Elements of the Dow Theory

What is Dow Theory, Best trading Setup, Best Forecasting trading setup

Course: [ Simplified Support and Resistance : Chapter 2. The Dow Theory ]

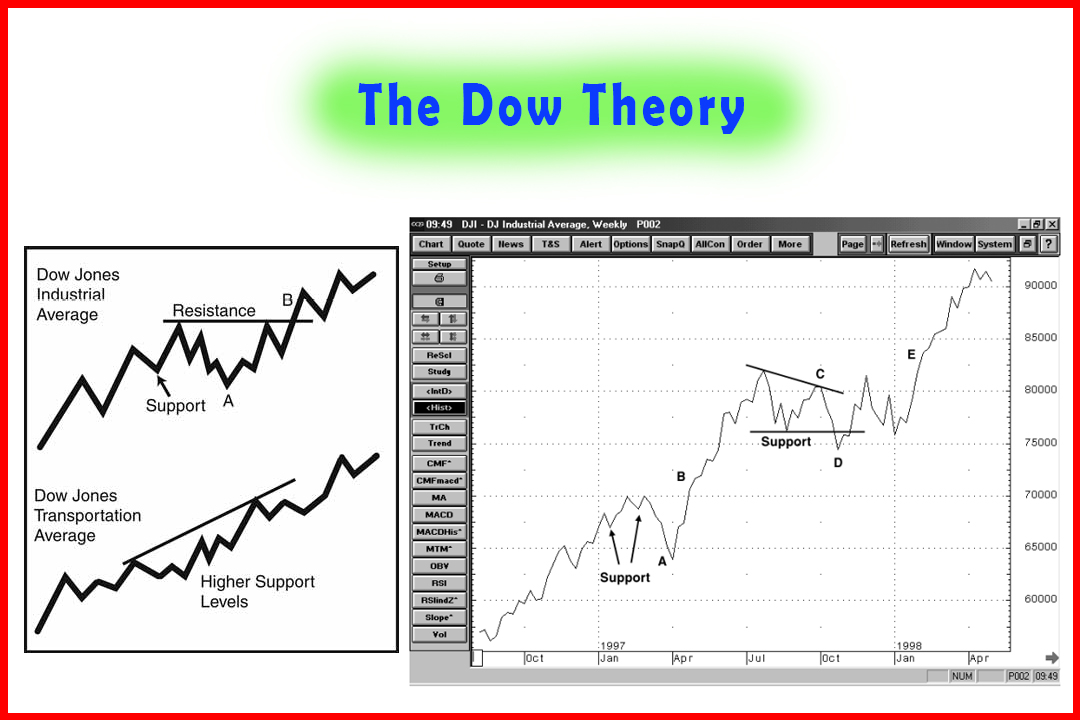

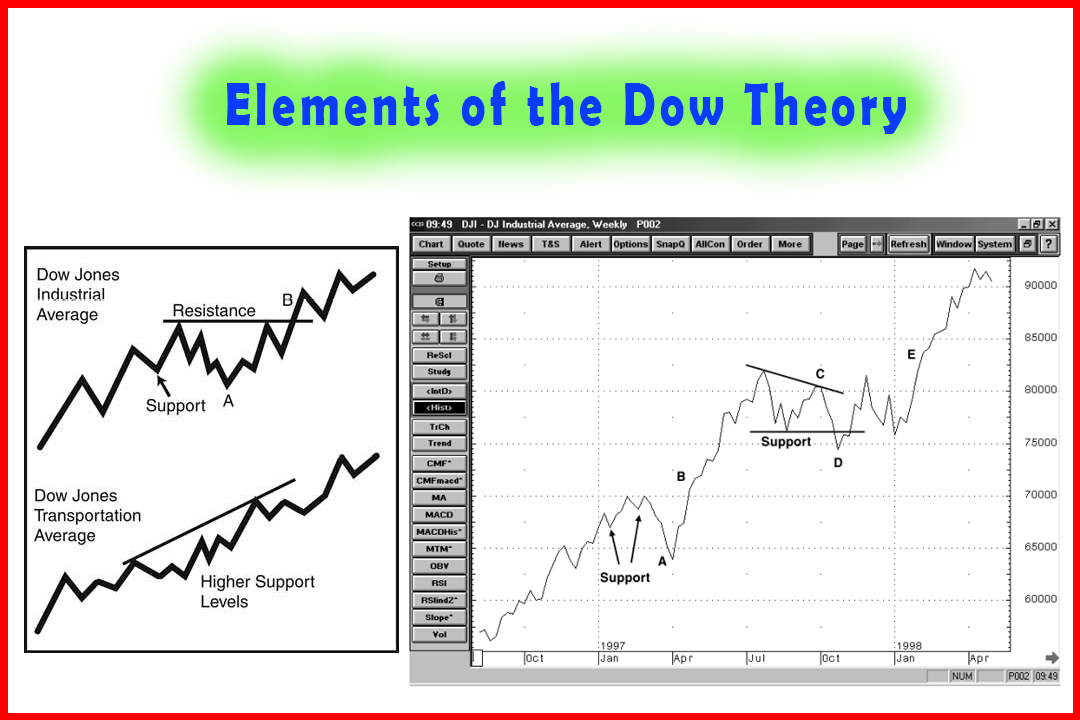

A study of overall market trends based on market indexes may indicate future likely trends; however, using SR in that analysis is not necessarily an accurate exercise. SR is more often used for tracking individual stock prices.

