TACTICS - Head and Shoulders

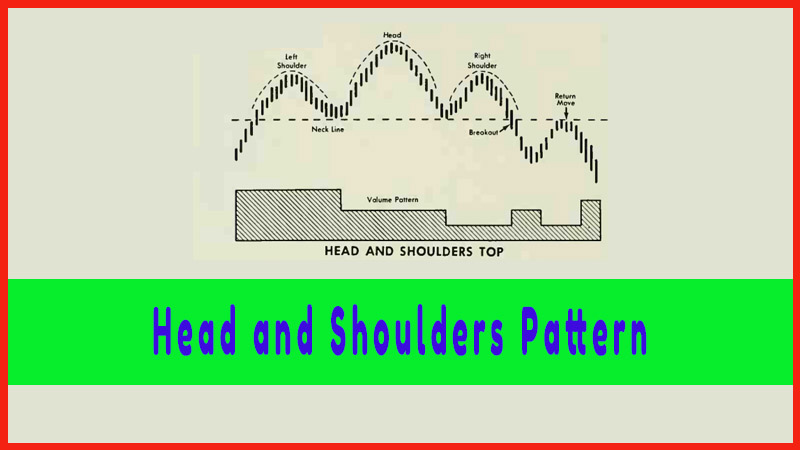

How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline, Head and Shoulder Pattern, Left Shoulder, Right Shoulder

Course: [ Profitable Chart Patterns in Stock markets : Chapter 4. Head and Shoulders Pattern ]

It’s time now to put our theory to work. For review, we present at the end of the chapter the actual case histories of six stocks. These charts were selected to illustrate interesting chart formations and problems in computing objectives.

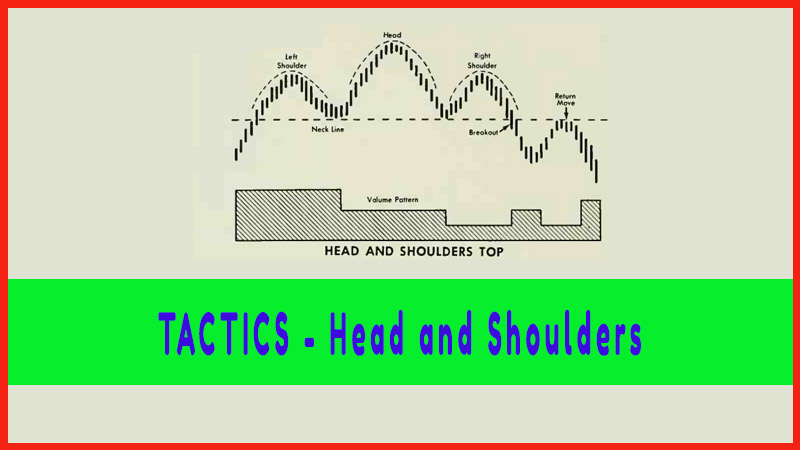

TACTICS

It’s time

now to put our theory to work. For review, we present at the end of the chapter the actual case histories of six stocks. These charts were selected to illustrate

interesting chart formations and problems in computing objectives. No doubt

other stock charts would have served as well, if not better, but given

basically similar patterns, the principles and results would have been the

same.

Our

Head-and-Shoulders theory, and a study of these case histories, demonstrate an

obvious conclusion: The investor should make his commitment, as a general rule,

when a stock breaks through the Neckline.

However,

an alert and experienced investor may act as early as during the formation of

the Right Shoulder, if there is strong reason to believe that the formation

will be completed. Such reason will exist if

1.

The relationship of the current price to the

historic price scale is favorable to a reversal of the previous extended trend.

2.

The previous trend has run into strong

support or resistance.

3.

Volume indications have been measuring up to

standards for Head and Shoulder formation.

4.

The general market is neutral or headed in

the direction opposite the one that our stock had been following before the

Head and Shoulders began to form.

In such a

case, the investor may take action very close to the top or bottom of a major

swing, which would be calling his shots very neatly, indeed.

