How to Trade Options: Interest Rates, Dividends, Calls Versus Puts

Volatility, Movement, Interest Rates, Dividends, Option prices

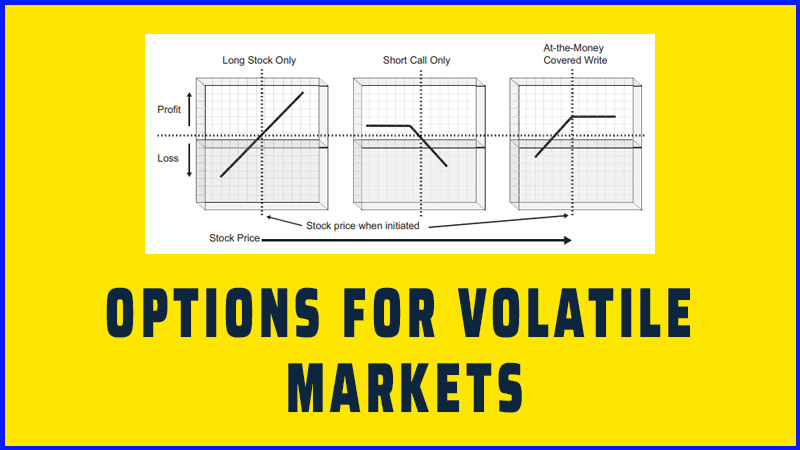

Course: [ OPTIONS FOR VOLATILE MARKETS : Chapter 2: Option Pricing and Valuation ]

Options |

Volatility is a measure of how much a security has previously moved in a given amount of time either up or down, and by implication, a measure of the future potential movement.

Volatility

Volatility is a measure of how much a

security has previously moved in a given amount of time either up or down, and

by implication, a measure of the future potential movement. It is important in

determining an option’s theoretical value, and it is essentially the factor in

the formula that accounts for the probability that the underlying stock can

move to or beyond the strike price before the expiration date. If a high-beta

(highly volatile) semiconductor stock and a conservative bank stock are both

trading at $30 a share, you would not expect both to have the same probability

of reaching $35 by a certain date. Their option prices would reflect this

difference as a consequence of their different volatilities.

Historical volatility is calculated

using the statistical formula for the standard deviation of a previous set of

prices over a defined time period—typically 20, 50, or 100 days. One problem

with that, however, is that each of these time periods can yield a slightly

different volatility value and different data sources use different sets of

historical values for their calculation. The greater issue is that none of the

historical probability periods may produce an accurate prediction of the

stock’s future volatility. The market may therefore price an option quite

differently from its theoretical price. It is important to know all this so

that you can keep a realistic perspective on the theoretical prices you see for

options on quote screens or other services.

As discussed in the Introduction, it is

really the implied volatility of an option (that which is determined in the

marketplace) rather than the historical volatility (calculated from historical

data) that is key, since what you pay for an option is determined by the

implied volatility. But it is the historical volatility that is used to create

the theoretical value that we at least use as a rough benchmark to determine

whether an option is undervalued, fairly valued, or overvalued.

Volatility is discussed in greater

detail in Chapter 9.

Interest Rates

Interest rates play a role in

determining option prices as they affect the cost an arbitrageur would have to

pay to carry a riskless stock-and-option position. Although a very minor one

from day to day, the effect can be noticeable when comparing option prices

during periods of very low interest rates with those of very high interest

rates. For the short duration of most option trades, the impact of interest

rates will be imperceptible unless they are changing somewhat dramatically in a

short period of time—say, weeks. Option writers can expect to get slightly

higher option premiums when interest rates are higher, all other things being equal.

Dividends

Option prices are affected by

dividends, although some models omit them for convenience. Since dividends are

cash distributions to shareholders from the earnings of the company, once paid,

they are no longer part of the company’s net worth. To reflect this fact, the

stock price is reduced on the appropriate date by the amount of the dividend

(and the stock is therefore said to trade ex-dividend on that date). No

adjustments are made to the price or terms of options on stocks that pay dividends.

Therefore, one would expect call options to be priced somewhat lower for stocks

paying dividends and put prices somewhat higher, since the option buyer gets no

benefit from the payout. Furthermore, the dividend represents value that is

removed from the company’s net worth each quarter rather than being reinvested

inside the company and thus reduces the growth prospects of the stock. Indeed,

the value of a call option does tend to be lower on a dividend stock and put

options slightly higher because buyers know the stock price will be lowered on

the ex-dividend date. As the dividend approaches, options tend to anticipate

the expected drop in value caused by the dividend.

The change is very slight and occurs

gradually, and because the stock price is continually changing, there is no

arbitrage that can take advantage of this option price change on a riskless

basis. There is, however, a common arbitrage on dividend paying stocks whereby

arbs will buy the stock, sell ITM call options that expire after the dividend

will be paid, and purchase puts at the same strike price and month. The

position is placed at a net price equal to the strike price (give or take a few

cents) such that if arbs are assigned on the stock prior to the dividend, they

make no money. But they don’t lose any either, and if they are not assigned,

they pocket the dividend and then exercise their put to sell the stock, earning

a dividend payment that was acquired with virtually no risk. Dividend arbitrage

on certain stocks can occur on millions of shares. As such, investors

implementing option strategies on high dividend-paying stocks should be aware

of this arb activity.

Calls versus Puts

Our discussion thus far about option

pricing has made no real distinction between the pricing of puts and the

pricing of calls. There are, however, differences, and, while small, they are

worthy of note.

Theoretically, the price of a call

option considers the possibility of the underlying stock rising to infinity.