Elements of the Dow Theory

A

study of overall market trends based on market indexes may indicate future

likely trends; however, using SR in that analysis is not necessarily an accurate

exercise. SR is more often used for tracking individual stock prices.

Understanding the Dow Theory is useful, however, in viewing how overall market

trends may influence prices on specific stocks.

The

first observation of the Dow Theory is that the market tends to follow the

leaders. Thus, an index of 30 industrial stocks, representing about 20% of

overall equity value in the United States, is indeed a strong market-wide

indicator.1

A

second belief of the Dow Theory is that markets have three trends: primary

(lasting months or years), secondary (20 to 60 days) and tertiary (day-to-day).2

Trends, which were of great interest to Charles Dow, are what Dow watchers follow, constantly seeking out signals of reversal. After all, just as chartists look for breakouts from SR ranges on individual stocks, broader market watchers look for three signs when new trends are established; this is the third belief of the Dow Theory.

Those three signs for establishment of a new bull market are:

- Experienced investors begin buying stocks when market prices are low and the mood is cautionary. This contrarian approach is well known today.

- Corporate earnings begin to rise.

- Buying activity in the broader market begins to increase.

A bear market trend would be signaled by these three events:

- Experienced investors recognize that stocks are over-bought and they begin selling off shares. Even though corporate earnings may be higher than in the past, these investors also know that companies are not going to be able to sustain those growth rates.

- Buying activity slows down as prices peak out.

- Market prices decline broadly. Investors rush to sell, creating an accelerating price decline.

These

three-step processes are widely recognized, notably by experienced investors

whose task is to try and recognize these emerging trends before formal

recognition by the market as a whole (and specifically as confirmed under the

Dow Theory).

The

fourth belief under the Dow Theory is that of confirmation. Once an average begins to show signs of a reversal in

direction, it must be confirmed by the same indication in a second average. For

example, if the industrial averages meet the three tests above, the trend will

only be recognized if and when the transportation averages mirror the same

steps.

As

a final "rule" under the Dow Theory, a trend is said to remain in

effect until both averages again reverse direction. This is the opposite side

of belief number four, requiring confirmation of a change in direction.

Market Trends versus Business Trends

The

tendency in the market to apply trend analysis against price has the result of

confusing two separate functions. Price is affected indirectly by corporate

earnings, and short-term price is far more a chaotic result of market

interactions. Price change in short- and intermediate-term periods should not

be given great weight; to truly follow the long-term pricing trends,

longer-term moving averages are the only realistic method for following a company's

market fortunes.

A

business trend, in comparison, is based on fundamentals: sales, costs, expenses

and profits. Charles Dow recognized the importance of trend analysis as part of

the corporate internal budgeting process, and his original intention was to

develop economic models to help anticipate fundamental changes. In modern

application, however, the science of trend analysis is applied to overall index

trends and to purely technical features, especially to market price. Thus, the

concept of applying the Dow Theory to SR is misleading.

To

the extent that SR patterns can be anticipated, there are many useful chart

patterns and signals and, by using the Dow Theory along with other tools, what

appears to be emerging can certainly be confirmed through many outside means.

However, SR should be viewed as a separate function of charting—it serves as

the basis for technical assumptions, and the Dow Theory is one of many

techniques that are used to anticipate price move9ment. However, remember that

there are vast differences between index trends (the net offsetting movements

of that index's components) and individual stock trends, which have isolated

and unique price patterns, SR, and other features.

Dow

Theory is a useful tool for understanding the nature of moving averages and

price patterns. When the concepts employed within the Dow Theory are applied as

tools for confirming SR trends in individual stocks, it is quite valuable.

However, there is no rational method for applying index trends to individual

stocks. SR proponents may gain valuable skills in anticipating stock price

patterns using Dow Theory rules, but they should also recognize the built-in

limitations when trend analysis, intended as a fundamental tool, is applied in

a purely technical environment.

Summary

The

Dow Theory is perhaps the best-known of technical theories about the stock

market. By understanding how it is applied to indexes of stocks, we can also

gain insight into how SR works on individual stocks, at least to a degree.

Just

as market-wide forces affect overall bull or bear trends in the market, individual

stocks exhibit price swings reflecting ever-changing interaction between buyers

and sellers. The trading range identifies the agreed-upon "fair

price" area of the stock. Buyers will continue to buy up to the resistance

level, but not above; and sellers will be willing to sell down to the support

level, but not below. Once prices break out of that trading range, the whole

agreement has to be revised. While market-wide changes require confirmation to

identify new trends, the same is true for individual stocks. However, breakout

signals are given different names. The next chapter identifies how trend lines

and channels can be used to spot emerging changes in SR and trading ranges.

Simplified Support and Resistance : Chapter 2. The Dow Theory : Tag: Support and Resistance, Forex : What is Dow Theory, Best trading Setup, Best Forecasting trading setup - Elements of the Dow Theory