General uses of Stop orders

How to set Stoploss, Risk Management rules, types of stop orders, Buy stops, Sell stops

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 9. Risk Management ]

There are a variety of stops that can be used depending on your situation, the market you are trading, and what you are trying to accomplish. There are various types of available stops and several techniques that can be used with these stops to help you manage your position and reduce your overall risk.

GENERAL USES OF STOP ORDERS

This

chapter will focus on protective stops used to offset a position and to protect

against losses and against accrued profits. You can also use a stop to enter a

position. There are a variety of stops that can be used depending on your

situation, the market you are trading, and what you are trying to accomplish.

There are various types of available stops and several techniques that can be

used with these stops to help you manage your position and reduce your overall

risk.

- Dollar

Limits. Stops can be based

on a dollar amount per position. The dollar amount is categorized under money

management for trading systems. If you are risking $250 per futures contract in

an e-mini Standard & Poor’s (S&P) contract, then your stop level would

be placed at a five-point distance from your entry price. This method is used

less frequently by professional traders because it has no relevancy to a

mechanical trading model, especially systems that are in the market all the

time, such as a moving average system. However, there are benefits to this

feature with setting a daily dollar amount on a loss limit for active day

traders. Some electronic order platforms allow you to set a daily loss limit.

Rather than per trade, it sets an overall loss limit on your account.

- Percentage

Figures. Most traders hear of

using a stop of a certain percentage of the overall account size. Generally

speaking, that number can be 2 percent up to as much as 5 percent of the

overall account. Unfortunately for most traders in futures or foreign exchange

(forex) markets, the average size trading account is $10,000, which means the

stop is $200 to $500 dollars per trade. This leaves little room for error. Normally,

you want to use at least a two-to-one risk/reward ratio on your trades. So if

you risk 5 percent on a $10,000 account, you should expect to risk $500 and

make $1,000 per trade.

- Time

Factors. After a specific

time period, if the price does not move in the expected direction or if the

velocity of such a move does not warrant holding onto the position, then exit

the trade. If you see a low close doji (LCD) or a high close doji (HCD) signal,

it is my experience that the market generally demonstrates an immediate

reaction within two or four time periods. After a long period of the market not

responding to this type of signal, liquidate the position. The timing of the

trade did not correspond with the historical tendency and did not generate the

desired results in a given period.

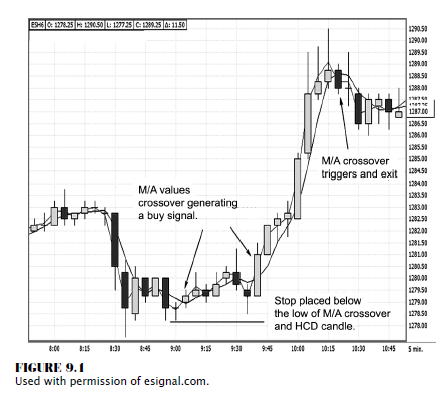

Another

consideration in the art of placing stops using a time element is the aid of a

moving average. A moving average is simply a trend line that is considered a

time-driven price-directional tool. One time factor that one can use as a stop

placement method is the crossover point of reference created when using two

moving average values. Once the shorter-term moving average crosses the

longer-term moving average, it reflects a value change in the market. In Figure

9.1, once the market triggers a signal to go long with the high close doji,

combining a close below doji low and the crossover point (using both the

one-period pivot point and the three-period pivot point moving averages) can

act as a stop placement level. Once again, you would want to look at the point

of crossover of the two moving average values; and if the market closes below

the low of the doji’s low and the moving average (M/A) values, then a trigger

to exit the position would be war-ranted. As you can see, a bullish trend

develops with the golden sequence of events: higher highs, higher lows, and higher

closing highs. The stop-loss was placed at a critical point.

