Extended Impulsive Waves

Multiple extensions, Impulse Pattern, Impulse wave trading, Complex Wave Structure, Elliott Wave Principle

Course: [ Harmonic Elliott Wave : Chapter 1: R. N. Elliott's Findings: Impulsive Waves ]

Elliott Wave | Forex |

Elliott also noted that impulsive waves had an occasional tendency to extend; he observed that there was more than a single set of impulsive waves in a trend

Extended Impulsive Waves

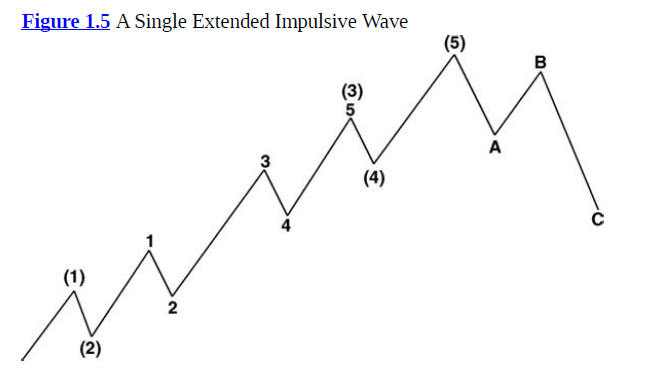

Elliott also noted that impulsive waves had an occasional tendency to extend; he observed that there was more than a single set of impulsive waves in a trend (see Figure 1.5).

This

is a simple concept, noting that the five waves constructing Wave (3) are made

up of five waves of the same degree. This can perhaps be best described as

saying that if this is a daily chart, then the five waves in Wave (3) are also

visible and measurable in the daily chart rather than, say, the hourly chart.

Of course, the impulsive waves 1, 3, and 5 will be composed of five waves

themselves.

In

addition to this, Elliott found that there were cases of multiple extensions

(as shown in Figure 1.6).

Figure 1.6: A Double

Extended Impulsive Wave

Extended

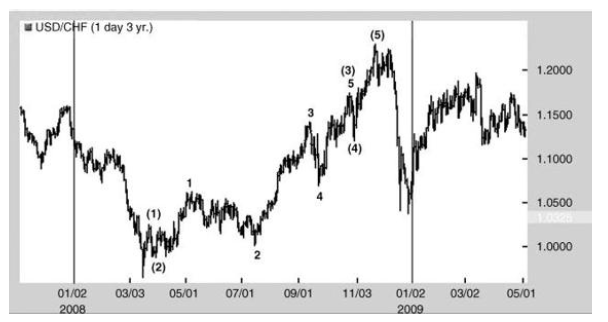

waves may occur in any of the three impulsive waves, but most commonly in a

third-wave position which Elliott observed was generally the wave with the

strongest risk of a powerful trending extension. Considering the often seen

reversal which tends to begin with the market believing that another correction

is developing thus adding to positions in favor of the prior trend it makes

sense that the third wave is more often than not the stronger move as it begins

with positions being unwound and fresh positions in the opposite direction

being established.

Figure

1.7 displays an extended wave in the Wave (3) position.

Figure 1.7 An Extended Wave in Daily USDCHF

There

is always the question of when should we know when an extended wave is likely

to occur. Sometimes it springs upon us quite suddenly and we are left

scrambling to understand what is happening. I have always suggested that if

there is any time where we may anticipate such a move then it must be that

perhaps the final stalling area is one that can be determined from an extension

of the prior wave structure. Perhaps we are looking at a five-wave move in Wave

(C), and this has projections in a wave equality move around the end of Wave

(5).

Later

on I shall highlight why I now feel this is unlikely.

Harmonic Elliott Wave : Chapter 1: R. N. Elliott's Findings: Impulsive Waves : Tag: Elliott Wave, Forex : Multiple extensions, Impulse Pattern, Impulse wave trading, Complex Wave Structure, Elliott Wave Principle - Extended Impulsive Waves

Elliott Wave | Forex |