THE MEASURED MOVE

Reversal pattern in stock, Why the Measured Move works, chart pattern, Head & Shoulders top

Course: [ Profitable Chart Patterns in Stock markets : Chapter 8. THE MEASURED MOVE ]

All price trends must come to a halt. Sometimes they switch into new directions without warning, as in V turns, but far more often they run into gradually increasing resistance.

THE MEASURED MOVE

All price

trends must come to a halt. Sometimes they switch into new directions without

warning, as in V turns, but far more often they run into gradually increasing

resistance. The pressure of buying comes to equal that of selling; as long as

this rough balance continues, a stock moves horizontally across the chart.

Market writers like to call this period of hesitation a “critical juncture,”

meaning the cats on the fence and they don’t know which way it’s going to jump.

As the

opposing pressures are building up or wearing down, their interplay in the

market at this “critical juncture” may form one of the reversal

patterns, meaning that a major switch in trend lies ahead. At other times,

however, a stock is just pausing to digest a certain amount of support or

resistance it has met, and once that’s gone, it will resume its original trend.

Such a pause, or hesitation, produces a Continuation Pattern essentially, a

more or less sideways trading range that interrupts, but does not end, a trend.

Its chief value to chartists is in indicating future support areas and in

forecasting the extent of subsequent price swings, as discussed in Chapters 2,

3 and 4.

That is

nothing to sneeze at, but in a certain type of situation, we can do

more—namely, to predict, from a price movement that has run into a hesitation

area, the probable extent of the subsequent price movement, or where the stock

next will meet a “critical juncture.” We hereby dub this situation,

which until now has been un-named, the Measured More. Such a move is,

basically, a fairly large price swing that has been interrupted roughly at the

midway mark, by either a fairly sharp “correction” (a rally or reaction,

as the case may be), or by a horizontal congestion range. The interruption cuts

the trend swing into two fairly equal legs, which tend to be parallel. In other

words, the stock on each cover about the same price distance in about the same

time (though sometimes the time is reduced on the second leg, which thereby

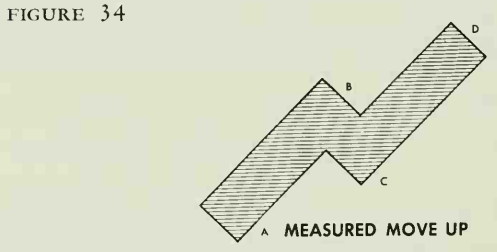

becomes steeper than the first). Here’s how it looks on the chart:

Note that

the illustration is heavily shaded. This was done to avoid being distracted by

the small counter movements contained within the broader waves. The same effect

is achieved when one looks across a brokerage office at one of those big,

framed wall charts of the market averages, covering many years. One then sees

the major bull and bear markets, as mountain ranges and valleys, rather than

the lesser moves. It is precisely such a broad picture on a smaller scale, of

course, that one needs to analyse a Measured Move.

The

components of a Measured Move, in detail, are:

·

A-B: The first

leg. This may be either a long, gradual rise, or a fast, sharp run-up. The

price will hold to a trend channel in a general way, but don’t insist that a

well-defined trend line be drawn along the lows of the move, for these trends

often curve. Remember, look at the chart pattern broadly.

·

B-C: The corrective phase. This may be

a sharp, quick reaction or a prolonged phase of consolidation. It is much like

a railroad switch that shunts a train to a parallel set of tracks. The

corrective action will mark the midpoint of the total rise.

·

C-D: The second leg. This move will

very nearly equal that of the first leg. Note, however, that one should measure

the indicated distance of the second leg beginning from the low point of the

corrective phase (B-C). There is an important volume indication in this sector.

Somewhere between the halfway mark and the two-thirds mark, on the second leg,

volume tends to increase notably. Beyond the two- thirds mark, volume tends to

drop off.

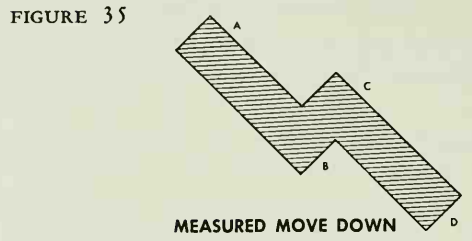

The

Measured Move is just as valid in a decline as in a rise. The description above

applies equally, in reverse.

Here is

an example of a declining Measured Move:

Now that

we can recognize the pattern, it may be worthwhile to re-emphasize a point made

earlier: there is no way of predicting a Measured Move before it begins. To try

do so would be like trying to predict what kind of reversal pattern a stock

will make at the end of a movement that is still in full progress. In either

case, it is only after the pattern has been developing for some time that some

determination of the possibilities can justifiably be made.

On the

other hand, Measured Moves are easily readable in their late stages, and are

extremely reliable indicators of the approach of a "critical juncture.”

They lend themselves remarkably well to the timing of market operations.