- Price

Levels. Traders often use

basic statistics to measure the degree of price volatility that can occur on a

daily basis in a given market. These measures can then be used to place a stop

order or a limit order that takes into account these natural daily price

movements. Statistics that are often used are the mean, the standard deviation,

and the coefficient of variation. The best trailing-stop approach has been explored

by many technicians. The various methods include placing a stop using a set

price amount, which could be as much as 50 percent of the average true range of

a given time period, either above or below the 10- or 20-day moving average.

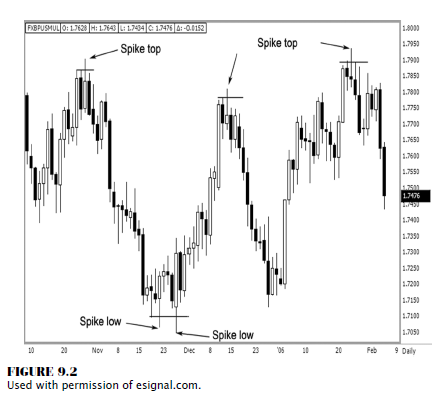

Why is

this an important method? If you place a stop near a specific chart point of

interest, such as an old high or an old low, that level is obvious to every

chart watcher. Markets do “test” and penetrate from time to time those levels.

If you set your stop too close, such as setting a sell stop below an old low

point or a buy stop above an old price high, chances are that your order may be

executed if it is too close, such as what the jackhammer or shooting star

represents. So generally, a certain factor or distance should be calculated for

your stop placement. Since most traders believe a market has reached a peak,

they will place a stop slightly above an

old high or below an old low. Depending on where you place your stop, the

market may demonstrate a spike pat-tern that will hit your order and then proceed

to move in the desired direction, without you, of course. Figure 9.2 shows an

example of when the market is at a major turning point, how a price spike

occurs. You may want to take the average daily range of the most recent 10 or

more periods and then use a factor between 20 percent and 50 percent of the

10-day average daily range. When entering a short position you would use a

protective buy stop based on a percentage above the 10-day average range. For

example, if you take the average daily range for the 10 trading sessions from

the low back on October 12 up to the first peak on October 25, you have an

average daily range for that 10-day period of 174 PIPs (percentage in points),

or points. The first spike top exceeded the prior high by 34 PIPs.

If you

established a short position and wanted to place your stop out of harm’s way,

then using a stop of 20 percent of 174 PIPs above the predetermined high would

not have worked out, as that was 34 PIPs, the exact amount by which the market

exceeded the high. If you increased the stop amount by 50 percent of the 10-day

average daily range, then you would have an 87-point stop above the high; and

this would have kept you from getting stopped out.

By using

120 percent of the average of the last 10-day period range, this method would

accomplish the goal of not getting stopped out. Realistically, that may be way

too much risk for an individual trader. But examine the risk/reward ratio on

that particular trade. A risk of 150 percent of the average daily range from

the most recent 10-day period would have been 261 PIPs. The stop would be

placed above the high on October 25 at 181.30. The low was at 170.65, made

nearly one month later on November 22. Granted, depending on your risk

tolerance, this may seem excessive; but you can select and back-test any

percentage variable of an average daily range stop placement.

The key

idea here is to keep your stops out of harm’s way. If a trade is to become

profitable, there should be signs, such as in the case of selling short, that

you see immediate results with lower highs, lower lows, and lower closing lows.

Even in the days where we see spike highs or spike lows, notice where the

market closes in relation to their respective highs and lows. The price

penetrates the highs but closes back below the prior highs. The reverse is true

at the spike lows. This is a good clue that the market has exhausted a trend

and is ready to reverse. Keeping a stop out of harm’s way will allow you to

participate in the move using a variation of an average daily range stop

placement.

- Conditional

Changes. A conditional change

is defined as a higher closing high in a downtrend or a lower closing low in an

uptrend. Such as the case with a spike top, the market does not close above an

old high. Therefore, one factor such as the stop-close-only order will be of

great use to a trader not looking to get bumped out of a position. There is, as

with any stop, the unknown risk that there is not a guaranteed price at which

your stop order will be filled. This order has a negative connotation among

traders because it spells too much risk. A buy stop will be elected and will

knock you out of a position if the market closes above the stop price; and a

sell stop will be elected and will knock you out of your position if the close

is below your selected price level. The unknown is how far away the market will

close from the selected stop price. The key benefit in using a stop-close-only

order is that it keeps your risk defined to a conditional change and helps you

from getting knocked out of a position from intra-period volatility.

