Market Tactics

buy at the bottom and sell at the top, How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline

Course: [ Profitable Chart Patterns in Stock markets : Chapter 2. Trends ]

New stock purchases can be made and previous investments should be held. Any break in a trendline flashes the amber caution light, especially if the break is on increased volume. New purchases should be deferred, and existing stockholdings should be re-examined.

MARKET TACTICS

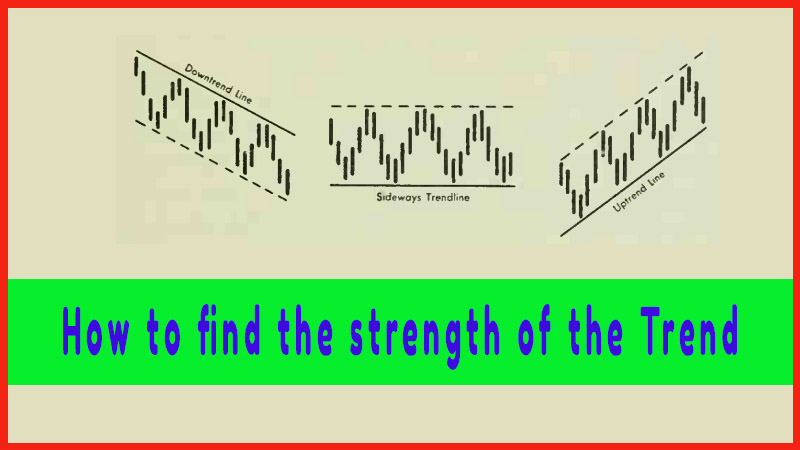

Like a

traffic light, the chart advises the knowledgeable investor when to go ahead,

slow down or stop. As long as an established upward trendline is intact, the

traffic signal is bright green. New stock purchases can be made and previous

investments should be held. Any break in a trendline flashes the amber caution

light, especially if the break is on increased volume. New purchases should be

deferred, and existing stockholdings should be re-examined. The longer the

trendline has held, the more significant will be the eventual breaking of this

line as a "bear” signal. Finally, evidence that a downtrend is

developing flashes the red light, indicating that it’s time to sell and cash in

on profits, or take other defensive measures to avoid losses. (Brokers are

familiar with such defensive steps as selling short "against the box,”

and buying "puts and calls,” which need not be discussed here.)

Assuming

that one has decided to buy or sell a stock, he may gain an advantage of as

much as several dollars a share by being familiar with the trend channel

through which the stock has been fluctuating. He would buy at the bottom of the

channel, and sell at the top. And of course, the break of a trendline or the

return move to a trendline may represent highly favorable buying or selling

opportunities.

To "buy

at the bottom and sell at the top” of major price moves is of course the

unattainable dream of all investors. To try for the last eighth of a point is

unwise, and unnecessary. The investor should use imagination at all times, and

avoid being bound by hard and fast rules, or fascinated by a formula that

offers too precise a forecast of prices. But the trendline is the first and

most significant picture to be looked for in any systematic approach to chart

reading.