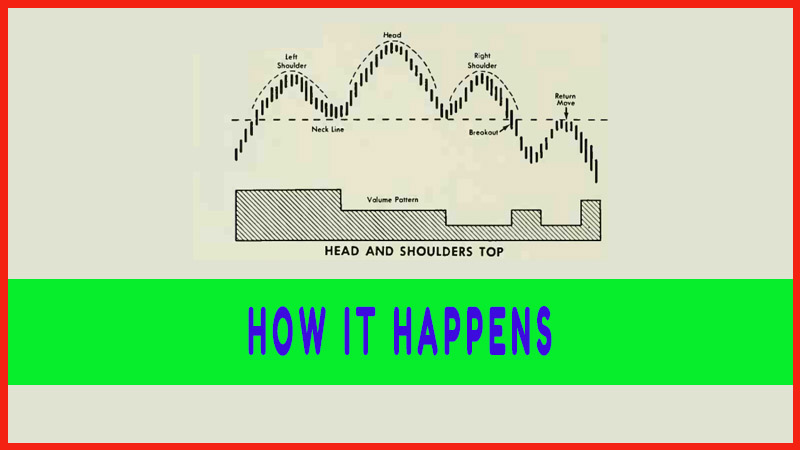

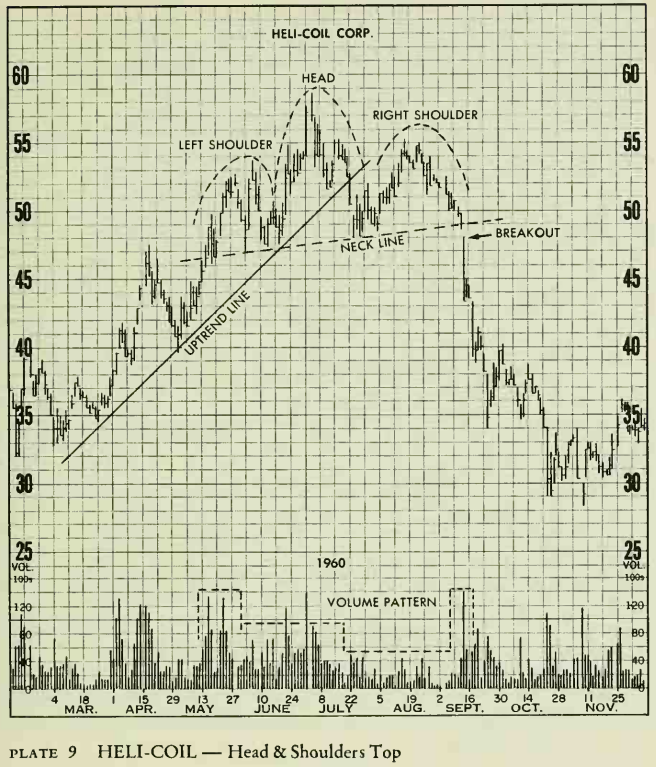

This

large and well-defined Head & Shoulders top can be easily identified

without the superimposed outline and labels. For the chartist following prices

in June, the change in volume pattern might have alerted him to a possible

change in trend. The rally to new highs was accompanied by somewhat reduced

volume, compared with the previous rally in May. Then the breaking of the

trendline on July 22 lent confirmation that the advance was in danger of

reversing. The third important clue was the building of the right shoulder on

very low volume. And finally, the breaking of the neckline, which in this case

was also a valid support line, left little doubt that selling pressure, or the

supply of stock, was then greater than buying pressure, or the demand. In this

case, the third clue—the right shoulder on unusually low volume—should have

been sufficient chart evidence for one to anticipate the pattern and take

profits not far from the top of the move.

