Candlestick Pattern Trading Ultimate Beginners Guide

candlestick chart trading strategies, candlestick patterns trading guide, candlestick patterns trading strategy, candlestick pattern trading books,

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 7. Candle Charts and Top Reversal Patterns ]

Candlestick charting is an extremely pronounced and effective method for tracking and examining the four most important price points: the open, the high, the low, and the close. Using candlestick charting helps me visually to better compare current price activity in relation to past price points of interest.

Candle Charts

Candlestick

charting is an extremely pronounced and effective method for tracking and

examining the four most important price points: the open, the high, the low,

and the close. Using candlestick charting helps me visually to better compare current

price activity in relation to past price points of interest. The advantage of

using candlestick charting in place of bar charting is that you can use the

same techniques and analysis that you do with bar charts and have the diversity

and unique signals that candlesticks generate. As you learn this method of

charting, you will come to see how it is a great barometer of human emotion,

namely, fear and greed.

In

addition, this is a simple, yet certainly more specialized format of charting.

It has gained in popularity in the United States and is currently followed by

more and more analysts. My first book covered most of the top formations, and I

want to review what I believe are the more frequent and reliable patterns. This

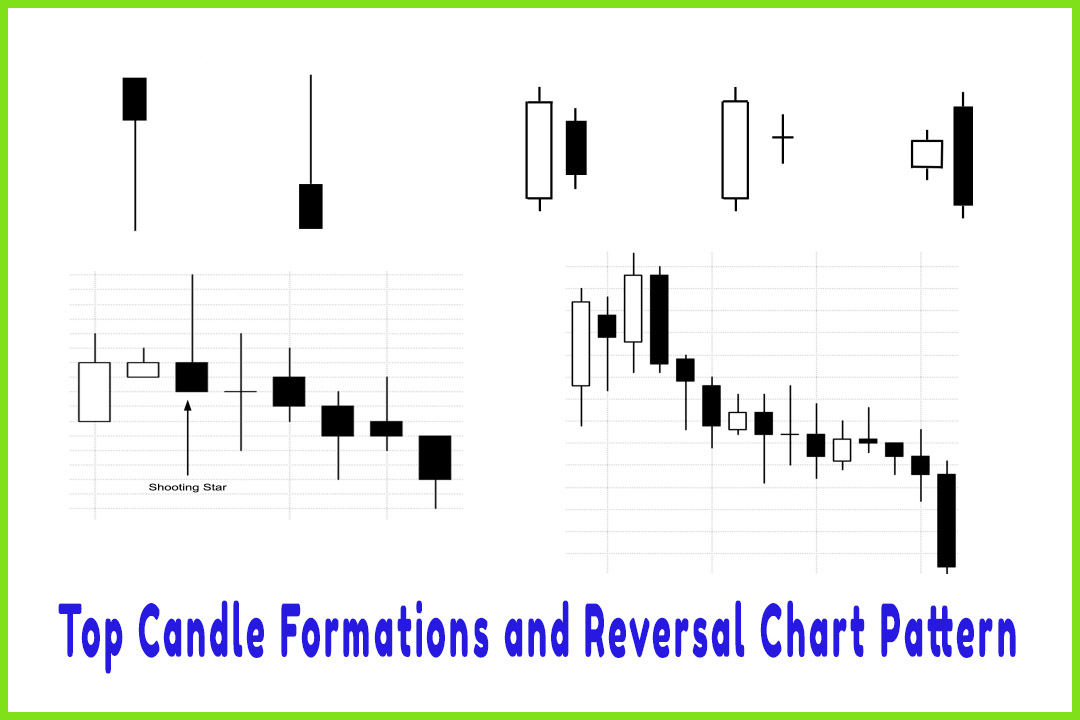

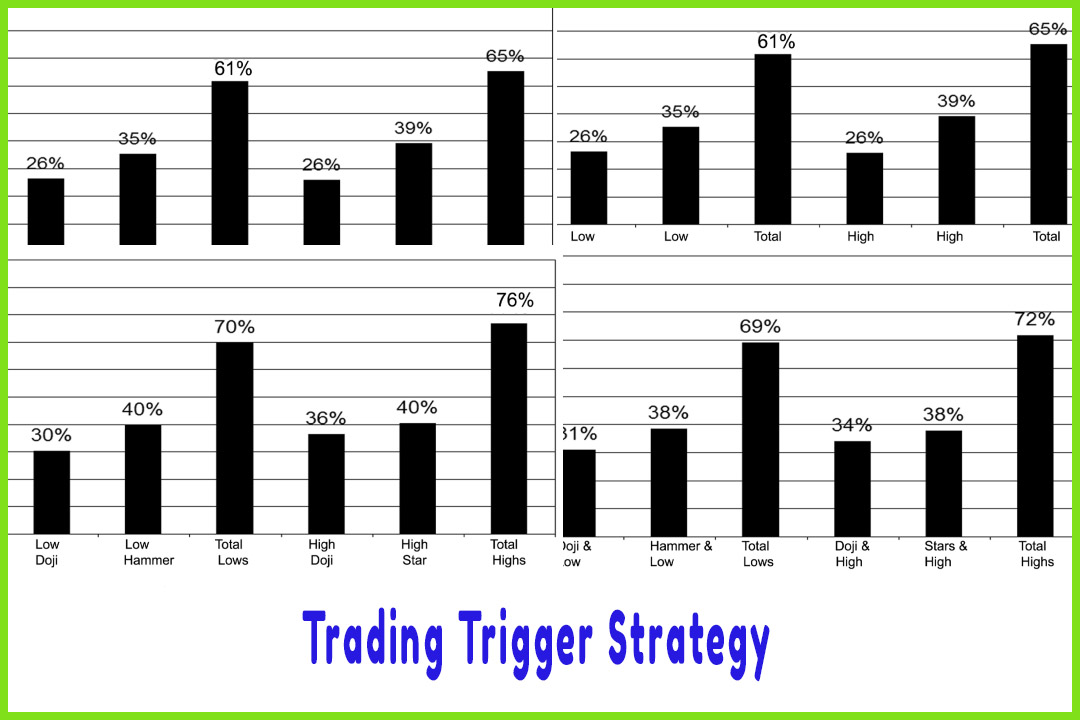

chapter will show some statistical evidence that there are certain patterns

that develop over and over again. Candlestick charting is extremely easy to

