How do I start? Profitable Trading

day trading Strategy, day trade signals, pivot point, moving average trading, pivot point calculations

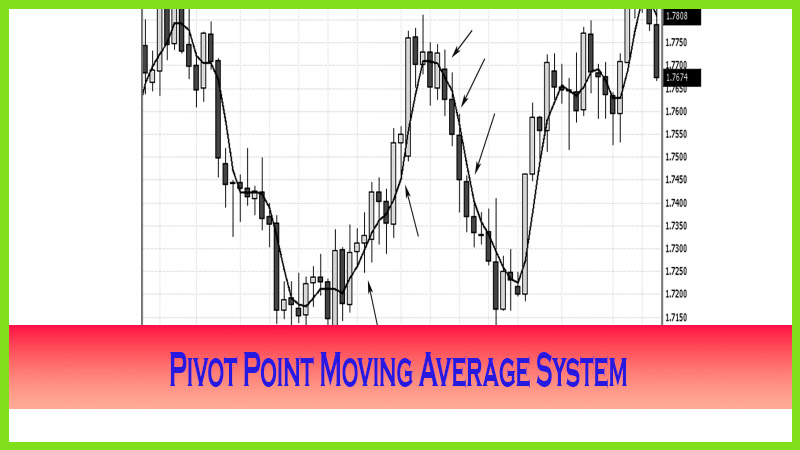

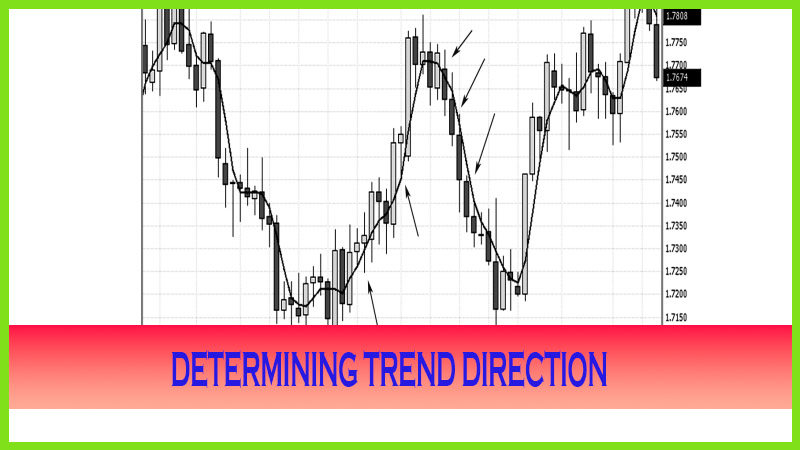

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System ]

