Chart Patterns - Visual Confirmation of Price Movement

Double Top, Double Bottom, Head and Shoulders Top, Head and Shoulder Bottom, Triangles, Short Term and Intraday Patterns

Course: [ Simplified Support and Resistance : Chapter 4. Chart Patterns - Visual Confirmation of Price Movement ]

Chart patterns are visual representations of what is taking place in a stock's price movement. Technicians seek out price stability for the purpose of establishing the SR (support and resistance) levels that define trading range. All price patterns can be classified either as continuation or reversal patterns.

Chart Patterns: Visual Confirmation of Price Movement

Chart

patterns are visual representations of what is taking place in a stock's price

movement. Technicians seek out price stability for the purpose of establishing

the SR (support and resistance) levels that define trading range. All price

patterns can be classified either as continuation or reversal patterns. A

continuation reinforces the existing trend and may be characterized by pausing

in price activity, followed by a return to a previous pattern. Reversal

patterns provide strong signals that price movement is about to head in an

opposite direction, or that an existing trading range is about to be broken and

reestablished at a higher or lower level.

In

highly volatile stocks, there are no apparent SR levels, because price movement

is both erratic and unpredictable. It is erratic because there is no trading

range to speak of; and it is unpredictable because no one knows what is going

to happen next. For the chartist, the highly volatile stock is most troubling.

As long as there is no SR level, it is also impossible to identify breakout

signals, or to make any kind of predictions.

A

similar problem exists in low-volatility stocks. If the trading range is well

established and movement is generally horizontal, the relatively small price

fluctuations provide only one kind of signal: a lack of any change whatsoever.

The chartist has nothing to do because no apparent or real change is on the

verge of occurring.

In

between these two extremes is a rather broad range of stocks, neither entirely

volatile nor stable. They are subject to the types of trading range

"rules" that make SR analysis interesting; occasional trading ranges

keep the chartist actively involved in watching for breakout signals and SR

tests; and the trading range itself is dynamic in one direction or the other,

or to a degree, moving in alternating waves. This middle range of stocks is far

more interesting to the chartist (and to most other analysts) than the

extremes. Remember, on the extremes, analysis is either meaningless or

impossible, and the chartist can only wait for something to change. However, as

long as a stock's activity is dormant or overly volatile, future change cannot

be anticipated with any scientific certainty.

An

interesting stock exhibits movement. That movement can be studied and

quantified using analysis of chart patterns, and changes in trading range and

SR can then be made. For example, a stock may over the course of six months

move from $45 up to $60, and then trade sideways between $55 and $60. The $55

level would become support and the $60 level would become resistance once price

levels off. However, that is a relatively narrow trading range, so the

applicable chart pattern should consider the likely effect of the original $45

per share level. That could be considered as initial support, while also recognizing

that the trading range has narrowed in more recent sessions. This is a common

pattern, but the narrowing is not necessarily permanent. The recent horizontal

trading pattern could be merely a short-term price consolidation, meaning that

the market is marking time awaiting further news that could propel the price of

the stock upwards, or it could be a reversal pattern, signifying the end of the

previous up trend and the beginning of a new down trend.

The Double Top

The

double top shows two price peaks (tests) that are separated by a declining

point or range. The initial peak in price often is accompanied by heavy volume,

as participants react to bullish news and bid prices higher. The market peaks

and retraces a portion of the last move. This pullback will often be

accompanied by relatively light volume as the retracement represents profit

taking off the high. The price next returns to the original up trend but as it

nears the previous peak, buying interest proves not strong enough to push

prices to new highs.