learn; and once you remember the sequence of events that form a trending market

condition, the candles will certainly be your best tool in spotting market

reversals at tops and bottoms. Having that information will certainly stack the

odds in your favor for making money consistently in the markets as an

independent trader.

CANDLESTICK CHARTING

Candlestick

charting gives a detailed depiction of a price graph with almost a

three-dimensional effect. What stands out most is that a chartist can see

patterns more clearly and distinctly than with other types of charts. There are

over 60 candle patterns that form to create certain setups. This book will

focus on only a few select patterns and, what matters most, the triggers that

initiate a call to action.

If you

are not familiar with candlestick formations, I am going over the foundation of

how to construct a candle and what it represents. If you wish to become an

expert at each of the patterns, several authors have written great books on the

subject. One is Steve Nison, who introduced the Western world to candles. (In

my first book, on page 44, I wrote about how he discovered candles.) Others are

Steve Bigalow and Greg Morris.

For the

expert, this section will be a great review. Since each market has a different

trading characteristic, such as volatility or price moves, certain candlestick

patterns vary and may occur more or less frequently. Each candlestick pictured

has a different characteristic that represents the difference or the distance

between the high, the low, the open, and the close. Candlestick charting

techniques can be used from data for whatever time period you use: hourly,

daily, weekly, or monthly. Candlestick charts lend themselves to pattern

recognition and trendline support, resistance, and channel lines. Candles also

help to corroborate other forms of technical analysis, especially pivot point

analysis.

