Different Time Frames

multiple time frames trading, multiple time frames in technical analysis, multiple time frame ichimoku, multiple time frames day trading

Course: [ Uses of Candlestick Charts : Chapter 6. The Real World - Practical Application ]

In this book we have discussed the common candlestick patterns by mostly viewing daily charts, where each candlestick represents a day’s data.

Different time frames

Discovering your time frame: longer-term traders and money managers

“So what

time frame charts should I use, then?” is a question I am often asked. My answer

is always the same: “You need to work that out for yourself.”

So far in

this book we have discussed the common candlestick patterns by mostly viewing

daily charts, where each candlestick represents a day’s data.

We have

seen a few examples of weekly charts, like the chart for Euro/USD with all the

Hammers on it (Figure 3-3).

Daily and

weekly candlestick charts can be used for making investment decisions with a

time horizon of anything from two weeks upwards. When I say “time horizon” I

mean the time frame for holding a position. Long-term buy and hold fund

managers use longer- term charts; there’s no point in them looking at intra-day

charts as the apparent volatility could spook them into making rash decisions.

They need a view of the bigger picture, and weekly charts do exactly this.

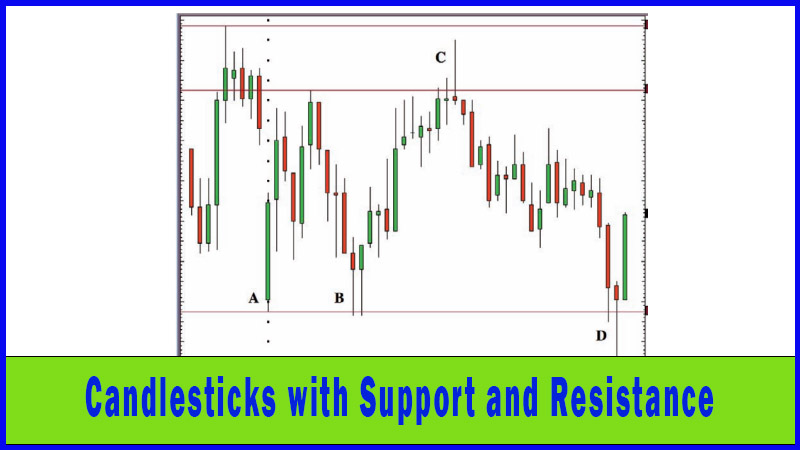

Figure 6-2a: LIFFE Long Gilt (adjusted

continuation); daily candlestick chart; 9 November 2005 - 14 March 2006,

showing 17, 18 and 19 January 2006 Evening Star

Many money managers use longer-term moving averages, the most common being the 50-day and 200-day averages, and I would suggest overlaying candlesticks onto these, looking for times when reversal patterns appear after a pullback to a reliable moving average line.

Figure 6-1: S&P 500 futures

(unadjusted continuation); daily candlestick chart; 31 March 2004 - 23 June

2004, showing a Hammer on 12 May and a Bullish Harami on 17 and 18 May, both on

the 200-day moving average line

As well

as this I would suggest longer-term investors might look out for situations

where there are candlestick reversal patterns appearing on weekly and daily

charts at the same time. Opposite is a great example of this kind of thing,

occurring at a top in the Long Gilt.

Figure 6-2b: LIFFE Long Gilt (adjusted

continuation); weekly candlestick chart; 9 November 2005 - 14 March 2006,

showing Long Legged Doji for the week of 16-20 January 2006

Most of

the time that I see technical analysis being used by long-term money managers

it is as a filtering process. You apply a set of conditions to a list of stocks

or markets and ask a computer to give you a list of constituents of said list

that tick all of your conditions. It is fairly simple these days to add pattern

recognition into this sort of programme, so that you can make candlesticks a

part of the process.

Say you

have a filtering process that looks for stocks on the LSE that are below their

10- day moving average but have just hit their 200-day average. This may

produce a list of, say, 50 stocks a day. If this is too many, then you need

another parameter to narrow the search. How about stocks that at the same time

post a candlestick reversal pattern? This is all very simplistic, but this is

an introductory book, so I’m merely trying to provide a bit of food for

thought. What you would then have is a list of stocks that have been selling

off in the short term but are now hitting key long-term support and showing

signs of reversing.

