The Dow Theory

Stock price trends, Support levels, Forecasting the trend direction, forecast market wide trends

Course: [ Simplified Support and Resistance : Chapter 2. The Dow Theory ]

Dow Theory used almost exclusively to forecast market-wide trends, there is little economic application other than to use the Dow Jones Industrial Averages (DJIA) to explain other economic changes.

The Dow Theory: Applying

SR to Individual Stocks

The

application of SR to specific stock price trends has its genesis in many of the

theories first suggested by Charles Dow. Among these theories is that of

confirmation, the independent signals derived from one indicator that support

the same conclusions previously found in another. All technical analysts should

recognize the importance of confirmation as they study SR and other chart

patterns.

Formulated

by Charles Dow in the late 19th century, what later became known as the

"Dow Theory" was originally intended to be used as a forecasting system

to anticipate economic conditions, not as a trading system for the stock

market. Dow believed that the market was the best prognosticator of the

economic future long before the days when such forecasting became dominated by

market analysts and fund managers. Dow saw the study of market averages as a

viable method for forecasting the direction of the economy. Today, with the Dow

Theory used almost exclusively to forecast market-wide trends, there is little

economic application other than to use the Dow Jones Industrial Averages (DJIA)

to explain other economic changes. However, the DJIA is more often cited today

as reacting to economic conditions, rather than anticipating them. So Dow's

original theory has been modified to serve different needs, those of the

technical analyst. The study of SR as part of the Dow Theory is worthwhile in

the sense that these ideas can be applied to individual stocks where they are

more useful. Overall market trends are of less interest to the technician,

whose time is better spent trying to anticipate price and trend changes in

individual stocks.

As

a model for studying price movement, the Dow Theory sets down specific

"rules" or observations to anticipate future changes. Dow and his

partner Edward C. Jones (the two are better known today as "Dow Jones") came up with the idea of using market indexes to track broader

trends. Their ideas were published in the financial newspaper that was first

printed on July 8, 1889, called The Wall Street Journal. (The paper was

originally called Customer's Afternoon Letter and was in publication since

1882.)

The

Dow Theory itself was not formulated until after Dow's death in 1902. Samuel

Nelson identified the attributes of the modern theory in his book, The ABCs of

Stock Speculation.

The

Dow Theory originally had one 12-stock market index, later expanded to two; these

were based on industrials and transportation stocks (originally called

"rails" because only railroad companies were included). These are

referred to today as the Dow Jones Industrial Average and the Dow Jones

Transportation Average. A third index, the Dow Jones Utilities Average, was

added later on. Dow made extensive use of confirmation. As a basic premise, he

determined that in order for a primary trend to exist, both indexes had to

confirm the factors required: specifically, in order to call a trend a primary

trend, both needed to break through the support or resistance level. If the two

averages diverged, that meant the indicator was a false one, because it failed

the confirmation test.

The

Dow Theory views the three averages as barometers of likely future market

activity. If the market climate is positive (bullish) then trends in prices

should be upward. If the mood of the market is pessimistic, that will be

reflected in weakening stock prices, and a negative climate (bearish) is likely

to pull prices downward. We must remember that, although Dow's original essays

discussed the use of market trends to forecast business activity, in modern

application it works in the opposite direction: stock price trends among market

leaders are used to predict market movement. Thus, weakening economic factors

affecting a company's sales and profits are later reflected in lowering stock

prices.

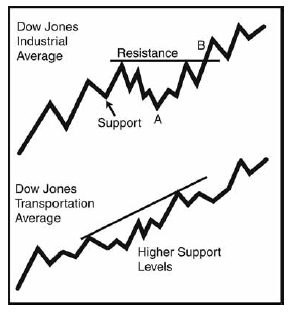

The

averages are studied in search of confirming or contradicting signals. The Dow

Theory is premised on the idea that trading trends—or overall support

Figure

2-1

and

resistance—can be anticipated by way of confirmation. Figure 2-1 shows an

example of a late confirmation of the trend by the DJIA versus the DJT. At

point A the Dow sells off, breaking support levels along the way, but the

Transportations continues to trend higher. Then at B, the Dow confirms the up

trend again by breaking resistance.

