Trading Trigger Strategy

Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 7. Candle Charts and Top Reversal Patterns ]

Forex traders note that these candle patterns show up frequently in the currency pairs. Since many times the currency markets trade between the European and U.S. sessions, we see periods of low volatility; and the foreign exchange (forex) markets move in sideways channels, otherwise known as longer-term intraday consolidation periods.

TRADING TRIGGER STRATEGY

Forex

traders note that these candle patterns show up frequently in the currency

pairs. Since many times the currency markets trade between the European and

U.S. sessions, we see periods of low volatility; and the foreign exchange

(forex) markets move in sideways channels, otherwise known as longer-term

intraday consolidation periods. We often see false breakdowns and breakouts,

which create the equal and opposite formations. Therefore, a trigger to enter a

position would be if the market price is near an important pivot point support

level: Buy on the close of the second candle’s time period or on the open of

the immediately next time frame. Place a stop two ticks (or PIPS) beneath the

double-bottom low. You should see immediate results as the market moves higher.

Adjust your stop accordingly.

Chapter 8

goes into more specific trading rules on entries based on three highly

effective and frequently reoccurring patterns. Dojis form more often than not

at pivot point support and resistance levels. With that said, the pivot point

support and resistance levels will usually be either the exact high, the exact

low, both, or darn close to it, which is why I wanted to get statistical

information on the doji, the hammer, and the shooting star patterns. Also, I

wanted to answer the following questions that apply for the most active day

trading markets in futures and forex.

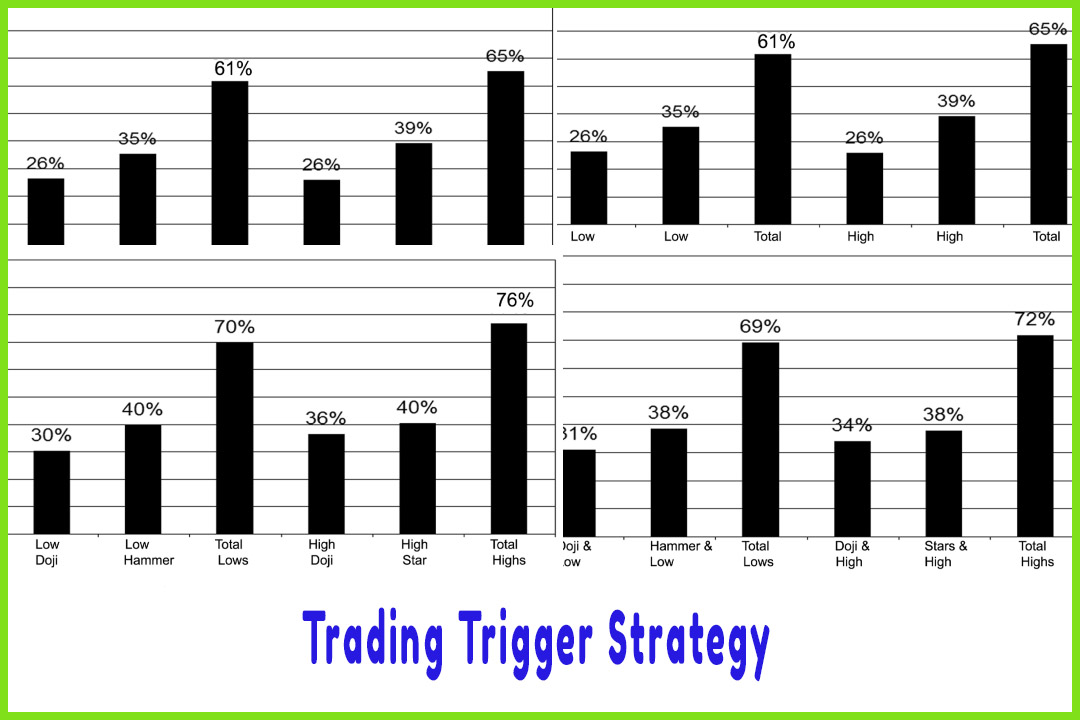

- How many lows of the day are formed by a doji candle pattern?

- How many highs of the day are formed by a doji candle pattern?

- How many lows of the day are formed by a hammer candle pattern?

- How many highs of the day are formed by a shooting star candle pattern?

