Candlesticks with Support and Resistance

how to find support and resistance in candle chart, candlestick support and resistance patterns, candlestick support and resistance binomo

Course: [ Uses of Candlestick Charts : Chapter 6. The Real World - Practical Application ]

We’ve touched upon this previously when we talked about the longer-term trader who’s looking to enter into a trade, but instead of jumping in with both feet waits to see whether the reversal patterns start to appear when the market gets down to an important support level.

Using candlesticks in conjunction with support and resistance

Using candlestick charts for negative selection

We’ve

touched upon this previously when we talked about the longer-term trader who’s

looking to enter into a trade, but instead of jumping in with both feet waits

to see whether the reversal patterns start to appear when the market gets down

to an important support level.

Support

and resistance levels are created because markets have a memory, and as a mass

we remember where things have got down to previously. Where the buyers returned

to the fray last time the market sold off. Where the market turned, and

therefore where the buyers decided enough was enough. Or maybe they simply

decided that things were just way too cheap!

But if a

market gets down to a supposed support level and there’s not a sniff of a

reversal from the candlesticks, maybe there isn’t going to be a reversal, and

if we then leave well alone we can save ourselves from a bad trade. The candles

have to come to the party as well, and if they don’t they can save us from bad

trades.

This is

what I mean by negative selection. Traditionally we look for candle charts to

provide us with tradeable signals. What I’m suggesting here is that they can

stop you from putting on bad trades.

Support plays

Obviously

views can change, but often you find markets bouncing from the same levels that

they bounced from the previous hour, day, week, or sometimes even months and

years.

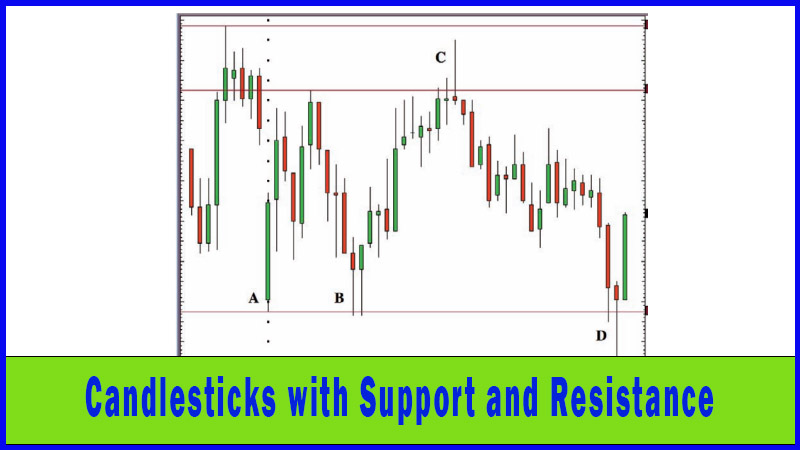

You only

have to look at the following chart to see a prime example of a market doing

exactly that, and it’s no coincidence that the reversal patterns also appeared

at this time. At the very least this should put you on alert that a change may

be occurring.approach £20. Supply and demand tells us that this will result in

lower prices as the market has to head lower to look for keen buyers. If there

are more sellers than buyers the price has to go down...

If you

get to a resistance level and reversal patterns start to appear you should be

ready for a turnaround, as shown in the example of the Shooting Star in Figure

6-9.

Figure

6.10 shows gold failing at 875 on 21 January 1980, then topping out at 729 on a

renewed move higher on 11 February 1980, and then again months later on 23

September 1980.

I think

you’ll agree that 729 was a big level at this time.

Figure

6-10: COMEX Gold futures (unadjusted active continuation); weekly candlestick

chart; November 1979 – February 1982

Then have

a look at the following chart, Figure 6-11. Two Shooting Star candlesticks

appeared in gold futures in May 2006, just when prices got back to the

26-year-old level of 729. Within days trading had changed tack and I was

looking for a pullback, which duly came.

Figure 6-9: CME Group Gold futures

(unadjusted active continuation); daily candlestick chart; 11 January 2008 - 23

May 2008, showing 17 April 2008 Shooting Star, on former high from 28 March

2008. Then, on 2 May the price got down to the low from 22 January 2008 and a

Hammer was posted, which ended that move.

Resistance plays

The same

applies to upside levels, or resistance, as it’s commonly known. Markets quite

often fall over at similar levels to previous failures. Think about the trader

who was long last time the market went up to £20 but didn’t get out. He or she

was still long when prices went back down to £15, and given a second chance -

if prices get back to £20 again - the trader may well take his or her money and

run. Think about the trader who wants to buy some but has seen that £20 has

been a barrier previously. Maybe they’ll hold off until this hurdle is clear.

The speculator trading via a spread bet or CFD has the opportunity to go short

and may feel that this one’s ripe to fall over again on reaching the £20 mark.

All of these factors would contribute to either a splurge of selling, or a

dearth of buying, as prices

Figure

6-11: CME Group Gold futures (unadjusted active continuation); daily candlestick

chart; 24 March 2006 – 16 June 2006

I’ve

reproduced this chart many times; it’s one of my old favourites, and I’ve been

challenged a few times that if you had adjusted for inflation then gold would

need to get up to somewhere north of $2000 in 2006 to be anywhere near its 1981

levels in real terms. I don’t dispute this, but you also can’t ignore the fact

that by drawing a horizontal line on the chart you would have been (and I was),

at the very least aware of this level, and could have taken profit on longs

somewhere near the high of the move.

A

Shooting Star bang on a massive resistance level will surely carry more weight

than a reversal signal that just appears out of the middle of nowhere?

At the

time that these two Shooting Star candles appeared it was difficult to think

about the idea of batting against such a solid trend, and looking back at my

analysis at this time I didn’t change tack fully to the bear side until the

market sold off through 650. At this time I targeted 550, a long-term Fibonacci

retracement level that was reached a few weeks later.

