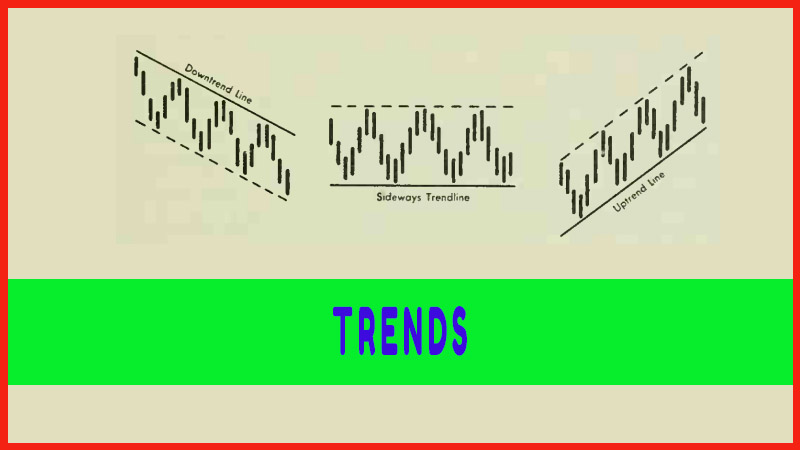

Trends

How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline

Course: [ Profitable Chart Patterns in Stock markets : Chapter 2. Trends ]

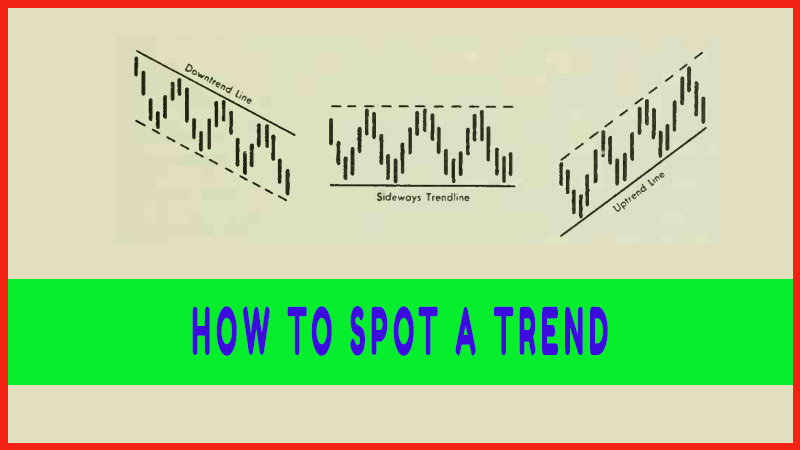

A few stock charts will reveal that prices have a prevailing tendency to move in a particular direction for a considerable time. A closer examination will show that this tendency, or trend, frequently assumes a definite pattern, zig-zagging along an imaginary straight line.

TRENDS

A mere

glance at a few stock charts will reveal that prices have a prevailing tendency

to move in a particular direction for a considerable time. A closer examination

will show that this tendency, or trend, frequently assumes a definite pattern,

zig-zagging along an imaginary straight line. In fact, this ability of

prices to cling extremely close to a straight line is one of the most

extraordinary characteristics of chart movements.

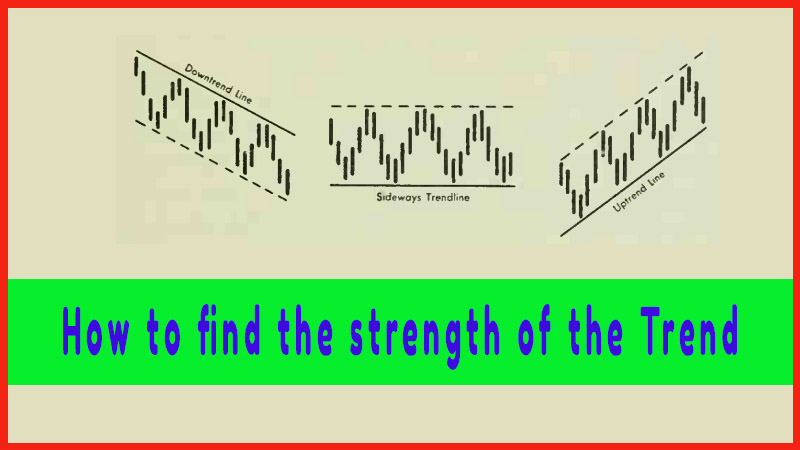

Now,

there is nothing mystical or hocus-pocus about chart reading. Stocks trace

various patterns for reasons soundly based in human psychology—and it’s

psychology that determines stock movements. The tendency of stocks to move

along a straight line, for example, is not hard to explain. In physical terms,

it often is likened to the law of inertia; that an object in motion will

continue in motion in the same direction, until it meets an opposing force. In

human terms, an investor will tend to resist paying more for a stock than the

price other people have recently been paying for it—unless it continues moving

up, which will give him some confidence or hope that it will keep going up.

Conversely, an investor will resist selling a stock for less than the price

other people have been getting for theirs—unless the price keeps declining, and

he fears it will continue to decline.

Let us

see how market psychology, reacting to a news development, forms a trend in an

imaginary, but highly typical, case. Suppose the XYZ Corporation is nearing

completion of the development of a new product that promises to increase sales

and earnings. Its stock has been selling at $20 a share. Insiders—executives,

employees, relatives and friends—are the first to learn about it. They are

immediately removed from the ranks of those who might be willing to sell their

stock at $20, $21 or even $22. Their shares are off the market, and to that

extent, the supply of stock at those prices has been reduced, creating a

tendency for the stock to rise. More important, some of them will begin to buy

more stock, increasing the demand. By this time, word of the new product may

have reached brokers, investment counselors and perhaps other people in the

industry concerned. The price has been rising steadily, to $23, $24, $25,

attracting more and more attention, and traders and the general public begin to

scramble aboard. Everybody loves to give or get a stock tip (this is one of

those rare ones that are sound) and more and more buyers are attracted.

Then

comes the public announcement of the new product. Brokerage firms, in pamphlets

sent to their clients, discuss what effect it will have on XYZ’s earnings. XYZ

itself advertises and publicizes the item. All this creates new demand. But

there comes a point when the market price has fully "discounted”

the development—that is, the stock has risen enough to take into account the

increase in earnings likely to occur. This point is often reached by the time

the public announcement is made. Many traders "sell on the news” to

cash in their profits, especially when the news occurs after a sharp price

rise.

A

downtrend may develop if it appears that the rise went too far. Perhaps the

early estimates of sales and earnings were too optimistic. Perhaps other

companies quickly introduce competitive products. Or profits from other XYZ

departments may decline. As the price of XYZ falls back, buyers who still have

profits may cash in. Then, latecomers who bought near the top of the rise may,

in disgust, sell out at a loss, to avoid even bigger losses. And so the decline

continues.

Profitable Chart Patterns in Stock markets : Chapter 2. Trends : Tag: Candlestick Pattern Trading, Stock Markets : How to trade Uptrend, How to trade down trend, sideways, sell on the news, How to draw trendline - Trends