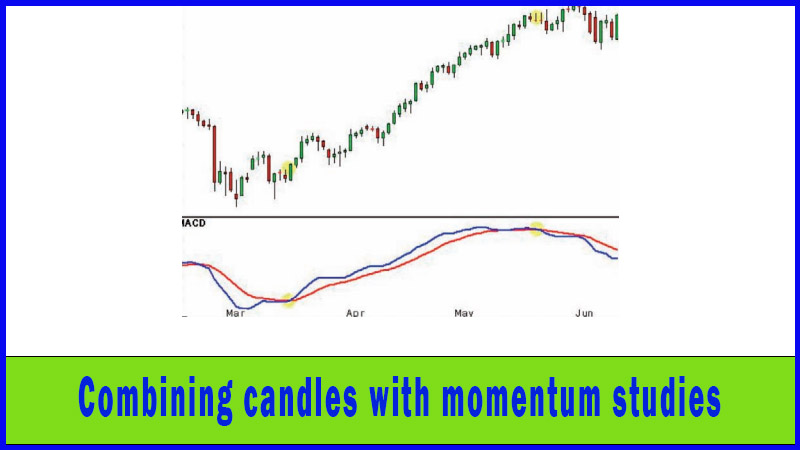

Ichimoku Charts

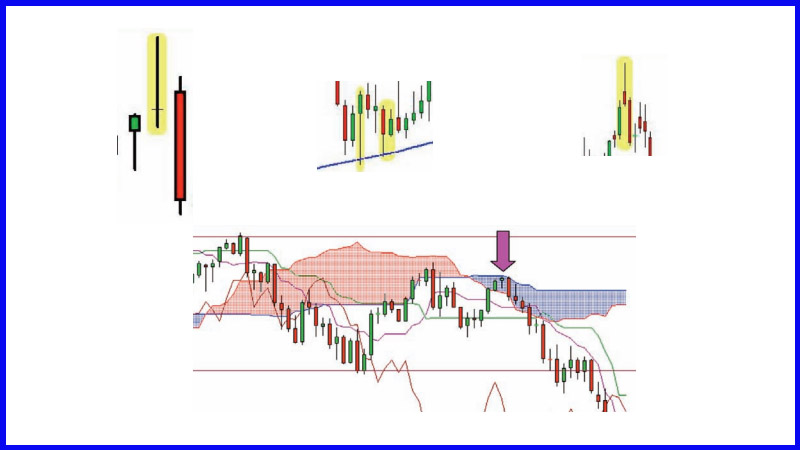

There is

an increasing following for Ichimoku charts in longer-term decision making.

It’s a very simple box to tick to ask that something is above the Ichimoku

Cloud on the weekly and daily charts before a buy signal is classed as

confirmed. My STA colleague Nicole Elliott has written a fine book on the

subject and in the UK we’re also lucky enough to have another strong exponent

of the subject (again, an active member of the STA) in David Linton.

Ichimoku

charts are overlaid on a candlestick chart - the two go hand in hand.

Figure 6-3: S&P 500 futures

(unadjusted continuation); daily candlestick chart overlaid with Ichimoku; 22

October 2007 - 23 January 2008

At the

end of December an Evening Star with a Hanging Man for a middle candle was

posted (highlighted with the purple down arrow). This was seen within the

cloud, with the top of the cloud capping upside on the pattern. A few days

later when the market sold off through the bottom of the cloud the downside

accelerated dramatically.

Discovering your time frame: shorter-term time frame traders

Daily

charts can be used by all participants to keep a firm grip on the market’s

overall direction, and any suspected changes, from longer-term players right

down to intra-day traders who are executing many trades per day. It’s this

group I want to talk about now because they can (and many actively do) use

candlestick charts of all different time frames, down to 1 -minute intervals if

they’re trading products that are liquid enough (although I’m not a big fan of

going this short-term, personally - I don’t like to view anything less than a

10-minute chart).

