THE EXTENDED V FORMATION

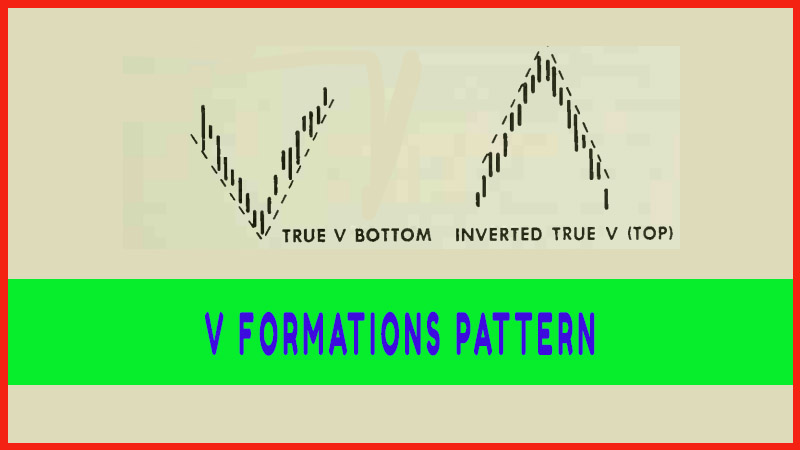

INVERTED TRUE V, Uptrend trading, Pilot, Downtrend trading, THE TRUE V FORMATION

Course: [ Profitable Chart Patterns in Stock markets : Chapter 7. V FORMATIONS ]

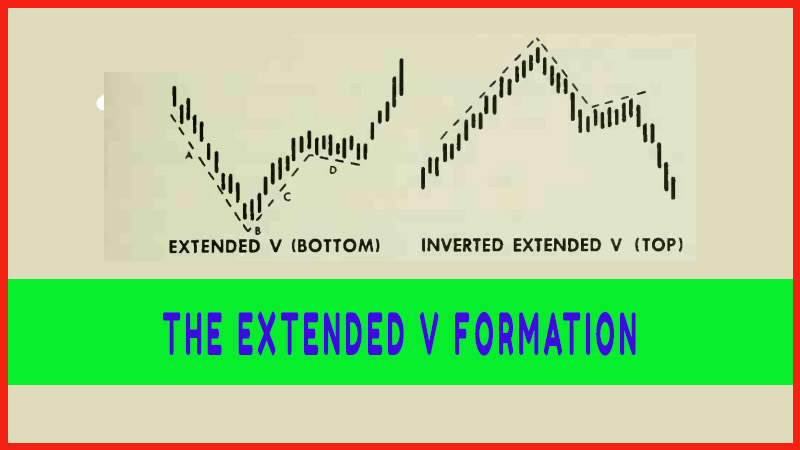

No less potent than the True V, the Extended V lends itself more readily to accurate forecasting because of one significant difference. This comes after the pivot, when the stock has penetrated up through the downtrend line, as described just above.

THE EXTENDED V FORMATION

No less

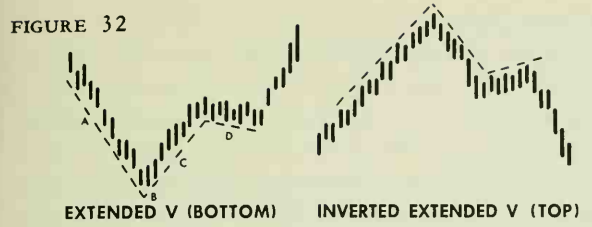

potent than the True V, the Extended V (Figure 32) lends itself more readily to

accurate forecasting because of one significant difference. This comes after the

pivot when the stock has penetrated up through the downtrend line, as

described just above. In True V, the upward move begins more or less

immediately. In the Extended V, a fairly sizable lateral trading range

develops. Eventually, the stock breaks out above the tops of this trading

range, thus completing the formation. In detail, the four components of an

Extended V are:

·

Downtrend: As in the True V, this may be

steep or irregular. In a good many cases though far from all the downtrend is

interrupted by a “sideways” or “consolidation” phase a short distance before

the final low.

·

Pivot: Again as in the True V, the

turn often comes in a single day, but sometimes takes several days. Volume

behavior is similar: usually up sharply.

·

Initial Markup: The stock price pushes up

through either (1) a downtrend line drawn along the rally peaks of the preceding

decline or (2) a line marking the top of the "sideways” or

"consolidation” phase that formed just before the pivot. Volume picks up

during this penetration.

·

Platform: This is the portion that sets

the Ex-tended V apart from the True V, and makes it more identifiable, as well.

The Platform may be quite horizontal but usually slants moderately down. As

the platform is developing, volume tends to slacken. Then, when the stock

begins its final swing toward the breakout, volume tends to pick up. The breakout

itself normally is accompanied by heavy volume.

An

Extended V may be regarded as completed, or confirmed when the price breaks

through the highs of the Platform on increased volume. If the Platform happens

to slant downward, one may watch for the stock to push through the downtrend

line drawn along the rally peaks within the Platform. If this penetration

occurs on increased volume, the pattern is likely to follow through, and a

trader may at this point decide to buy near the bottom of an extended swing.

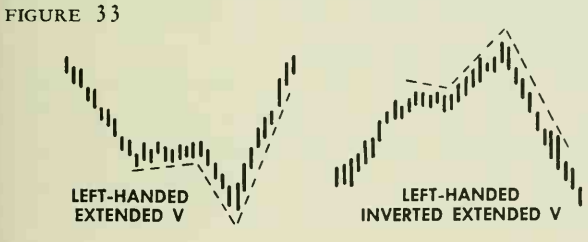

LEFTHANDED

Sometimes

an Extended V develops in which the price and volume follow exactly the pattern

described above, except that the Platform is on the left instead of the right.

Some people are born with the appendix on the left and the heart pointed right;

it doesn’t seem to matter. The Lefthanded V spells a price reversal just the

same.

Profitable Chart Patterns in Stock markets : Chapter 7. V FORMATIONS : Tag: Candlestick Pattern Trading, Stock Markets : INVERTED TRUE V, Uptrend trading, Pilot, Downtrend trading, THE TRUE V FORMATION - THE EXTENDED V FORMATION