Swing Trading: Creating Profitable Opportunities

High Profit Trading Strategy, Swing trading, Swing bottom, Support and Resistance, Swing tops, Multiple time frames trading

Course: [ Simplified Support and Resistance : Chapter 5. Swing Trading: Creating Profitable Opportunities ]

You can use chart patterns to time your entry and exit points. By analyzing consecutive high and low points and spotting SR test signals, you can invest as prices swing from one direction to the other. As a "swing trader," you combine well-known price patterns with gaps, volume analysis and confirmation signals, to anticipate which direction prices are going to take.

Swing Trading: Creating Maximum Profit Opportunities

You

can use chart patterns to time your entry and exit points. By analyzing consecutive

high and low points and spotting SR test signals, you can invest as prices

swing from one direction to the other. As a "swing trader," you

combine well-known price patterns with gaps, volume analysis and confirmation

signals, to anticipate which direction prices are going to take.

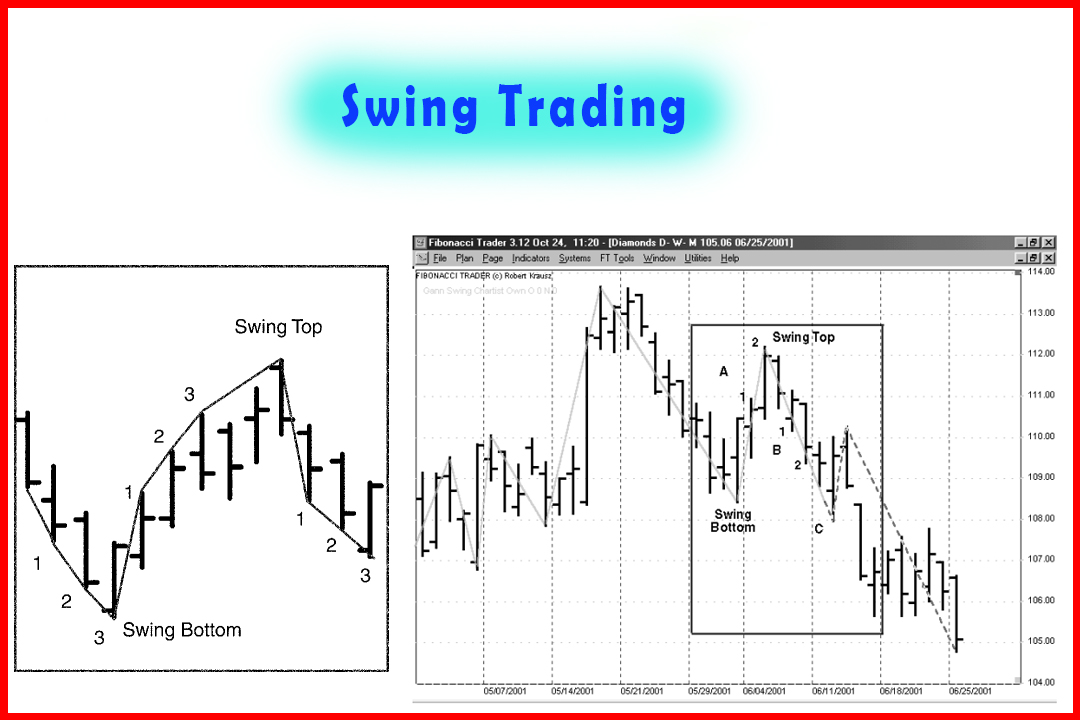

One

popular swing trading method is based on a three-bar pattern demonstrating

peaks with three higher highs, or dips with three lower lows.1 For

example, Figure 5-1 shows an upswing as the price bars achieve higher highs,

but when the bars make three lower lows, the swing turns down. Once the swing

turns direction, the highs or lows do not have to be consecutive. If the market

traces out two higher highs and the next high is a lower high, and then prices

rally to another new high, the swing is still up. A swing chart determines the

trend by tracking the highs and lows. Whether consecutive or not, the pattern

is established by

Figure 5-1

highs

outpacing previous levels, or lows declining below previous levels.