This

inability to break out above resistance is recognized early during the assault

on the old high by comparing the volume of the second run to the volume of the

first run. If the volume is lighter, it indicates that fewer buyers are joining

in on the rally. The signal that indicates when the double top formation is

complete comes when prices break down through the support level established

between the

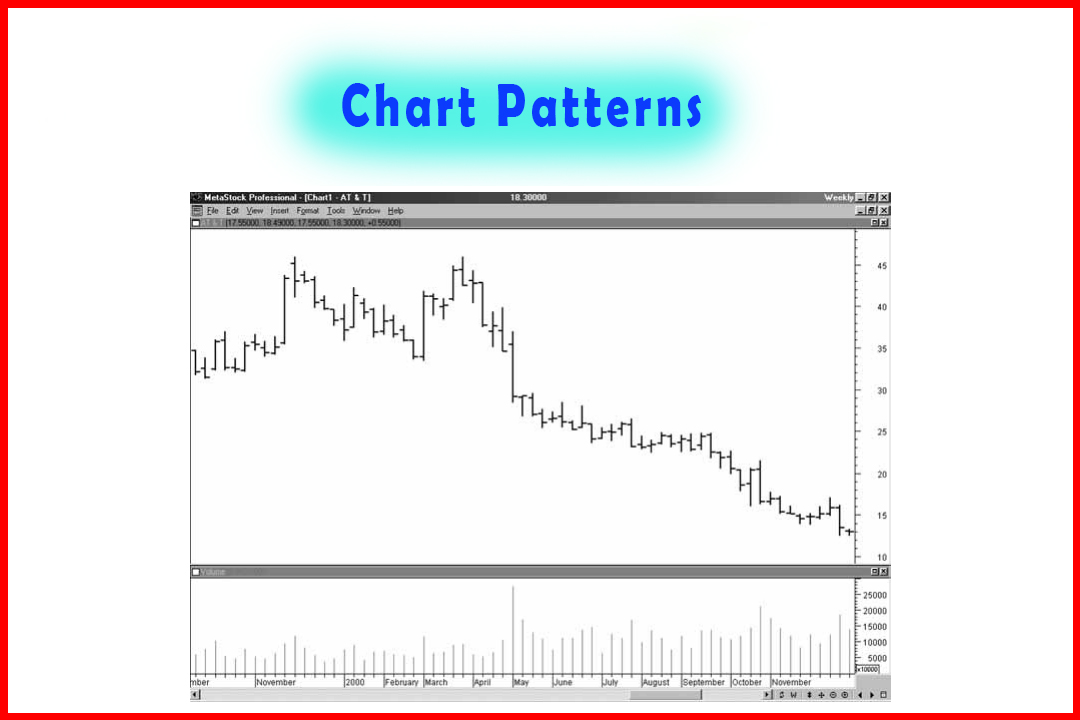

Figure 4-1

two

peaks. Often, volume will increase dramatically as this occurs, representing

the possibility of a major shift in trader expectations.

Figure

4-1, a weekly chart of AT&T, shows a double top with a price break at the

support point between the two price peaks. Volume expanded noticeably,

confirming the top formation.

The Double Bottom

The

double bottom is characterized by two price troughs that are separated by a

price peak. As the price falls to form the first low, volume often is relatively

high, at times exceptionally high. However, in the typical double bottom,

sellers are unable to break through the support level and a retracement of the

decline follows. The price rallies, due to a combination of short covering and

bargain hunting. A popular interpretation of the retracement is that the bad

news that caused the first price decline is discounted by the point of the

second leg, and the market then advances as buyers take up well-priced shares.

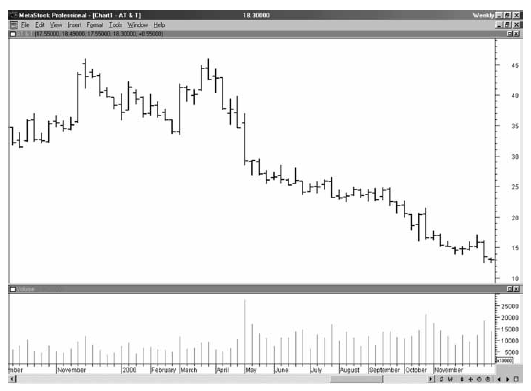

Figure

4-2 shows a double bottom on a weekly chart from American Express. The large

volume occurred as the price reached its bottom. A healthy level of support

appeared as the double bottom unfolded.