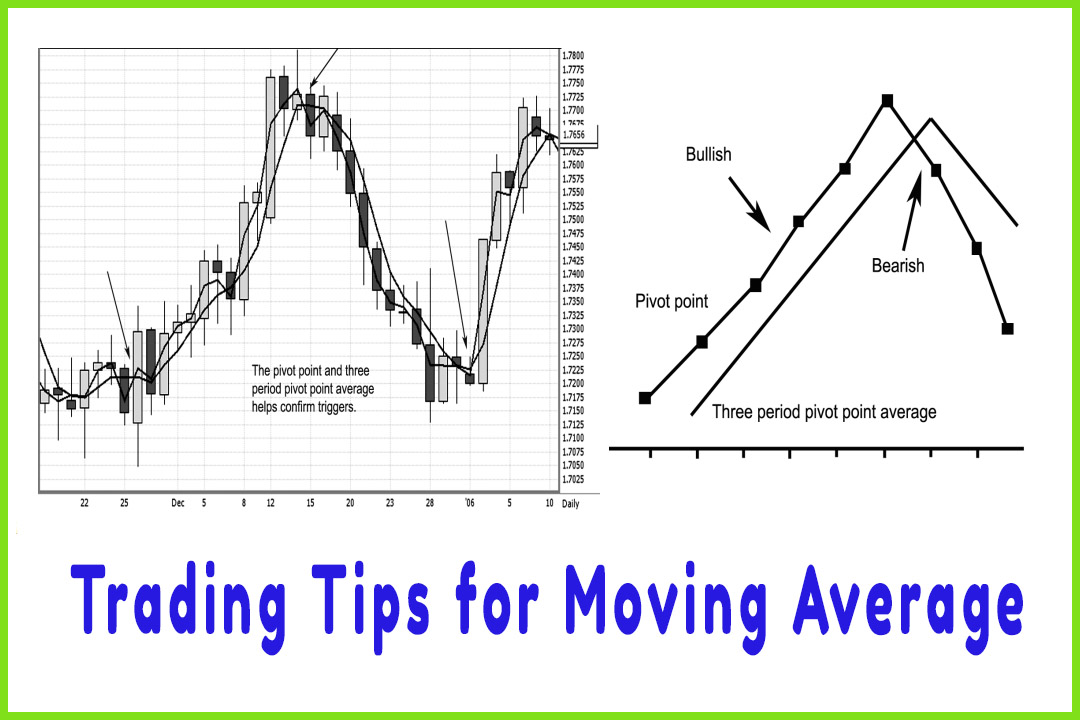

Using the pivot point as a moving average in addition to using the pivot point calculations to identify target ranges will certainly make you a more prepared trader.

HOW DO I START?

First,

I need to structure my computer and my charts to a format that is conducive to

day trading. For stock index contracts, I watch two “like” or “tandem” markets in two time periods. These are the CBOT mini-Dow and

the e-mini-S&P. Lately, due to client requests, I have been alerted to

trading the Russell 2000 and the German stock index Deutscher Aktien Index,

known as the DAX. The DAX, an index portfolio of 30 German blue-chip stocks,

opens at 3 a.m. (ET) and closes at 11 a.m. (ET). (On a side note, as of October

2006, the DAX, based in Frankfurt, Germany, will start accepting non-German

companies. In order to qualify for the Index, foreign companies must conduct

their operations in Germany.) The DAX 30 actually tracks close to moves in the

S&P 500 futures. In spot forex, I use the euro and a like market, such as

the British pound and the yen.

