble here is that, as we pointed out in a previous

chapter, a stock normally meets resistance at a previous high, and support at a

previous low. This often causes it to hesitate, or pull back a bit. But it may

be only a brief pause before the stock absorbs all the supply or demand waiting

at this point, and then easily penetrates the level and resumes its advance. To

the beginner, any hesitation may look like the top of an M or the bottom of a W.

More often than not, it is only routine price action within any one of a host

of other chart configurations.

Let’s

examine a true Double Top in terms of market psychology. The first peak

represents the price level where a big enough supply of stock was put on the

market to satisfy all demands and cause a moderate reaction. This reaction may

reflect selling based on a combination of motives, such as a fairly widespread

decision to cash in on profits, and a well-informed view that, for various

reasons, the stock has gone about as high as it’s likely to go for the time

being.

After the

reaction, "weak” holders of the stock may feel they missed an

opportunity to sell out at the top. When "bargain hunters” and

other optimists move in, running the price back to its previous peak, these

sellers who missed the first peak rush to unload. In addition, some of those

who sold the first time have more stock to offer at the same price. The supply

therefore again increases enough to drive the stock down. Now, if prices drop

down through the previous reaction low, it is clear that the demand for stock

at prices in the top area has been satisfied, and that the supply of stock is

still heavier than the demand. With an advance thus ruled out, the path of

least resistance leads downward.

VOLUME

The

normal volume pattern of a Double Top is a marked increase in trading around

each of the peaks. However— and here’s a big however a study of valid Double

Tops and Bottoms reveals a considerable variation in volume behavior. Trading

may be light on one peak, and heavy on the other. In fact, some very potent

tops and bottoms have formed on unusually light volume throughout. The best

rule appears to be this: Heavy volume around one or both peaks, or any unusual

change in volume, such as a notable drop-in activity, tends to confirm the

development of a Double Top or Bottom.

VARIATIONS

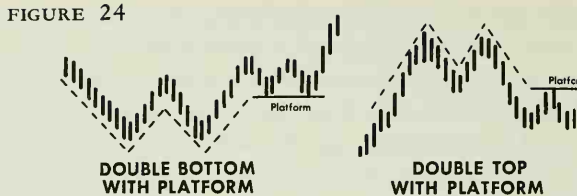

Many

Double Tops that form on daily charts show one peak slightly higher than the

other, but still, mark a true reversal pattern (Figure 24). Sometimes, a

stock that’s completing a Double Top or Bottom may hesitate, and build a small

platform, or congestion range, before the main move gets underway. This more

often occurs in a Double Bottom. The platform takes shape in the area just

beyond the middle leg of the W, or just at the breakout area.

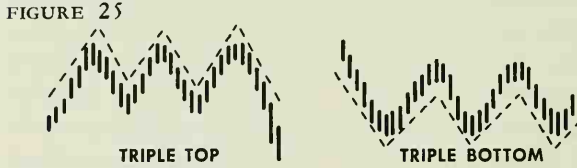

The Triple

Top or bottom is a well-known, and valid, variation (figure.25) on daily hi-low

charts, although somewhat rare on weekly or monthly range charts. In this case,

the stock declines from the second peak of what is shaping up as a Double Top but runs into support buying around the level of the previous low. Instead of

breaking through and completing the Double Top, it rallies to form the third

peak. Then it reacts again. By now, it has used up much of the demand existing

at the two previous lows, and it pushes down through. Volume may be high on the

first peak and is apt to be relatively low on the second and third peaks—

picking up, however, when the direction of the new major move has been set.

Profitable Chart Patterns in Stock markets : Chapter 5. DOUBLE TOPS AND BOTTOMS : Tag: Candlestick Pattern Trading, Stock Markets : How to trade with double top, bottom trading, Triple Top or bottom, W formation, M formation, Resistance leads downward - DOUBLE TOPS AND BOTTOMS