Figure 4-2

The Head and Shoulders Top

The

head and shoulder top is so named for the shape of the chart pattern. It

involves a center high level (the head) with lower plateau levels preceding and

following (left and right shoulders). Also called an 'M' because of its shape,

the head and shoulders is one of the most reliable of all chart patterns. The

volume characteristics commonly involve a peak during the left shoulder or at

the head, and much lower volume during the right shoulder trading period. The

trading area in between each shoulder and the head is often called the

neckline. Penetration of the neckline following completion of the pattern

signals that the top is complete and a downward price trend is likely to

follow. Volume may expand as the price breaks down through the neckline. The

price may also retrace and test the neckline in subsequent movements. The head

and shoulder top may establish a new resistance point at (or below) the

neckline, and a new trading range could become established at or below that

level.

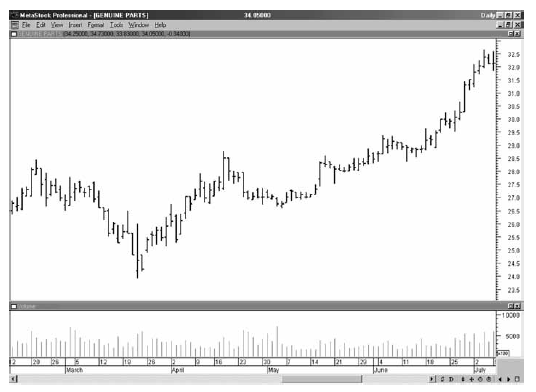

Figure

4-3 shows a complex head and shoulders top that developed in IBM. It is complex

because the two shoulders show multiple tests of the resistance level. After

the neckline at $110 was broken, the price dropped to below $90.

The Head and Shoulder Bottom

The

inverse of the head and shoulders top, this pattern marks the end to a

previously downward trend. The pattern consists of three price bottom levels

with the center (the head) trading lower than the left and right shoulders. A

breakout above the

Figure 4-3

neckline

is a sign that a new support level is likely figure 4-3 to be established there

as part of a new, higher trading range. This pattern is also referred to as 'W'

due to its distinctive shape.

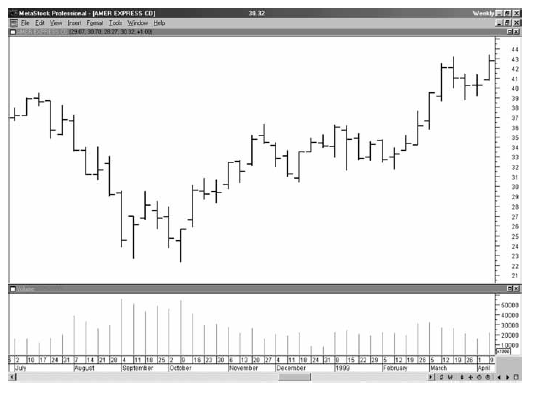

Figure

4-4 shows that the head and shoulders pattern can represent both a bottom as

well as a continuation pattern. The first head and shoulders bottom occurred in

March, then proceeded to rally, followed by a price decline in April, and

finally another smaller head and shoulders bottom formation. This indicated

strong support, and the prices advanced once again.

As

a general observation, the head and shoulders formation is a strong signal that

is either bearish

Figure 4-4

(top

pattern) or bullish (bottom pattern). The repeated test of the SR levels is met

with weakness and an inability to break through, and then is followed by a

strong price movement in the opposite direction.

The

importance of head and shoulder formations is in the way that resistance (top

pattern) and support (bottom pattern) are tested, and in the forecasting

advantage that these patterns provide. Head and shoulders is one of the more

popular methods for anticipating breakout of SR. The triple signal attempt at

breakout, with each one failing, provides confirmation that, in fact, prices

are going to head in the opposite direction.

Triangles

The

triangle pattern, so called for its shape, is one continuation pattern closely

associated with the establishment of a new SR and trading range; or, the

triangle may precede a period of increased volatility.