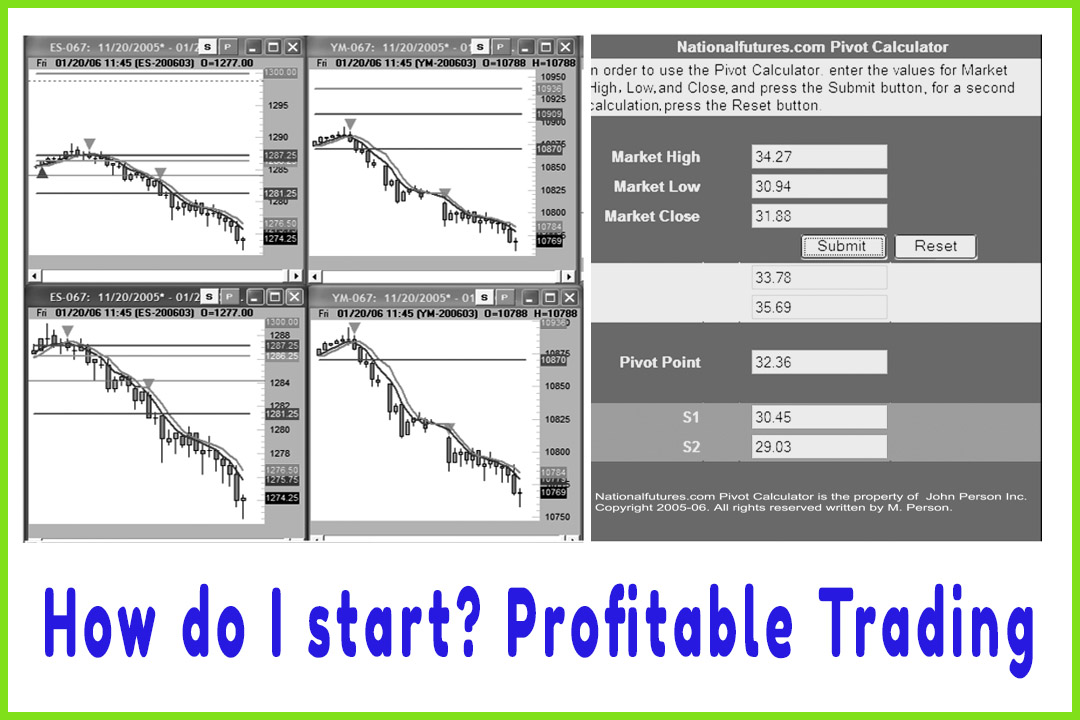

For day

trading, I use the 5- and 15-minute time periods. All of my chart screens look

the same: The 5-minute e-mini-S&P and the mini-Dow are on the top, and the

15-minute S&P and mini-Dow are on the bottom. All my chart pages are set up

this way; therefore, all chart pages are synchronized so that I do not watch

different time periods when switching from one screen to another—I have a

uniform setting.

- I find the most reliable day trade signals are confirmed in the 15-minute time frame and triggered in the 5-minute time period as well.

- When both time frames are in sync with each other and when like markets have similar signals, this generates a higher probability trigger.

As I

stated earlier, the parameters I use in this book are a variation of what is

programmed in my proprietary library with Genesis Software. This is a system

that generates buy and sell signals based on the principles we have gone over

in the book so far. More information on this software can be found on my web

site at www.nationalfutures.com

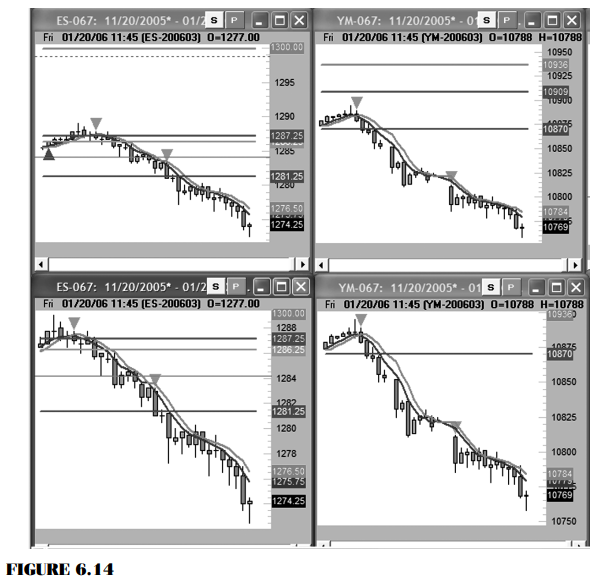

Figure

6.14 illustrates how I line up the e-mini-S&P with the mini-Dow side by

side with the corresponding time periods of 5 minutes at the top and 15 minutes

at the bottom. Stock and forex charts are lined up the same way.

The greatest feature with this software

is that it highlights a sell signal with a red triangle pointing down, and it

signals a buy trigger with a green triangle pointing up. These coincide against

resistance levels to sell and support levels to buy. As you can see, the sell

signals when aligned against the pivot point resistance numbers offer a

fantastic visual confirmation based on my predefined strategies; therefore, it

will help eliminate the emotional element and impatience of acting on

anticipation rather than on a true signal.

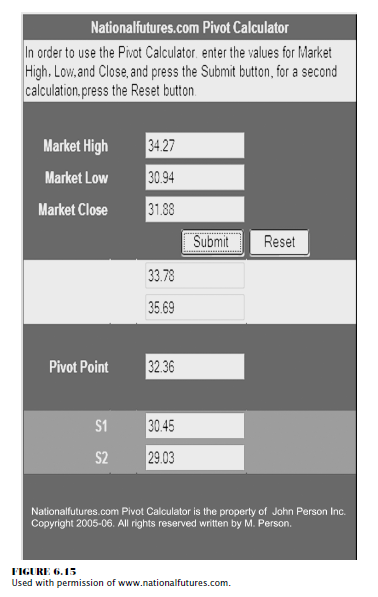

All the

signals and methods covered in this book can be applied with most charting

packages. In fact, 26 years ago, I was calculating the pivot point support and

resistance numbers with a handheld calculator. The pivot point calculator is

available on my web site. In addition, this book comes with a CD (compact disc)

that has a pivot point calculator as well. All that needs to be done is to

input the data for the high, the low, and the close; and the R-2 down to the

S-2 numbers will be calculated for you. It is very easy to use; all you need

are the prices for stocks, futures, or forex markets for any time frame. Figure

6.15 shows the monthly price range for Dell Inc., which I will use to

demonstrate how powerful this method of market analysis is when combined with

certain candlestick patterns.