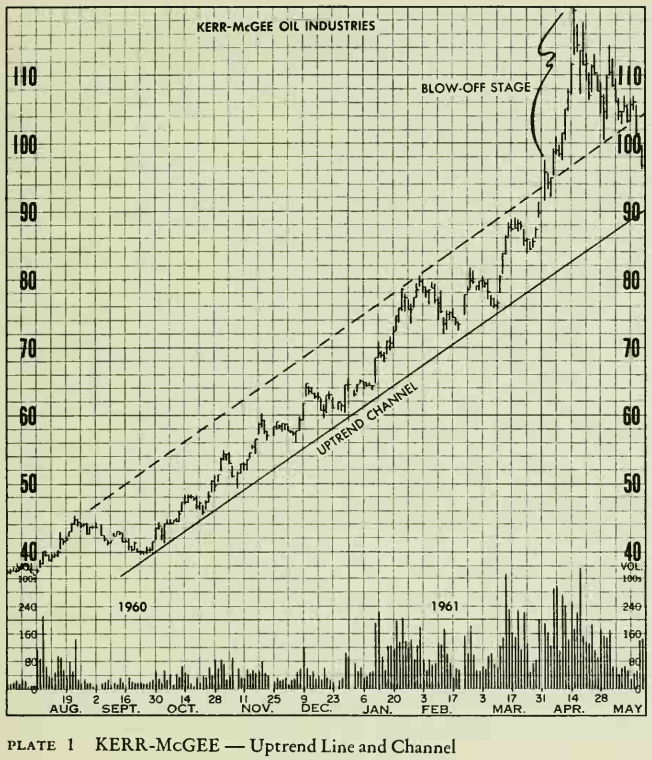

The chart

above shows how Kerr-McGee Oil tripled in value in less than seven months. For

the first six months, prices adhered remarkably close to an imaginary uptrend

line (heavy line) and within the confines of a relatively narrow channel

(outlined by the dotted line drawn parallel to trendline). Further examination

will reveal that the trendline was well established within the first month of

the advance. In April, 1961, prices broke through the upside of the channel and

accelerated into a blow-off or climax phase of development. This type of action

often marks a temporary or major top. The vertical part of the rise was

attributed to anticipation of a 2 for 1 stock split, which became effective May

31. By early 1962, prices were still well below the highs recorded on this

chart.

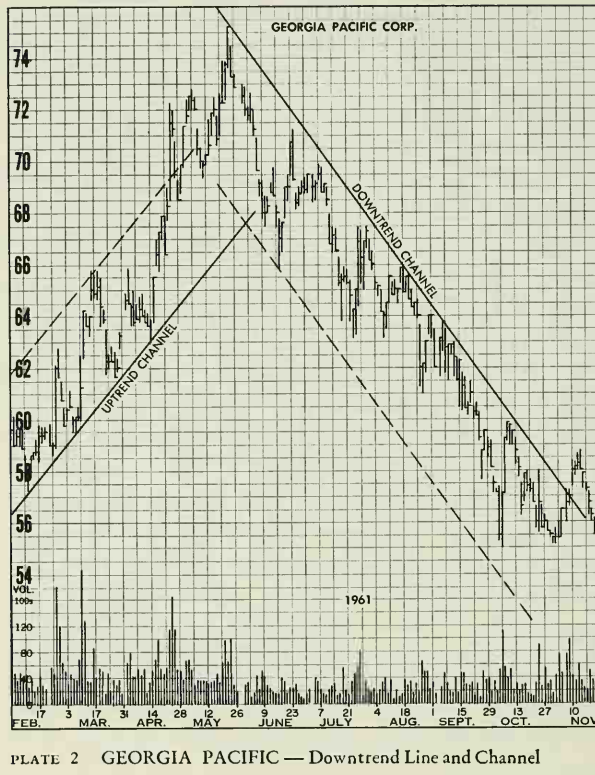

Note how

prices broke through the upper limit of the uptrend channel at the end of April

and, as in the Kerr-McGee chart on the preceding page, this proved to be the

start of a "blow-off” which signaled the end of an upswing. Price

movements on the downswing stage appeared to be glued to the trendline except

for occasional sharp reactions and rallies which served to outline the over-all

channel development. This situation proved rather ideal for market tactics based

on buying stocks as they hit the lower rims of channels and selling as they

approach the upper limits. After the long downtrend line was finally broken by

the rally of the first week in November, prices "pulled back"

to the trendline at the end of November. Also note how the volume pattern

changed in November—increasing on rallies and decreasing on declines.

