How to Find Corrective Waves

Corrective Analysis, Pattern Trading, Zigzags Waves, How to find Corrective Waves

Course: [ Harmonic Elliott Wave : Chapter 2: R. N. Elliott's Findings: Corrective Waves ]

Elliott Wave | Forex |

The corrective wave structure is probably the biggest headache for any Elliottician. The large variation in types of corrective structures is still rather overwhelming for even me following the completion of a five-wave move.

Findings: Corrective Waves

The

corrective wave structure is probably the biggest headache for any

Elliottician. The large variation in types of corrective structures is still

rather overwhelming for even me following the completion of a five-wave move.

How

deep will the retracement be? How long will it last and how complex will it be?

There is a bewildering range of potential outcomes that can push a new analyst

attempting to learn the principle into finding a more simple method of

forecasting. While it can be a deterrent, I find the eventual benefits far

outweigh the negatives, and the understanding of how structures develop

actually aids the final recognition and awareness of not only when a correction

is complete but also when an alternative structure is developing.

With

the use of Fibonacci and harmonic ratios and a broad understanding of how these

need to slot into the structure of the next higher degree, it is possible to

piece together the developing clues as to what will happen next. I would

therefore encourage all students of the principal to stick with it and remain

determined to conquer the challenges; the benefits are substantial.

Corrective Waves

Let's

now have a look at corrective waves.

Zigzags

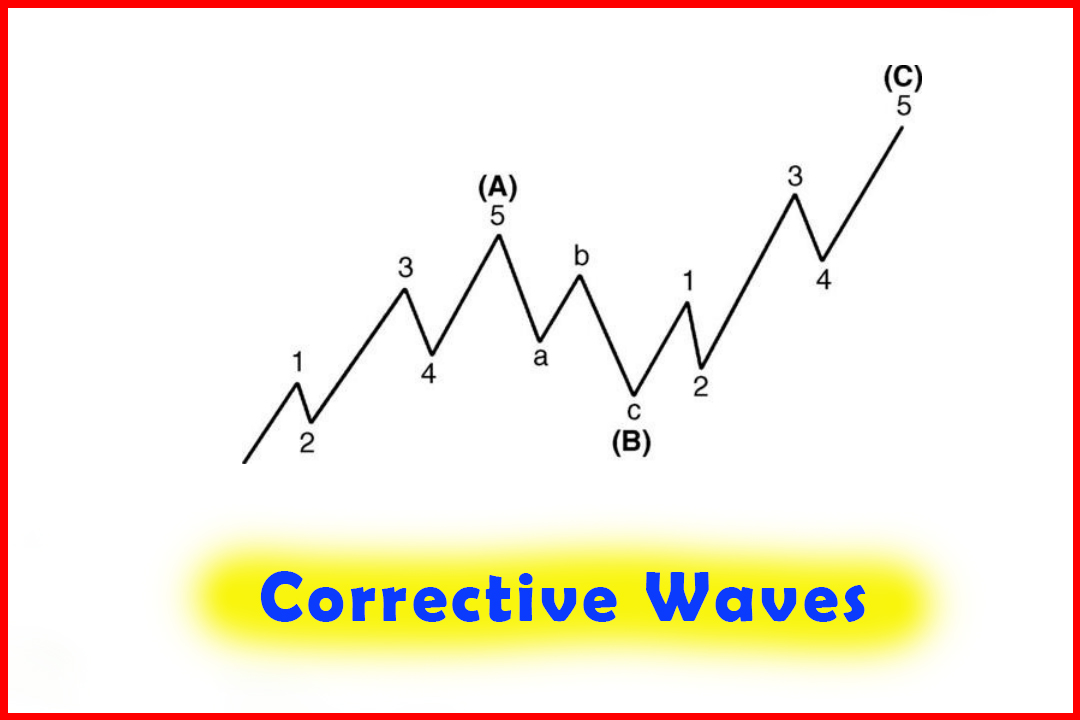

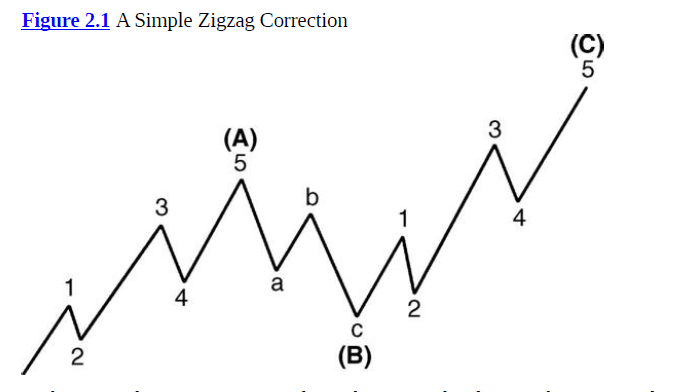

Zigzags

(as shown in Figure 2.1) are the most basic and simple of all corrections. They

comprise two counter-trending waves, Wave A and Wave C (that develop in five

waves), which are divided by a three-wave structure (or combination of

three-wave structures). Quite commonly Elliotticians will refer to these as 535

moves.

This

type of move is quite simple to observe, and as long as the two impulsive

waves—that is, Wave (A) and Wave (C)—can be identified through observing the

five waves, it is unusual to get too confused.

Figure 2.2 shows

how a three-wave correction in a Zigzag may look in USDJPY.

Following

completion of a simple ABC correction we can expect the main trend to resume.

Harmonic Elliott Wave : Chapter 2: R. N. Elliott's Findings: Corrective Waves : Tag: Elliott Wave, Forex : Corrective Analysis, Pattern Trading, Zigzags Waves, How to find Corrective Waves - How to Find Corrective Waves

Elliott Wave | Forex |