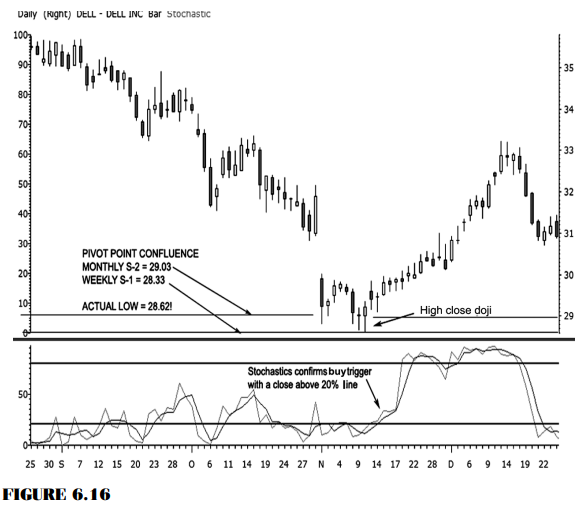

Figure

6.16 is Dell with the monthly and weekly pivot support targets indicating a

possible bottom. Using the higher time frames, such as the monthly figures,

alerted me to a major bottom. All I then needed to do was a high close doji pattern.

The next few chapters will really bring home the message of the value of incorporating pivot points and candlestick patterns. Using the pivot point as a moving average in addition to using the pivot point calculations to identify target ranges will certainly make you a more prepared trader.

This method has captured the attention of

many experts who are now using it; and its accuracy at predicting turning

points in the market constantly amazes me. Believe me, many people are

fascinated by this concept. In December 2002, Futures Magazine first

published an article I wrote on the subject, “Combining Cycles and Pivot Points

to Predict Market Values” (p. 38), and has published several other articles of

mine. Perry Kaufman, the famous technician and author, in the fourth edition of

his nearly 1,200-page New

Trading Systems and Methods (Wiley, 2005) quoted my work from such magazine

articles.

Many other educators have come to

listen to me teach, have taught my ideas, and have seen improvement in their

students. I have had the opportunity to share my work and research with others,

and I would like to share it with you. These trading ideas are not new, and

they have stood the test of time.

Here is

an excerpt from an online interview I had in February 2003 (see www.nationalfutures.com).

The concepts I was talking about then pretty much cover what we have gone over

so far and will continue to cover in the following chapters. The difference is

that I am going over in detail what the specific signals, settings, and rules

are for the trading triggers.

Q: How do you calculate pivot points?

A: I use the traditional formula. To determine current

support/resistance levels, the first step is to find the pivot point [PP]

number: PP = (H + L + C) divided by 3

The first

resistance level (R-1) = (PP x 2) - L

The

second resistance level (R-2) = PP + H - L

The first

support level (S-1) = (PP x 2) - H

The

second support level (S-2) = PP - H + L

Q: What time frames do you apply to calculate the pivot

points?

A: I find it extremely important to use multiple time frames

in my research and analysis. For those who are familiar with the “numbers” from

the pivot point calculations, the idea of applying them from any time period

other than the prior day’s session may make little or no sense. However, I

apply the daily, weekly, and even monthly target numbers and incorporate these

in my traders “tool box.” Often traders will comment, “If I am a day trader, why would I want to

be concerned with a monthly or a weekly market outlook?” Consider that in every month, there will be a

high and a low, and the close will be somewhere in between. In one week, a high

or a low will be established; and in one day of the week, the market will form

that point of interest. More often than not, in an hour or so, trades will take

place that will establish that high and subsequently that low!

Q: What are the various time periods in forex markets from

which you take the data to calculate the numbers?

A: For the daily numbers, I take the New York Bank settlement.

For weekly numbers, I use the data beginning from the open on Sunday night to

the close on Friday afternoon. Monthly numbers are calculated by calendar

periods.

Q: What is the main purpose for using the pivot points, and

how can traders use them?

