Impulsive Waves

Impulse Pattern, Impulse wave trading, Complex Wave Structure, Elliott Wave Principle

Course: [ Harmonic Elliott Wave : Chapter 1: R. N. Elliott's Findings: Impulsive Waves ]

Elliott Wave | Forex |

Ralph Nelson Elliott was a distinguished businessman, an accountant whose career began at the age of 25 in 1896. He was a renowned organizer, fastidious in his approach, and over the following 25 years he rescued a number of distressed companies and brought them back into profitability.

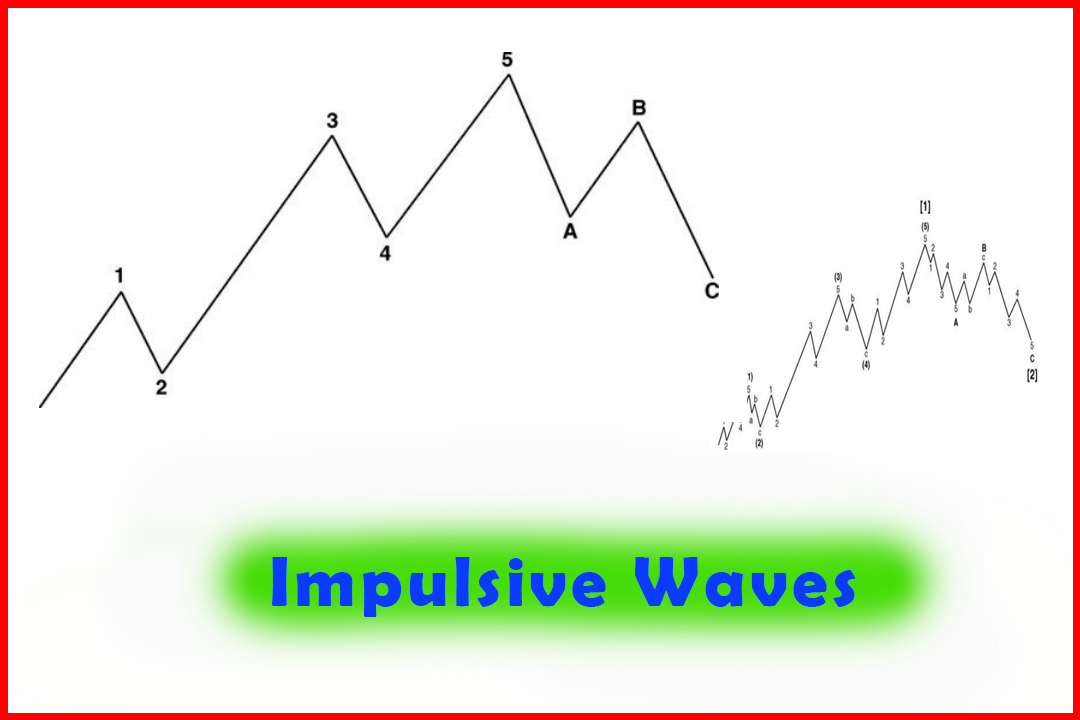

Impulsive Waves

Ralph Nelson Elliott

Ralph

Nelson Elliott was a distinguished businessman, an accountant whose career

began at the age of 25 in 1896. He was a renowned organizer, fastidious in his

approach, and over the following 25 years he rescued a number of distressed

companies and brought them back into profitability. In 1924 he was appointed by

the U.S. State Department as chief accountant for Nicaragua—then under the

control of the United States—to reorganize the finances of the entire country.

However,

in 1929 he became seriously ill with pernicious anemia, which kept him confined

to his bed. It was at this time, while recuperating, that he studied stock

market charts, examining price behavior across all time frames. It took over

five years for him to draw his conclusions. In March 1935, as the Dow Jones

Average closed almost at its lows, he published his findings by declaring that

the index was making its final bottom. The accuracy of his findings was impressive,

and they were published in his first book The Wave Principle. He followed up in the early 1940s with an addendum on the

application of the Fibonacci sequence of ratios to his findings on the

structure of wave development.

This became known as the Elliott Wave Principle, and it is

applied by what may be millions of

traders around the world in today's markets. Before offering my

modifications to this principle, I will present Elliott's findings and

observations, which still remain the basis of what I consider the most accurate

tool in forecasting markets.