Support and Resistance

On

Figure 5-1, the support point is the swing bottom as prices moved from a

downswing to an upswing. If movement were taking place in the opposite

direction, the resistance point would be identified as the point where an

upspring reversed into a downswing. As with all cases of patterns,

SR

levels are established by unsuccessful attempts to break through, and these are

usually followed by a reversal in price movement.

3-bar Swings versus 2-bar Swings

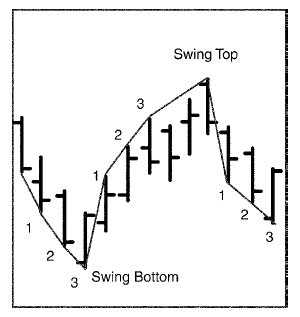

Some

traders have observed significant differences between swings lasting over two

bars and those

Figure 5-2

taking

three bars. According to these traders, two figure 5-2 bar swings are

preferable to three-bar swings because the likelihood of picking and timing the

impending movement correctly is stronger with the shorter-term swing pattern.2

Figure 5-2 shows a two-bar swing chart.

According

to proponents of the preferred two-bar method, if and when a two-bar swing top

is violated, the trend turns up. If a two-bar swing bottom is broken, then the

trend turns down. Figure 5-2 shows an example within the box on the chart.

At

point A, two consecutive higher highs precede an upturn of the swing. At point

B, two consecutive lower lows precede a downturn of the swing line, and a swing

top is established. At point C, the previous swing bottom is violated so the

trend turns down and the swing line is dashed.

Reviews

of charts show well-defined up trends as a series of rising support swing

bottoms (support points). Downtrends consist of falling swing tops (resistance

points). By applying the definition of the trend to the chart, the swing trader

can time entry into long positions at the bottom of the channel, or right at

support, or short positions at the top where resistance is established. On the

closing side, the long position exit should be made when resistance appears to

weaken, and short positions should be closed when support appears about to

erode and give way.

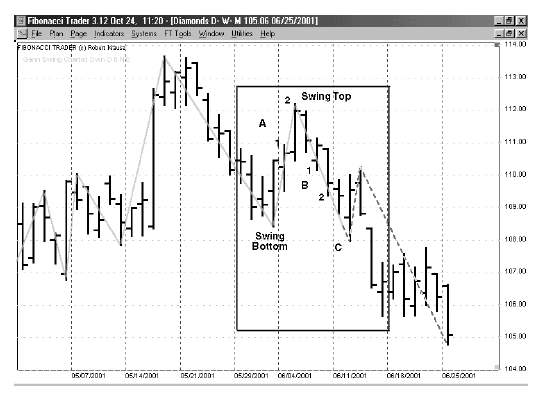

Swing

traders may advance this technique by using multiple time frames alone or in

combination. For example, your current trading pattern could be set using daily

bars, and the next time frame would be the weekly bars. By using a multiple

time approach, you are able to differentiate between major and minor signals.

Swing tops and bottoms would be interpreted as major SR on a weekly basis and

minor support and resistance on a daily basis, for example.

Figure

5-3 (Microsoft) shows that the Weekly Gann Swing is up, but the trend is down

(dashed lines) indicating that prices recently broke a weekly swing bottom. The

Daily Swing Lines are solid and form a swing bottom. When prices broke the

swing bottom, the Daily Swing Trend came into agreement with the indicators on

the Weekly Swing Trend. With this information, breakouts of major SR levels

would be more easily identified than minor SR probes, providing you with useful

confirming signals.

Figure 5-3

Other Swing Trading Concepts

Many

swing traders have further observed that up trending markets tend to move in

patterns exhibiting swings of higher highs and higher lows.3 By

using specific setups for entering into trades based on market direction, swing

traders can employ the strategy of simply watching for consecutive lower highs

or consecutive higher lows.

Once

the price reaches a new high it may be followed by three to five consecutive

lower highs. This downswing is due to late buyers coming in and buying at the

short-term top. As the market moves lower, the same late buyers will be likely

to exit their positions to cut their losses. The same strategy works on the

downside. Once the price falls to a new low it may be followed by three to five

consecutive higher lows. Similarly, following market action presents the short

seller with timing opportunities.