Why the

Measured Move works as it does is not known, but we can speculate about it. It

might be compared to a fast ball hurled over the plate, which a batter barely

tips just enough to give it a hop, but not enough to cut its momentum in the

original direction. Slightly deflected, the ball flies on into the catcher’s

mitt or, if he misses it, the ball sails on until it has lost the momentum the

pitcher originally put into it. The corrective phase in a Measured Move may be

attributed to profit-taking, short selling, or any or all of the other

motivations that may check a trend. Why the second leg is about equal to the

first may take higher statistical mathematics or psychology to explain. Perhaps

it’s related to the fact that stocks tend to retrace half of the distance

gained in any swing (the 50% rule). But regardless of the reason, there is a

close correlation between the first and second legs of a Measured Move, which

can be exploited by the chartist.

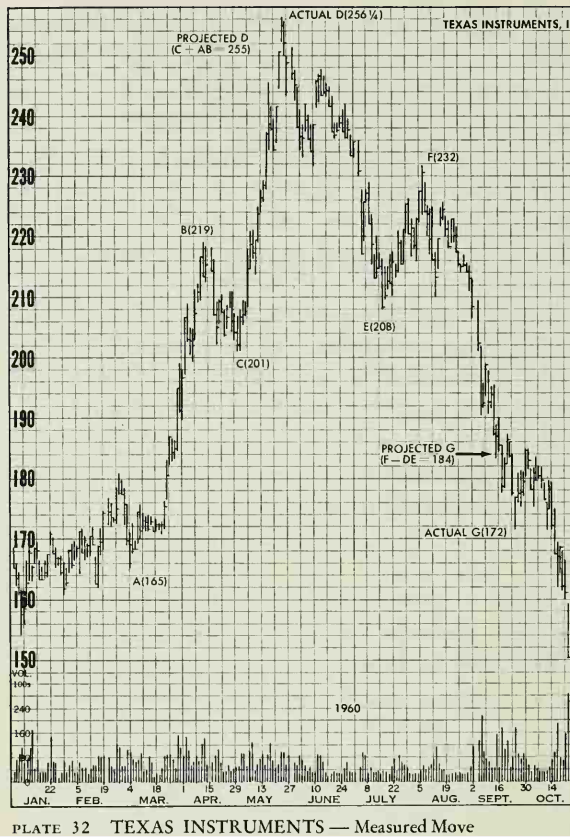

Let us

now go over some actual case histories. If these analyses demonstrate that the

reader can master the Measured Move, then by all means he should add it to his

collection of valued tools.

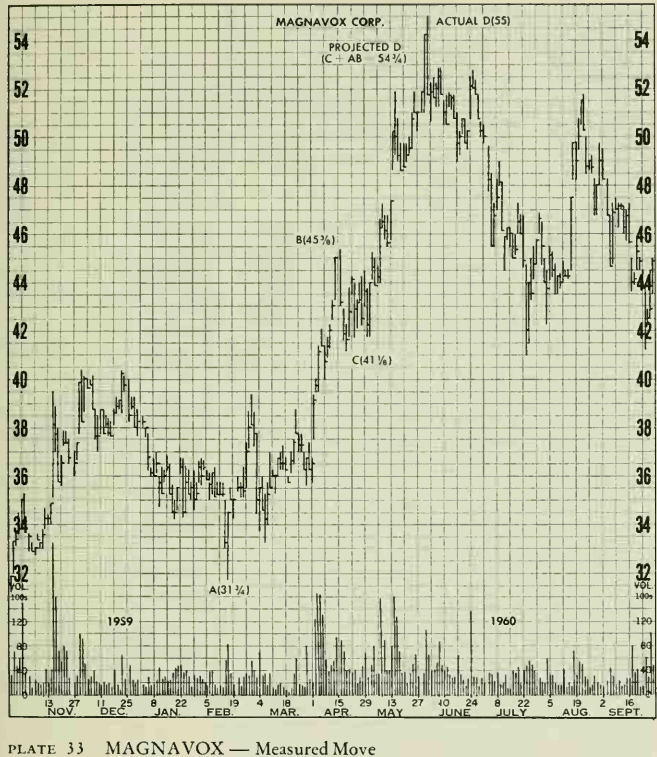

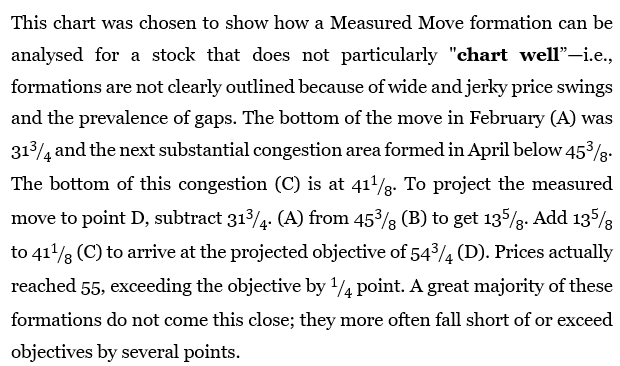

This

Measured Move almost hit its objective on the nose. The move A to B (219— 165 =

54) is expected to equal C to D. Adding 54 to C (201) projects the move to 255.

The move reached 256

Profitable Chart Patterns in Stock markets : Chapter 8. THE MEASURED MOVE : Tag: Candlestick Pattern Trading, Stock Markets : Reversal pattern in stock, Why the Measured Move works, chart pattern, Head & Shoulders top - THE MEASURED MOVE