Triangles Pattern Trading

How to trade triangle pattern, Best trading Pattern, Triangle wave structures, Double Zigzag, corrective structure

Course: [ Harmonic Elliott Wave : Chapter 2: R. N. Elliott's Findings: Corrective Waves ]

Elliott Wave | Forex |

A final complex corrective structure is the Triangle. In contrast to classic technical analysis which has no structure for the Triangle, Elliott&apos's version is strict in requiring five sets of ABC patterns and generally (but not always) with contracting peaks and troughs.

Triangles

A

final complex corrective structure is the Triangle. In contrast to classic

technical analysis which has no structure for the Triangle, Elliott's

version is strict in requiring five sets of ABC patterns and generally (but not

always) with contracting peaks and troughs (as shown in Figure 2.13).

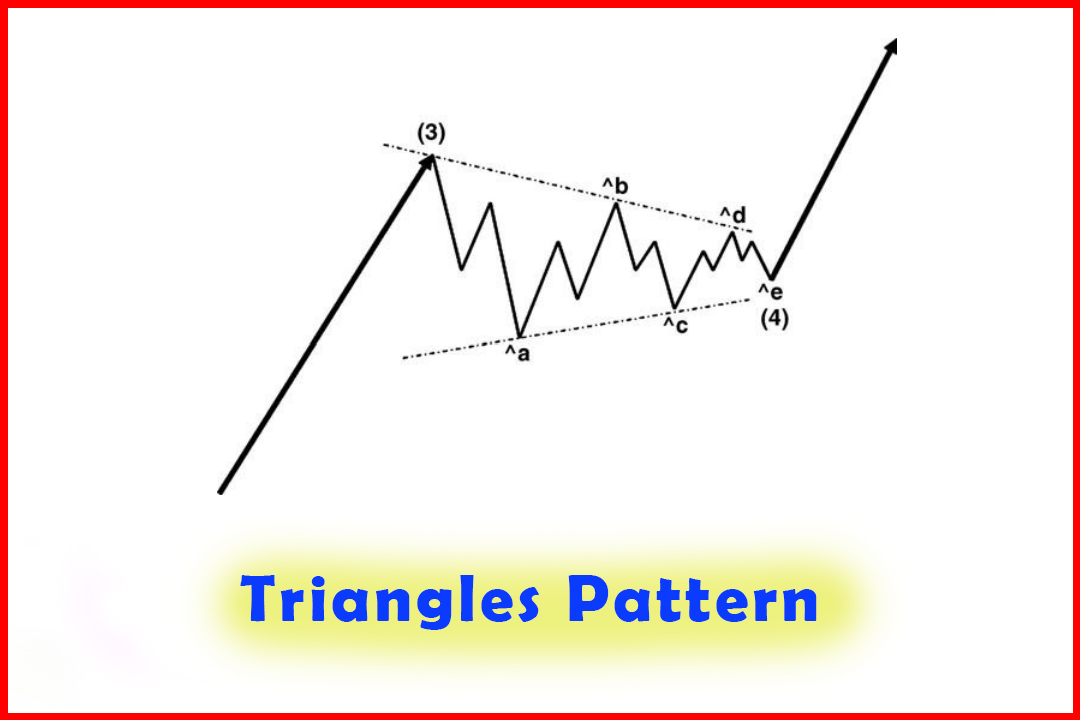

Figure

2.13 A Triangle

Correction

Note

that each leg of the Triangle comes in three waves or may come as a combination

of three waves, as Double Zigzags or Triple Threes. The Wave b of each leg can

also be any of the simple or complex corrective structures. They tend to be the

most complex of all wave structures as they basically represent a conflict

between bulls and bears, with neither camp being able to force an extension of

their sentiment.

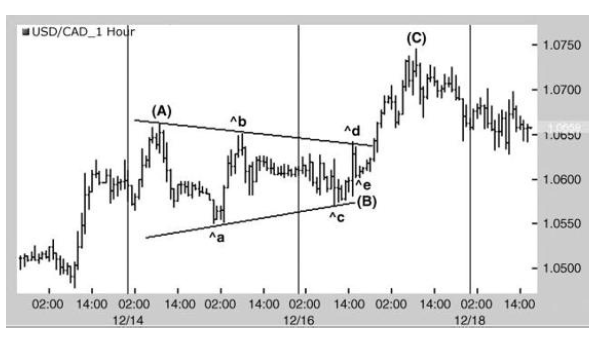

In

Figure 2.14, price rallied in Wave (A) and then fell into a sideways

consolidation within converging peaks and troughs. It is not always obvious

that each leg of the Triangle develops in an ABC structure (or combination of

three- wave moves), but these should be more obvious in the lower time-frame

chart. Once the five legs are complete in Wave Ae, this completes Wave (B) and

triggers an extension high in Wave (C).

Figure 2.14 A Triangle within a Wave (B) Position in a Zigzag Higher in USDCAD

Judging When a Complex Correction is More Likely to Occur

Clearly

the array of corrective structures can be quite dismaying and generates some

uncertainties over just what may occur. Indeed corrections are a lot more

complex due to the fact that more two-way views are being expressed by the

market, possibly due to inconclusive economic releases or the market is

awaiting such a release.

However,

there are clues that are quite straightforward if these occur in particular

areas of the wave structure. In Chapter 4, I describe the use of Fibonacci and

harmonic ratios to determine high-risk areas where corrections should end. For

example, if we are looking at a correction in Wave 4 which has a high chance of

providing a 50% retracement, if the first ABC move has retraced only 20% of the

length of Wave 3 then there & apos; a much greater chance of seeing a

Double Zigzag or Triple Three. However, if the first ABC move retraces a full

50% then we must be alerted to the possibility of a Flat, Expanded Flat, or

Triangle in the Wave 4 position.

We

must also be aware of the structure of price development to confirm whether it

is consistent with an impulsive structure (and measurement) or whether it is

consistent with another three-wave move which will imply a corrective structure.

Harmonic Elliott Wave : Chapter 2: R. N. Elliott's Findings: Corrective Waves : Tag: Elliott Wave, Forex : How to trade triangle pattern, Best trading Pattern, Triangle wave structures, Double Zigzag, corrective structure - Triangles Pattern Trading

Elliott Wave | Forex |