Combining Candles with Momentum

Support and resistance, Moving averages, Trend lines, Parabolic SAR, MACD

Course: [ Uses of Candlestick Charts : Chapter 6. The Real World - Practical Application ]

When I spend a good amount of time with a group of trainees the thing I try to impress upon them is that they are all individuals and that they’re all going to find different things that work well for them as individuals from the huge array of technical tools available.

Combining candles with momentum studies

When I

spend a good amount of time with a group of trainees the thing I try to impress

upon them is that they are all individuals and that they’re all going to find different

things that work well for them as individuals from the huge array of technical

tools available. I’m even happy to concede that they might choose not to use

technicals at all, although I say this through gritted teeth!

Work out your favoured canvas

My best

suggestion is to work out what your favourite canvas is. Some swear by Market

Profile charts, some see Point & Figure as the cleanest and clearest way of

viewing the markets and gleaning signals. Some will firmly stick to bar charts

even after reading this book, I guess (astonishing!)

Whatever

you decide, there’s more to do once this decision has been reached. We’ve

talked about waiting for confirmation before taking a reversal signal in the

previous chapter, but there are other methods that can be employed for

confirmation purposes. A reliable moving average, a trend line, or a signal

from an indicator like Stochastics or RSI are the sort of thing that you can

incorporate into your decision making process.

It comes

back to the analogy I used earlier: if you wake up one morning and decide to

buy a red jumper do you go to the high street and buy the very first red jumper

you clap your eyes on, or do you have a few more criteria you want to satisfy?

On something as simple as buying a pullover you’ve got more than one condition,

and you need to have layers of conditions that need satisfying before jumping

into a trade.

Over the

following pages you will see the same chart reproduced several times, each time

with a different method of confirmation used. I have accompanied each chart

with a brief explanation of the method. This is by no means a definitive

discussion, more a precis of each method, with enough to help you decide

whether it’s something you might attempt to incorporate into your strategy.

Figure 6-13: Eurex Bobl futures

(adjusted active continuation); daily candlestick chart; 11 February 2008 - 23

April 2008

We have

shown this chart before. We talked about it in Chapter 3 (Figure 3-22). The

candle at the very top of this chart is a Rickshaw Man. As you can see this

pattern appeared on the day the market retested the high from a few days

earlier. At the time that the market got above that previous high, the bulls

were in charge and looking good for it. But they dropped the ball, and prices

ended up back where they started. The market started selling off from the very

next day as the bears picked up the ball and started running back up the other

end with it!

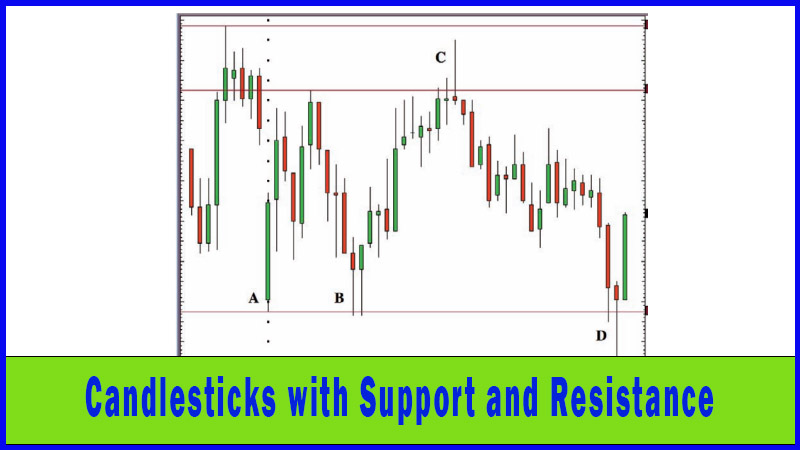

Support and resistance

This is a

recap of the previous section but it fits in nicely with what I’m trying to do

in this section, so here goes!

Support

occurs when a market that is selling off reaches a level where the buyers

return to the fray sufficiently to turn things around. Using the basic laws of

supply and demand we know that a market that is selling off is the result of

more sellers than buyers. Supply is outstripping demand. But the moment when

price reverses and the market starts to go up is where the balance between

buyers and sellers changes.

It is

often noted that markets change from downwards to upwards at similar levels to

previously, so chartists look back at the historic prices to see where previous

turning points occurred.