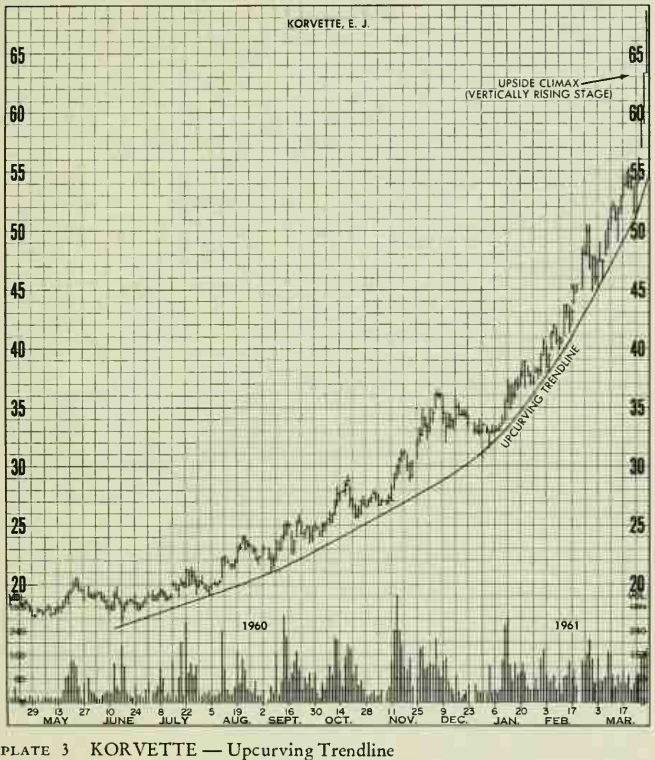

The

uptrend which got under way in July and August was preceded by a sideways price

movement of several months’ duration. The curving was gradual until January, of

1961, when Korvette started to curve sharply higher and by the end of Match

entered a "blow-off” stage, characterized by a vertical price rise,

which marks either a temporary or major turn. As explained in Chapter 2,

the curving uptrend line usually leads to this type of market action, but

pinpointing the end of the vertically rising stage is extremely difficult,

since it can carry a considerable distance in a very short time. In the case

above, the high on the last day charted (68![]() ) proved to be a temporary top.

Prices reacted all the way back to 47% in June, 1961, before again turning up

to an eventual 1961 high of $129.

) proved to be a temporary top.

Prices reacted all the way back to 47% in June, 1961, before again turning up

to an eventual 1961 high of $129.

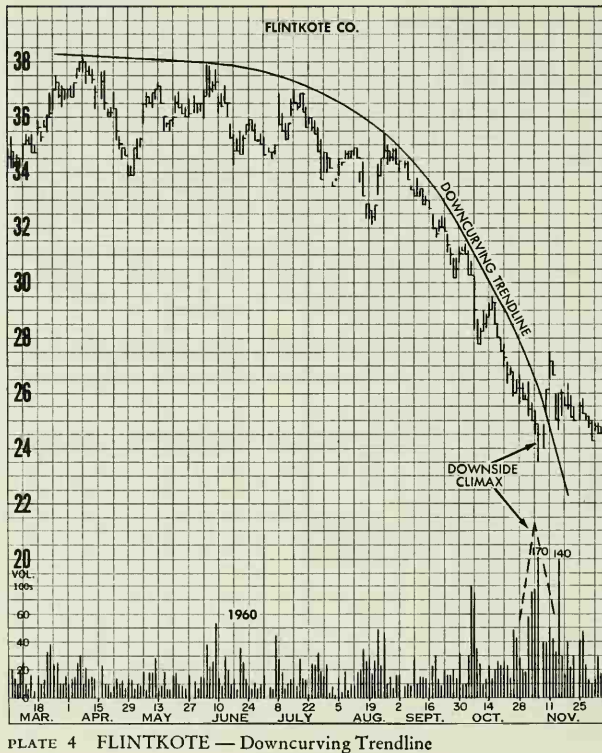

The curving downtrend line starts off the same way as the uptrend variety. There is a very gradual curving along the top of the formation and this becomes steeper as the move progresses. As in the chart above, volume remains relatively stable until the decline is well under way and then begins to pick up as the climax stage is reached. The upcurving trendline on the Korvette chart (plate 3) climaxed with very sharp moves but not unusually high volume. In Flintkote, the climax occurred on exceptionally high volume, but day-to-day price moves were not unusual. Climaxes are marked by either wide price moves or exceptional volume or both.

Profitable Chart Patterns in Stock markets : Chapter 2. Trends : Tag: Candlestick Pattern Trading, Stock Markets : buy at the bottom and sell at the top, How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline - Market Tactics