Interpretation of Price and Volume

volume indicator strategy, Preice Action Trading Strategy, Best Trading Strategy

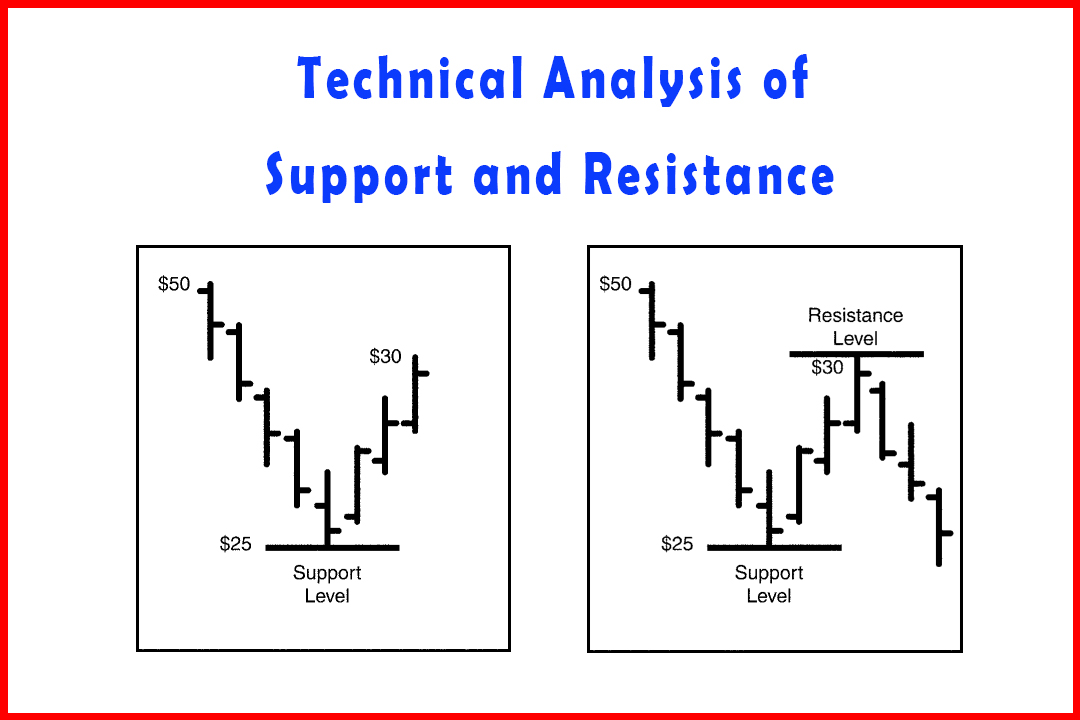

Course: [ Simplified Support and Resistance : Chapter 1. Technical Analysis of Support and Resistance ]

Daily movements of price, as a chaotic and momentary force, may appear to be setting net SR trends but, in fact, are merely part of a larger and longer-term pattern. Of equal importance, remember that identifiable trading ranges are not always present.