A: One popular application of the pivot point concept is to go

long or cover any short positions at either of the two support levels or to go

short or sell at the projected resistance levels. Knowing these fixed price

levels gives the trader unambiguous points to trade off, to enter, or to exit

the market or, more important at times, where not to enter a position. For example,

you should not buy right at either of the resistance levels. These levels act

as boundaries that can turn back price advances or declines, at least on the

first attempt. Another technique is to trade the breakout of the first support

or resistance levels. If prices do break through the S-1 or R-1 level, traders

have a new target at the R-2 or S-2 level to take profits. The benefits of

using the both short- and longer-term pivot points for a short-term day trader

are numerous: They give a trader a better edge due to the ability to work with

predetermined price levels, which lead to precise entry and stop loss points,

all of which give the trader the additional edge in the quest for bigger

profits.

Q: You use different technical tools in your daily videos. On

which ones do you put more trust or emphasis?

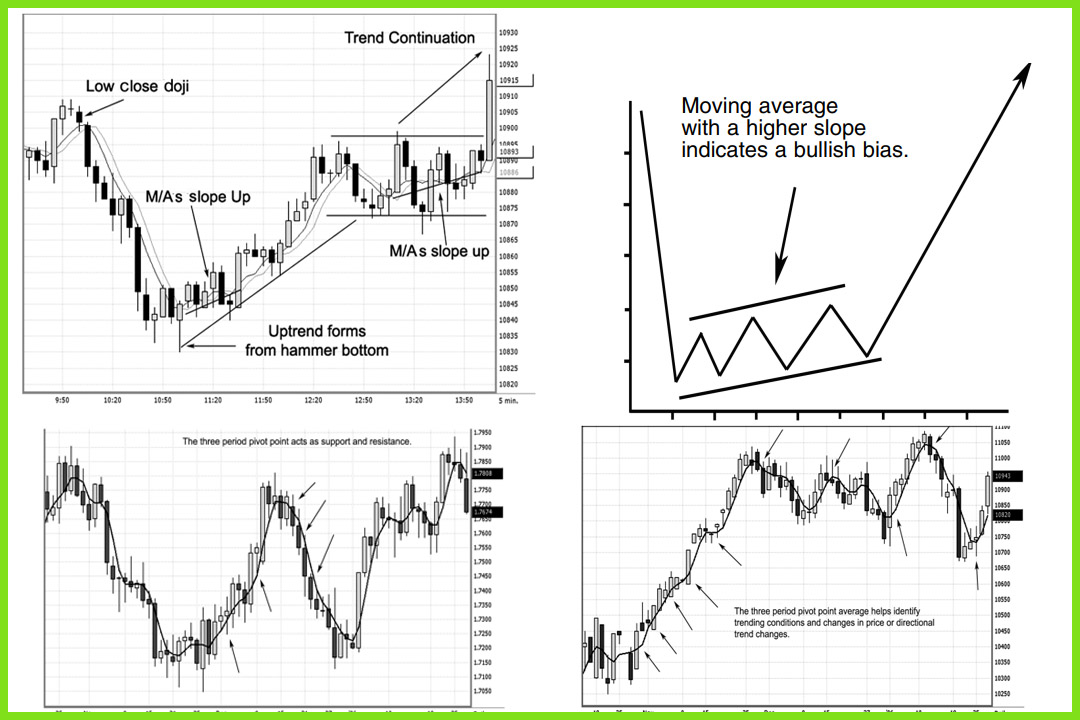

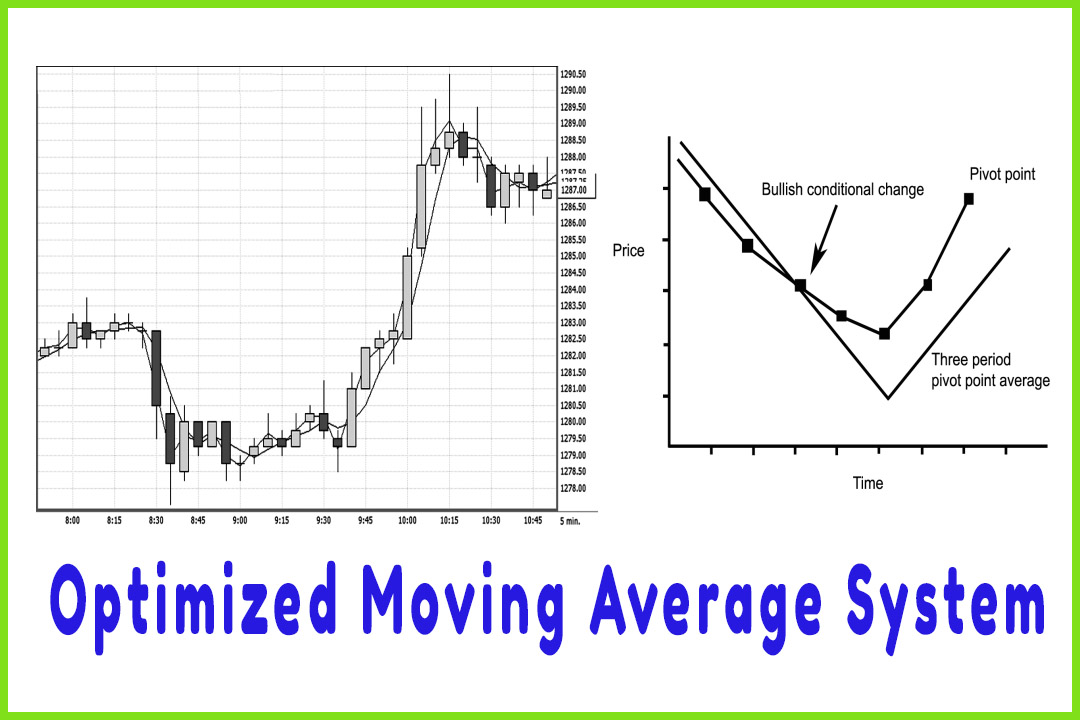

A: Great question! I use stochastics as an overbought/oversold

indicator, and I use it to help me determine divergence and convergence

signals. I use three-period variable moving averages to help keep me focused on

the trend. Moving averages also help me identify potential turning points when

the short-term average crosses over or below the longer-term average.

Q: You use candle charts over bar charts. Why is that?

A: Each candle has different characteristics that represent

the difference, or the distance, between the high, the low, the open, and the

close. These characteristics use colors to differentiate the relationship

between the open and the close, referred to as the real body. Candlestick

charting acts as an immediate way to illustrate and to help identify the

current market’s environment and the current time frame’s acceptance or

rejection of a specific support or resistance level in a clear visual manner.

If, for example, on a given trading session, prices move higher from the

opening price, establish the high, and then fall, the distance formed from

those points of interest is called the “shadow.”