Triangles

may be symmetrical, descending or ascending. The symmetrical triangle, also

called the coil, has a rising support line and a falling resistance line. The

two lines converge near the middle of the initial range. The volume will often

peak at the end of the trend just as or right before the triangle pattern

starts to unfold. As the market moves sideways, the volume will continue to

recede. If the volume is higher on the support side, this suggests that the

market is likely to break through on the upside. On the other hand, if the

heaviest volume appears when the prices are trading near resistance, and the

price bars close near the lower end of the bar's range, a downside breakout can

be anticipated. The symmetrical triangle typically indicates that, at least for

the moment, buying and selling interests are balanced against one another.

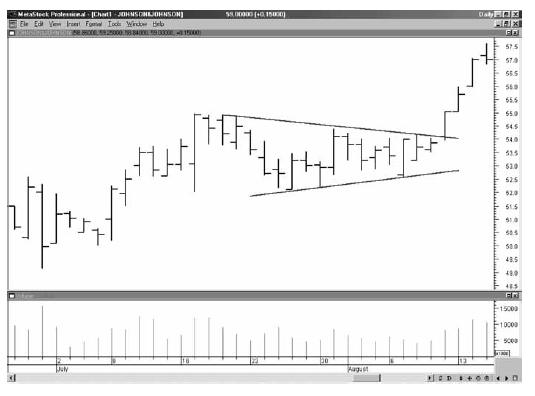

Figure

4-5 shows Johnson & Johnson (JNJ) trading sideways as a symmetrical

triangle. Volume declined during the triangle and then expanded as the price

broke out.

The

descending triangle has a falling resistance line and a horizontal support

line. As the market moves sideways, the prices fail to achieve higher levels;

yet, the support line holds. The volume characteristics are important to

analyze along with the emerging triangle pattern, since the combination of

price and volume are required to properly anticipate the

Figure 4-5

next

price move direction. Despite the observation that support is holding

throughout the development of the triangle, if the volume is heavier on the failed

attempts to move through resistance, then support may collapse. In that

instance, the inability of price to move through resistance even with heavy

volume indicates that buyers are too scarce to create a breakout. The

descending triangle is usually a bearish price pattern and, when confirmed with

other information, can be used to anticipate a weakening price trend.

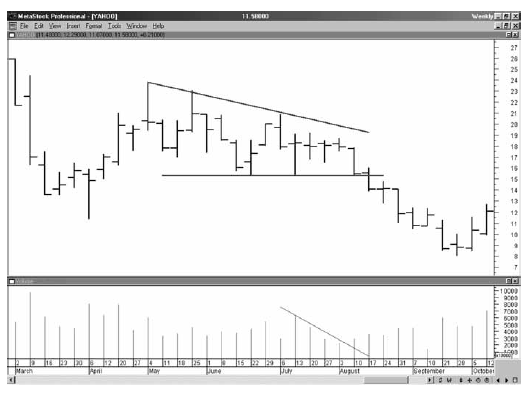

Figure

4-6 shows a descending triangle for Yahoo! (YHOO). The test of support saw a

price rally with expanded volume. However, during the week of August 10, the

price closed at the low for the

Figure 4-6

week

and the volume broke the down-trend line, figure 4-6 which anticipated a

breakout below support.

The

ascending triangle is composed of a rising support line and a horizontal

resistance line. In this pattern, buyers are coming into the stock, creating

higher and higher prices, while sellers hold at a fixed price level. Volume is

essential to determining the significance to this price pattern. Heavy volume

at resistance indicates weakening buyer activity and a possible downside

breakout. If the volume is rising when price is at or near support, that may

point to an impending breakout above resistance. The ascending triangle pattern

is usually considered bullish and can be useful in anticipating an upward price

trend.

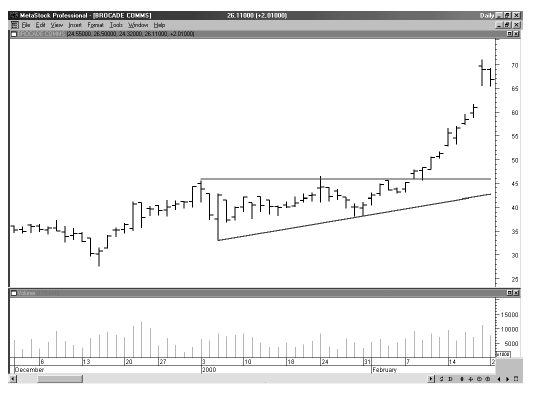

Figure 4-7

Figure

4-7, Brocade Communications (BRCD),traced

out an ascending triangle before resuming another up leg in the trend.