To find

the answers, I conducted a back test using Genesis Software (visit

www.nationalfutures.com for more details) with its head programmer, Peter

Kilman. Pete came to a seminar I was giving on Advance Trading Tactics for

forex markets in Houston in January 2006. It is interesting that, at the time,

I was unaware of his preliminary test results when he offered to share them

with the audience. In fact, he had thought that he ran the test wrong when the

results popped up, so he ran it three times. Pete ran the test from the

preceding 255 trading days on a 15-minute time period for each market. Because

there are about 255 trading days in an average year, I felt this was a pretty

good sample of information. Most people want to see longer-term studies; for

some applications and specific studies, that may be a novel idea. However, I

would say the markets in 2005 generated enough volatility, with macroeconomic

and geopolitical events combined with the Federal Reserve tightening interest

rates. Moreover, energy prices were on the move; and we were faced with global terrorist

attacks, such as the heinous bomb blast in London that shocked the world in

mid-July 2005. That event sent a tremendous price shock to global equity

markets. In addition, there are more independent online traders and a new crop

of super traders known as hedge funds trading in the markets. So with these

variables and market influences, I would say 2005 was a good representation of

a more modern historic test period for determining what influenced market

prices.

A 10-year

back study would not take into account the more active online trading vehicles

or the popular spot foreign currency markets. Even if this were a 2-, 5-, or

10-year study, risk disclosure and the government still would require me to

state that past price history is not indicative of future results. So, my study

was a back-test study to determine the validity of finding out if dojis,

hammers, and shooting stars were really forming at major turning points or were

making the actual highs or lows in the more active day trading markets and how

often. Here are the parameters Pete and I used to determine the back test and

the results of the findings: If a doji is within three ticks of the low, we

count it. It could be the low itself, or it could be within one, two, or three

ticks of the low. In the same sense, we will include when a shooting star is

within three ticks of the high. To create a percentage, we take the number of

days when we are within three ticks of the low and divide that by 255.

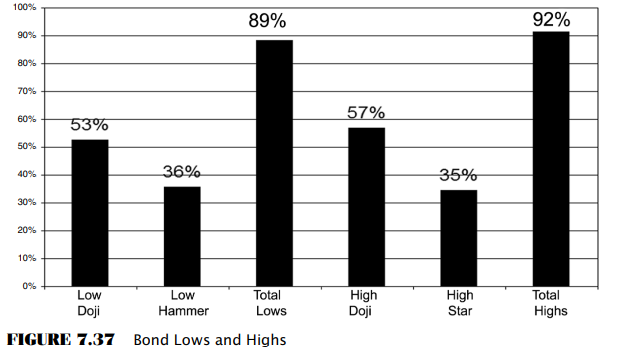

For

example, we found that on 132 of the past 255 days, a doji came within three

ticks of the low on bonds. We took 132 and divided by 255, getting 0.528, which

is 53 percent. We also found that the hammer pattern was within three ticks of

the low 36 percent of the time on bonds. We added the two pattern totals

together and found that hammers and dojis formed the low on bonds 88 percent of

the time, either making the exact high or coming within three ticks. We must

keep in mind that there are many days that have multiple dojis or hammer

patterns.

