Simulated Trading

How to use Simulation, Best way to practice trade, Financial setup

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within ]

The more practice you have, the better you will perform. But if you practice the wrong thing over and over, then there is little hope for improvement. That is not a line for a trader that was a line from a golf pro to a bad golfer.

SIMULATED TRADING

It goes

without saying that the more practice you have, the better you will perform.

But if you practice the wrong thing over and over, then there is little hope

for improvement. That is not a line for a trader—that was a line from a golf

pro to a bad golfer. It just so happens that it applies to trading. Almost any

brokerage firm will give you a free trial to a simulated trading account for

you to bang around on. With no real money on the line, you really are not

putting your time to good use. It is extremely advisable if you never traded or

if you switch to a new company to get accustomed to the trading platform that

may be unique to that company. That makes all the sense in the world.

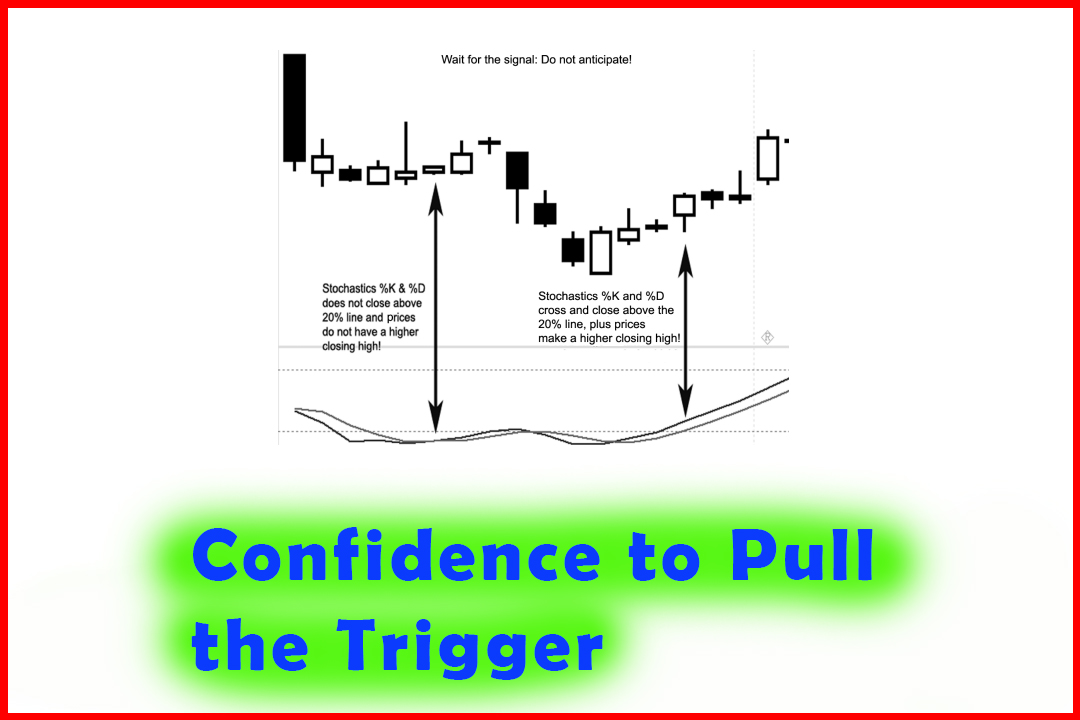

A trader

needs to take action when a trigger is generated, rather than taking a

wait-and-see attitude and then reacting to the market long after the market has

moved. As a trader, you need to be quick. A sudden brain spasm spawned by fear,

doubt, or greed will most likely not bring consistently good results.

Hesitation is a trader’s enemy; that is why I say, “Plan your trade, and then trade your

plan.”

Simulated

trading can help you test a trading method, but what about testing your

emotional response to market conditions? How will you develop the confidence

from within to win? What will seriously help the trader who enters too early or

too late and can’t hold on to the winner? What can help the trader who

hesitates and can’t pull the trigger?

For

starters, you need to not trade with what we call “scared money.” That’s the money

that you are afraid of losing, that you protect so well that you end up losing

it. Remember in Chapter 11 that we went over the performance sheet on the

trading system results. The payout ratio is the amount of the average winner

versus the loser. If you cut out of a winning trade too early and do so

randomly because you need to make a profit, then you are possibly setting

yourself up for a financial meltdown because you are not letting your winners

ride.

One

question that new investors ask me is why they did better at paper trading than

they did when they traded with real money. The answer is easy. They let their

emotions such as fear, doubt, complacency, greed, anxiety, excitement, and

false pride interfere with their rational and intellectual thoughts. When

dealing with real money, you are faced with the realization that you and your

money can part.

