THE COIL (OR TRIANGLE)

Inverted Triangle, Symmetrical Triangle, Ascending Triangle, Descending Triangle, line of supply

Course: [ Profitable Chart Patterns in Stock markets : Chapter 9. THE COIL (OR TRIANGLE) ]

When a stock fluctuates in progressively smaller price ranges, it is in effect winding up like a spring in a mechanical toy. And just as a wound spring holds enough tension to move the toy, a coiling action in a stock can propel prices. In the toy, the tension is mechanical.

THE COIL (OR TRIANGLE)

When a

stock fluctuates in progressively smaller price ranges, it is in effect winding

up like a spring in a mechanical toy. And just as a wound spring holds enough

tension to move the toy, a coiling action in stock can propel prices. In the

toy, the tension is mechanical. In the market, the tension builds on the

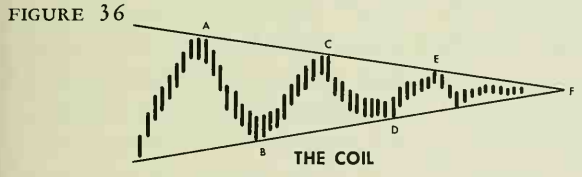

increasing uncertainties of buyers and sellers. A typical coil (or triangle)

looks like this:

Invariably,

a coil follows an advancing or declining phase of market action. In the example

shown, prices are depicted as advancing to Point A, where evidently buying has

dried up, and perhaps profit-taking develops. Here, a measure of uncertainty

has been introduced in the minds of the "bulls.” The reaction to B

halts the profit-taking and attracts new buying. The ensuing rally to C upsets

those who fear prices are too high. The decline from C to D increases

anxiety among the bulls, and the rally to E has the same effect on the "bears.”

Meanwhile, the volume has steadily decreased through the coil as buyers and sellers

alike become more uncertain about the future direction of prices. At the apex

of the coil, Point F, buying and selling pressure for the moment reach complete

balance. At this point, it takes very little new buying or selling to tip the

balance and create a fairly sharp rally or decline. This accounts for the great

difficulty of making a definitive price forecast from a coil.

WHICH WAY NOW?

More

often than not—perhaps 60% of the time—this balance between supply and demand

is only temporary and represents nothing more than a pause in the long-range

trend of prices. Therefore, coils are often regarded as indications of a

continuation of the prevailing trend. But the other 40% of the time, coils

become parts of other formations or mark bonafide reversals. Even in such

cases, the coil represents a balance between supply and demand, which has made

the market sensitive to any new bullish or bearish influence. In some cases,

the breakout itself, even though it was caused by small buying or selling, may

be sufficient to swing a market sentiment that is evenly divided or uncertain.

While the

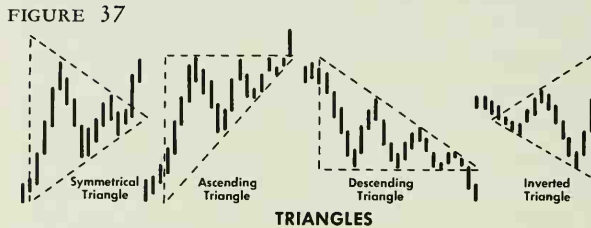

word Coil suggests the spring action of this pattern, Triangle becomes more

useful for further analysis. Now, the Triangle assumes one of four basic shapes

on a stock chart: the Symmetrical (or Isosceles) Triangle, the Ascending

Triangle, the Descending Triangle, and the Inverted Triangle, or Funnel. They

appear as follows:

Symmetrical Triangle:

Lines

drawn connecting the rally peaks and the reactionary lows tend to converge on

the apex, or dead center, of the pattern. When the price breaks outside one of

these lines —preferably on increased volume, the formation is regarded as

completed.

Ascending Triangle:

Here the

top line, ideally, is horizontal, while the bottom line slants up to meet it.

The picture suggests a “line of supply” available at the price

represented by the top line, while demand becomes more aggressive—that is, more

willing to meet the supply price—as time goes on. When demand finally overcomes

the supply at that level, the price breaks above it, completing the formation.

Volume remains relatively low during the formation, and should pick up on the

breakout.

Descending Triangle:

The

opposite of the Ascending Triangle, it foreshadows a renewed decline. The lower

line is a line of support, or demand. The supply, or offers to sell, become

more aggressive with the passing of time. As sellers lower their ideas as to

the value of the stock, the price works down until support gives way, the price

breaks through the lower line, and the formation is completed. Again, volume

tends to decline as the formation develops, and to pick up on the breakout.

Inverted Triangle:

While

this figure, which may also be called a Funnel, looks like a normal Triangle

turned backwards, it represents quite a different situation—a very nervous and

uncertain market. In this case, volume rises as the price swings grow wider.

Profitable Chart Patterns in Stock markets : Chapter 9. THE COIL (OR TRIANGLE) : Tag: Candlestick Pattern Trading, Stock Markets : Inverted Triangle, Symmetrical Triangle, Ascending Triangle, Descending Triangle, line of supply - THE COIL (OR TRIANGLE)