Some days may have four doji patterns

where only one of these doji patterns formed the low, while the other three

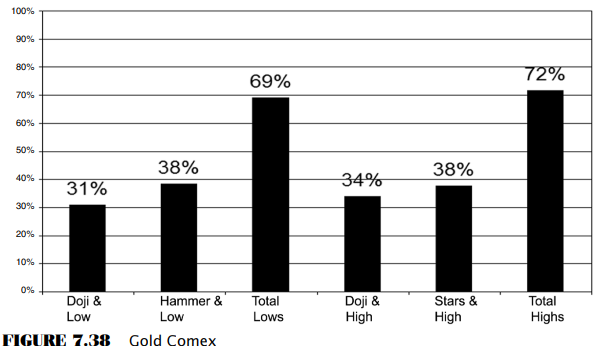

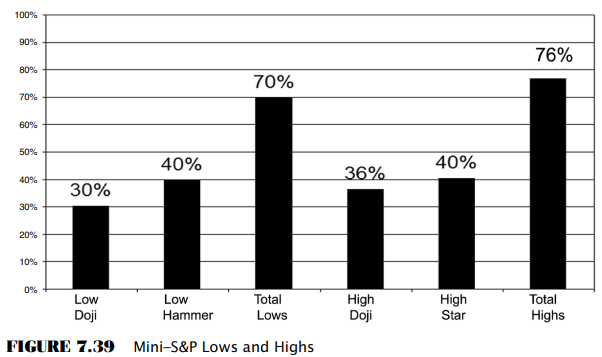

gave false signals. For gold, we used four ticks. For e-mini-Standard &

Poors (S&P) 500, we used four ticks (each tick is 12.50, so four ticks is

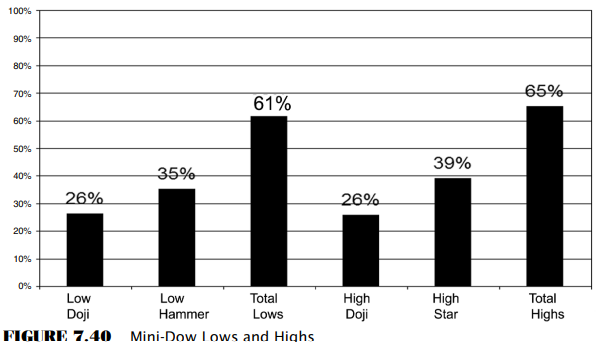

one full point). In the Chicago Board of Trade (CBOT) mini-Dow, we also used

four ticks, which may explain why the resulting difference is a lower

percentage of occurrences for hammers, stars, and dojis forming at tops and

bottoms in the Dow. As you can see, the results are staggering that the highs

and lows are formed by these three patterns. If you just focus on when these

patterns form, looking for a shift in momentum or the turning point, you may

improve your profitability and frequency of winning trades as you may develop a

better level of confidence armed with these findings (Figures 7.37 to 7.40).

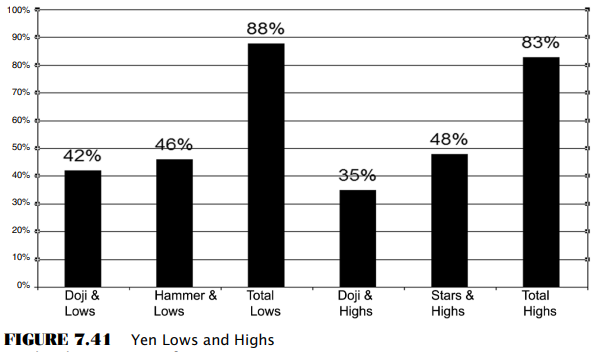

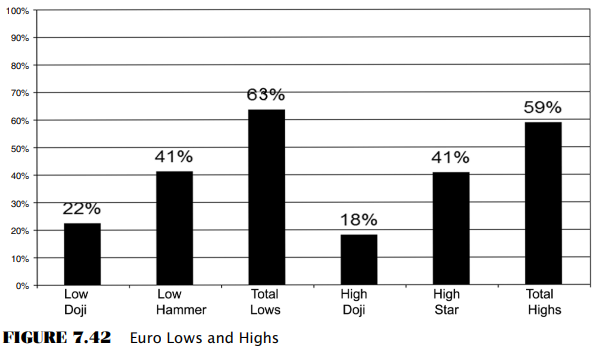

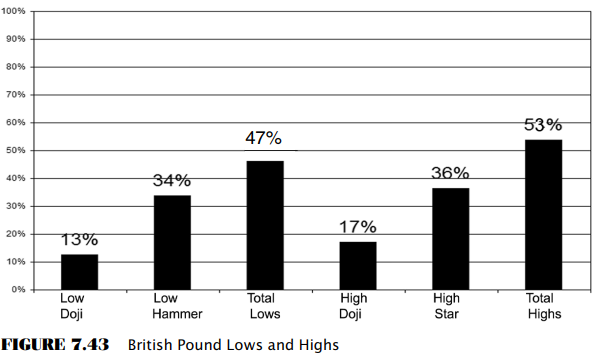

As we

know, spot forex currency trading goes on 24 hours a day, without a centralized

marketplace or exchange. There are many arguments on when the day ends and

begins. For our analysis in calculating pivot points, I established that the

forex trading day ends with the New York Bank closing at 5 p.m. Eastern time.

From a market time period to run a study as to what makes a high or a low, I

needed a rigid sample test period with accurate and stable data. We wanted to

find the highs and the lows of the day based on trades and real trades. Forex

data is not exchange based. Each broker has his or her own set of data.

Although the data is parallel to the that of the futures, as we discussed in

Chapter 1 (known as the basis), they are not trades; instead, they are

bids/asks.

To get a

taste for the true highs and lows of the day from a centralized market place

that had actual time-stamped transactions (time and sales data), we used the

futures markets open outcry session, which is from 7:20 a.m. until 2 p.m.

