Head and Shoulders Pattern

How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline, Head and Shoulder Pattern, Left Shoulder, Right Shoulder

Course: [ Profitable Chart Patterns in Stock markets : Chapter 4. Head and Shoulders Pattern ]

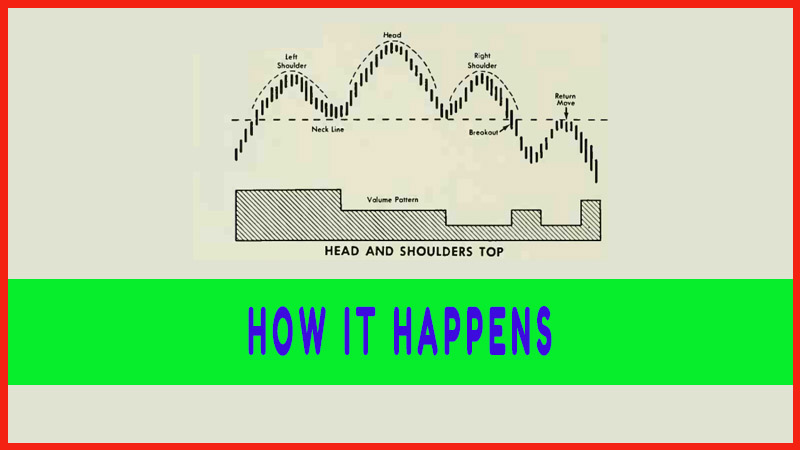

The chart patterns that signal a reversal of trend, the "Head and Shoulders” is by far the best known. It often stands out sharply, and it’s almost always possible to find one of them in the process of unfolding on some chart in one’s collection.

HEAD AND SHOULDERS

Of all

the chart patterns that signal a reversal of trend, the "Head and

Shoulders” is by far the best known. It often stands out sharply, and it’s

almost always possible to find one of them in the process of unfolding on some

chart in one’s collection. Experienced chartists are fond of it as among the

most reliable of indicators, while newcomers to chart analysis seize upon it as

an early opportunity to put their theories to a practical test in the market.

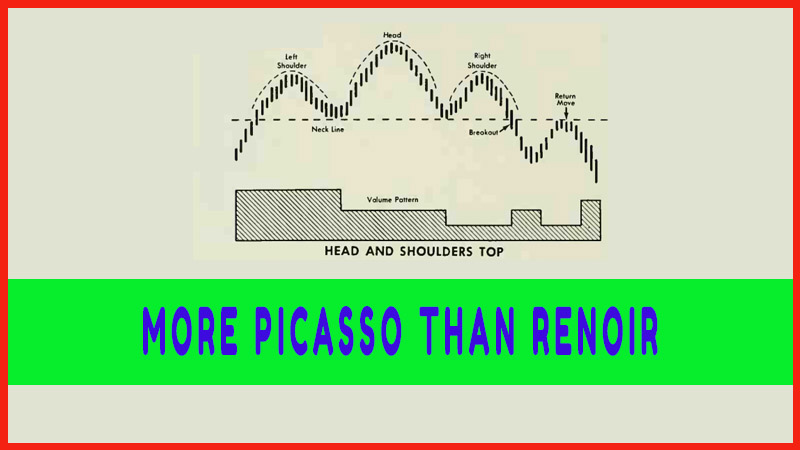

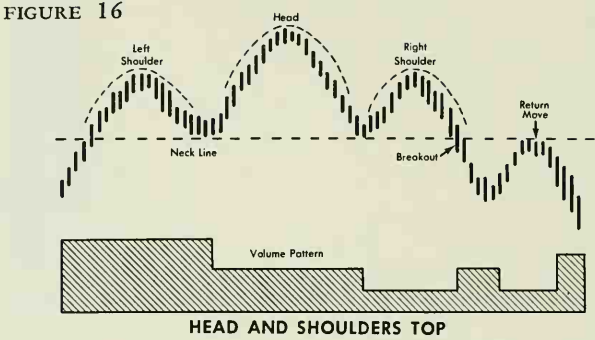

As in

abstract art, one should not expect the picture of a Head and Shoulder closely

to resemble the real thing. Over-simplified, a Head and Shoulders (right-side

up, as in Figure 16) simply portray three successive rallies and reactions,

with the second one reaching a higher point than either of the others. The

failure of the third rally to equal the peak of the second is a warning that a

major uptrend may have come to an end. Conversely, a bottom Head and Shoulders,

found upside down following a declining trend, suggests that an upturn lies

ahead. Let’s examine the three phases of the Head and Shoulders top in detail:

Left Shoulder

This

forms when an upturn of some duration reaches a climax in a rally, which is

followed by a reaction. Volume is important. It should expand materially on the

rally, and contract noticeably on the reaction. Overall volume is heavy during

the formation of the left shoulder.