Candle

charts give me color and depth, which help me almost immediately determine

where current prices are in relation to past price levels. Candlestick charting

techniques can be used from data for whatever time period you are looking at:

hourly, daily, weekly, or monthly. There are 60 to 70 different classifications

of named candlestick patterns—from one on up to several candle components. They

can signal reversal, stalled, and continuations of a market’s price move. Day

traders want to focus on a small arsenal of the more consistent and reliable

reoccurring formations. Several patterns that a trader wants to home in on and

recognize are the more powerful reversal formations at tops and bottoms of

price ranges.

Q: How do candlesticks help you in your trading?

A: My trading approach incorporates time-tested techniques but

uses the aid of candlestick charts, which help me identify the true condition

of the markets. If you believe market prices are simply the reflection of human

emotion on perceived current value and focus on what the market is doing,

rather than on what the market might do, then you are ahead of the crowd in

understand how markets function. With that understanding, you will then be able

to have the confidence to act swiftly and to execute or trigger into a trade or

position in the market.

Q: Which do you favor more—fundamental or technical analysis?

A: I watch what reports are coming out, as some can generate

wild gyrations (e.g., monthly unemployment report). I rely heavily on technical

analysis. After all, it is the purest and most objective study of price action.

It is used for expedience. You can review one, five, ten, or even twenty charts

in a matter of seconds or minutes to get a quick overview of the general

trends. How long would it take to study the fundamental reports on the economy

or interest rates in various countries to develop an opinion to buy or sell a

foreign currency? That process could take hours, days, or even weeks to figure

out. Specific chart patterns and price actions have a high degree of

repetition. They are not 100 percent accurate; however, they do have a high

percentage of reoccurrences. Success comes in the simple form of managing risk

when applying a systematic method to these principles and being able to quickly

identify when and why a particular pattern fails.

