MARKET TACTICS - CONTINUATION PATTERNS

Diamond Pattern Formations, support or resistance levels, How to trade continues pattern, continuation patterns and reversal patterns, continuation patterns candlesticks, continuation patterns in tech

Course: [ Profitable Chart Patterns in Stock markets : Chapter 10. CONTINUATION PATTERNS ]

Breakouts from tight Boxes, tight Flags and tight Pennants are exceptionally reliable signs of future trends. They not only indicate the direction prices will move, but they also usually precede fast and wide movements.

MARKET TACTICS

Breakouts

from tight Boxes, tight Flags and tight Pennants are exceptionally reliable

signs of future trends. They not only indicate the direction prices will move,

but they also usually precede fast and wide movements. For this reason, some

traders act only on such signals.

Not quite

so reliable, but still among the more reliable of chart indicators, are loosely

built Boxes, Flags and Pennants, and all Wedges and Diamonds. They can help to

confirm other signs of a major trend development, and they of course are useful

in locating levels of support and resistance and good buying or selling points.

CAUTION

It is

always possible that an apparent Continuation Pattern may slip suddenly and

without notice into a Reversal Formation. The chart follower must accept this

risk as part of the odds, and remain alert and ready at all times to turn with

the trend.

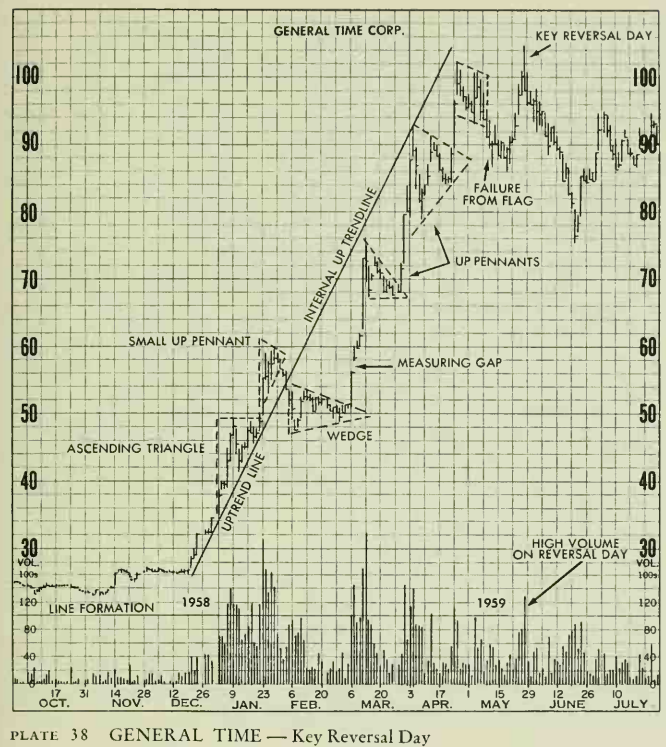

This

chart of General Time is a kaleidoscope of formations described in preceding

chapters. Between September and December, a Line formation or Long Base

prepared the way for a vigorous bull move. Triangles, Flags. Pennants and Gaps

heralded the advance. A sharp uptrend line was penetrated on Feb. 5, but the

advance resumed along the underside of the trendline extended. In Chapter 2.

this was described as an Internal Trendline. Of interest are the Pennant (end

of January) and the Flag (end of April) which were not completed. In both

cases, new highs were made later, but the breakdown of the Flag did warn of an

impending top. The Key Reversal Day was on high volume and marked the beginning

of a decline that lasted five months and carried prices back to 60.

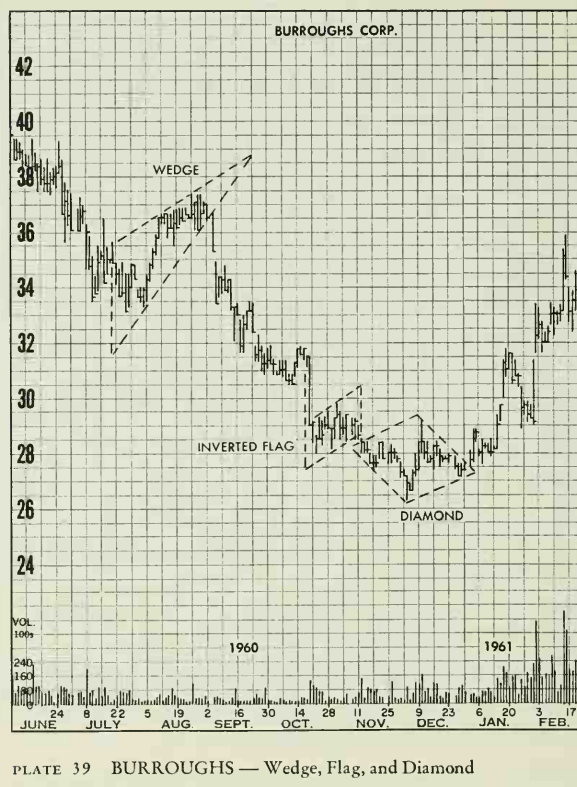

The first

formation outlined left is a rather large rising Wedge. As explained in the

preceding chapter, the tilt distinguishes the Wedge from a Triangle. Further, a

rising Wedge has bearish implications, which is confirmed by a downside

breakout. The Inverted Flag shows that flags form just as well upside down and

are fairly reliable signs that a decline will continue, at least for the time

being. Immediately after the Flag was completed, prices traced out a well-cut

diamond, which here proved to mark a reversal in the major trend, an uncommon

role for what is usually a continuation pattern but a tricky one.