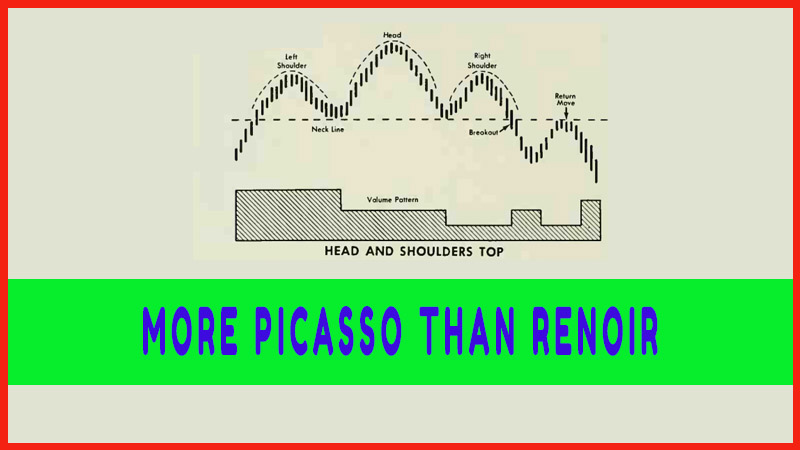

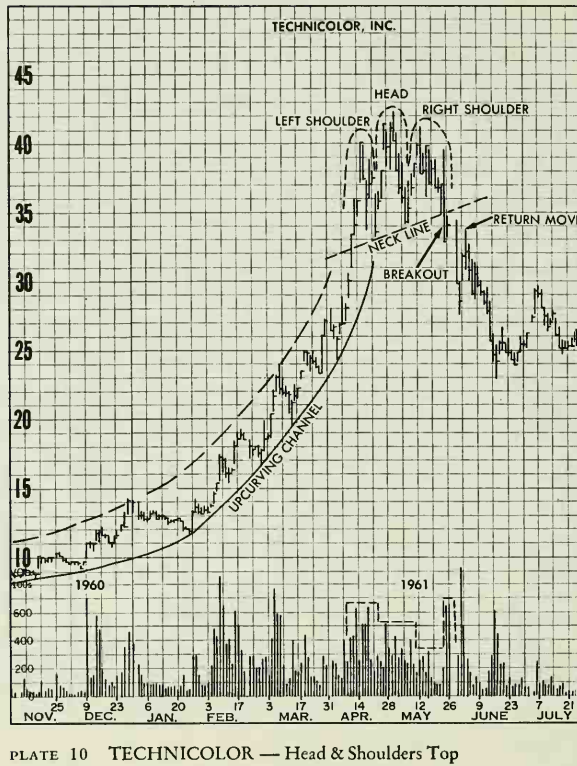

In price

and volume behavior, this April-May top was almost an ideal Head &

Shoulders formation, yet the closeness of the shoulders to the head (1 to 2

points) could argue strongly for those who see Triple Tops. As can be seen from

the chart, prices formed a well-defined up-curving trendline and channel,

reaching a climax with vertically rising prices on high volume. High volume

also marked the left shoulder. The activity was progressively lower for the head

and right shoulder. The breaking of the neckline was on high volume and the

return on lower volume. Although not shown, prices rallied in October for a

test of the top pattern (now a resistance area) and were thrown back from about

the 36 levels, eventually declining to around 21.