Q: You learned that certain candle patterns developed near

these pivot points. Which ones do you look for near support or resistance

levels?

A: Top reversal or bearish, such as dojis, bearish haramis,

harami crosses, dark cloud covers, and evening star formations. And for bottom

reversal or bullish candle patterns, I look for bullish haramis, harami

crosses, bullish piercing patterns, bullish engulfing patterns, or, my

favorite, a rare occurring pattern called a morning doji star.

Q: How significant are doji patterns?

A: Extremely significant, especially if you know what to look

for. There are specific criteria that dojis need to meet; but if you know what

these are, they can be very powerful in helping your trading decisions. Doji

formations help confirm reversals. There are different names and nuances

associated with certain dojis. Dojis indicate indecision, the market ends or

closes, where it began or opened. Dojis signify that confidence is lost from

buyers or sellers after the open as the market made a lot of intraday noise as

the range during the day was established. In a bullish or bearish trending

market, indecision is the last thing you want to see. Strong rejection or

failure from the high and/or the low is a significant telltale sign that

changes are coming.

Q: What other considerations can you share with us regarding

dojis?

A: In a strong up-trending market, usually the market will

close near a high, as larger capitalized traders will hold positions overnight.

If the large money traders are not confident the market will move higher in

price, then usually the market closes back near the open. I find it uncanny how

many times dojis form at or very close to the actual pivot point calculated

support or resistance numbers. That is what helps me set up my trades; it is

the relation of the next candle’s close after a doji that triggers my entries,

especially if they are lined up at the pivot points.

Q: What is the shortest time frame that you use for charting?

A: Five minutes.

Q: What other time frames do you track?

A: Besides monthly, weekly, and daily charts, I use the 5-,

the 15-, and the 30-minute and even the 60-minute for overnight trend trading.

Q: What is your favorite or most reliable time frame?

A: For day trading, the 5- and 15-minute are equally

important; so I watch both.

Q: Do you just use pivot points, or do you use other methods

for forecasting support and resistance levels?

A: In my book A Complete Guide to Technical Trading Tactics:

How to Profit Using Pivot Points, Candlesticks, and Other Indicators, I

demonstrate many powerful ways to anticipate support and resistance levels,

including Fibonacci retracement, Fibonacci extensions, and projection methods.

In fact, in my trading course, I teach specific trade setups and confirm

signals to trigger or execute trades, how to manage a trade, and how to know

when to exit or even reverse a position.

Q: What signals or rules do you follow for a trading trigger?

A: Without giving away too many of my trade secrets, there is

one that can be found in my advanced trading course—a special trading setup

that I look for in a bullish setup.

- When the market approaches a key pivot point, buy on the close or on the next open once a new closing high is made above the previous bullish reversal candle pattern or a doji.

- Place your initial risk-management stop below the low of the lowest low point of the bullish candle pattern on a stop-close-only basis.

- Exit the trade on the close or on the first open of a candle that makes a lower low after a prolonged uptrend, especially if it is near a pivot line.

- One can use a “filter,” or a back-up process, to confirm the buy signal against a major pivot point number, such as a bullish convergence stochastic pattern.

Remember,

a bullish candle pattern can be a harami, a harami doji cross, a bullish

piercing pattern, a bullish engulfing pattern, a doji, or a morning doji star.

Q: Tell us about this course and book you have mentioned?

A: The book was published by John Wiley and Sons in May of

2004. I put the course together based on several seminars I conducted, one of

which was at the Chicago Board of Trade back in May 2003 and then again in

December 2004. I had a huge response from folks who could not attend but were

impressed with my methods. I offer it on my web site, which is

www.nationalfutures.com. Both the book and the course are available on my site,

and I do get asked to autograph and add a personal message when these are pre-purchased

from my web site.

The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System : Tag: Candlestick Pattern Trading, Forex, Pivot Point : day trading Strategy, day trade signals, pivot point, moving average trading, pivot point calculations - How do I start? Profitable Trading