How To Spot a Trend

How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline

Course: [ Profitable Chart Patterns in Stock markets : Chapter 2. Trends ]

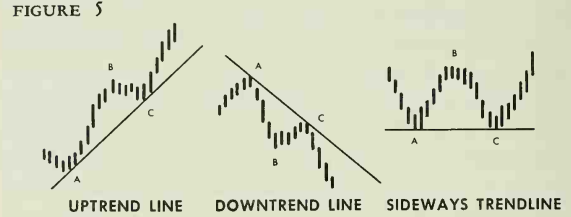

A stock’s normal wavy movement across the chart, as few as three points, each marking the top or bottom of a wave, may suggest the presence of a trendline; more are usually needed to confirm it.

HOW TO SPOT A TREND

In the

course of a stock’s normal wavy movement across the chart, as few as three

points, each marking the top or bottom of a wave, may suggest the presence of a

trendline; more are usually needed to confirm it. In Figure 5, note that in the

uptrend, the third point, C, becomes fixed at a higher level than the first

point, A. With only three points observed so far, the trendline may be

difficult to recognize until prices move away from Point C and in some cases

actually cross Point B. In the downtrend, Point C is lower than Point A. "Sideways,”

or horizontal trendlines may occur when Point C is even with Point A.

Please

note that the uptrend line is drawn by connecting the lower points of a stock

movement. A downtrend line must be drawn by connecting the higher points. This

is an important distinction. The inexperienced chart reader invariably—and

quite naturally—does the opposite, drawing uptrends from the upper limits and

downtrends from the lower ones. This technique appears to work at times, but

experience has shown it to be highly unreliable and of little use in precise

forecasting, where it is desired to determine at what point a stock is likely

to halt on its next swing. When a sideways trend forms, both upper and lower

points often conform to parallel, straight horizontal lines, but it is safer to

draw a sideways trendline along the low points, as one does for a hypothetical

uptrend.

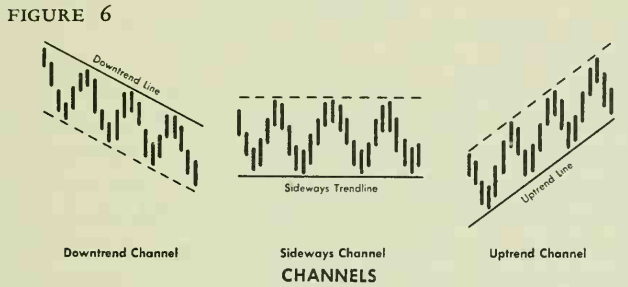

Figure 6

(page 31) shows how trendlines and channels would look on a daily basis

vertical line chart. Flow trendlines actually develop are shown in the charts

at the end of this chapter, all taken from actual market action. The heavy,

solid lines are the trendlines. The broken lines, which were drawn parallel to

the trendlines, help to outline channels. Briefly, channels are grooves or

ducts through which prices move as they zigzag along a trendline. Once a

trendline has been clearly established, a channel can usually be determined.

Needless to say, channels seldom occur as neatly defined as in the selected

charts shown in Figure 6, but when found, they are useful in suggesting at what

price to buy or sell, if the decision to buy or sell has been made.

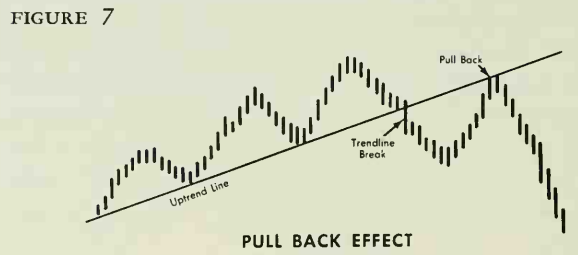

It is

perhaps obvious that the longer a stock has been moving along a given trend, or

within a given channel or groove, the stronger that trend is likely to be. For

this reason, trendlines on longer range charts such as weekly or monthly

high-low-and-close charts are usually more reliable than trendlines that form

on daily high-low-and-close charts. Trendlines that form in just a few weeks

cannot be expected to hold in the majority of instances. But, even when stocks

break away from an established line, and signal a true shift in direction, they

have a tendency to return to it. This magnetic attraction of the old trend,

this "pull-back

effect” common to trendlines, will be observed on the completion of

many of the formations covered in later chapters. An awareness of this movement

can help the timing of purchases and sales.

Profitable Chart Patterns in Stock markets : Chapter 2. Trends : Tag: Candlestick Pattern Trading, Stock Markets : How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline - How To Spot a Trend