Major Factors Affecting Call-Writing Returns

Stock, Strike Price, Expiration, Volatility, Interest Rates, Strategy, Institutional

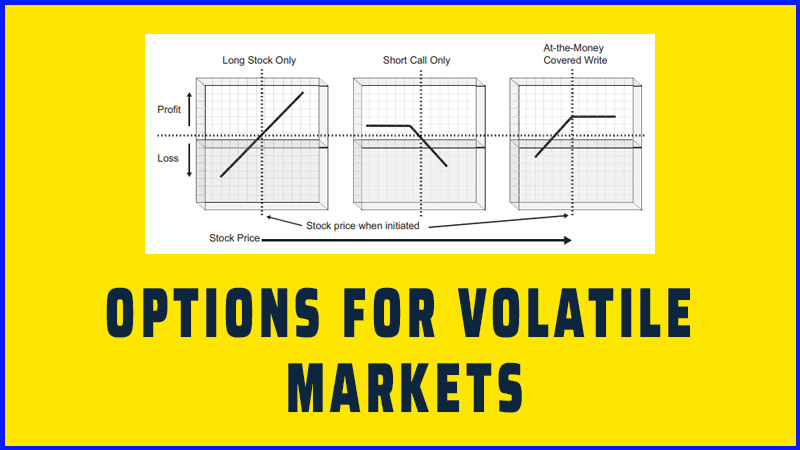

Course: [ OPTIONS FOR VOLATILE MARKETS : Chapter 3: The Basics of Covered Call Writing ]

Options |

Returns from covered writing will depend very much on how you implement the strategy your choice of stock, strike price, expiration, and your follow-up program (rolling).

Major Factors Affecting Call-Writing Returns

Returns from covered writing will

depend very much on how you implement the strategy—your choice of stock, strike

price, expiration, and your follow-up program (rolling). Above all, covered

call writing is an equity strategy, and its results will be reflective of the

performance of the underlying equities in one’s portfolio.

Stock Selection

If you are picking stocks specifically

for a covered writing portfolio, you may find that you will gravitate toward a

somewhat different set of criteria from that employed to select stocks for

outright purchase, whether as long-term holds or as short-term trades. Instead

of picking stocks for long-term appreciation potential, you will more likely

focus on the shorter-term scenario, where the “shorter term” will coincide with

the duration of the option you write. That will generally lean you more toward

technical analysis than fundamental analysis as your decision mechanism.

A common trap in call writing is to

look for stocks with the largest option premiums under the assumption that

fatter option premiums will generate higher returns on the same amount

invested. They do generate higher returns, but only when they succeed. It’s

much the same logic as betting on the horse at 10-1 odds instead of the horse

with 2-1 odds. The 10-1 horse will pay five times as much, but should only win

one-fifth as often. Fatter option premiums exist on higher-volatility (i.e.,

higher beta) stocks because the stocks tend to move more in both directions.

So, while you receive more option premium, you have a commensurately higher

risk on the stock itself. A better approach is to determine whether the options

on a particular stock are abnormally high or low, and that is discussed in the

Volatility section later in this chapter.

It is also important to remember that

higher call premiums cannot necessarily be taken as a signal that the market

feels the stock has a greater chance of moving up than down. As we mentioned

previously, both call and put options will expand in price when volatility in a

stock jumps. Bad news on a stock may drop the price and create a surge in

demand for puts, but in that situation, both calls and puts will expand due to

higher implied volatility. Therefore, if you are focusing only on the calls for

covered writing and you see that the percentage return from a covered call

write on the stock has jumped recently, it might have been due to greater

expectation of a drop in price than a rise. A classic example of this would be BP

stock after the Deepwater Horizon rig explosion in April 2010. In the aftermath

of the explosion, the stock dropped precipitously and implied volatility

skyrocketed. If you were using an online filter to screen for covered writes

with the highest potential returns, BP would have surely been near the top of

the list at that point. But the reason it was there was because holders were

desperate for put protection in case the disaster caused additional harm or

sent the company into bankruptcy. The resulting implied volatility made the

stock look like an enormously attractive covered call write at that point in

time—but not necessarily because the market was overly bullish on the stock.

(One way to give yourself a sanity check on a stock with high option implied

volatility is to see if the volume of trading activity is higher on the call

side or the put side.)

There is no right answer for everyone

regarding stock selection, whether writing calls or not. As with buying stocks

without writing calls, you are always well-advised to diversify, regardless of

your method of stock selection. A big boost to covered call writers is the

introduction of ETFs on market sectors, broad indexes, and even commodities,

upon which calls are available. Covered call writing on these ETFs may reduce

or even eliminate entirely your need to diversify your holdings, and the

call-writing strategy works exactly the same on ETFs as on individual stocks.

Chapter 8 is devoted to a discussion of options on ETFs.