One

useful technique for trading a triangle is to plot the trend lines to the point

they cross, and then determine the 50-66% range from the point where the

triangle begins to the point where it ends. This 50-66% zone is the typical

area that prices will exit the triangle. If the price stays within the confines

of the triangle past this exit zone, the breakout will not develop into a

longer-term trend.

Triangles

are likely to serve only as short-term price indicators. They can anticipate SR

breakouts, of course, and that is ultimately their usefulness. They should not

be viewed for price patterns alone,

however.

An expected breakout should be confirmed by volume trends as explained above.

If the corresponding volume changes are not found, then the triangle could be a

short-term aberration or merely a coincidental and random pattern. When triangles

are short-term in nature, they are more properly classified as flags.

Short Term and Intraday Patterns

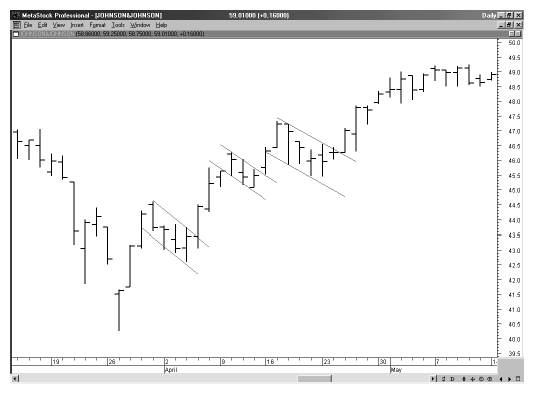

Flags

and short-term triangles are quick consolidation periods with tight boundaries

of support and resistance that occur within existing trends. A flag is so named

because the trading action has parallel support and resistance trend lines that

are either horizontal or slope downward. Figure 4-8 is a

Figure 4-8

30-minute

bar chart of Johnson & Johnson showing a series of flags during the up

trend.

The

value of identifying flags often is in specifically distinguishing them as

pausing in the established trend rather than as a sign of newly emerging

trends. The short-term flag tends to slope in a direction opposite the trend.

Thus, if prices are inching upward, the flag will have a downward shape, with a

tendency for prices to climb upon completion of the flag's pattern.

A

pennant looks like the triangle, but is usually shorter-term in duration,

usually lasting no longer than a week or two. The pennant is a type of slowdown

or pause in the price trend and usually is followed by a resumption of the

previously established price movement direction.

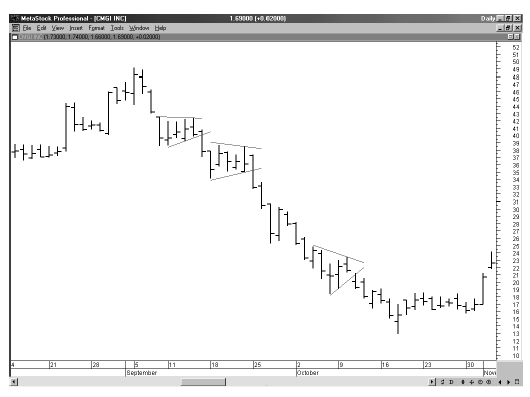

Short

term triangles, or pennants, often occur as brief pauses in a steep up or down

trend, but may be more pronounced due to the rapid and volatile nature of that

steep price change. Figure 4-9 shows CMGI Inc. (CMGI) with a number of short-term triangles during a larger down

trend.

