Setting Stops

How to set Stoploss, Risk Management rules, types of stop orders, Buy stops, Sell stops

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 9. Risk Management ]

The various types of stop orders and when and where to place them. It will also provide a great deal of important information on the reasons for stop orders, the type of stops that should be placed at critical price levels, and identifying these specific price levels.

Setting Stops

This

chapter will walk you through the various types of stop orders and when and

where to place them. It will also provide a great deal of important information

on the reasons for stop orders, the type of stops that should be placed at

critical price levels, and identifying these specific price levels. If a trader

is to maintain a degree of profitability over time, managing risk and using a

system that helps evaluate price changes are essential. When you have finished

this chapter, you will understand how to select stops to limit your potential

losses and how to let profits ride.

The

process in selecting stop placement as a risk management tool starts with the

price of where the trade was initiated. Here are some finer points on the

rationale for using a risk method, or having a stop-loss system in place.

- Predetermined stops help conquer emotional interference.

- Stops should be part of a system or included in a set of trading rules.

- The risk/reward ratio should be weighed before entering trades, and a stop objective should be set.

- When volatility is low, stops can be placed closer to an entry level.

- When volatility is high, stops should be placed further away from entry level.

One of my

favorite bits of advice that I give students and have taught at seminars is

that the first rule of trading starts with the premise that it is okay to form

an opinion on a gut, or instinctive, feeling—just act on a trade signal that

substantiates that opinion. Write your rules down and have them posted on your

trading screen on your computer. Before you enter the trade, check your rule

list; and make sure you know why, where, and what type of stop to place. As you

gain more experience in the business, you will undoubtedly get caught in a

news-driven, price-shock event, that is, if you have not already experienced

one. These are unavoidable and hard to escape unscathed. It is considered a

cost of doing business and should not reflect on your abilities as a trader.

Managing risk is your job, and capturing as much profit as possible from

winning trades should be your utmost goal. The descriptions of the types of

stops and the pros and cons of each should help you make the right decision for

the various circumstances or market conditions.

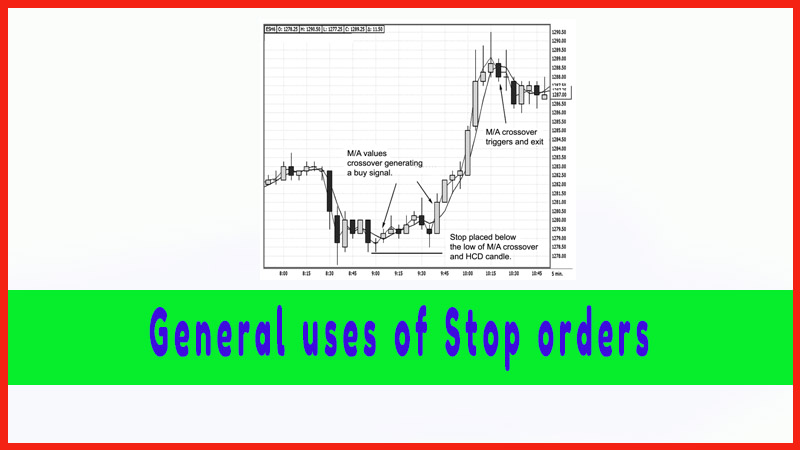

PLACING STOP ORDERS

Stop

orders are often referred to as a protection method against losses. These

orders can also be placed to enter positions. Specifically, a stop order is an

order that you place either through a broker or online. If the market trades at

a certain price, then the order is triggered and becomes a market order to be

filled at the next best available price. The general rules of stop placement

are:

- Buy stops are placed above the current market price.

- Sell

stops are placed below the current market price.

The Candlestick and Pivot Point Trading Triggers : Chapter 9. Risk Management : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to set Stoploss, Risk Management rules, types of stop orders, Buy stops, Sell stops - Setting Stops