I want to

explain the basics, and then I want to show you specific patterns so you can

see for yourself how to utilize them. I will also show a few examples of the

more popular named candle formations. Moreover, I will explain the psychology

of what is behind creating the pattern as it relates to the open, the high, the

low, and the close of a given time period. Armed with the knowledge of which

patterns have a higher frequency of occurring and with the understanding of

what they symbolize, you should be able to trade the markets from recognizing

them; and when patterns do develop, you should be able to instinctively act on

the signals, thereby increasing your ability to make money as a trader.

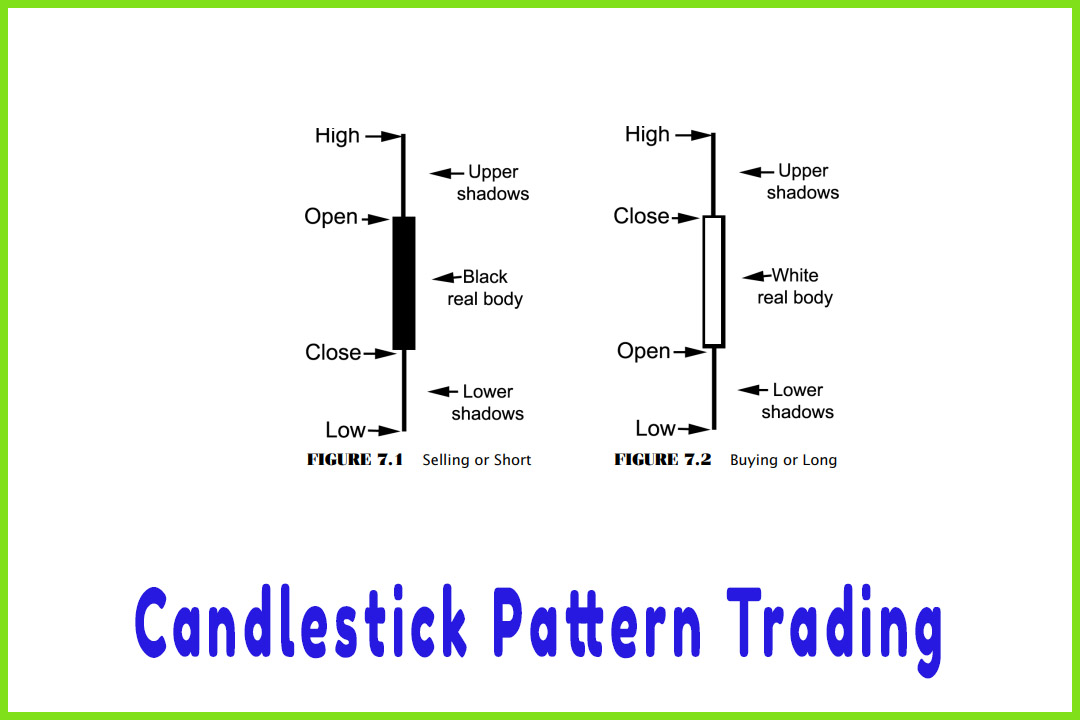

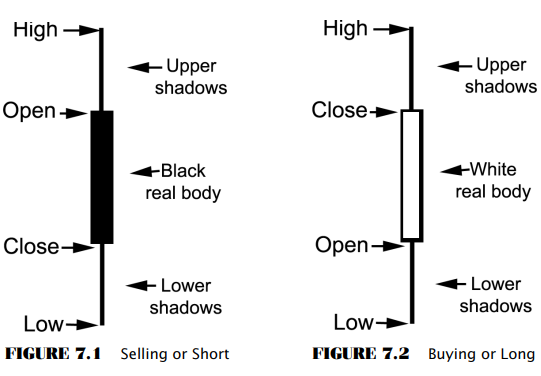

The

components of a candlestick are derived from the open, the high, the low, and

the close. In Figure 7.1, we see a dark candle (in a color charting software

package, it would be a red candle). This signifies that this particular time

period’s close is below the open. It does not indicate whether the market

closed higher or lower than the previous time period did. The computer code for

this sequence would be C < O—the close is less than the open. We can also

assign a negative (-) value or reading to help determine the relative strength

of a trend.