Resistance

is the opposite to support: a high price where the balance between buyers and sellers

shifts back in favour of the sellers. In an uptrending market the bulls, or

buyers, are dominating. The top of a move is when the sellers take over, where

demand no longer outstrips supply, causing a top in price. Previous highs are

well watched levels when a market is rising. These levels are the moments at

which market conditions changed previously, where the balance of power changed

from bulls to bears. It’s obvious why they are classed as so important.

To take

support and resistance one very simple step further, many chartists and traders

look for a clearly defined trend whenever they fire up a chart. Charles Dow

first mooted the simple idea that an uptrend is a series of higher highs and

higher lows, whereas a downtrend is comprised of lower highs and lower lows.

Figure 6-14: CME Group mini-Dow futures

(unadjusted active continuation); daily candlestick chart with support and

resistance lines; 7 March 2007 - 8 June 2007

Using

this basic assumption on the preceding chart, you can see where the uptrend

started (hence giving us a buy signal), and where the market broke a previous

higher low to stop the long trade out. On this occasion the lower lows and

lower highs were not really clearly defined when we got out of the trade, but things

had started to look messy and the price had broken an important support, thus

triggering liquidation of the long position.

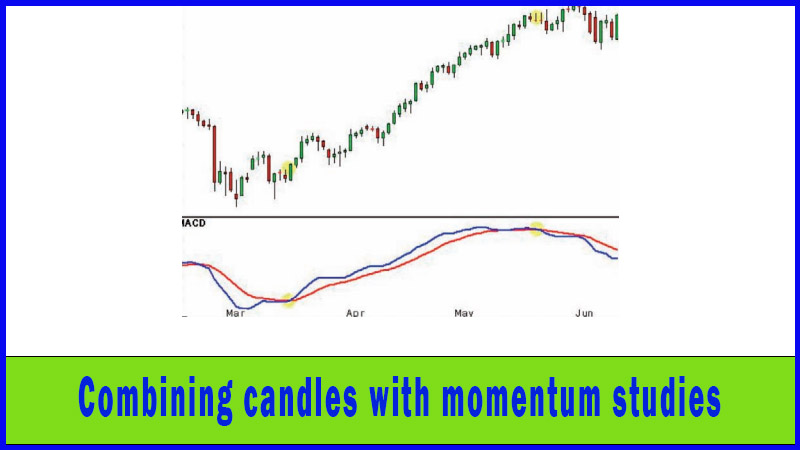

Moving averages

Figure 6-15: CME Group mini-Dow futures

(unadjusted active continuation); daily candlestick chart with 20 and 50-day

simple moving averages; 7 March 2007 - 7 June 2007

Many

traders and analysts use a moving average line as a reference for market

direction, as it smoothes the data set. Sometimes candlesticks can be a tad

confusing and trends can be difficult to define. A moving average takes the

average value of a set amount of data (usually closes) and plots them as a

line. They are called moving averages because the lines move with the market. A

10-day moving average adds up the last ten days of data and divides the total

by ten. Obviously as a new candlestick is added to the right hand side of the

chart we lose one from 11 days before from our calculation. Hence the line

moves with the movement of the candlesticks.

The

preceding chart - Figure 6-15 - is a daily candle chart with 20-day and 50-day

simple moving averages applied. Note particularly how the 20-day line reacts

more quickly to the price trend changing than the 50-day average.

Also see

how on several occasions we saw a pullback in the uptrend that got prices down

to the 20-day average line.

So if

after the Evening Star in early March and the Hammer in mid-March (the bottom

left hand side of the chart - there should be no need to highlight them by

now), you ask for a break of the 20-day moving average to confirm, you got your

confirmation on 20 March and bought at 12,381. If you subsequently used the

same 20-day moving average line as a trailing stop you would have been at most

66 ticks offside on 30 March, and you would have sold out for a profit of 1080

points on the close on the 6 June.

A simple

rule of thumb if you want to apply moving averages to candlesticks is to use

your eyes, and find the average line (by playing around with different period

settings) that acts as good support in a rising market (i.e, any pullbacks in

the uptrend find a bottom at or around the moving average line), and good

resistance (i.e, it caps upside advances) in a falling market. Then you want to

see that it gives clear signals when the market crosses the line.

This all

sounds easy but it isn’t, and a lot of patience and time is required to find

the line that does the best job for you. One of the biggest problems with

moving averages is that they become rather unreliable during trendless or

sideways markets, so this is something to watch out for and guard against when

you’re backtesting.

Trend lines

Figure 6-16: CME Group mini-Dow futures

(unadjusted active continuation); daily candlestick chart with trend lines; 7

March 2007 - 8 June 2007

Trend lines

are straight lines that define trends. It is amazing how many times the market

moves higher or lower with a consistently steady velocity that can be tracked

by a straight line.