The Head

A second

rally carries the stock higher than the first one but is followed by a

reaction that erases just about all the gain, leaving the price in the vicinity

of the previous low. Volume is high on the rally phase, but overall volume

usually is not quite so high as during the left shoulder.

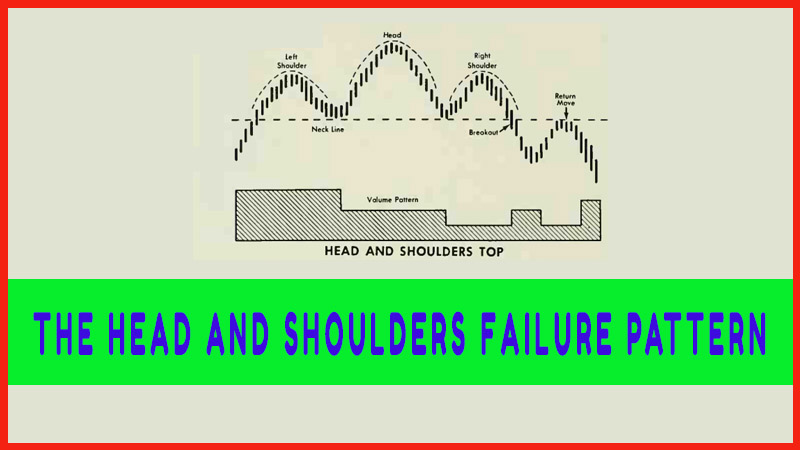

Right Shoulder

A third

rally fails to reach the height of the Head before another reaction sets m. The

formation of a right shoulder is a decided manifestation of weakness. Yet it is

in this area that most chart misreadings are apt to occur. These can be

avoided if particular attention is directed to volume during the building of

the right shoulder. If volume contracts noticeably on this rally, one may take

it as strong evidence that the price structure has been weakened. If, however,

the volume increases, beware of a false signal, no matter how ideally the

picture may have been unfolding.

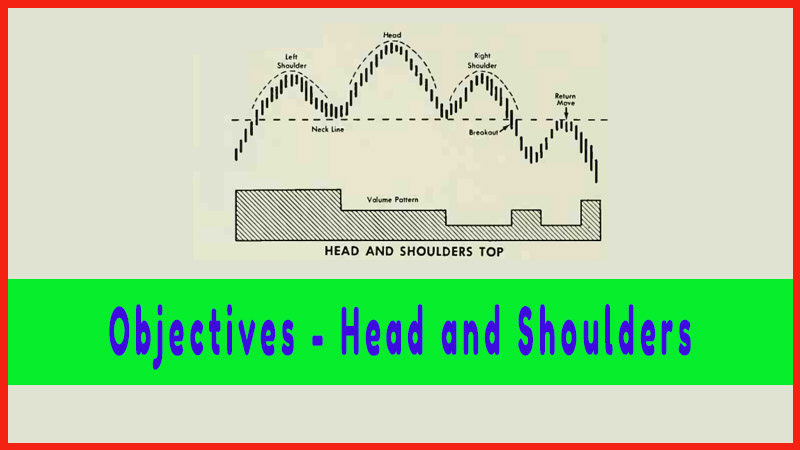

No Head

and Shoulders should be regarded as complete until the price breaks down below

a line drawn tangent with the low of the left and right shoulders. This is

called the Neckline. (Some advanced students believe it makes some difference

in degree whether the Neckline slants up or down, or is horizontal, but this is

debatable, and in any case, need not concern us here.)

Once the

Head and Shoulders are completed, more often than not a rally will carry the

price back to the Neckline. This is called the Return Move. Whether a stock

will make such a move often depends on conditions in the general market. If the

market as a whole is turning strongly upward, a return move in the stock is

quite likely. On the other hand, if the general tone is soft, there may be no

return move. The same applies to trends of the industry that includes this

stock: if it’s an oil, and the oils are rallying, we may look for a return

move, etc. Since outside factors must be considered, it’s not feasible to set

down a hard and fast rule.

Profitable Chart Patterns in Stock markets : Chapter 4. Head and Shoulders Pattern : Tag: Candlestick Pattern Trading, Stock Markets : How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline, Head and Shoulder Pattern, Left Shoulder, Right Shoulder - Head and Shoulders Pattern