Complex Corrective Structures

Double Zigzag, Zigzag Trading Strategy, Corrective Structures, ABC patterns

Course: [ Harmonic Elliott Wave : Chapter 2: R. N. Elliott's Findings: Corrective Waves ]

Elliott Wave | Forex |

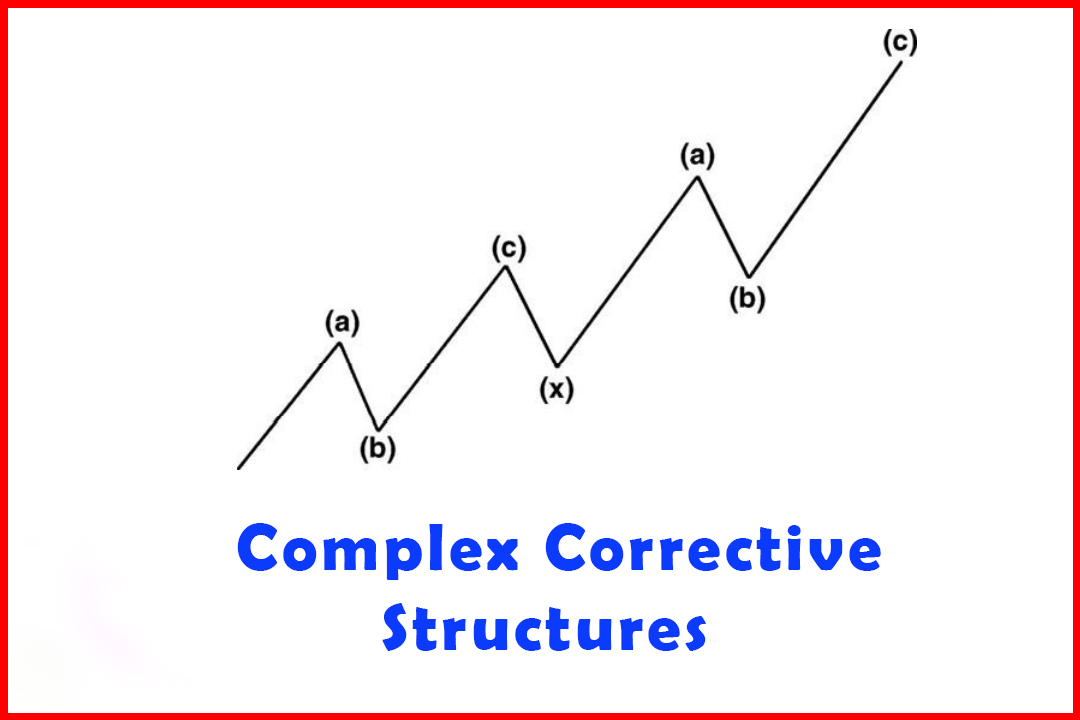

There are several basic types of complex corrective structures which all commence with a simple ABC move. I shall outline some guidelines to highlight when you might be able to anticipate the development of a more complex correction later. For now I shall describe the basic types of complex corrective structures.

Complex Corrective Structures

From

the initial description of corrective waves it should come as no surprise to

learn that ABC patterns do not always complete a correction. There are several

basic types of complex corrective structures which all commence with a simple

ABC move. I shall outline some guidelines to highlight when you might be able

to anticipate the development of a more complex correction later. For now I

shall describe the basic types of complex corrective structures.

Double Zigzag

To

complicate matters, and probably more often than not, corrections do not end

with just a simple ABC move. In the second variation, once an ABC move has been

seen a correction is seen in what is then labeled Wave (x) and which is then

followed by a second ABC move (see Figure 2.3). The Wave (x) will not normally

break through the prior Wave (b), and will itself comprise three waves or a

combination of three waves in any of the corrective structures in this list.

Figure

2.3 A Double Zigzag Higher

Once

the Double Zigzag is complete the underlying directional move will continue.

Figure

2.4 demonstrates how a Double Zigzag could develop.

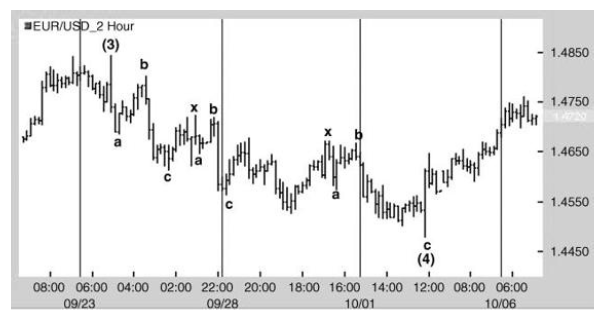

Figure 2.4 A Double Zigzag Higher in

Two-Hour EURUSD

This

shows a two-hour EURUSD chart in which there are two ABC corrections higher and

separated by a Wave (X). The two instances of a Wave (B) are constructed of a

simple Zigzag structure. Also note how the Wave (X) declines close to the first

Wave (B) but does not penetrate. Normally we can judge that the directional

move is resuming by a break of the last Wave (B).

