How Options Are Traded: Options in Your Account

Institutions, Exchanges, Market order, Liquidity, market makers

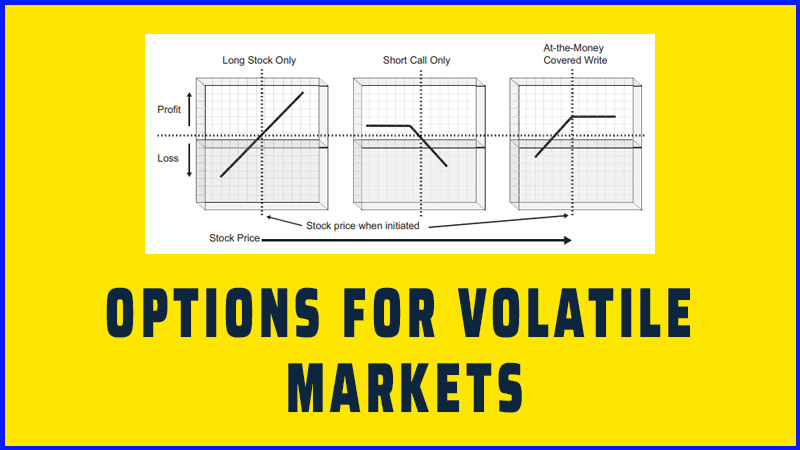

Course: [ OPTIONS FOR VOLATILE MARKETS : Chapter 1: Option Basics ]

Options |

While customized, over-the-counter options do exist, they are entirely the province of institutions. This book discusses only the standardized options that are listed on one or more U.S. exchanges.

How Options Are Traded

While customized, over-the-counter

options do exist, they are entirely the province of institutions. This book

discusses only the standardized options that are listed on one or more U.S.

exchanges. As listed securities, options are subject to many of the rules

associated with listed stocks, but there are differences worth noting.

The Exchanges

Today, options trade on as many as a

dozen different exchanges, some of which are electronic. There are two types of

trading systems employed by the stock and option exchanges: the specialist

system and the market-maker system. In the specialist system, a single person

(actually a single firm) facilitates the market. When there are no external

buyers or sellers, the specialist is responsible for providing both a bid and

an offer from his or her own account, at which the public can transact. In the

market-maker system, several competing market makers perform the same function.

Stocks on the NYSE and American Exchange trade under a specialist system, while

those on the NASDAQ exchange trade through remotely located market makers who

are connected electronically. Options on the Amex or Philadelphia exchanges trade

by specialist, whereas the Chicago Board Options Exchange (CBOE) uses an

exchange-based market-maker system. At the CBOE, the order book is handled by

an exchange employee called an order book official (OBO). If there is a

discrepancy on a CBOE option trade, your broker will contact the OBO to resolve

it.

For the most part, a covered call

writer does not need to be overly concerned with the type of trading systems on

the various exchanges. In almost all instances, it will be invisible to you.

But there are slight differences that may become apparent if you are dealing

with a fast-moving or relatively illiquid option. The biggest issue is that in

a market-maker system, if you place a limit order—one specifying a price that

must be met or bettered for execution to occur—the option can trade at your

price without your order being filled if the trade is between market makers.

This means that even if you see the option trade at your price after you have

placed your order, it may not necessarily have been filled. If the option

passes your price, then your order should be filled unless the print is from an

earlier transaction out of sequence.

Options can trade on multiple exchanges

and through multiple market makers. When you see an online quote, you are

generally (though not always) looking at a composite quote, meaning the best

bid and best offer from all available sources. However, when you enter an

order, you do not know which exchange your brokerage firm’s computer will

direct it to or that it will always be to the exchange with the best price at

the time. To illustrate, consider the following hypothetical scenario for

quotes on a particular option.

|

Source |

Bid |

Offer |

|

A |

1.10 |

1.30 |

|

B |

1.05 |

1.25 |

|

C |

1.05 |

1.20 |

|

D |

1.10 |

1.25 |

A composite quote for this option would

show a bid of 1.10 and an offer of 1.20. A market order to buy should return an

execution at 1.20. But if your order is routed to sources A, B, or D, you might

get executed at 1.25 or 1.30. If you placed a limit order to buy at 1.20, that

order should be executed immediately, but if your order doesn’t go to source C,

then it might not.

Sometimes, your quote source may be

showing only one market’s quote, not the composite quote. And you may be

viewing quotes and trades that are delayed 20 minutes rather than in real time.