If you

are a day trader wanting to use short-term candlestick charts as the basis, or

even as just one element of your trading strategy, then I would like first of

all to stress one very important thing: Make

viewing the daily and weekly charts for the instrument(s) you’re trading a

compulsory part of your daily routine.

Warning!

I’ve seen

many traders get so involved in the short-term price action that they forget

the bigger picture. Candle charts, even daily and weekly charts, are dynamic,

and can change without you even realising it. A potential reversal pattern can

creep up on you, believe me!

Seeing

the bigger picture can also help you to trade in the direction of the

prevailing trend, and you should find making money easier if you’re not trying

to battle against the crowd every time you put a trade on. “The trend is your

friend” is an old adage that’s used in technical analysis and trader circles,

and it’s often greeted with a groan, but it’s so much easier to make money in a

falling market by going short than trying to pick the bottom.

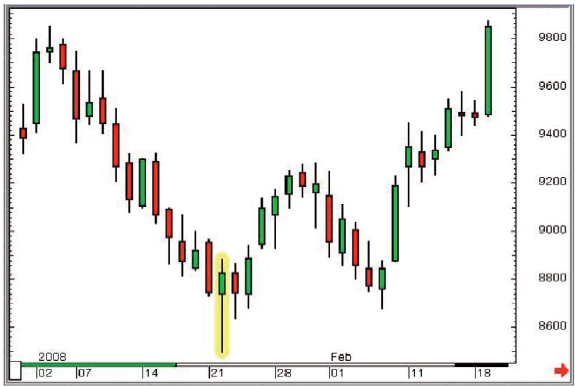

But back

to the short-term time frames: look at the two charts on the following pages.

Both show similar-looking down moves followed by similar-looking up moves after

the appearance of similar-looking Hammers, wouldn’t you agree? Except Figure

6-4 is a daily candlestick chart, showing 35 days worth of data with a price

range of $13.50, whereas Figure 6-5 is a 10-minute chart showing around eight

hours worth of price action over a 79 tick range.

The

Hammer in Figure 6-4 therefore took a whole day to form. In other words, over

the course of an entire session the market sold off from 87.38 to 85.00 then

rallied again, all the way back up to a high of 88.86, closing the day just shy

of this high at 88.25.

Figure 6-4: ICE Brent Crude Oil futures

(all sessions, unadjusted continuation); daily candlestick chart; 31 December

2007 - 19 February 2008

This

turned out to be the low of this move and over the course of the next 20

candlesticks (ie, 20 working days) the market rallied $10.

Figure

6-5 has a Hammer at the bottom as well, except this is a 10-minute chart. More

or less exactly the same thing happened over this 10-minute period as happened

on the Hammer day in Chart 6-4: the market sold off and then rallied, closing

strongly. The message is the same; there was a period of time where the market

sold off then recovered - a sign that the buyers had returned to the fray

because the price looked cheap.

The range

on this 10-minute period was 17 ticks. The market sold off from 113.77 to

113.63 then rallied to print 113.80 before ending the 10-minute period at

113.78. The following 20 candles (representing 3 hours and 20 minutes of trade)

saw the market rally steadily, adding 29 ticks.

Figure 6-5: Eurex Bund futures;

10-minute candlestick chart; 18 April 2008, 11.20am to 7.20pm

It

doesn’t matter what the time frame is, the message is the same: the market has

witnessed some selling off, but found support and then rallied - the market may

have found a bottom.

Now we’re

getting down to the real crux of the whole thing. Candlesticks tell you where

the market has been. From this you can make assumptions as to the state of mind

of the market as a whole. You can make up your mind as to whether the bulls are

feeling confident or whether they’re recovering from a good beating. You can

decide whether the bulls are running the show and whether they’re comfortable

in doing so. You can tell when the cracks are appearing, when things may be

changing. It doesn’t matter whether this is with respect to short-term time

frames or long-term, because the two way pull, the tug-of- war, is dealing with

the same issues: fear, greed, emotion, elation, euphoria, crowd psychology, etc.