The

classic chart patterns may occur not only in long-term trend patterns, but also

in short-term daily price patterns or Intra-day trading patterns. The technical

analyst faces the challenge of trying to distinguish between patterns that

represent emerging new trends, and those that are only false starts. This is

the great challenge, of course, because as trends emerge, it is more difficult

to interpret them than it is to look back and identify what happened in the

past. However, this does not

Figure 4-9

mean

that seemingly brief or short-term patterns can be ignored; they may be the

beginning of important reversals. Many price swings on stocks begin from

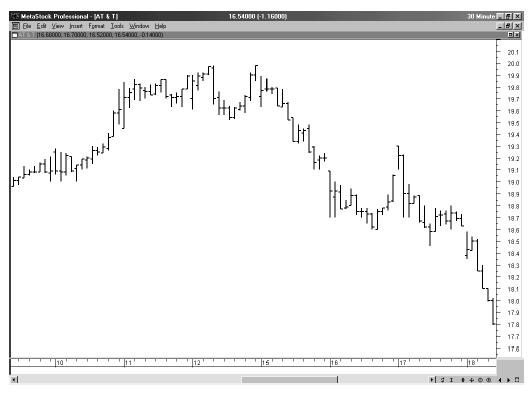

Intra-day chart patterns. Figure 4-10 is the 30-minute chart of AT&T,

showing a double top formed before the price fell from $20 to below $18. Figure

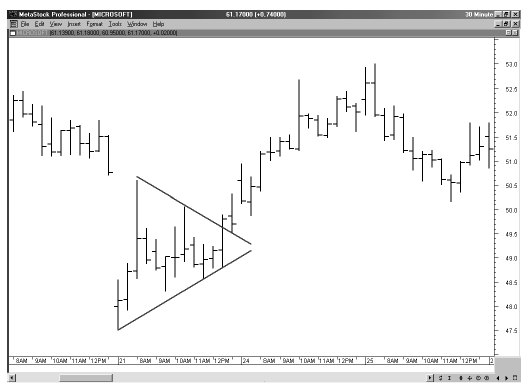

4-11 shows trading the 30-minute chart for Microsoft (MSFT), which formed a symmetrical

triangle as a reversal pattern.

Gaps

A

gap is a space in between price range from one day to the next. For example, if

a stock trades today between $18 and $21 per share, but opens tomorrow at $23,

a two-point gap occurred.

Figure 4-10

Gaps

can be interpreted in three different ways. A breakaway gap signals a strong

market move. For example, if the gap occurs above the neckline of a head and

shoulders bottom, that could strongly confirm the head and shoulders trend.

A

second interpretation is called the runaway gap, which occurs within an

established trend, normally one in which prices are rising or falling strongly.

The third type of gap, an exhaustion gap, is likely to occur at the end of a

strong price trend and could indicate that the trend is about to end out. For

example, if prices have been climbing rapidly and strongly, an exhaustion gap

may signal that prices are about to top. This type of gap may be

Figure 4-11

followed

shortly by a breakaway gap heading in the opposite direction. Together, this

pattern, often called an island reversal, is a sign that prices are going to

head in the opposite direction.

Summary

Chart

patterns may serve as indicators that continue or reverse established SR and

trading ranges. It is not a simple matter to distinguish short-term or false

starts from the stronger and more permanent changes in price direction. The key

is to study volume trends along with those price patterns. The two together are

more likely to anticipate breakout or confirm the current SR range.

In

order to more thoroughly understand the nature of SR and why price may breakout

and establish a new trading range, the study of interim patterns is a useful

exercise. As prices test SR levels, volume trends confirm what the price

pattern appears to imply; however, every technician also needs to remember that

there is a random element to short term price movement. Not every pattern is

significant. It is prudent to always watch volume as well, and to ensure that

the elements of price movement—SR tests, price spikes at top or bottom, head

and shoulders patterns, and triangles—are interpreted properly, and are not

misunderstood in error. The value in price movement patterns is always confirmed

when SR is tested and either holds or is broken.

With

that observation in mind, how can you best use price patterns to take advantage

of extremely short-term changes? The next chapter shows how swing trading puts

these valuable patterns to work.

Simplified Support and Resistance : Chapter 4. Chart Patterns - Visual Confirmation of Price Movement : Tag: Support and Resistance, Forex : Double Top, Double Bottom, Head and Shoulders Top, Head and Shoulder Bottom, Triangles, Short Term and Intraday Patterns - Chart Patterns - Visual Confirmation of Price Movement