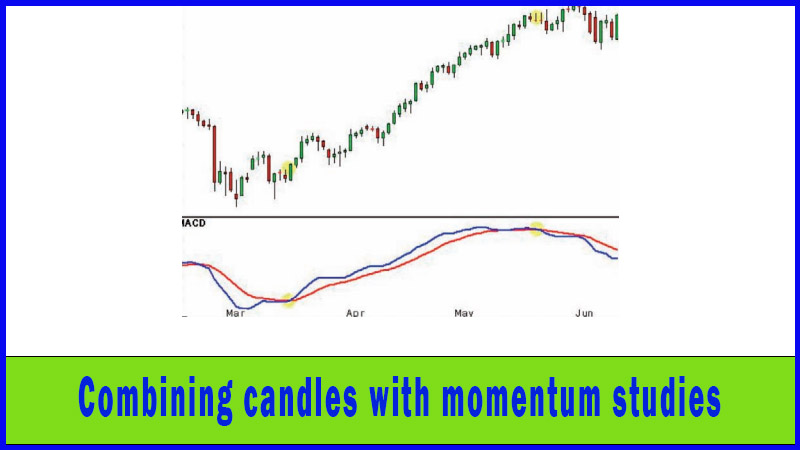

Waiting for confirmation - what to use

So this

is how I do it: I’m always watching keenly for candlestick reversal patterns,

and then when I see one I do absolutely nothing, preferring to wait for some confirmation

before jumping on the reversal bandwagon. This is the result of years of

experience - years of jumping too early!

This is

where trend lines, moving averages, Fibonacci levels, gaps, Marabuzo lines and

the like come into play. Upon seeing a reversal pattern in a rising market we

immediately look for the first significant support level and we ask that it

gets broken to confirm the reversal. Prior to this some lightening up of longs

may be advisable, but an all out bear tack needs a bit more time to be decided

upon.

Likewise,

if the market is in a downtrend and a reversal pattern appears, we immediately

look up and find the first strong resistance level. We want to see the market

through here at the very least before we think about buying.

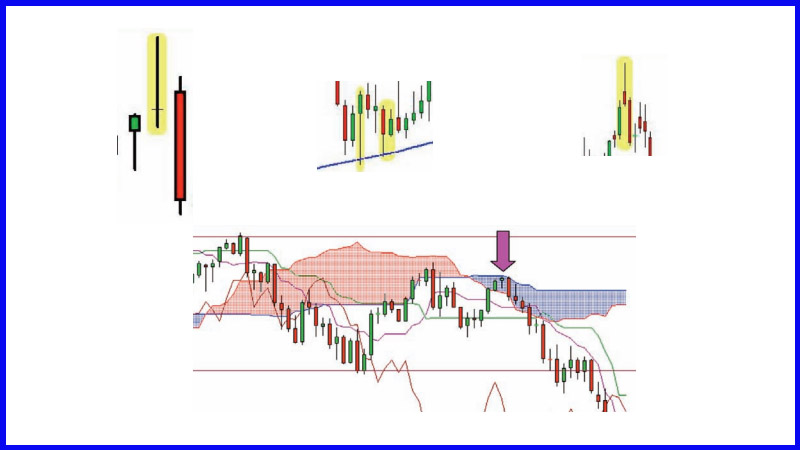

A few

more practical examples of support and resistance combining well with

candlesticks, over various time frames, can be seen in the following charts.

If you

had taken this Shooting Star at resistance as a sell signal you would have

traded to the short side from then on, until Point D was reached. The market

got through the earlier lows, only to retake these levels very quickly, ending

that 10-minute period with a Hammer, which would have flipped you back to the

buy side. Again there would have been some instant gratification for longs

after this pattern.

You

didn’t need to be a bull or a bear to make money using these parameters. You

didn’t need a directional view at all.

All you

needed was a flexible approach to trading, tight stop criteria and discipline,

and a keen eye for candlestick patterns coinciding with technical levels. This

is a mistake I often make, as many traders do. I was bearish about the markets

on this particular day, so would have favoured the sell trade after the

Shooting Star, and would have missed the Hammer opportunities. My being

“married to the bear tack” would have stopped me making money from the well

flagged short-term up moves.

Some

would argue this is no bad thing, though, since the market was in a pretty

beaten up state around this time, and there was quite a bit of risk attached to

trading on the long side. These are valid arguments, and decisions will depend

on several factors, including time frames, expectations from trades, risk

versus reward and running tight stops, all of which are beyond the scope of

this introductory book.

Examples

The following chart illustrates how you

can use candlesticks with support and resistance to place short-term trades

that can make a quick profit and involve minimal risk.

Figure 6-12: LIFFE FTSE futures (March

2008); 10-minute candlestick chart; 4.00pm, 5 February 2008 - 3.10pm, 6

February 2008

Point A

is the start of trade on 6 February. The first hour sees a range set of 5807.5

to 5862.5. It didn’t quite reach the first resistance from the previous day at

5878.5. Then the market sold off to point B, which saw the low from earlier in

the day retested. Prices held this level, and a Hammer was posted to boot. In

fact two were posted in a row. Combined with the hold of support this would have

seen day traders buying. They would have made money trading on the bull side

right up until the Shooting Star at point C was reached. This appeared when a

high of 5875 was set, slightly above the 5862.5 high set in the first hour, but

just below the 5878.5 high from late in the session on 5 February.

Uses of Candlestick Charts : Chapter 6. The Real World - Practical Application : Tag: Candlestick Pattern Trading, Forex : how to find support and resistance in candle chart, candlestick support and resistance patterns, candlestick support and resistance binomo - Candlesticks with Support and Resistance