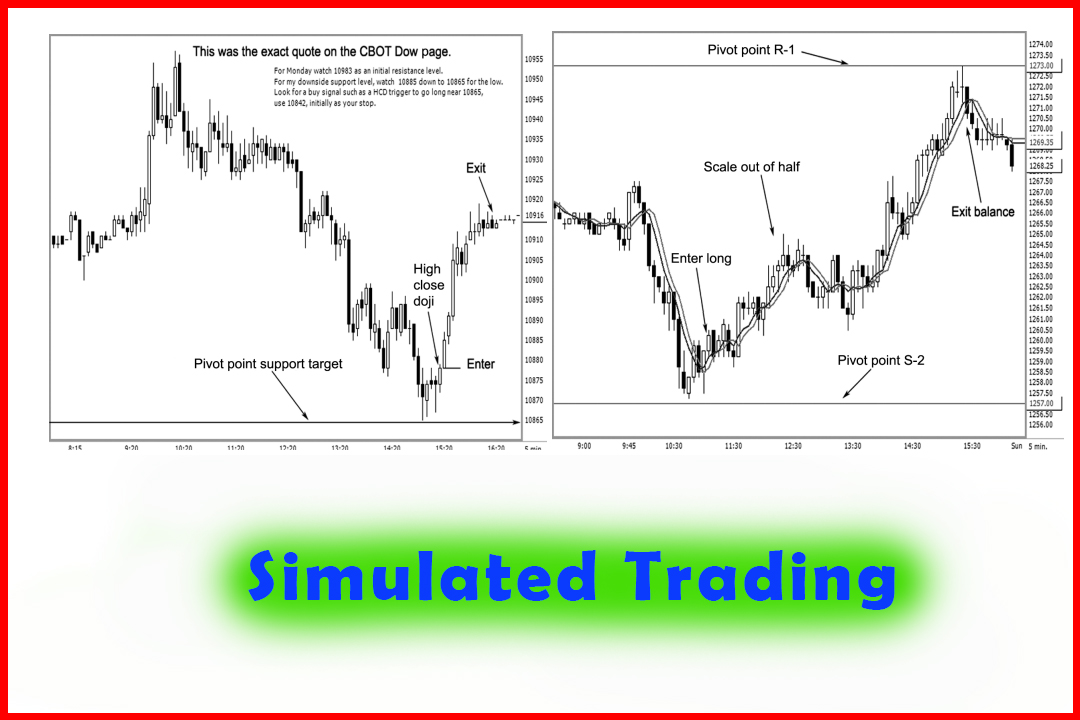

Simulated

trading is good to understand the mechanics of a trading execution platform.

However, putting real money on the line is what will test your trading skills.

Here is a suggestion: If you want to really see if you have what it takes to be

a professional trader who can execute a testable trading system, then trade

with the smallest lot or position size for a period of six weeks or two months.

You may not make lots of money if you are consistently right, but you will

develop the confidence to act on your signals when your self-imposed training

session is completed. If you trade stocks, instead of trading 200 shares of an

$80 or $100 stock, trade 50 shares. This will help you feel more at ease, and

it will also put your emotions to the test as you are trading with real money.

Here is

another suggestion: Open an ultra-mini-sized foreign exchange (forex) account

and apply the trading signal to that market. This is a nifty idea for those who

are beginners and still have day jobs. The markets trade 24 hours a day, you

can afford to hold positions overnight, and you have money on the line so that

you will be more realistic in the execution of your trading plan. You can trade at

night and execute trading signals in an extremely liquid market. If you have a

system that works reasonably well based on statistical back-testing studies,

the only confidence that should be in question is your ability to execute the

signals. That is what trading a mini-forex account can do for you. It will

exercise your emotional intellect. You will learn that when you place a trade,

it is an educated decision, not merely a guess. One website to visit is

www.fxtriggers.com to help select a forex account and to open a simulated

trading account and develop the knowledge that will give you the confidence to

execute and act on the trading signals. Building confidence in yourself and in

your trading skills is extremely important in stimulating an optimistic winning

attitude. Opening a mini-forex account just may help a newcomer using a

technical-based system. Over a period of time, as your trading skills improve,

so will your attitude. As Thomas Jefferson once said, “Nothing can stop the man with the right

mental attitude from achieving his goal: Nothing on earth can help the man with

the wrong mental attitude.”

If you

want to follow what the money makers do, have a good plan, method, or system

and execute when a trigger presents a call to action. Maintain a winning

attitude!

I believe

the principles in this book combining candles and pivots will keep you on the

right side of the profit ledger. It is the method I have used for over 25

years. I have taught my own family to use these setups, and they have served us

well. My former students have expressed gratitude in seeing a method and

applying the concepts whether it is stock, futures, or forex. Some have moved

on to open their own brokerage firms, and even other educators come to learn my

technique. There is back-tested data to support the validity and frequency of

patterns. All you need to do is apply the knowledge and follow the rules.

LIVE BY THE RULES

If

you follow the rules of any methodology, then you have a better chance of

succeeding. That applies to any aspect of life, for that matter. As

Leonardo da Vinci stated, “Simplicity breeds elegance.” Keep things simple.

- Look for buy signals near support.

- Look for sell signals near resistance.

- When the system triggers a signal, act on it.

- When a system says get out, get out!

I wish

you well in all your trading endeavors. Remember that if you act on validated

signals, your actions are validated. If the method has merit, then your rewards

should have merit.

The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to use Simulation, Best way to practice trade, Financial setup - Simulated Trading