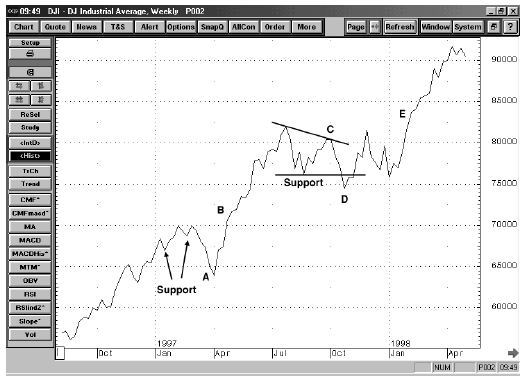

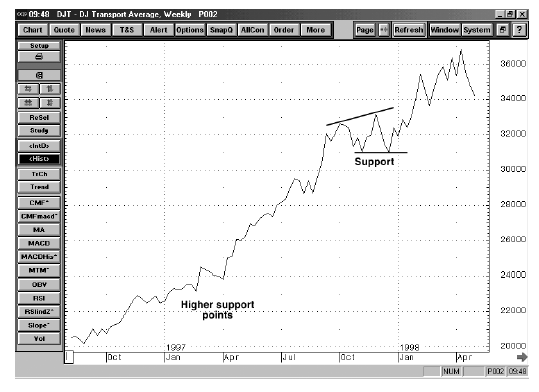

Figure

2-2 is an example of the weekly closing chart for the DJIA and the DJTA for

1997-98. At point A, the DJIA trades down, breaking the previous support

points. Next, the DJIA makes a peak followed by a lower peak (trend line C),

and closes below support at point D. However, the DJTA diverges by making a new

high, but holds support. Next, at point E, both averages are once again in

gear, confirming the up trend.

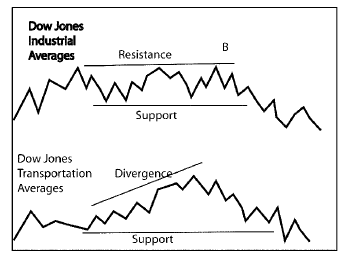

When

one average breaks through resistance and the other does not, the "failure

to confirm" is a

Figure 2-2

warning,

also called divergence. This should not be construed as a market reversal, but

as a trend reversal when both averages break support levels and have falling

resistance levels (Figure 2-3).

Figure 2-3

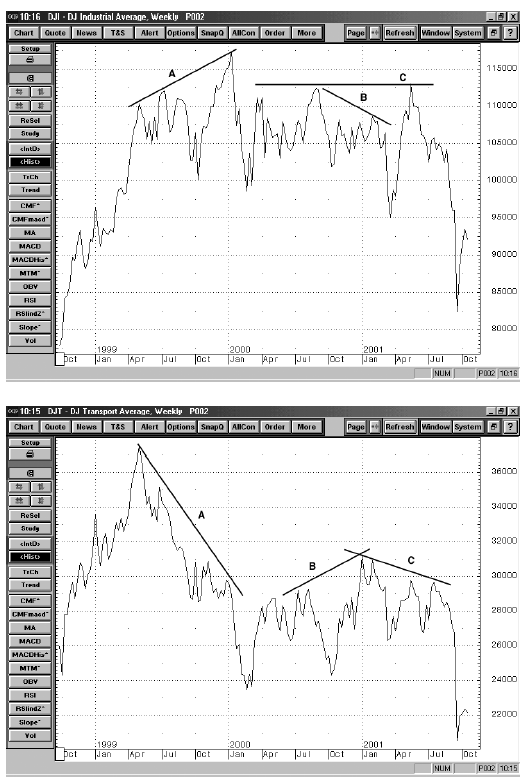

The

divergence between the two averages often precedes confirmation of a newly

established down trend. Figure 2-4 illustrates how the divergence indicates

trading range price action or a trend reversal. Trend line A is upwards on the

Dow, while it is downwards on the Transportations, a typical divergence

pattern. Trend line B is up on the Transportations and down for the Dow.

Finally, trend line C for the Dow is horizontal, showing strong resistance at

11,250 while trend line C for the Transportations is down. This divergence

series ultimately led to a major decline for both indexes. Still, the trading

range encompassed approximately two years' trading range activity with multiple

divergences before the breakdown occurred. Trading ranges are called lines and

can last for a considerable period. During these periods, the astute technician

may adopt a more conservative trading approach, as the trend moves sideways

until a confirmed new trend begins.

Figure 2-4

Simplified Support and Resistance : Chapter 2. The Dow Theory : Tag: Support and Resistance, Forex : Stock price trends, Support levels, Forecasting the trend direction, forecast market wide trends - The Dow Theory