Central time. This eliminates the possibility of the true low being an extra

few ticks away on the real exchange markets. Using this trading time period

eliminated arguments over what time we should switch from one day to the next

based on the forex data. However, since, again, this is a test to find the

candle pattern that formed when the market made highs and lows during a

specific trading session, it is best to check on the day-session-only highs and

lows to avoid possible anomalies with regard to holidays, early bank hours, and

market surges in the future (Figures 7.41 to 7.44).

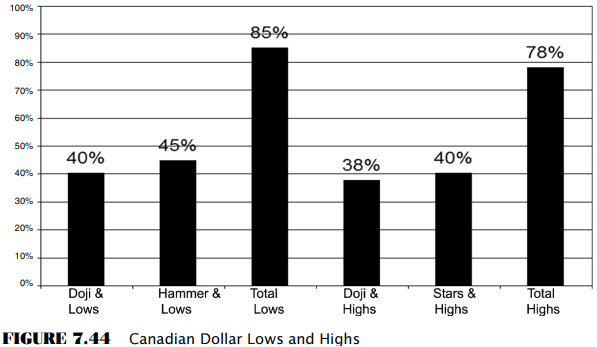

We can

dig a bit deeper in the results and say that certain markets respond better

than others with the psychological elements that dojis, hammers, and stars

represent. Each market has its own character. The Canadian dollar, for example,

is a currency that highly correlates to commodities, which would be a good

reason why it has a strong percentage of occurrences versus the British pound.

The Canadian dollar tracks closer to the moves in gold. In addition, the volume

of trading is lower as compared to the British pound, the euro, or the yen,

according to the Triennial Central Bank Survey 2004. While most currencies are

tradable, the five currencies, including the U.S. dollar (four currency pairs),

that represent the majority of foreign exchange trading volume are the euro

(EUR/USD), with the majority of volume of 28 percent; the yen (USD/JPY), with

estimated 17 percent of market share; the British pound (GBP/USD), with 14

percent; and the Swiss franc (USD/CHF), with an estimated 5 percent share of

overall volume activity. The Canadian dollar volume trades comparatively

speaking about less than 4 percent.

There are

those who will take these statistics and show that there is no evidence that it

is reliable information or that there was not enough back test studies

completed. In fact, statisticians and those who understand Bayesian

calculations will most likely dispute these findings. Well that’s alright, as I

see these patterns form over and over and over; and the computer findings

substantiate that. In case you wanted to know what Bayesian theory is, it is

from the famous mathematician Thomas Bayes. He was born in London in 1702 and

died in 1761. One of the few works Bayes published during his lifetime was a

defense of Issac Newton against a bishop who had attacked the logic of his

calculus, according to the Encyclopedia Britannica. Bayes was successful enough

as a mathematician to win election to the Royal Society of London. He would

have been long forgotten had it not been for his friend Richard Price, who

inherited Bayes’s papers. Price, himself famous for devising one of the first

actuarial tables, came across the “Essay towards Solving a Problem in the Doctrine of

Chances” and helped develop the Bayes rule. Statisticians have long

recognized the rule’s importance, and some high school classes use it to solve

straightforward probability problems. But once both data and beliefs enter the

picture, the math can become unbelievably complex. Over the past 10 or 15 years,

however, computers have become powerful enough to handle Bayesian calculations

with relative ease; and the method has won a following. Bayes’s formula allows

scientists to combine new data with their prior beliefs about how the world

works. It is an idea that amounts to heresy in much of the statistical world.

After all, the method requires individuals to make subjective decisions about

how strongly to weigh prior beliefs. The essence of the Bayesian approach is to

provide a mathematical rule explaining how you should change your existing

beliefs in the light of new evidence. In other words, it allows scientists to

combine new data with their existing knowledge or expertise.

This rule

applies to the statistics provided on hammers and dojis forming bottoms, as in

the case of the Canadian dollar, saying “40 percent of bottoms are hammers” is not equivalent to saying “40 percent of hammers are bottoms.” The

Bayes rule can be used to connect these two statements. Therefore, you must be

aware that what happened in the past might not repeat with the same frequency

or that this data is even reliable. However, the facts are the facts. During

this time period, the results speak for themselves.

Now that you are armed with enough

information to be dangerous in your trading, let’s go over how to find certain

setups and explain what triggers a call to initiate a trade based on these

findings combined with what we have learned so far with pivot point analysis.

In the following chapters, we will also cover the type of risk parameters to

use and when and where to exit positions.

The Candlestick and Pivot Point Trading Triggers : Chapter 7. Candle Charts and Top Reversal Patterns : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns - Trading Trigger Strategy