An

uptrend line is a straight line that joins a series of higher lows in a market

that is travelling higher. You draw them below the price action, sloping higher

from left to right. You can use them to define the move and keep you in a long

trade. You can put a trailing stop below a trend line, and your stop order will

move higher as the market moves higher.

A

downtrend line is a straight line that sits above a downtrending market,

joining successive lower highs.

I always

apply a “rule of three” to the drawing of trend lines. I want to see three

lower highs joined together before classing a line as a hard and fast downtrend

line.

A move up

to a downtrend line where a bearish reversal pattern is posted is a good start

for a short trade set up. Once in the trade, as long as the market moves back

down, away from the line, you can use the line as a reference for a trailing

stop.

If you

have three higher lows that can be joined with a straight line you have a valid

uptrend support line and you should be looking to buy dips to this line,

especially if the market displays bullish candlesticks when hitting the line.

Using the

same chart as before we can see that in this case the short-term downtrend line

was broken after the candlestick reversal patterns, but just prior to our

moving average buy signal. The exit was a few days later than the moving

average sell signal, but at similar levels. The main message was that the

trailing stop using the trend line kept you in the trade for a good while.

Parabolic SAR

Figure 6-17: CME Group mini-Dow futures

(unadjusted active continuation); daily candlestick chart with Parabolic SAR; 7

March 2007 - 8 June 2007

This is a

study devised by Welles Wilder and introduced in his 1978 book New Concepts in

Technical Trading Systems. It relies on a trailing stop that gets closer to the

action as the trend progresses. As you can see, trades are triggered when

prices move through the dashes in one direction or the other.

It is an

“always in” trading tool, which means you are either short or long at all

times. SAR stands for Stop and Reverse, i.e, you stop out the previous position,

and simultaneously move to the opposite tack. I don’t tend to use it quite so

literally. I find it can be good to keep you in a strong trend for as long as

possible. It is another effective tool for stop placement, and for giving trend

beginning and trend ending signals, but as with a moving average it can be a

rather unreliable tool during sideways markets.

Once

again we’ve kept the same chart for this as the previous examples of moving

averages and trend lines. We got an earlier signal, and this would have

actually seen you quite a bit offside before things came good. In this instance

the SAR dashes didn’t do the best job for us, although you can see how they can

have value in strongly trending conditions.

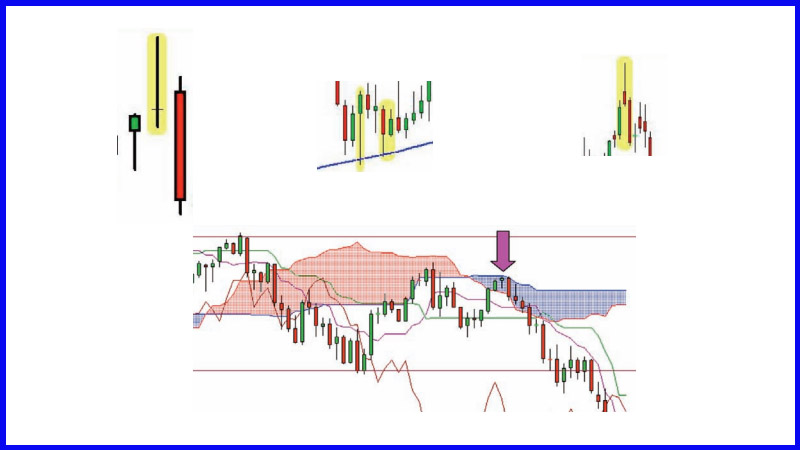

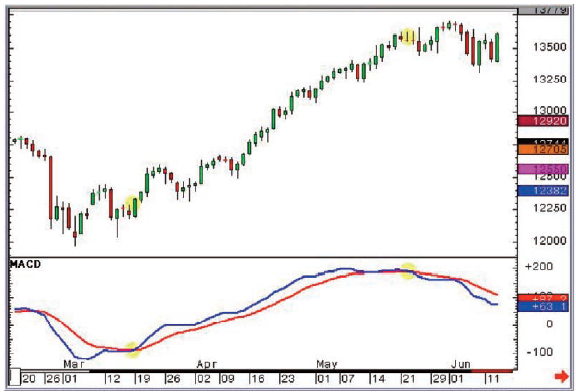

MACD

Figure 6-18: CME Group mini-Dow futures

(unadjusted active continuation); daily candlestick chart with MACD (12,26,9);

7 March 2007 - 8 June 2007

MACD

stands for moving average convergence/divergence and is a momentum study that

gives clear-cut buy and sell signals with the crossing of two lines, one of

which is a moving average of the other. The faster base line (the blue line in

this example) tracks the difference between two moving averages (the default

being the 12 and 26 day exponential moving averages). Longer-term traders find

this a robust, reliable momentum study. Once you’ve seen a candlestick reversal

pattern you want to add weight to the argument for a reversal, and a

corresponding signal from something like MACD is a good example of the sort of

thing you may want to add into your check box system.

