Projecting Entry and Exit Points

How to find entry point to trade, How to Exit the trade, Pending orders, trailling stops, Sell stop, Buy stop

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 10. Projecting Entry and Exit Points ]

A system or a method that provides an accurate daily market forecast, helping them define where the market might go each day.

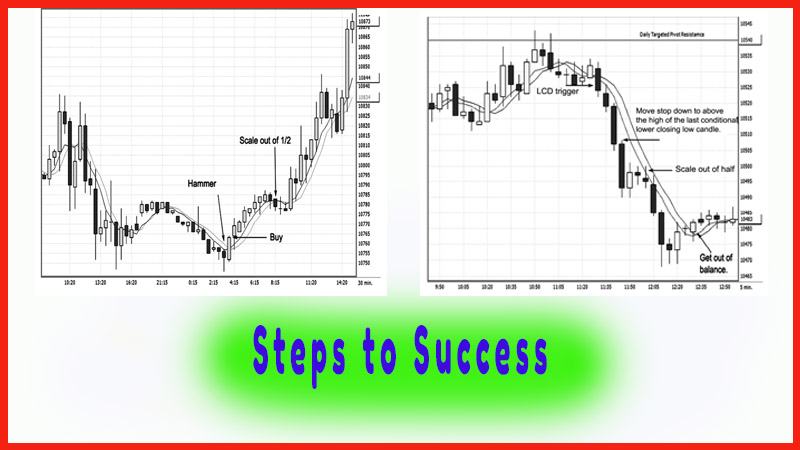

Learn to Scale Out

What are some of the most important

things that successful traders do? They have:

- A system or a method that provides an accurate daily market forecast, helping them define where the market might go each day.

- A set of rules for when to get in and out of the market and a bit of discipline to follow these rules.

- A set of timing indicators to help them pull the trigger at the key areas.

The

legendary basketball coach Bob Knight often says, “Most people have the will to win; few

people have the will to prepare to win.”

This is true in many aspects of a person’s life, be it in athletics,

academics, business, a profession, or trading.

Trading

is about making money, not about being correct in market analysis or being a

great prognosticator. Traders must be consistent in their approach and strive

to completely remove emotion from trading decisions. This is often best

achieved by having and sticking to a plan for every trade. We trade in the future

markets, not in the past markets. Hindsight is always 20/20. Keep in mind that

you will never trade as well in real time with real money as you will by

looking at or trading in the past. Trading in the past is an exercise in

futility that will only harm your psyche going forward. You should view every

trade you make as the best trade you could make at the time with the

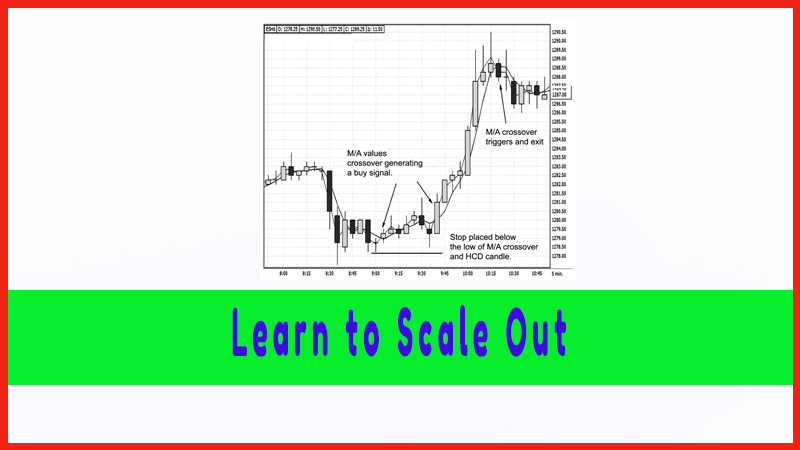

information available. That is why I like to scale out of my positions as a

short-term trader at market points that signal when a trend has a loss in

momentum. The reason I like to keep a portion of positions on is simple: As

good as my triggers can be, I cannot predict the future. I do not know if a

market will develop into a consolidation phase or if it is simply pausing

before continuing the trend or getting ready to reverse the trend entirely.