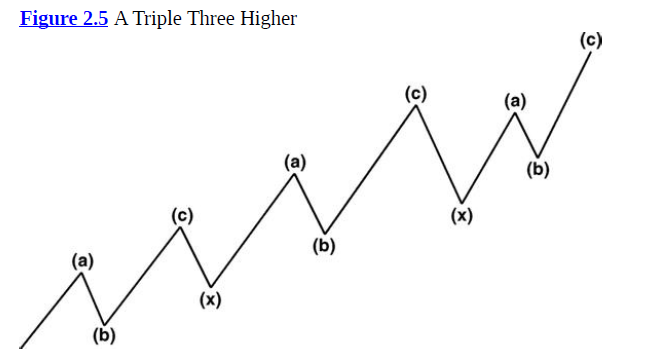

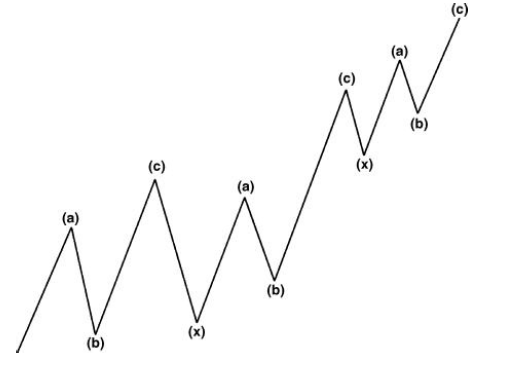

Triple Three

The

next example of a complex series of ABC corrections is simply another ABC move

tagged on the end of a Double Zigzag. The third ABC structure is separated from

the second by a second Wave (x). This is shown in Figures 2.5 and 2.6.

Figure

2.6 A Triple Three Lower in

Two-Hour EURUSD

If

I am to make an observation on these types of corrections I would say that I

find Triple Threes the most common. I do not notice Double Zigzags that often

or a simple ABC structure, except for those acting as a Wave (x).

The

corrective decline in EURUSD was particularly complicated. It comprised three

ABC declines, each separated by an intervening Wave x. These tend to occur when

the market has had a strong directional move which, on completion, leaves the

market unconvinced of that move. Hence the tendency to attempt to look for the

resumption of the underlying trend, only to have the early resumption thwarted

and followed by a further erratic correction. This then happens a second time.

The

more positive note is that once there has been a Triple Three we can be

confident that a Quadruple Three does not exist. Hence, if the completion of

such a correction is correctly identified the resumption of the trend is a

certain event.

There

is a tendency for a deep Wave (x) following a deep Wave (b) (see Figure 2.7).

This is a guideline only and does not occur in 100% of the cases, but the

tendency is quite common in complex corrective structures. Following a deep

Wave (b) the subsequent Wave (x) is also quite deep and can correct quite close

to the prior Wave (b).

Figure

2.7 A Triple Three Higher with the First Wave (x) Retracing Close to the Prior

Deep Wave (b)

The

deep Wave (b) can clearly occur either in the first or second Wave (b), which

will both have a subsequent Wave (x) developing on the completion of the Wave

(c). If one of the instances of Wave (b) happens to be deep then the Wave (x)

can often be the same.

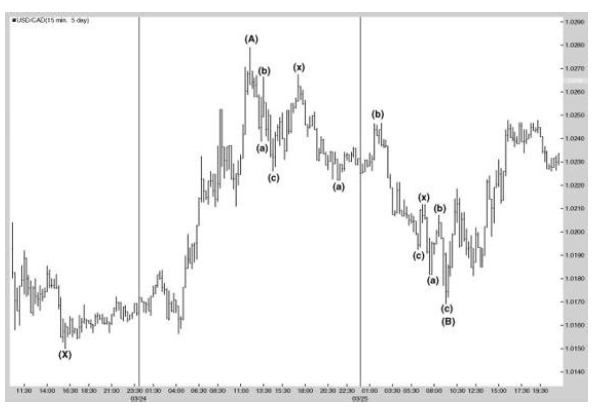

Figure

2.8 displays a pullback in Wave (B) that develops as a Triple Three. The first

correction in Wave (b) is quite deep. Note that following the completion of

Wave (c) the Wave (x) retracement is also very deep, and in this case actually

retraces above Wave (b). The third Wave (b) is also very deep. However, since

there have been three sets of (a)(b)(c) structures in this decline and since

Quadruple Threes do not exist, we can be confident that there will be no third

instance of a Wave (x).

Figure

2.8 A Triple Three Lower in

USDCAD with a Deep First Wave (x)

Harmonic Elliott Wave : Chapter 2: R. N. Elliott's Findings: Corrective Waves : Tag: Elliott Wave, Forex : Double Zigzag, Zigzag Trading Strategy, Corrective Structures, ABC patterns - Complex Corrective Structures

Elliott Wave | Forex |