Methods for Identifying SR Levels Using Trend Lines and Channels

How to trade trendlines, Trade trendlines using S&R, How to trade S&R

Course: [ Simplified Support and Resistance : Chapter 3. Methods for Identifying SR Levels Using Trend Lines and Channels ]

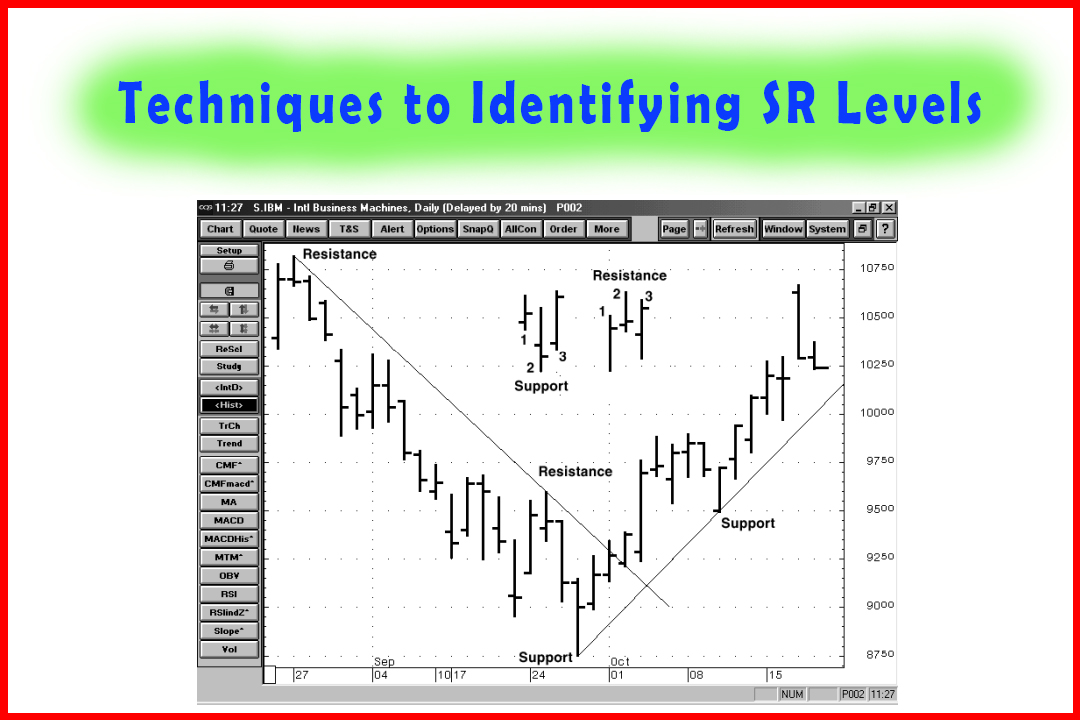

Trend lines are straight lines drawn on a chart connecting support points for a rising trend or resistance points for a down trend. Figure 3-1 shows a support point using a three-bar pattern where the center bar is the lowest bar. This chart pattern is called a pivot low, isolated low or a three bar head and shoulders pattern

Trend Lines and Channels: Techniques to Identifying SR Levels

Trend

lines are straight lines drawn on a chart connecting support points for a

rising trend or resistance points for a down trend. Figure 3-1 shows a support

point using a three-bar pattern where the center bar is the lowest bar. This

chart pattern is called a pivot low, isolated low or a three- bar head and

shoulders pattern. This pattern is a support point. It represents three

attempts by prices to move below support. This pattern occurs frequently at

many upturns in the market. The pattern for resistance is called a pivot high,

isolated high or three-bar head and shoulders pattern. Downturns in the market

often are signaled with one of these patterns.

A

trend line may rise, fall or move sideways. Trend lines are not drawn through

any price bars; they are used to connect two or more support points that define

the trend and indicate its direction (Figure 3-1).

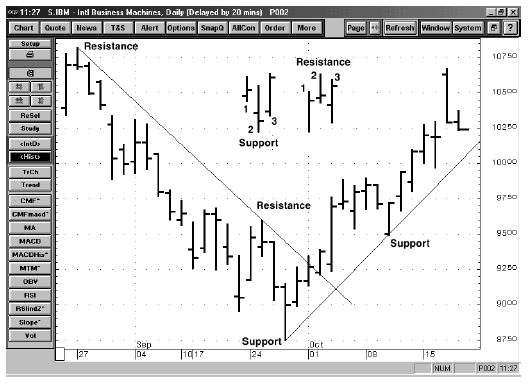

Horizontal

trend lines are drawn along the two lowest support points in the trending

range. A horizontal trend line is also drawn along two or more

Figure 3-1

of

the highest resistance points in the trading range. As long as the prices trade

between the support trend line and the resistance trend line, the trading range

continues (Figure 3-2).

