LINE AND SAUCER FORMATIONS

chart reader’s dream patterns, Volume trading, Line bottom or long base, Line Top trading Method, demand for the stock

Course: [ Profitable Chart Patterns in Stock markets : Chapter 6. LINE AND SAUCER FORMATIONS ]

Lines and Saucers from the chart reader’s dream patterns. They’re easy to recognize, they’re reliable, they usually portend an extensive price move, and best of all they give the chartist plenty of time to assume a market position close to the bottom or top of the ensuing swing.

LINE AND SAUCER FORMATIONS

Lines and

Saucers from the chart reader’s dream patterns. They’re easy to recognize,

they’re reliable, they usually portend an extensive price move, and best of

all they give the chartist plenty of time to assume a market position close to

the bottom or top of the ensuing swing. They have only one major drawback:

they’re rare among popular, actively traded stocks.

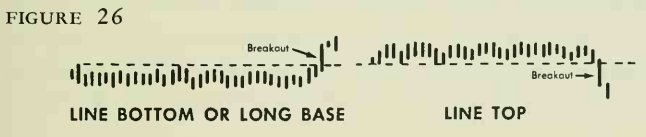

When a

Line Formation evolves into a major bottom, it is commonly called a long base.

This appears on the chart as a long sideways movement of prices within a narrow

range, followed by a sudden eruption into new high ground, well above the preceding

price range. Sometimes, although rarely, a line formation will form a major

top, in which case it will look like one of our Western mesas, or plateaus.

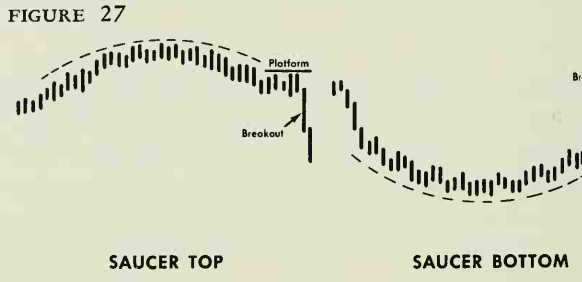

The

Saucer, or "rounding turn,” is closely related to the Line Formation,

but has its own characteristics and may form much more quickly. (See Figure 27.)

Prices forming a saucer gradually curve upward (in the case of a bottom

formation) or downward (in the case of a top). The curve, of course, tips off

the probable direction of the major move to come. There’s another picturesque

feature. A great majority of Saucers (not quite all) develop a Handle or

Platform, consisting of either a horizontal or slanted line before the main

move gets underway. Perhaps the formation should be called a Saucepan, instead.

HOW IT HAPPENS

As with

all valid chart patterns, these stem from typical market psychology in certain

situations. For example, the Line Bottom, or "long base,” occurs

when the supply of and demand for a stock are in a very stable balance. There

is little trading in the stock because there has been no change in its

outlook, for better or worse, and no news to draw attention to it. Stockholders

see little reason to sell at the current price level, and potential buyers see

little reason to buy, especially if they must bid the price up to smoke out any

sellers. A breakout from this long base on increased volume probably means that

something is brewing a new product, a jump in sales or profits, a merger, and

this rumor or fact have produced an unusual demand for the stock. Incidentally,

such breakouts are rarely accompanied by company announcements that come

later. Frequently, "insiders” have been quietly adding to their

holdings during the "long base” period. At any rate, someone in the

know is buying, and sooner or later, the facts become known to more and more

people, and the price begins to take off.

VOLUME

A tidy

characteristic of the Line and Saucer formations is that the volume portion of

the chart tends to follow the price. Throughout a Line or base formation,

volume is always exceptionally low until the breakout into new high ground.

Even then, trading may be relatively light at the outset, but it soon expands

dramatically.

In a

typical Saucer, on the other hand, trading slowly diminishes to a low at the turn

of the formation, then gradually picks up as prices curve to complete the

pattern or move to the Platform stage. The volume thus has formed a saucer itself.

It may become quite active at the start of the Platform, and again at the end,

as the stock breaks out of the Platform area.

At the

outset, we noted that the Line and Saucer formations were easily recognizable,

and we have discussed how to recognize them. Now, a mild word of caution. One

should never take a pattern of any kind for granted until it is nearly

completed. This applies even to so simple a formation as the Line or long

base. A stock may appear to be developing one but evolve into an entirely

different formation in short order.

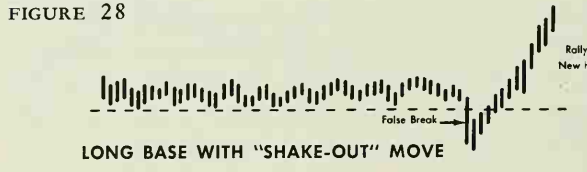

There is

an interesting variation of the base formation that deserves comment. On

occasion, just before the breakout move, there will be a "shakeout,”—that

is, a false swing in the opposite direction, which may "shake out”

timid or ill-informed stockholders. (See Figure 28.) During this shakeout, prices

drop to a new low. Then they rally through the base range and into new high

ground, on high volume. Despite the weakness displayed by the brief dip, this

variation can result in as great a rally as the more orthodox base formation.

Profitable Chart Patterns in Stock markets : Chapter 6. LINE AND SAUCER FORMATIONS : Tag: Candlestick Pattern Trading, Stock Markets : chart reader’s dream patterns, Volume trading, Line bottom or long base, Line Top trading Method, demand for the stock - LINE AND SAUCER FORMATIONS