V FORMATIONS PATTERN

INVERTED TRUE V, Uptrend trading, Pilot, Downtrend trading, THE TRUE V FORMATION

Course: [ Profitable Chart Patterns in Stock markets : Chapter 7. V FORMATIONS ]

In the stock market, as elsewhere, where there is profit, there is a risk. And, generally speaking, the greater the potential profit, the greater the risk. So it is with a certain group of chart reversal patterns that are so powerful that they spark the most dynamic of all price swings but, unfortunately, are among the hardest to anticipate or analyze.

V FORMATIONS

In the

stock market, as elsewhere, where there is profit, there is a risk. And,

generally speaking, the greater the potential profit, the greater the risk. So

it is with a certain group of chart reversal patterns that are so powerful

that they spark the most dynamic of all price swings but, unfortunately, are

among the hardest to anticipate or analyze. In fact, even after they are

completed, the most experienced chartist can’t be certain that trends will

follow through in a normal way. These elusive chart patterns are known as V

Formations.

In other

reversal patterns, buyers and sellers vie for dominance over a more or less

extended period, with one group and then the other alternating in the lead.

This interplay of forces may be said to prepare the market for a reversal and

to alert the chartist. Not so with a V Formation. As the name implies, there is

no such preparation. The progressive shift from a downtrend to an uptrend,

which is a function of other reversal patterns, is absent.

Instead,

the V-turn strikes with little warning; it’s dramatic and final. It’s as

though, by some prearranged signal, all the stock that sellers have to offer

has been suddenly taken up, and buyers remain the dominant force for some time

to come.

Hence, V

Formations signal sharp reversals in trend, but at the same time are among the

most difficult to analyze. Nevertheless, there are a few positive clues that

can be of assistance in catching a good number of these moves. And because the

price swings that follow are often substantial, it pays to master these

patterns. At the end of this chapter, we will carefully examine a number of

actual market situations in an effort to lessen the mystery.

But

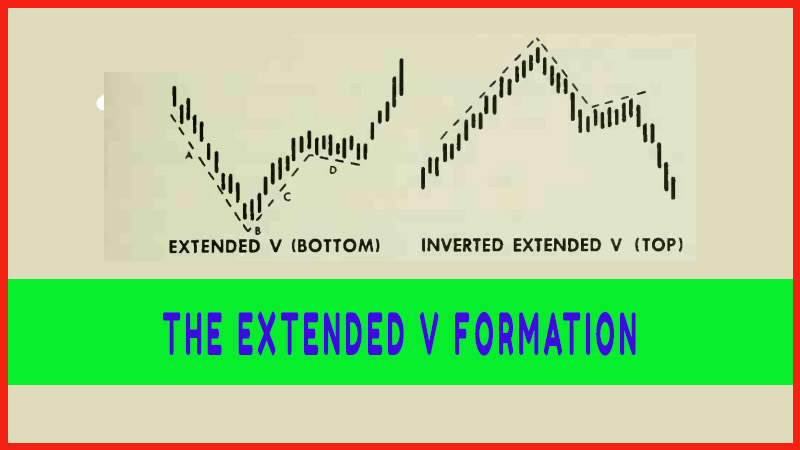

first, let us define our V patterns. There are two kinds: the True V and

the Extended V.

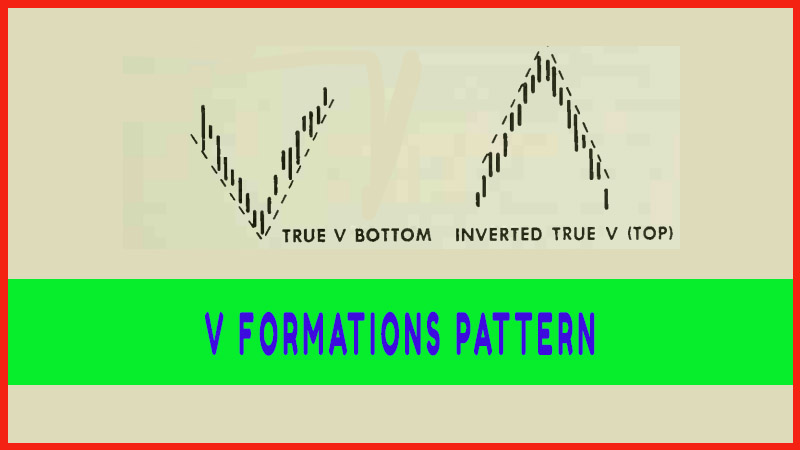

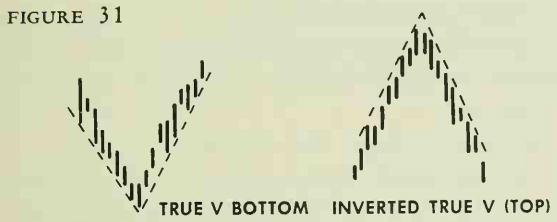

THE TRUE V FORMATION

The

typical true V (Figure 31) is V-shaped indeed, and has three components:

·

Downtrend: More often than not, the

decline that marks the left arm of a V is fairly sharp and extensive, but it

may be quite slow and irregular —just so the trend is down.

·

Pilot: A single day’s action

frequently marks the low point of the decline. At times, the turn is more

gradual, but rarely does the price pause in this region for more than a few

days. In most instances, volume picks up noticeably near the lows. Sometimes,

the heaviest volume will be registered on the very day of the turning point,

marking this as a climax day.

·

Uptrend: The first signal of a turn is

given when the stock price penetrates a downtrend line, which has been drawn

along the rally peaks of the preceding decline. After the turn, volume tends to

pick up gradually as the move progresses. The early part of this phase is the

trouble spot, because until the move has gone far enough, we can’t be sure that

the formation is a valid V-turn. However, the uptrend phase of the true V will

tend to duplicate the preceding downtrend leg. If the downtrend, A, measures

down as a 45 degree angle, the uptrend, C, is likely to measure up as a 45

degree angle.

INVERTED TRUE V

The Inverted

True V marks a top and is, as its name indicates, the opposite of the V bottom.

In a great majority of cases, volume picks up sharply around the pivot, and

this forms an upside-down V on the volume scale, as well as the price.

Sometimes, however, volume on the turn is relatively normal or even unusually

light.

Profitable Chart Patterns in Stock markets : Chapter 7. V FORMATIONS : Tag: Candlestick Pattern Trading, Stock Markets : INVERTED TRUE V, Uptrend trading, Pilot, Downtrend trading, THE TRUE V FORMATION - V FORMATIONS PATTERN