You can

see once more that after our reversal patterns we get a buy signal from the

crossing of the MACD lines, and once the market starts to fall over so do the

lines, leading to a sell signal which came slightly earlier than those seen so

far from trend lines, moving averages and the like.

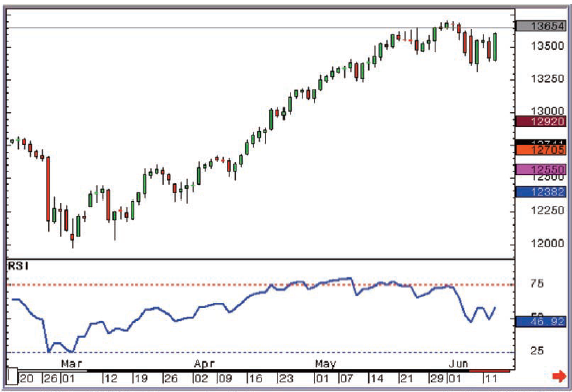

RSI

Figure 6-19: CME Group mini-Dow futures

(unadjusted active continuation); daily candlestick chart with RSI (14 day); 7

March 2007 - 8 June 2007

This is a

momentum study dealing with the ratio of up days to down days over a set time

period. It is constructed only using one line, which generally moves in the

same direction as the market. Many traders look for Divergence set ups, where the

indicator goes in one direction and the market in another; these can work

extremely well combined with candlestick analysis, with one signal confirming

the other. One of my favourite momentum studies, and well worth reading up on

(once again this was introduced by J Welles Wilder in New Concepts in Technical Trading Systems)!

As you

can see, throughout most of May the market kept heading higher but the RSI had

topped out a lot earlier, and didn’t subsequently emulate this high. Even a

month later in July, the indicator failed to follow when the Dow rallied to new

highs before finally topping out and cracking nastily lower as the 2007

sub-prime crisis bit hard.

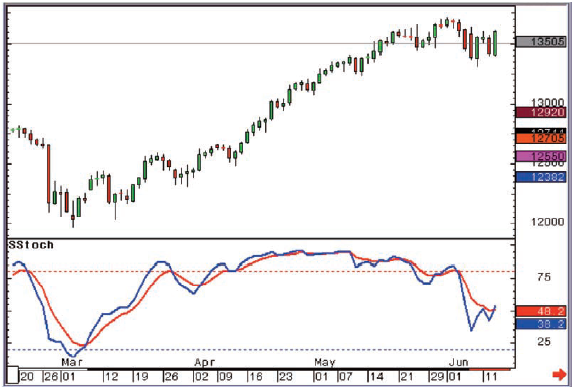

Stochastics

Figure 6-20: CME Group mini-Dow futures

(unadjusted active continuation); daily candlestick chart with Slow Stochastics

(10,3,3); 7 March 2007 - 8 June 2007

The

Stochastic Oscillator has a similar interpretation to MACD and RSI. This

short-term momentum study employs two lines, with the crossing of the lines

giving definitive buy and sell signals. Once again you can use something like a

Stochastics signal as confirmation for any candlestick reversal pattern.

A classic

buy signal is the lines coming out of oversold (ie, from below a reading of 20)

then crossing, with the blue line piercing through the red line. As you can see

this gave a pretty early signal in this instance, hard on the heels of the

Morning Star formation, but as with the Parabolic SAR discussed earlier there

was a fair bit of draw down after the signal was given before the Hammer was

posted and the market got going to the upside once more.

The other

thing this chart shows well is how unreliable signals can be from a short-term

momentum study when a market is in a solid trend, but as with the RSI a

divergence setup came to the rescue to try and make sense of things. If this

had caused you to liquidate longs you would have missed the last month of the

bull move, but you would not have been long when things started selling off

hard soon after that.

So what to use?