Stop-close-only orders (SCOs) are for end-of-day trading and can be placed on

most trading platforms. The SCOs can be used for day trading; however, they

must be used manually, as most platforms do not accept intraday SCOs. Some

consider these mental stops, which are predefined risk factors. However, many

traders violate the rules once a signal calls for an exit but they do not exit,

thereby increasing their losses. A trader needs to have a strict disciplinary

approach.

The

challenge in selecting the right stop is to reduce risk while not being shaken

out of the trade by market volatility. It is important to try to maximize your

trading results and to stay in profitable trades as long as possible. Employing

random stop-losses and profit targets can ruin a trading strategy, making it

perform significantly worse than it would have otherwise. One successful method

is to use trailing stops that adapt to market volatility so that the stop is

placed far enough away, which combines enough sensitivity to price changes with

flexibility to fit your risk/reward parameters. Using this combination may

provide profitable consistency from a stop-placement aspect for the

intermediate-term trader. The trailing stop is used as an attempt to lock in

some of the paper profits that could accrue should the market move in the direction

desired. Like an ordinary stop, the trailing stop is started at some initial

value but then is moved up (in a long trade) or down (in a short trade) as the

market moves in your favor.

Testing

has demonstrated that a proper combination of even simple exit methods, such as

placing a stop below the low of the prior past two trading sessions, can

substantially improve the behavior of a trading strategy, even turning a

random, losing strategy into a profitable one!

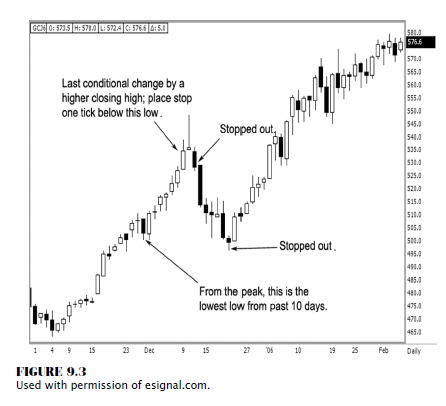

Another

less complicated method to use for a bullish trending market condition is

placing a stop below the lowest low from the most recent 10-day period. Another

method is a trailing stop method using the lowest low from the last conditional

change. I define the last conditional change as a higher closing high. This is

a much more important event than a higher high. Buyers who stepped in on the

open have a strong conviction that price should expand to new higher territory

once the market established a new high ground. Therefore, if the lows are

violated, then the market is demonstrating weakness. In Figure 9.3, we are

looking at the daily chart on gold. Starting from the low on November 4 near

465, the market does not make a lower closing low. On December 1, we see a

close at a doji low but not below the low of the doji. The trend then continues

higher with a sequence of higher highs, higher lows, and higher closing highs.

It is not

until the shooting star develops that the intermediate top is made. A stop

placed beneath the low of the candle prior to the star would be the last

conditional change or the last higher closing high that occurred. That would be

where you would want to place a sell stop. Using the two-period lowest-low

method, you would have been stopped out at 528. If you used a stop-close-only

below that low, your fill was the next time period’s close; and that was not as

friendly or as profitable, as the market closed at 514. However, using the

lowest low for the most recent 10 periods, your stop-out point was all the way

down at 497.