Two Modern Trend Line Techniques

One

expert developed a system for drawing trend lines to clearly define tops and

bottoms of the trading range. This technique is referred as the 1-2-3 formation.1

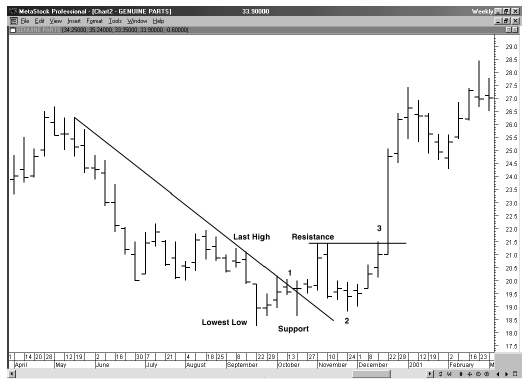

First,

for a downtrend, the line is plotted along the highs so that the last high

shown then becomes the next high preceding the lowest low. A break of this down

trend line is step 1 of the formation. This is followed by an upward price

movement and

Figure 3-2

then

a retest of the low. This is step 2. The third and final step is a breakout of

the resistance point between the first low and the retest. Figure 3-3 is a weekly

chart of Genuine Parts (GPC). The down trend line is plotted across the highs

that preceded each new low. At point 1, the down trend line is broken. The

market rallies and forms a resistance point. Next, there is a retest of support

at point 2. Support holds and the market trades up and breaks through

resistance at point 3. A price bottom has been established.

For

a top formation the support line has to be drawn along a series of lows that

precedes the final high. The first sign of the top is the up trend line is

broken. Next, the price pulls back, forms a

Figure 3-3

support

point and then retests the high. This is step 2. The third step occurs when

prices return back down through support.

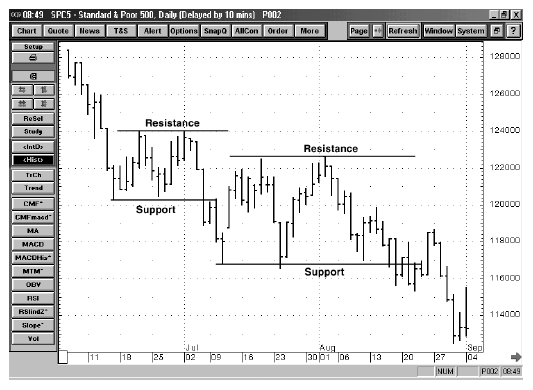

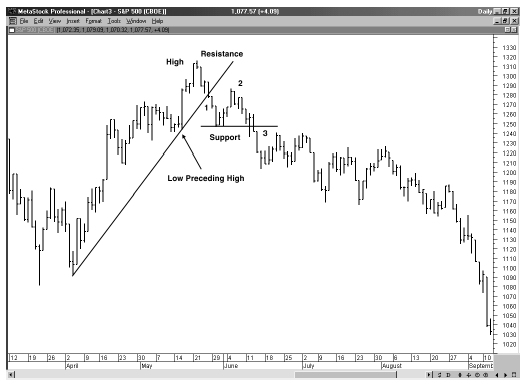

Figure

3-4 is a daily chart of the S&P 500 index. The up trend line is drawn along

the lows that precede each new high. At point 1, the trend line is broken. The

market retraces almost 50% of the decline (point 2). Next, the support level is

broken (point 3), and the top formation is complete.

Another

method for using trend lines with support and resistance levels is the Andrew's

pitchfork or medial line method. Developed by Dr. Alan Andrews, this technique

identifies the trend as well as its outer boundaries. The technique identifies

three points. For up trends there will be two

Figure 3-4

support

points and one resistance point, and for down trends there will be one support

point and two resistance points.

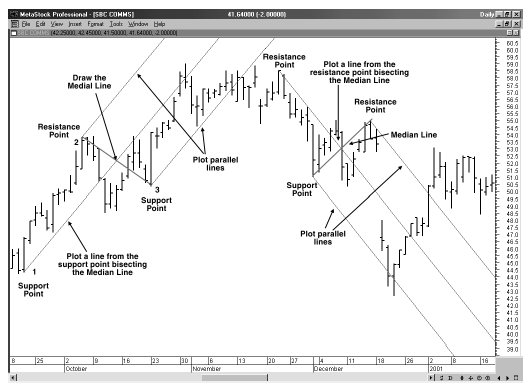

Figure

3-5 has both an up and a down trend using the Andrew's Medial Line method. For

an up trend, this method first finds the support point (point 1), the

resistance point (point 2) and support point to the right (point 3). A line

connects the high of the resistance point (point 2) to the low of the second

support point (point 3), and determines the halfway or median point of this

line. Another line is drawn between the low of the first support point (point

1) bisecting the median point and extending upward.

One

line is also drawn upwards from the resistance point parallel to the median

line, and another

Figure 3-5

upwards

from the support point parallel to the median line. Technicians use the

pitchfork method to identify decision points. For example, they may buy when

the median line is pointed upwards and prices have retraced to the support

line. Similarly, if the median line is pointed down, they may enter a sell

order if and when prices rally back to the resistance line. Penetrations of the

support or resistance lines of the Andrews pitchfork may signal that a new

trend is underway.