In Figure

7.2, the white, or hollow, candle signifies that the concluded time period

shows that the close is above the open (in a charting software package, you

would universally see this as a green candle). Keep in mind that you can adjust

almost any parameter in any software package to your liking.

Therefore,

you may want the candle to be white. The point is that the color of a “lower close

than open” candle should be

different from the color of the “higher close than open” candle. The computer code for this sequence would

be C > O—the close is greater than the open. We can also assign a positive

(+) value or reading to help determine the relative strength of a trend by how

many more positive, or “higher close than open,” candles exist.

The three main components of candle

charts that we need to identify are:

- Relationship

between Open and Close (Candle Bodies).

With the real candle body colored and representing a negative or a positive

reading, we can see what is dominating the market.

In

uptrends, or bullish market conditions, we see buying come in on the open; and

as we learned from the stochastics indicator, the market should settle closer

to the highs. It should also close above the open; and that is why in bullish

market conditions, we see hollow, white, or green candles. This is why I assign

it a positive (+) reading. How much the bulls are dominating the market is

reflected by the length or the distance between the open and the close. If the

market opens on the low and has a large range where it closes at the high of

the session, that signifies that the bulls are in strong control. However, if

the market has a wide-range session and the market price closes back near where

it opened—say, in the middle of the range—that is not a sign that bulls

dominate the market for that particular time period.

In a

bearish market condition, or a strong downtrend, we would see dark- or red colored

real body candles. This represents sellers entering the market on the open and

dominating the session right into the close of that time period. If the market

opens on the high and prices decline where the close is at or near the low,

this shows that the bears are firmly in control. This is why I assign a

negative (-) reading. The distance factors between the open and the close are

illustrated in a much more defined way in candle charts than in bar charts due

to the shape and color coordination of the candles.

- Shadows

and Correlations to Candle Body.

The distance of a low and/or a high in relation to the real body as created by

the open and the close can really illustrate the market’s denial of a support

or a resistance level. Long shadows, tails, or wicks, as they are called, that

form after a long downtrend indicate a potential that the trend has exhausted

itself and that demand is increasing or supply is dwindling. Shadows, tails, or

wicks formed at the tops of real bodies, especially after a long price advance,

indicate that demand is drying up and supply is increasing. The overall size of

shadows is important to watch in relation to a real body and can be easily

identified.

- Shadows

and Correlations to Candle Body.

The distance of a low and/or a high in relation to the real body as created by

the open and the close can really illustrate the market’s denial of a support

or a resistance level. Long shadows, tails, or wicks, as they are called, that

form after a long downtrend indicate a potential that the trend has exhausted

itself and that demand is increasing or supply is dwindling. Shadows, tails, or

wicks formed at the tops of real bodies, especially after a long price advance,

indicate that demand is drying up and supply is increasing. The overall size of

shadows is important to watch in relation to a real body and can be easily

identified.

- Size

or Length of the Overall Candle.

Now this is one that is hard to miss using the color-coded method of candle

charts. A long candle that opens at the bottom and closes at the high, which

would be an abnormal occurrence, has significant meaning. After a long

downtrend, seeing this formation indicates that a major trend reversal is

taking place. After a long uptrend, seeing an unusually long candle that closes

above the open (a positive value) would indicate that an exhaustion or blow- off-top

condition may exist.

The

reverse is true in down trades. After a long price decline, a tall red- or dark

colored candle, which represents the market close below the open (a negative

assigned value), may indicate that a capitulation or an exhaustion bottom has

formed. After a long uptrend or price advance, if that same candle was formed,

it might indicate that a major trend reversal is occurring.

The Candlestick and Pivot Point Trading Triggers : Chapter 7. Candle Charts and Top Reversal Patterns : Tag: Candlestick Pattern Trading, Forex, Pivot Point : candlestick chart trading strategies, candlestick patterns trading guide, candlestick patterns trading strategy, candlestick pattern trading books, - Candlestick Pattern Trading Ultimate Beginners Guide