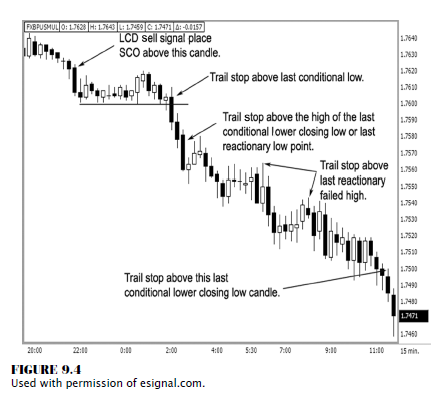

Let’s

examine this method with a day trade using a chart example on the spot forex

British pound market from 2/6/2006 using a 15-minute time frame. Figure 9.4

shows a low close doji trigger to sell short at 176.07. The initial stop per

the LCD trigger states to use a stop-close- only above the doji high. That

would be 176.28. As you can see, the market stalls in a traditional sideways

channel, as forex markets are known to do. But, sticking with your trading rules,

as the market starts to deteriorate, you would change the stop from a

stop-close-only to a regular stop one tick above the high of the second

conditional lower closing low candle. You now have the option to move stops

above the highs of the last reactionary high points; and if you follow the

trail of the market, you will notice the high from the last conditional lower

closing low. This failed reactionary high was the perfect spot to move your

stop down to just one PIP above that high point. At the end of the run, you

want to trail the stop to the point one PIP above the high of the second-to-last

candle that made a conditional change, which would be a lower closing low.

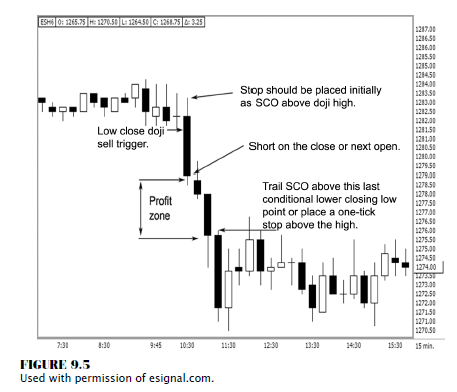

Let’s

explore this method further for day traders in the stock index futures. Figure

9.5 shows a 15-minute candle pattern showing another low close doji trigger to

sell short. The fill would be 1279.25, and the initial stop would be a mental

stop-close-only above the doji high at 1283.5. As we want to see when short,

immediate results materialize with the sequence of events such as lower highs,

lower lows, and, best of all, lower closing lows. We now have the option to

change and trail a hard stop above the high of the second conditional change

candle. Here, a conditional change is a candle that makes a lower closing low.

Prices now decline to 1270.75; we have over an eight-point gain, or $400 per

contract. We can do several things, such as taking profits on half of our

positions, because the market has reached a move equal to the average daily

range from the most recent 10 trading days, or moving stops down to lock in

profits and letting our winners ride. We should now place a trailing stop above

the high of the last conditional change or an SCO to exit the balance of

positions.

In this

example, you would not have been able to sell the high or buy the low using a

set of trading rules. However, a solid chunk of middle of that trading session

was captured with having little-to-no risk pressure. The trailing stop method

would allow you to stay with the trade until the bearish conditions changed.

The chart in Figure 9.5 is also a great illustration of how a market moves from

a trending condition to a consolidation phase. Once you have captured the

profit, it is time to wait for another trade setup.

There are

many different variations to placing stops. The key is watching for conditional

changes; for example, in a declining market, you should watch for the last

reactionary high as the peak at which to place a trailing stop once you are in

a short position. You should use a stop-close-only above a conditional change

candle especially on a two- period time count. These methods will help you

limit losses, prevent you from being prematurely knocked out of a trade, and

reduce emotional stress, while capitalizing on letting your winning trades

ride.

THE BOTTOM LINE

The

bottom line is this: Stops are not for sissies. You just need to know when

changes in a market’s condition occur to help determine when to exit a trade.

If you are in a trending condition for too long, chances are that you may be

overextending your welcome; therefore, tightening stops is a good way to

protect profits. After all, it really counts most when you get out of the

trade. All traders struggle with stop placements. There is no one single best

method. The concept is to develop a consistent method that helps you define

cutting your losses and letting winners ride.

The Candlestick and Pivot Point Trading Triggers : Chapter 9. Risk Management : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to set Stoploss, Risk Management rules, types of stop orders, Buy stops, Sell stops - General uses of Stop orders