Interpretation of Price and

Volume Together

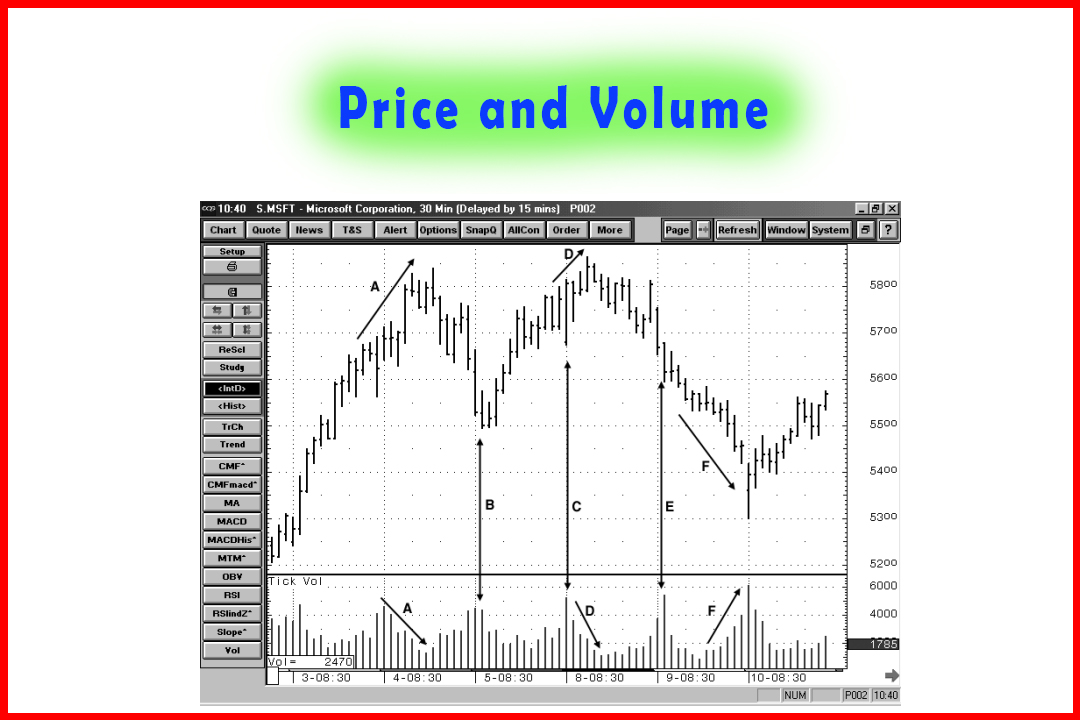

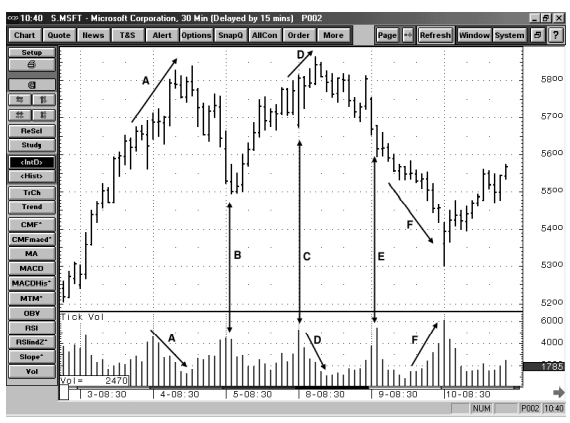

If we

limit our observations to price alone, we are likely to miss some important

emerging signals. We also need to keep an eye on trading volume. When buying or

selling volume levels change significantly,

Figure

1-9

it could

signal a coming change in the price trend as well.

Figure

1-9 is a 30-minute bar chart of Microsoft (MSFT). Price trendline A is up but

the volume trendline A is down. As prices have moved higher, volume has waned,

indicting that fewer and fewer buyers are coming into the market. It appears

that the upward drive is exhausting itself. The price reacts by retreating back

down to form a low at $55. Here, the volume expanded noticeably, exhibiting a bottom-heavy

activity coupled with a downside price trend. Bargain hunters step up to absorb

the stock at its softer price level. At point C, the market opens lower and

rallies with volume at its highest level to this point. But as prices begin to climb

at trend line D, volume recedes. The market rolls over as prices fall; volume

expands (Point E) but prices continue to slip lower. Demand is not strong

enough to support that price level. Volume continues to rise (trend line F) as

price falls, until the price gaps down to $53, and volume reaches its highest

point on the chart.

When

prices climb and volume falls, buying activity is weakening. As prices fall and

volume declines, selling activity is exhausted. As prices fall and volume

rises, and as prices then hold in the same area with rising volume, that means

buying activity is growing in strength; if prices rise to a point that they

stall and volume continues to rise, it indicates that sellers are gaining

momentum.

Daily

movements of price, as a chaotic and momentary force, may appear to be setting

net SR trends but, in fact, are merely part of a larger and longer-term pattern.

Of equal importance, remember that identifiable trading ranges are not always

present. Highly volatile stocks often have not yet found a trading range, so

prices rise or fall in reaction (often overreaction) to many market forces. In

those cases of extreme volatility, few charting techniques are of any value.

Highly volatile stocks, by definition, do not possess a single trading range

and have to be viewed in a larger perspective. A stock's high volatility, in

and of itself, makes SR and other charting inapplicable.

Summary

Support

and resistance, the study of the interaction between buyers and sellers in

relatively low-volatility stocks, is the foundation of technical analysis. As

traders, the study of SR gives us a window into how most traders react to price

movement. Most traders do not try to forecast short-term price movements, they

follow trends as they emerge.

The

professional or active trader's ability to react swiftly to a new trend helps

him to understand the interaction between volume and price. The observant

technician understands that SR serves as a starting point for developing an

idea of what may occur next in price movements or patterns. However, he also

knows that short-term price movement has a random quality to it, and spikes or

waves may mislead the impatient trader, causing mistakes and misjudgments. A

patient trader awaits confirmation from a suspected change in the current

trend, remembering that important change is not going to take place every day.

By utilizing other indicators, the technician is able to use SR and emerging

chart patterns to anticipate the next step in price trends. The next chapter

explains how SR applies to one of the most important theories of the market,

the Dow Theory.

Simplified Support and Resistance : Chapter 1. Technical Analysis of Support and Resistance : Tag: Support and Resistance, Forex : volume indicator strategy, Preice Action Trading Strategy, Best Trading Strategy - Interpretation of Price and Volume