This

type of trading action is typical of the majority of market followers, who

chronically buy after a price peak and sell only to cut losses. This presents

the astute swing trader with an opportunity to take positions in the up trend

by buying after this series of three to five consecutive lower highs or higher

lows. This variation on swing trading is a chartist's version of contrarian

investing—going against the action of the market. By timing long or short entry

to consecutive lower highs or consecutive higher lows, the contrarian swing

trader is able to take advantage of the common trading patterns of market

reaction.

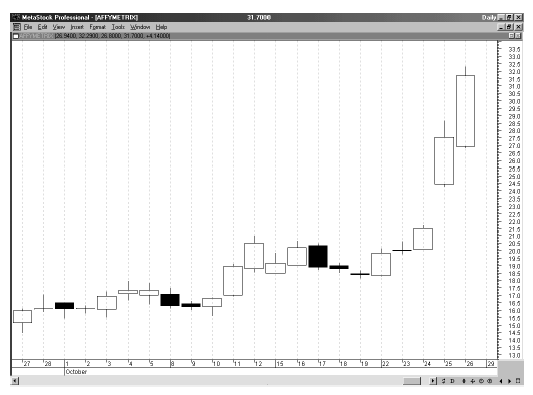

For

example, Figure 5-4 is Affymetrix. This market had been making higher highs and

higher lows.

The

expectation is that this pattern represents a new support point in a general up

trend. If the support point does not hold, the swing trader should exit with a

small loss. Partial profits can be taken when the market returns to the old

high, and a trailing stop order placed for the remainder of the position.

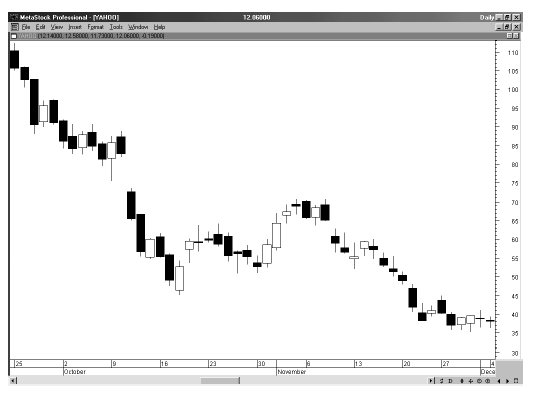

For

stocks in a down trend consisting of a series of lower lows and lower highs,

look for stocks that have rallied with three to five consecutive higher lows.

Here, a stock may be advancing because buyers believe that the market has come

down too far too fast and may be making a bottom—this is believed despite the

fact the market is clearly in a down trend. For example, Figure 5-5 shows Yahoo

Figure 5-4

(YHOO) in a downtrend with a short term rally consisting

of four higher highs, after which the price rolled over again.

Traders

who buy against the trend will likely sell out quickly if the trade does not

work. This presents another opportunity. If the price trades below the low

third or higher consecutive low, the contrarian swing trader may go short and

remain at risk up to the high of the entry bar or the previous bar, whichever

is higher. In this trade, the setup takes advantage of a potential resistance

level just as it is forming. If the resistance level does form, then prices

should fall to new lows typical of the down trend. Partial profits can then be

taken near

Figure 5-5

the

previous low, entering a trailing stop for the remainder of the position.

Summary

Swing

trading takes maximum advantage of the tendency for prices to ebb and flow in

the short term, to move in directions against the trend, and to reestablish

that trend again. By waiting for the counter trends to occur and then trading

in the direction of the trend, you create many more short term profit

opportunities. Swing trading utilizes SR as points to enter stop losses for

trades, as well as targets for profit-taking.

This

is the essence of swing trading, and ultimately it defines your success in

technical market trading. Beyond the short-term effectiveness of swing trading

techniques, you can employ the same skills to forecast likely SR trends into

the immediate future. The next chapter shows how to spot the signals for

emerging SR trends.

Simplified Support and Resistance : Chapter 5. Swing Trading: Creating Profitable Opportunities : Tag: Support and Resistance, Forex : High Profit Trading Strategy, Swing trading, Swing bottom, Support and Resistance, Swing tops, Multiple time frames trading - Swing Trading: Creating Profitable Opportunities