All option exchanges have a procedure at the beginning of the day called the

opening rotation. This was devised to help provide orderly markets in all of

the options on a particular stock at the beginning of a trading session and to

insure that all options open at a single price. (Listed stocks all open at a

single price, though futures actually open in a range of prices.) The process

operates in accordance with the following rules:

- Trading in the underlying stock must begin before any options on the stock can be traded. Thus, when a stock has a delayed opening or is halted during the day, option trading is suspended as well.

- Trading in each option on a given stock opens in an established order, with the farthest expiration months and lower strike prices opening first and the nearest expiration month and higher strike prices opening last.

- Once an opening trade (or quote) is established, no additional trades in that option can take place until trading on all other options on the same underlying security has opened.

- To be eligible as the opening transaction on any option, an order must be placed before the opening rotation.

- Public orders are given priority over those of market makers.

The rotation process is an efficient,

orderly way of opening the markets on listed options, but it is not perfect.

Even with the help of computers, it cannot be instantaneous, and orders

received during the rotation cannot be processed until after the entire process

is complete.

Liquidity

Liquidity refers to the trading

activity in a listed security, and it is of greater concern in dealing with

options than with stocks. There is no hard number that distinguishes liquid

options from illiquid ones, but if an option trades thousands of contracts per

day, it is considered quite liquid; if it trades only a few or none at all, it

is considered illiquid.

The important issue is whether there is

enough activity to get a fair execution. The less liquid the option, generally

the wider the spread and the more you will pay for a purchase (or the less you

will receive from a sale) if you use market orders. If less than a few hundred

contracts of a particular option trade on an average day, the spread between

the bid and the offer will probably be very wide, a consideration in deciding whether

to initiate a position in that option.

Along with average daily trading

volume, you should also check the open interest when evaluating an option to

sell. Open interest tells you how many outstanding contracts exist for any

option, as of the previous night’s close. It’s helpful to see an open interest

of more than 1,000 options, although here, too, there is no magic number. If a

stock has moved recently, you could be looking at a newly issued strike price

that has almost no open interest at all yet. That does not mean you should

necessarily avoid the option. It just tells you that it may be a bit more

difficult to get it at the price you are interested in.

The option exchanges now post size with

each option quote, indicating how many option contracts can be executed at the

stated bid or offer, and you can see this if your quote service provides it.

For instance, if you see that 30 contracts of a particular call option are bid

for at a particular price, you know that you can sell up to 30 at that price—regardless

of volume or open interest considerations. It may be possible to sell more than

30, but you know you can sell at least 30. This figure is now available because

of the electronic execution capabilities of the options market. When

specialists or market makers place their markets in the electronic system, they

must state how many contracts they are “good for” at the

stated bid and ask prices. Consequently, size is now available to individuals,

much as it has been for professional traders for a number of years.

Options in Your Account

Industry regulations require that

brokerage firms preapprove all customers who wish to buy or sell options. There

are no exceptions to this process, and you cannot buy or sell a single option

until you are approved. Even if you are just going to write covered calls,

which does not entail nearly the same risk as buying options or selling naked

options, you will still have to be approved by your firm. It will require you

to fill out and sign an Option Agreement, separate from your new account form,

and provide you with a copy of the booklet, Characteristics and Risks of

Standardized Options, also referred to as the options disclosure document. You

can trade options in multiple accounts, but you must be approved in each account.

If you have a joint account with someone else, that person will also need to

sign the Option Agreement.

The Internal Revenue Service does not

forbid Individual Retirement Accounts (IRAs) and other qualified retirement

accounts such as defined benefit or profit-sharing plans from using options.

However, different brokers have set up their own rules and some will permit it

while others will not. At most, such accounts will be permitted to buy puts or

calls, sell covered calls, and buy or sell spreads. Other strategies that may

involve margin, such as put writing or ratio spreads, would not be possible,

since retirement accounts cannot be set up as margin accounts. As with regular

accounts, an Option Agreement is required.

When you fill out an Option Agreement,

you are required to indicate which strategies you intend to use, and you will

be approved for specific strategies only. Some firms combine the various

strategies into two or three general risk categories and approve you for one of

them. Covered call writing will always be in the lowest risk category. However,

it may be lumped together with a strategy like option buying, which carries

much more risk but still not as much as strategies such as writing naked calls.

To initiate a naked option position, you

must not only acquire preapproval but also secure the position with a hefty

amount of cash or margin. If you are approved for covered writing but not naked

writing, then you must always have or purchase the stock before selling calls

against it. If you want to sell the call first and try to buy the stock at a

lower price sometime later, your broker will not let you unless you are

approved to sell naked options (which is not a recommended practice, anyway).

OPTIONS FOR VOLATILE MARKETS : Chapter 1: Option Basics : Tag: Options : Institutions, Exchanges, Market order, Liquidity, market makers - How Options Are Traded: Options in Your Account

Options |