Candlesticks

can be an extremely potent ally for short-term time frame traders, and in the

many years I’ve been advising traders on market direction using candlesticks

I’ve almost always done so using 10-minute and 60-minute candle charts for

short-term turning points, and daily and weekly charts to keep tabs on overall

direction.

Emotion

The key,

then, is to work out your time frame. One of the biggest challenges facing any

trader is working out the time frame that works for them. We are all

individuals, and on that basis will all have different ways of dealing with

things. Trading is an emotional game, there’s no getting away from it. This is

where technical analysis can help, and in particular candlestick analysis,

because the signals provided can reduce the emotion in your decision making

process, whether for trade entry or trade management/exit strategy. I have

heard people say that technical analysis can remove the emotion from trading

but this is wrong. The vast majority of people cannot remove emotion from

trading, but you need to try and find a way to manage it so that the old evil

pairing of fear and greed do not take over your decision making. As soon as

they take over, you’re on a slippery slope.

But

there’s no point in a day trader using the weekly chart for signals, and by the

same token a fund manager has little use for 10-minute charts. I often think

that there is a real opportunity for voice brokers with a technical leaning.

Longer-term money managers could come up with the ideas, then leave it to the

broker to time the entry of the trade using short-term technicals.

Applying flexibility when viewing short-term time frame charts

In the

early chapters of this book I covered some of the more popular candlestick

reversal patterns, and with each one I presented a box that summarised the

rules that need to be satisfied for each particular pattern. Now I’m going to

suggest that there are times when the rules need to be, let’s say, massaged!

If you

are viewing intra-day candlestick charts for liquid products such as, say,

S&P 500 futures, do you get gaps between the candles; gaps that are needed

to form patterns like Dark Cloud Cover, Stars or Engulfing candles? The answer

is no, in the main. Most candlesticks will start exactly at (or at worst a tick

away from) the same price as the close of the last candle on intra-day charts,

as there is literally a nanosecond between one candle ending and the next one

starting. Just because one 10-minute period is over and another is beginning doesn’t

mean we’re suddenly going to see a big jump (or fall) in price. This needs to

be factored into the equation.

Look at

the following chart. It shows a couple of bottoms on a short-term chart, both

of which were very effective, and both of which would have been called Piercing

Patterns had there been a gap lower on the first trade of the second candle.

But this isn’t going to happen in reality on a short-term intra-day chart - the

real message is in the strength of the rally on the second candle. We need to

adopt a flexible approach to where these candles start life, or we will be

missing the patterns, and the message that they’re conveying.

Figure 6-6: Eurex March 2003 Bund

futures; 10-minute candlestick chart; 21 January 2003, 9.30am - 6.00pm

Going through the time frames for trade placement and management

Those

looking to put on longer-term trades but searching for the best possible entry,

and later on exit, can start with short-term time frames then move up through

the time frames until they’ve got a position on and are looking at a chart that

suits the time frame of the trade.

Quite

often something like a 10-minute or 30-minute chart can be used to gauge the

market’s sentiment in the short-term. You may have a big line to buy, but you

can see clearly on the short-term charts that the market is coming off, and

that there’s some strong support just below. You could wait and see if the

market reacts to the strong support then jump in as and when bullish reversals

appear on the short-term charts at these levels. The fact is you already know

you want to buy, you’re just asking the chart to show you the best time to do

so. If the short-term chart has got you into a trade you can then switch to a

longer-term chart to run the trade.

Why do you

need to jump to a longer time frame? Because the same short-term chart that

gave you those early clues to get in can also spook you to jump out of your

position too early. Viewing a 60-minute or daily chart is far less exciting

than looking at a 10-minute chart, even though it’s tracking the same prices.

As with

many things in charting and trading, it’s all about the messages that get sent

to the brain. A less exciting chart means less chance that you’ll trigger some

sort of panic mechanism and jump out of your trade early.

If you’re

in a position for a few days and it’s starting to work out well the ideal

scenario is to use the weekly chart for stop placement, and to run the thing

for as long as possible.