The put, however, accounts only for the probability that the stock goes to

zero. Stated another way, a $40 stock can only drop by a maximum of $40 or 100

percent, yet it could conceivably go up by $60 (150 percent) or more. The

probabilities of the stock going to either of these extremes during the option’s

life may be miniscule, but from a statistical perspective, they are meaningful.

They require that options pricing formulae use an assumed distribution other

than a normal (bell-shaped) distribution for prices of the underlying. The

options pricing formula developed by Fischer Black and Myron Scholes accounts

for this phenomenon by utilizing a lognormal distribution, which essentially

holds that prices may range between zero and infinity, corresponding well with

the reality of stock prices. The result is that call prices contain a small

positive bias in price over the equivalent (same strike and month) put. That is

to say, that for a stock at exactly $50 with a volatility of 20 percent, a

50-strike call with 60 days to go would theoretically be $1.64, while the

50-strike put would theoretically be $1.60.

Option Skews and Anomalies

As you will discover, some options may

trade near their theoretical values while others may deviate significantly from

the formula-derived price. You will also observe, however, that when an option

trades above or below its theoretical value, most others in the same month will

also, and by a similar amount. Both of these observations are very important to

the development of option strategies.

When demand for a specific option on a

given stock is particularly high, the price of that option will be expected to

rise, perhaps well above the theoretical value. Let’s say that XYZ is trading

at $25 and there is abnormally strong demand for the May 30 call option. As

that occurs, it presents opportunities for riskless arbitrage between that

option and its underlying stock, which tends to bring that option back into

line with other options in the same month and with the stock itself. Such

arbitrage is rather straightforward and widely practiced by professional

traders, market makers, and brokerage firms.

Aiding in the maintenance of price

relationships between options is the fact that market makers price them by

computer, and when they want to change the prices on a particular stock’s

options, they commonly do so by simply changing the implied volatility in their

pricing model. That results in all of the options on a given stock (at least

those in the same month) being ratcheted up or down, essentially in unison, by

the press of a button.

But there are other pricing anomalies

that commonly occur with option prices that cannot be rectified by an arbitrage

trade. The most common deviation in option pricing is the tendency of a given

class of options (those on the same underlying stock) to trade at prices that

imply a higher or lower volatility than the historical volatility used in the

Black-Scholes formula. This happens extremely often and is readily visible when

viewing an option chain, as both actual and theoretical prices are typically

available in most option chains. An example is illustrated in Table 2.4, using Apple Computer (AAPL).

TABLE 2.4 Market Price versus

Theoretical Value

|

Stock = AAPL Price = 348.48 (1/14/11) Option Strike = 350 Calls |

|||

|

Month |

Market Price |

Theoretical Price |

Implied Volatility |

|

Jan |

6.55 |

2.70 |

.35 |

|

Feb |

11.10 |

6.51 |

.27 |

|

Mar |

14.95 |

8.93 |

.27 |

|

Apr |

18.65 |

10.87 |

.28 |

|

Jul |

27.65 |

15.69 |

.29 |

|

Oct |

36.15 |

19.67 |

.30 |

|

Jan LEAP |

43.17 |

22.79 |

.31 |

Data source: Power Options®

www.poweropt.com/.

Table 2.4 shows us that on this day in January 2011, the market

prices of options on AAPL closed considerably higher than those calculated by

Black- Scholes. This is supported by data from McMillan Analysis Corp., showing

the actual historical volatilities for AAPL to be as follows:

|

Historical |

Volatility |

|

20-day |

11 |

|

50-day |

17 |

|

100-day |

19 |

Depending on which time period you use

for your volatility calculation, the implied volatility is almost double and,

accordingly, so are actual prices. This may be a relatively extreme example,

but the phenomenon is quite common. You will also notice that the implied

volatilities in different months are not even the same. They are very high for

the current month option, then dip by 25 percent in the next month and begin

rising each subsequent month. (The full option chain shows almost identical

implied volatilities in all strikes of the same month.) These are the realities

of option pricing.

The reasons for such a differential

between actual and theoretical pricing may be varied. The market may simply be

expecting higher volatility in future months than during the period on which

historical volatility was calculated. Or the market may be injecting a bias to

either the upside or downside on the stock, which manifests itself as a higher

implied volatility for both put and call options.

It is important to note that,

regardless of the direction of an inherent bias being priced in by the market,

both puts and calls on the same underlying will rise or fall accordingly. This

phenomenon can be very misleading to those trying to interpret a directional

message from the price of an option alone. When bad news comes out or is

anticipated on a particular stock, there may, for example, be an increased

demand for puts on that stock, causing put prices to rise above theoretical

value. What happens, due to market forces and arbitrage, is that both the puts

and calls on that stock will rise above theoretical value, and they will do so

by a similar amount (i.e., the implied volatility of the puts will be similar

to that of the calls).

Such differences in option prices between actual and theoretical or between actuals in different months are called skews—anomalies between the prices of different options on the same instrument. They cannot be arbitraged away, but they can be used in the development of option strategies that may offer a statistical advantage over time. The overvaluation in AAPL call options is somewhat akin to finding a blackjack table that pays 3-1 for a blackjack instead of 2-1. Over a large number of hands, it represents a definite statistical advantage to the player, but you still may not get one in the short run.

OPTIONS FOR VOLATILE MARKETS : Chapter 2: Option Pricing and Valuation : Tag: Options : Volatility, Movement, Interest Rates, Dividends, Option prices - How to Trade Options: Interest Rates, Dividends, Calls Versus Puts

Options |