One thing

that the past few pages may have had you thinking is that across all the

different methods discussed we ended up with pretty similar confirmation

signals, and pretty similar exits. I did this deliberately, with a familiar and

constant chart; to try and get you thinking. This won’t always be the case, and

there will be certain indicators or methods that work better for you than

others. Your job is to discover what works best for you on your charts, taking

into account your time frame and your style of trading.

In other

words, you need to work it out and decide!

Tick the boxes

I

encourage the idea of producing, at least in the early days, a grid where you

need to tick say four boxes before pulling the trigger. Below is an example:

Conditions

for a buy signal

Established long/medium term uptrend Y/N

Retracement sell off seen on light

volume Y/N

Bullish candlestick reversal pattern

after pullback Y/N

Now rallying, and breaks first strong

resistance Y/N

Buy signal from Slow Stochastics Y/N

Pick up in volume as buyers return Y/N

If most

of the answers are “Yes,” then you have a compelling argument that the selling

is done and you should be getting long...

After a

while this way of systemizing your trading decisions will become second nature,

but even then if you find yourself starting to make undisciplined “hope”

trades, you can go back to using this sort of grid in order to force yourself

to justify your decisions.

Once you're in, stay in!

One other

idea I would also like to try and encourage you to think about is that you will

probably need something else to keep you in a winning trade for as long as

possible, but which will get you out in a timely fashion. It’s an easy trap to

fall into to use the same thing for entry and exit, but I don’t think that’s

necessarily the way forward.

Obviously

using the example grid on the previous page, you could argue that you get out

of a long position once you tick all the boxes that are saying you should sell,

but I’m not sure it’s as simple as that. I like to find a way to use a trailing

stop once you’re in a trade, and obvious candidates to achieve this result are

moving averages, trend lines, or one of my favourites: Welles Wilder’s

Parabolic SAR.

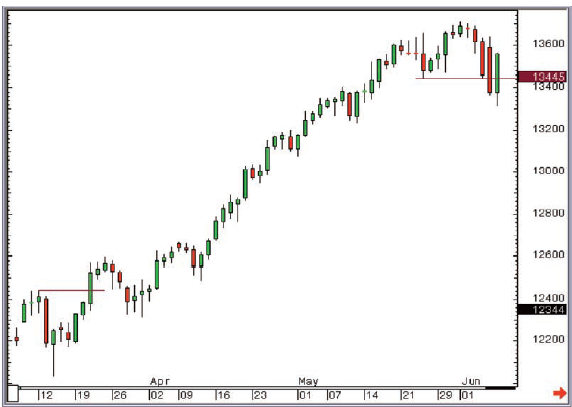

I also

like using Marabuzo lines for this, as you can see from Figure 6-21. At the

bottom is a Hammer on a strong support. The market then starts to move higher

in an obvious uptrend, and we were able to stay bullish all the way up in this

one, and use Marabuzo lines as a reference to stay with the bulls every time

they appeared. The trend was extremely strong during this period, and the lines

all pretty much held like a dream. Sweet!

Figure 6-21: ICE Gas Oil futures

(unadjusted active continuation); daily candlestick chart; 14 November 2007 - 27

March 2008

There’s a

load more on this chart as well, though. Have you spotted the variation on an

Evening Star at key resistance at the start of January? Or the Hammer on

support towards the end of January? How about the Inverted Hammer that was

confirmed the following day just a few weeks later? Not the strongest of

patterns, until the market gapped higher the next day. Then the market got

through the previous resistance and posted a nice big reaction day in

mid-February. There was no stopping the market then, not until prices got up to

the psychologically important $1000 mark. The day this level was hit a Shooting

Star was posted. Then traders sold off, but only to a Marabuzo line, where a

small bodied candlestick was posted upon hitting this key support.

I could

point all of these out to you, but we’re at the end of the book, and I’m rather

hoping you’re finding them yourself now!

Chapter summary

A lot of

time and energy is spent on momentum indicators these days, among both

professional and beginner traders. I always beg newcomers not to get too bogged

down with these, and to make sure they don’t have too many indicators all

running alongside each other, as they will often be telling you the same thing.

“Paralysis

by analysis” is a phrase that springs to mind.

But even

saying that, an indicator can be an integral element of a trading system, and

there’s nothing more important than having a system.

I’m a big

believer that candlesticks can be incorporated into any trading system, and can

enhance your system, for example by providing an earlier “heads up” indication

of trend change.

Uses of Candlestick Charts : Chapter 6. The Real World - Practical Application : Tag: Candlestick Pattern Trading, Forex : Support and resistance, Moving averages, Trend lines, Parabolic SAR, MACD - Combining Candles with Momentum