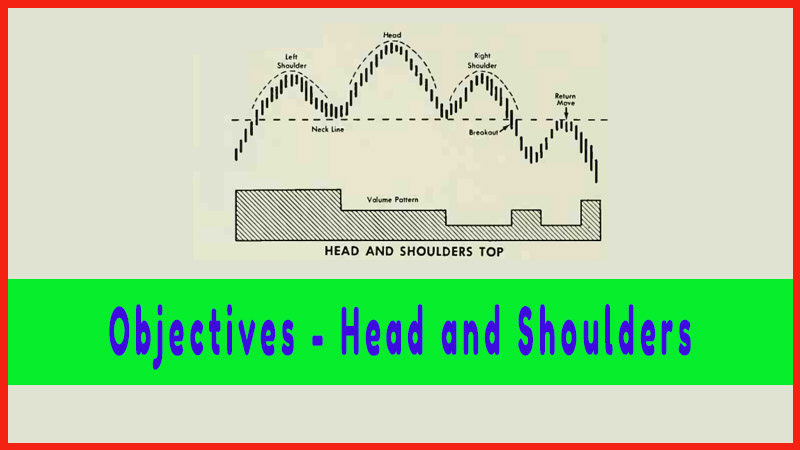

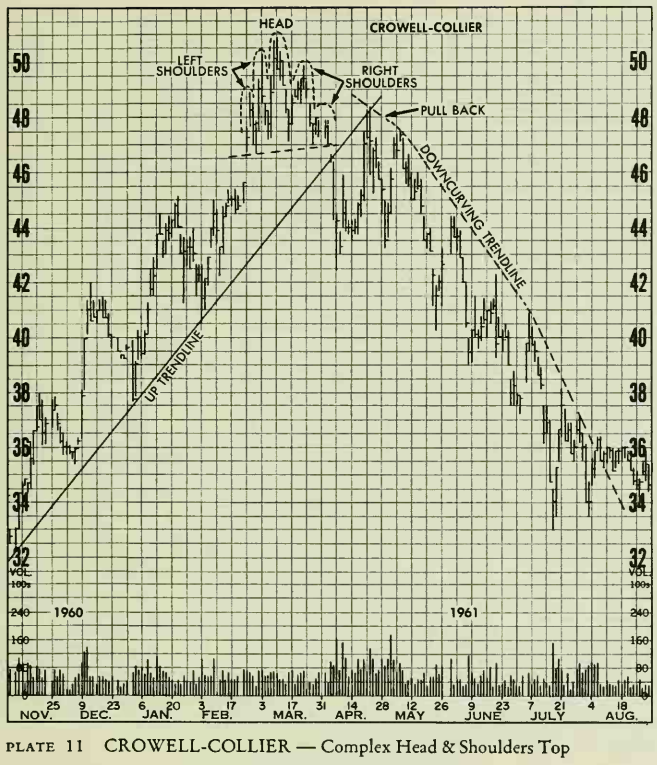

If all

formations were this clear, chart reading would be a snap. From November

through March, prices followed an uptrend line as if they were glued to it.

Then a small Head & Shoulders top formed and prices broke the neckline and

the long uptrend line simultaneously. This reversed the trend, and prices then

closely traced out a downcurving trendline. The Head & Shoulders top here

has two left and two right shoulders, which are interesting for their symmetry.

But the characteristic Head & Shoulders volume pattern is missing, which

would support those analysts who prefer to call this formation a Triple Top.

Also, note how the "return move” did not stop at the neckline, but

did halt exactly at the previous major uptrend line, illustrating the magnetic

pullback effect common to most trendline breaks. Whether one called it a Head

& Shoulders or a Triple Top, the forecasting implications were the same.

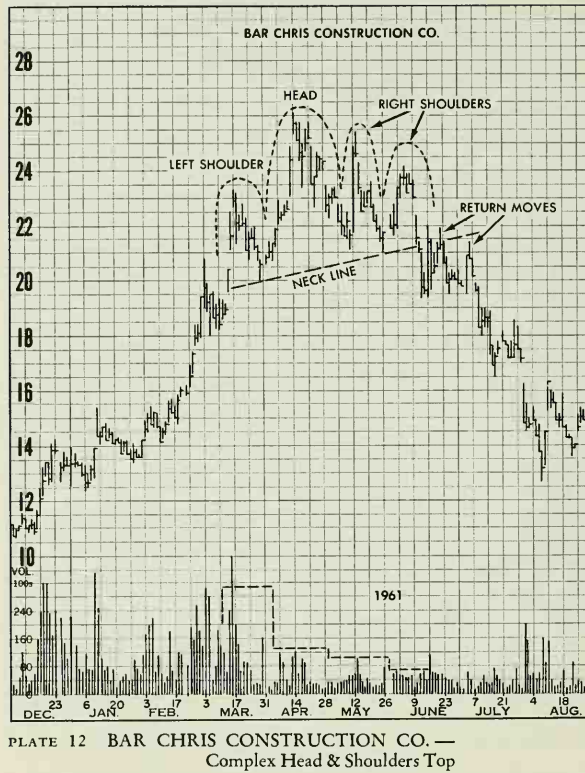

This is

another chart where an upcurving trendline climaxed and led to a Head &

Shoulders top. This one has only one left shoulder, but two right shoulders.

Coincidentally, after the neckline was broken in June, there were two return moves,

apparently balancing the two right shoulders. This should not be taken as

typical. As a matter of fact, more often than not, Head & Shoulder tops

don’t have a return move, even the complex varieties. This top proved to be

quite potent. By February, 1962, prices dropped to $9, completely wiping out

the 1961 advance. After the reader has finished this book, a review of this

chart will disclose Flags, Pennants, Triangles, Measuring Gaps and Exhaust

Gaps.