Stop orders

Placement

of stops (and subsequently moving stops to protect a profit) is essential for

successful trading, and a candlestick chart is as good a canvas as any for this

exercise. I also have a lot of time for Point & Figure charts and Ichimoku

charts with respect to the running of trailing stops, but that’s for another

time!

We’ve

spoken about gaps and Marabuzo lines as strong support levels during uptrends

and great references as resistance in a market that’s heading lower. These

could also be incorporated into your stop strategy.

Different time frames all showing reversal patterns = alert!

Earlier

we looked at the idea of spotting reversal patterns on weekly and (at the same

time) daily charts. This exercise can be just as effective with short-term time

frames. Many short-term traders in the futures markets use 10-minute or

15-minute charts, whereas longer-term players will tend to be watching

longer-term charts - hourly charts at least. 1 get very excited when 1 see

candlestick reversal patterns on short-term (say 10-minute) charts that appear

at the same time as reversal patterns on the 30-minute or hourly charts. This

means that different types of trader are all getting the same message from

their candlestick charts, and if everyone starts to pull in the same direction

you should start to see a definite one way reaction.

And this

sort of situation is not unusual, as 1’ll try to explain below. Take a

combination of three candlesticks on a 10-minute chart that have the look and

feel of a Morning Star.

As we’ve

discussed it’s very unlikely that the gaps to form a textbook Morning Star will

appear on the 10-minute chart, so we need to exercise some flexibility. You can

see opposite that the three candles highlighted are a large filled candle, a

small-bodied candle flagging indecision, then a big open candle to confirm the

turnaround. So the idea of a Morning Star is clear, 1 hope you agree. Also, in

this example the middle candle was a rather neat Doji.

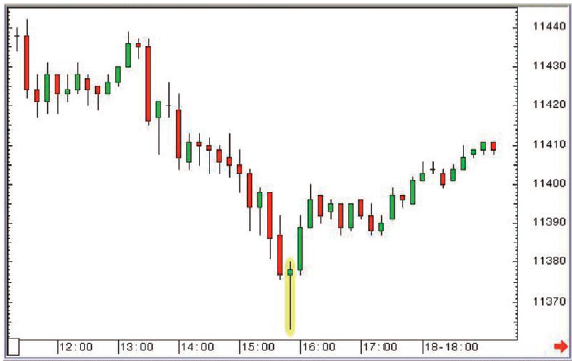

Figure 6-7: Bund futures (June 2008);

10-minute candlestick chart; 24 April 2008, 5.30pm until 25 April 2008, 2pm

Remember

because it is an intra-day chart we’re exercising some of that flexibility

talked about earlier.

Now let’s

look at the 30-minute chart (Figure 6-8). You can see a clear Hammer

candlestick. Whatever the time frame being viewed the trader is looking at a

powerful reversal, because the price action has taken on a “V” shaped direction

of travel. The buyers are back!

Figure 6-8: Bund futures (June 2008);

30-minute candlestick chart; 24 April 2008, 5.30pm until 25 April 2008, 2pm

This is

another gentle introduction to the idea of merging or blending candles, as

Nison calls it. If you have a series of candlesticks that look like they should

be a reversal but there’s no firm name to attach to them, try moulding them

together. You may just find you’re staring at a potent pattern like a Hammer or

a Shooting Star!

The three

candles that form an Evening Star on a 10-minute chart, when combined together,

will likely give you a Shooting Star, which is what will be showing up on the

30- minute chart. For a reminder of what I’m talking about here refer back to

Figure 4-14.

Which

neatly brings us back to our “going through the time frames” idea. Say you’ve

bought something on the back of a Doji on the 10-minute chart. This Doji turned

out to be the middle candle of a flexible Morning Star, which blends to form

another Hammer on the 30-minute chart. All the time frames are screaming the

same thing, and if you’ve moved up to the 30-minute chart from the 10-minute

you will still be confident that a bottom is in place due to the Doji on your

chart.

Uses of Candlestick Charts : Chapter 6. The Real World - Practical Application : Tag: Candlestick Pattern Trading, Forex : multiple time frames trading, multiple time frames in technical analysis, multiple time frame ichimoku, multiple time frames day trading - Different Time Frames