Strike Price

The strike price with the greatest

amount of time value is always the one closest to the current price of the

stock. Consequently, the farther away the strike price is from the current

stock price, the lower the static return (return unchanged) for the position. Table 3.2 illustrates this point.

Remember that this is not the only

factor you should consider when deciding which strike to write. Lower strike

prices will provide greater downside protection, while higher strike prices

offer greater potential gains from the stock. You should, however, understand

how these trade-offs affect your static return.

You can see from the table that the

difference between writing the Sep 35 call and the Sep 40 call is 5.4

percentage points. Remember that this is only a two-month return. On an

annualized basis, the difference between writing the near-the-money call and

the next higher strike price is more than 30 percentage points in return. Of

course, this is the static return and therefore ignores appreciation in the

stock, but it gives you a perspective on how much return from option premium

you give up when you write a higher strike price in the hope that the stock

will move up. The higher you go in strike price, the greater the potential

return from a covered write, but the lower the contribution from option premium

and the more uncertain the overall return.

If we take Table 2.1 from Chapter 2, which showed how time value varied with

strike price, we can look at the impact that has on covered call returns.

TABLE 3.2 Call-Writing

Returns at Different Strike Prices

|

Price of XYZ stock = 50 Volatility = 20% Days to expiration = 60 Interest rate = .5% |

||||

|

Strike Price |

Option

Price |

Time

Value |

Annualized

Return if Exercised |

Annualized

Return if Unchanged |

|

40 |

10.04 |

.04 |

.5 % |

.5 % |

|

42.5 |

7.57 |

.07 |

.9 % |

.9 % |

|

45 |

5.21 |

.21 |

2.6 % |

2.6 % |

|

47.5 |

3.15 |

.65 |

7.9 % |

7.9 % |

|

50 |

1.64 |

1.64 |

20.0

% |

20.0

% |

|

52.5 |

.71 |

.71 |

39.0 % |

8.6 % |

|

55 |

.26 |

.26 |

64.0 % |

3.2 % |

|

57.5 |

.08 |

.08 |

92.2 % |

1.0 % |

|

60 |

.02 |

.02 |

121.9 % |

.2 % |

Clearly, the selection of strike price

will vary results extensively. But you will not know which strike is optimal

when you initiate the position. Therefore, it is necessary to go with a strike

price that fits your risk tolerance or upside expectation each time you write.

Writing OTM calls such as the 57.5 or 60 strike calls in Table 3.2 provides an exceptional return when the stock makes a 7

to 10 percent move in 60 days, but provides subpar returns when the stock does

nothing or declines during that period. Unless there is reason to believe the

stock may have a significant drop or rise in the next two months, the strikes

between 47.5 and 52.5 provide the best combination of attractive return and

safety.

Expiration

The selection of expiration month will

also affect the expected returns of your covered writing program, because

options do not lose time value (decay) at the same rate throughout their life.

The differing rate of decay is important and can have a significant effect on

the returns from the strategy. It is also why we emphasize that while covered

writing can certainly be an ongoing approach, each individual write is a

relatively short-term strategy.

TABLE 3.3 Percentage

Return from Different Durations

|

Price of XYZ stock = 50 Volatility = 20% Interest rate = .5% |

|

|||

|

Expiration |

Time

Premium |

Premium

per day |

% Return

Unchanged (Annualized) |

|

|

30 days |

1.15 |

.038 |

28.0 % |

|

|

60 days |

1.64 |

.027 |

20.0% |

|

|

90 days |

2.01 |

.022 |

16.3 % |

|

|

120 days |

2.33 |

.019 |

14.2 % |

|

|

360 days |

4.07 |

.011 |

8.1 % |

|

In

Chapter 2, we showed how time value diminishes slowly at first and then

accelerates closer to expiration. The faster time value declines in an option,

the better it is for the writer, and the writer will garner more time premium

by writing one month options for three months in a row than by writing a single

three-month option to start. This means that option writers garner higher

annualized returns by writing shorter duration options, and the difference can

be considerable. Table 3.3 shows the

difference in annualized returns by writing options of different durations. For

purposes of comparison, one has to assume all other factors remain equal and

that the ETF remains at exactly the same price for a year. While this is

obviously not a reflection of reality, we can at least isolate the time value

aspect to demonstrate the difference between durations. The new weekly options

(available only on a dozen or so stocks and ETFs at the present time) offer a

unique opportunity for ultra short term covered writes. This technique will be

discussed further in Chapter 5.

There are expected trade-offs to using

the shorter duration options in covered writes. The writer needs to take

follow-up action more often during the year and transaction costs are

accordingly higher. One concern about short duration writing is that the calls

have less time premium and therefore offer less downside protection than longer

duration options. It is true that you take in more total premium by using a

more distant expiration month, but you don’t necessarily gain much in near-term

protection unless the stock falls considerably.