Therefore, it is crucial to take money off the table when given the

opportunity, while letting a trade mature and potentially develop into a larger

profit. There is only one way I know to manage such a feat, and that is by

scaling out of partial positions. The question some traders ask is, “What is

the formula or percentage that I use to take positions off?” I normally use the

50 percent rule, but at times the one-third rule works as well. In order to

define what the percentage figure is, I need to judge what condition the market

is in. I do that by using the diagnosis described in this book. In the trade

process, there are three critical stages:

- Gathering information on which to make decisions.

- Using that information to help formulate a trading idea.

- Planning the actions to be taken.

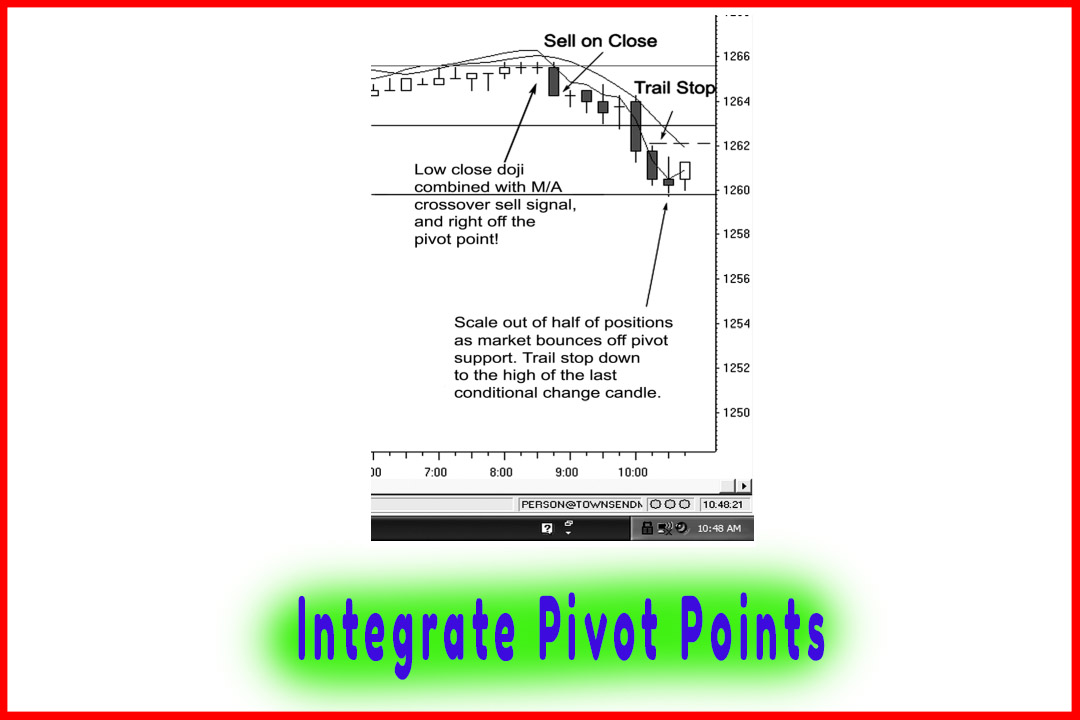

The

gathering of information involves collecting past data and then applying it to

a specific means of market analysis, such as what I have covered in this book

using pivot point analysis. In formulating ideas, you may look at the pivot

point moving averages to help determine a market’s ability to make a certain

price range. This step helps you to predict where the market might head and

then gives you information so that you can decide where it should be going.

Planning action involves thinking creatively about alter-native courses of

action, evaluating their feasibility, and making decisions on implementation of

the plans. This step involves helping you decide if you should be in multiple

contracts or if you should scale back on your normal position size. If the risk

is not worth the reward, then trade with fewer positions. In other words, scale

back your normal position size.

The Candlestick and Pivot Point Trading Triggers : Chapter 10. Projecting Entry and Exit Points : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to find entry point to trade, How to Exit the trade, Pending orders, trailling stops, Sell stop, Buy stop - Projecting Entry and Exit Points