The

Wave Principle can be loosely separated into two basic market characteristic

types: trends and consolidation (or correction). Elliott named the trending

phase impulsive while the rest were classed as corrective. I shall reproduce these in full in

order that the original theory is provided, as it still forms the basis of what

is a brilliant example of observation and collation into a methodical tool that

can be applied even to modern markets. Those readers who are familiar with the

principle may wish to move on to Chapter 3.

The Impulsive Wave Structure

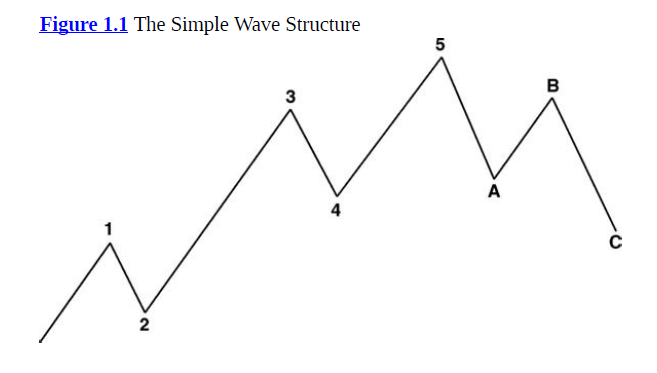

Elliott

proposed that when price movements demonstrate an underlying trend, they will

always develop in five distinct waves: three in the direction of the trend and

two as corrections to the underlying trend (as shown in Figure 1.1). The three

directional waves are labeled Waves 1, 3, and 5, and the corrective waves as

Waves 2 and 4. The directional waves in a trend are normally referred to as

impulsive waves. Once this five-wave sequence has been completed, a correction

will be formed. While a fuller description of corrective waves will follow, for

now I shall simply say that they develop in three waves and refer to these as

Waves A, B, and C.

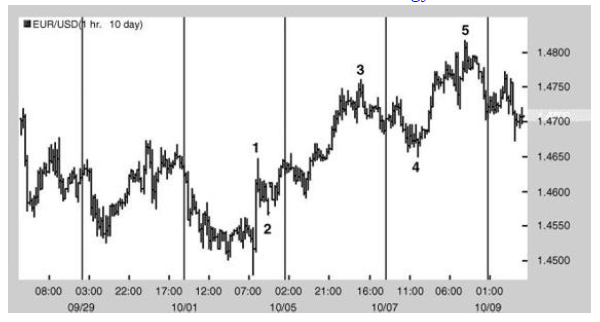

Figure

1.2 shows how a five wave move would appear on a chart, the example being the

hourly EURUSD chart.

Figure 1.2: An impulsive wave in EURUSD

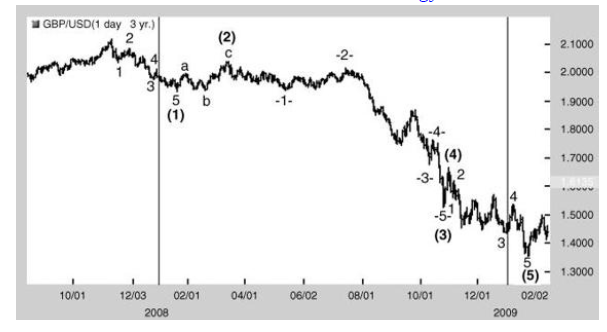

Elliott's

findings, which were observed over multiple time frames (daily, weekly, and

monthly), were that waves are fractal. This meant that the basis of all

movements, whether in five-minute charts or monthly, are intrinsically related

as the shorter time frames form the building blocks for the larger time frames.

This can be observed in the complex wave structure shown in Figure 1.3.

Thus,

a simple five-wave move at the beginning of a new sequence will form a Wave (1)

and the three-wave correction will then become Wave (2), followed by Wave (3),

Wave (4), and Wave (5). Indeed, this larger five-wave move will form Wave [1]

of the next higher degree, followed by a Wave [2].

Note: In a

simple corrective move, Wave A and Wave C will consist of five waves due to the

fact they are counter-trending moves. Wave B will always consist of three

waves, or as we will find later a combination of three-wave moves.

Already

it becomes apparent that where you see a five-wave directional move with the

exception of Wave 5,it will always be followed by another five waves.

Figure

1.4 shows how a complex five-wave decline would appear on a chart, the example

being the daily GBPUSD chart.

Harmonic Elliott Wave : Chapter 1: R. N. Elliott's Findings: Impulsive Waves : Tag: Elliott Wave, Forex : Impulse Pattern, Impulse wave trading, Complex Wave Structure, Elliott Wave Principle - Impulsive Waves

Elliott Wave | Forex |