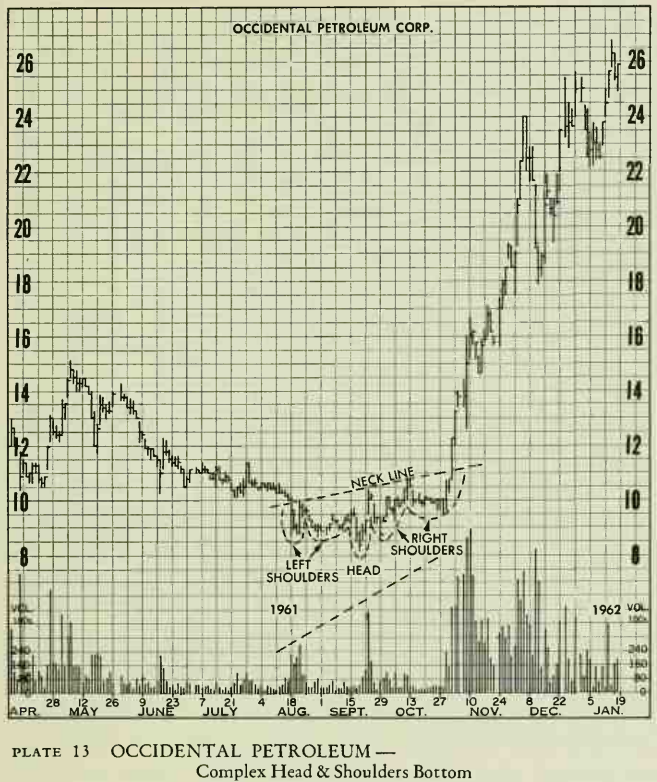

This Head

& Shoulders bottom has two left shoulders, one head and two right

shoulders, and it is upslanting. The breakthrough of the neckline came on

tremendous volume and there was no return move to the neckline after the

breakout. The price rose to 24 virtually without interruption, on feverish

volume. The stock price just about tripled in twelve weeks. Any slowdown of an

advance accompanied by such high volume would be considered an adverse

development, since it would mean that the supply of stock was sufficient to

meet the most urgent demand. The more advanced chartist will also note the

formation of a small Diamond within the overall complex Head & Shoulders

bottom. In this case, the Diamond was overshadowed by the longer formation and

has little chart significance. Other patterns often form within Heads &

Shoulders, especially Triangles.

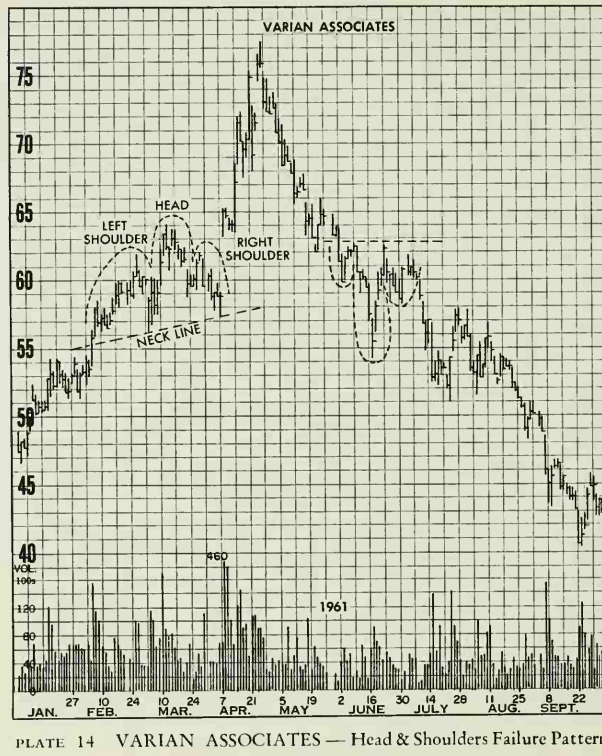

This illustration contains two interesting examples of Head & Shoulders failure patterns. A Head & Shoulders top appeared to be forming between February and April. Just as prices were easing for a test of the "neckline'', prices opened on April 8. 4 points higher than the previous day's close, on tremendous volume. Prices jumped above the right shoulder and head, thus signaling a strong advance. Again (in June.) and around the same level, prices attempted to outline a Head & Shoulders bottom, but before the neckline could be broken, prices reacted sharply to new lows, thus tipping off a resumption of the decline. (After completing chapter 7, you will be able to identify the top as a true V formation.)

Profitable Chart Patterns in Stock markets : Chapter 4. Head and Shoulders Pattern : Tag: Candlestick Pattern Trading, Stock Markets : How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline, Head and Shoulder Pattern, Left Shoulder, Right Shoulder - TACTICS - Head and Shoulders