Figure

3-5 shows how prices during late October stayed within the lower channel side

and only closed above the median line once before prices moved out of the

upward channel. Moving below the lower up-channel line signaled an end to the up

trend. Next, the market rolled over and new channel pointed downward. When the

market gapped down in mid-December, prices reversed at the lower side of the

downward channel.

Classic Channels

The

up-trend line may also be referred to as the demand line and the resistance

points as the overbought line. The down-trend line plotted over the resistance

points may be called the supply lines. A parallel line may be drawn along the

lows of the supply lines to identify the oversold area.

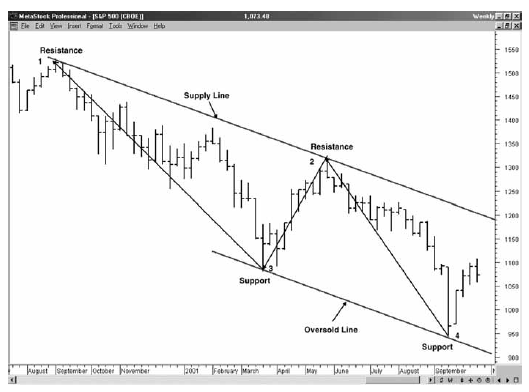

Figure

3-6, the weekly chart for the S&P 500, shows a down-trend line along

resistance points

Figure 3-6

Figure 3-7

1

and 2, and then a parallel line (the oversold line) from support point 3, which

lies between the two resistance points. Notice how the market rebounded from

the oversold line.

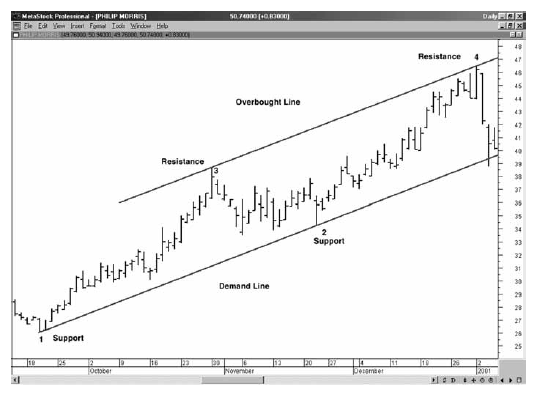

Figure

3-7, a daily chart of Phillip Morris (MO), shows an up-trend channel. The

demand line is plotted along the support points 1 and 2, and then a parallel

line is plotted from the resistance point upward. The prices stopped right at

the overbought line in January.

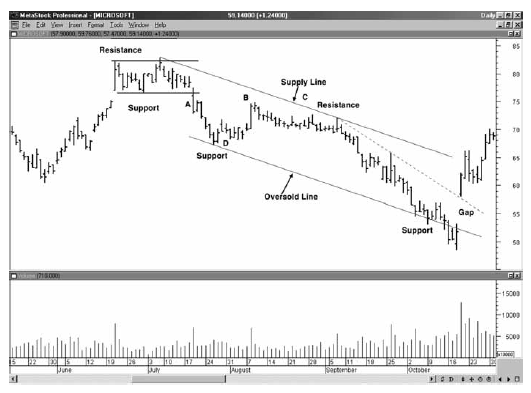

Volume

Volume

is an important confirming tool for breaks of trends lines. Figure 3-8, a chart

of trading in

Figure 3-8

Microsoft,

shows at point A prices breaking down through support. At the same time, volume

expands noticeably. Once support is broken it

becomes

resistance in a newly established trading range. At point B, the market

retraced back near the original support level, and volume was heavy, but prices

did not return above the original support level. A supply line may be along the

two resistance points and the oversold line along the support point D. Prices

fell below the oversold line but reversed back into the down-trend channel, accompanied

by heavy volume. The next day, the market gapped above the down-trend line

(dashed) with heavy volume confirming the breakout. The guideline is to look

for an increase in volume to confirm a break of any trend line. In this

respect, volume can serve as yet another confirming factor when studying

SR—especially when spotting breakouts.

Summary

Trend

lines are used to identify support and resistance levels, which may be extended

out into the future with a straight line through price and time. Penetration of

trends lines may also be accompanied with an increase in volume, further

confirming the newly established trend. Light volume breaks of trend lines tend

to be false, with that low volume indicating lack of widespread participation

or interest on the part of traders and investors.

The

next chapter extends trend line analysis to an equally interesting visual study

of price. Chart patterns help you to place the trend line into a valuable

context.

Simplified Support and Resistance : Chapter 3. Methods for Identifying SR Levels Using Trend Lines and Channels : Tag: Support and Resistance, Forex : How to trade trendlines, Trade trendlines using S&R, How to trade S&R - Methods for Identifying SR Levels Using Trend Lines and Channels