Unbreakable Rules

Trading rules, Impulse Wave rules, Trading Guide

Course: [ Harmonic Elliott Wave : Chapter 1: R. N. Elliott's Findings: Impulsive Waves ]

Elliott Wave | Forex |

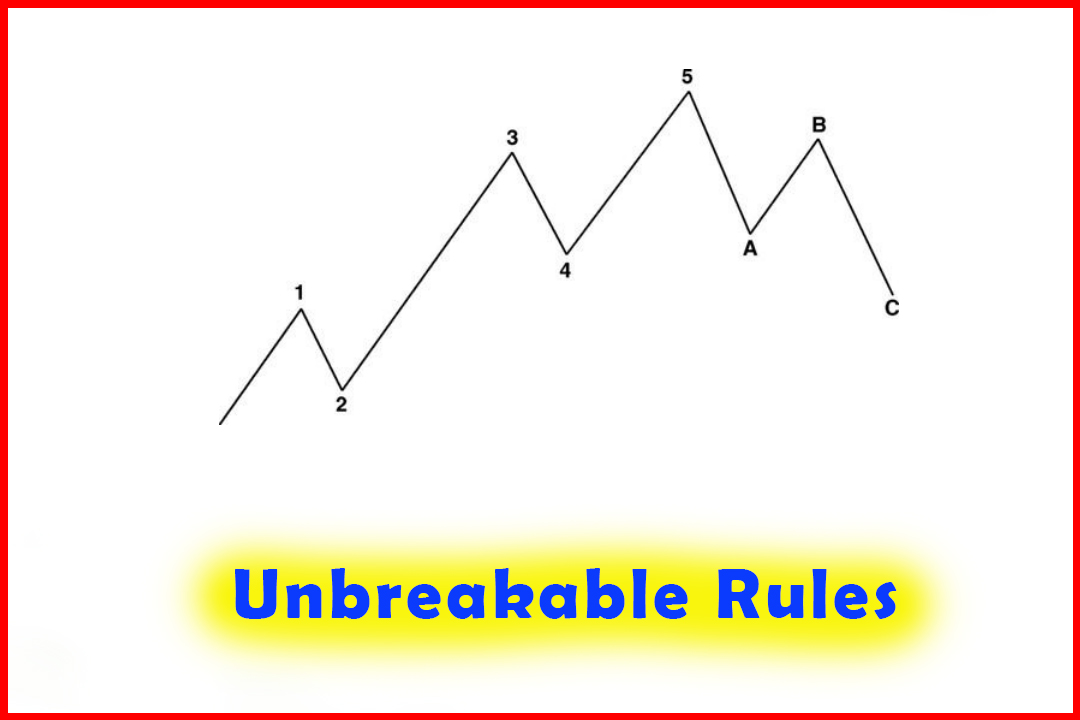

Elliott detailed only three rules in the entirety of his findings, and all were confined to the actions of impulsive waves.

Unbreakable Rules

Elliott

detailed only three rules in the entirety of his findings, and all were

confined to the actions of impulsive waves.

- Rule 1: Wave 2

can never retrace more than 100% of Wave 1.

This

is quite logical. If we are talking about an impulsive wave representing the

underlying trend, it would be illogical to have a retracement that breaks the

basic definition of a trend as defined by classical technical analysis.

An

uptrend is a sequence of higher highs and higher lows. Once that sequence is

broken, the uptrend can be assumed to have ended. A downtrend is a sequence of

lower lows and lower highs. Once that sequence is broken, the downtrend can be

assumed to have ended.

- Rule 2: Wave 3

is never the shortest of the three impulsive waves.

Elliott

also noted that statistically Wave 3 is generally the longest, and of all

extended waves it is Wave 3 that most commonly extends as this is where the

market has realized that it has the wrong position, and exits from its prior

trending position to enter into the anticipated new trend direction.

- Rule 3: Wave 4

in an impulsive wave never retraces to a level below the peak of Wave 1 in an

uptrend or above the trough of Wave 1 in a downtrend.

This

rule basically highlights that during a trend that indicates a sustained

movement in one direction, the extreme of Wave 4 would not be expected to

retrace so deep as to overlap with the extreme of Wave 1.

Harmonic Elliott Wave : Chapter 1: R. N. Elliott's Findings: Impulsive Waves : Tag: Elliott Wave, Forex : Trading rules, Impulse Wave rules, Trading Guide - Unbreakable Rules

Elliott Wave | Forex |