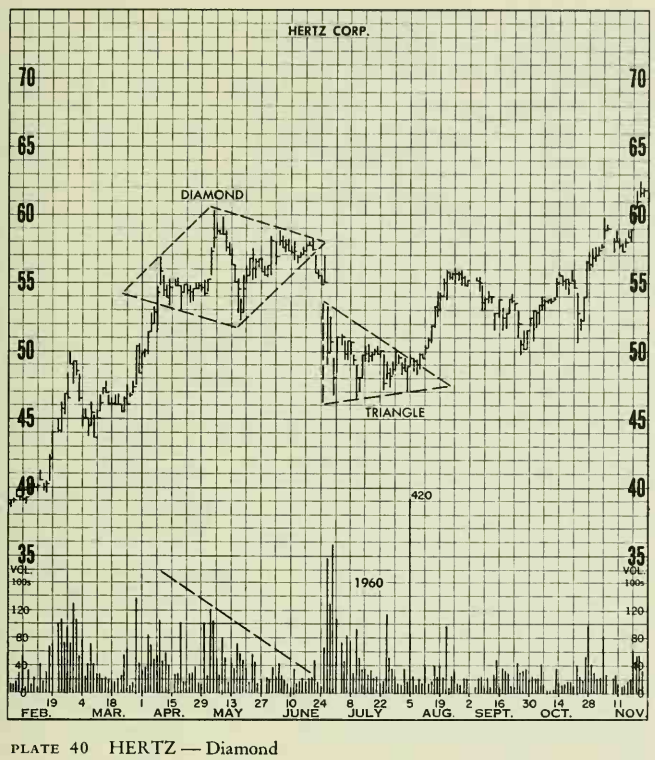

The

Diamond outlined in April, May, and June is of a type often mistaken by

inexperienced chartists for a Head & Shoulders pattern. However, the

difference can be easily distinguished by the experienced chart reader. In the

first place, the decline from the head carries below the low of the supposed

left shoulder. It can be added that in most Diamond formations, it would be

difficult to recognize shoulders. In this chapter, a behavior pattern was

described that fits the illustration above. As stated on page 126, "Often,

prices will break down through an apparent Diamond top and later turn to rally

to sharply higher ground". Here the Diamond proved to be a

continuation pattern, even though the initial breakout made it look like a

reversal.

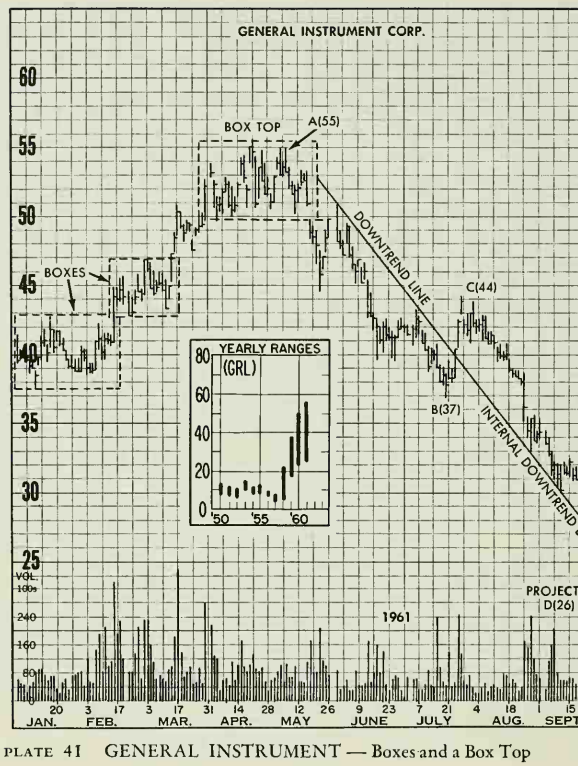

A series

of Boxes featured the chart of General Instrument in early 1961. The third one

evolved into a major top, which set the stage for a decline that wiped out

about 55 percent of value in less than five months. As explained in the

preceding chapter, Box formations are usually continuation patterns and only

infrequently signal major turns. The long-range chart picture can be helpful in

finding these exceptions. At 50-55, General Instruments was selling at all-time

highs after a four-year advance. Such heights should make anyone a bit queasy.

Second, (not shown here), a Measured Move objective was achieved at 55. And

third, a major trendline was broken on the completion of the pattern. The

decline that ensued proved to be an excellent illustration of an internal

trendline and a downside Measured Move formation. Note how prices, after

breaking the initial downtrend in July, then adhered to the top side of the

trendline, and how to swing A to B almost exactly equals C to D.

Profitable Chart Patterns in Stock markets : Chapter 10. CONTINUATION PATTERNS : Tag: Candlestick Pattern Trading, Stock Markets : Diamond Pattern Formations, support or resistance levels, How to trade continues pattern, continuation patterns and reversal patterns, continuation patterns candlesticks, continuation patterns in tech - MARKET TACTICS - CONTINUATION PATTERNS