TABLE 3.4 Price Protection

from Long-Dated Calls

|

Price of XYZ stock = 50 Volatility = 20% Interest rate = .5% |

|

|||

|

Expiration |

Protection

from 1-Point Drop |

Protection

from 3-Point Drop |

Protection

from 5-Point Drop |

|

|

30 days |

.44 |

.51 |

1.11 |

|

|

60 days |

.47 |

.66 |

1.46 |

|

|

90 days |

.48 |

.67 |

1.55 |

|

|

120 days |

.50 |

.77 |

1.79 |

|

|

360 days |

.53 |

.93 |

2.23 |

|

That’s because more distant options

assume wider price swings over time and do not vary as much with price moves in

the stock. In option parlance, they have lower delta. Using the same example

again, Table 3.3 shows how much protection would be provided by the various

expiration months available in scenarios in which the stock drops in the first

month to $32, $30, and $25.

Table 3.4 shows the differing time values and returns for call

options with the same strike price but different expirations. The strike used

is 50, because it is ATM and thus all the option premium is time value. Returns

are annualized for comparison purposes, since the time periods involved are all

different.

Table 3.4 shows that which expiration provides the most protection

depends on how much the stock actually drops. In general, for better overall

returns from covered writing, you will want to write a relatively close option

most of the time. But if you want protection from the possibility of a

significant drop in price, a more distant call may be warranted. We recommend

covered writers generally use durations of one to three months and then adjust

to fit personal preferences.

Volatility

As shown in Chapter 2, the time value

in option premiums varies directly with volatility, and since stocks all have

different inherent volatilities, the stock selection on your covered write

takes volatility into account and will determine your potential return from

that call write. But as we stated earlier in this chapter, one should not jump

to the conclusion that writing calls on the most volatile stocks will

necessarily provide the highest returns. While their premiums, and thus the

potential returns, are indeed greater, the downside risk is proportionately

greater as well. A better way to give yourself a statistical edge in call

writing is by writing calls on stocks where the implied volatility (that

forecast by the price of the call option) is greater than the actual volatility

that is characteristic of that particular stock.

In other words, writing call options on

higher volatility stocks doesn’t necessarily provide an edge, but writing

options that tend to be overvalued, whatever the volatility of the stock, may

improve your success. One must bear in mind, though, that determining when an

option is overvalued is not an exact science. (If it were, the arbitrageurs

would be all over it.) The Black- Scholes formula provides a guideline. Because

it uses actual historic volatility, we can identify options that are trading

above the Black-Scholes price and conclude that they are trading above

historical volatility for that stock. But that, by itself, doesn’t mean they

are necessarily overvalued. In reality, there is no way to know when options

are truly overvalued or when they are perhaps more accurately reflecting future

volatility.

An additional approach is not just to

look for the highest premiums you can find relative to stock price, but to look

for high implied volatility relative to previous implied volatility for that

particular stock or ETF. This is discussed further in Chapter 5.

Interest Rates

Since option premiums are affected by

interest rates, returns from covered writing will be as well. It takes a

substantial move in rates, however, to affect premiums. (LEAPS options of one

or more years in duration are much more sensitive.) Table 3.5 shows the effect of different interest rates on premiums

and returns for a hypothetical two-month option.

Covered Writing as an Ongoing Strategy

The prevailing assumption in the early

days of options (1970s and 1980s) was that writing calls on stock positions had

merit only when specific situations existed, such as a concentrated position in

low cost basis stock that a client wouldn’t sell, or speculative fever surrounding

potential takeover candidates. Brokers and professional money managers had a

difficult time justifying the sales of covered calls on stocks they liked for

long term fundamentals as they assumed call writing would force them to accept

lesser long term returns.

TABLE 3.5 Effect of Interest Rates on Option

Returns

|

Stock Price = $30 Strike Price = 30 Days to Expiration = 57 Volatility = 0.30 |

||

|

Interest

Rate |

Premium |

Return

Unchanged (Not

Annualized |

|

2.0% |

1.46 |

4.9% |

|

3.0% |

1.49 |

5.0% |

|

4.0% |

1.51 |

5.0% |

|

5.0% |

1.53 |

5.1% |

|

6.0% |

1.56 |

5.2% |

|

7.0% |

1.58 |

5.3% |

|

8.0% |

1.60 |

5.0% |

|

9.0% |

1.63 |

5.4% |

|

10.0% |

1.65 |

5.5% |

And when the fundamentals soured on a

given stock, the tendency would be to simply sell it and buy a different one.

No doubt, such sentiment may have been supported by the fact that much of the

industry made their living on commissions.

The

BuyWrite Index (BXM)

Meanwhile, institutional investors kept

the flames of covered call writing alive and began using it frequently enough

that they petitioned the CBOE to provide them with a covered writing index upon

which they could benchmark their performance. The CBOE responded to their

wishes in April 2002 with the creation of the CBOE BuyWrite Monthly IndexSM

(BXM). The BXM tracks a hypothetical portfolio that is long the S&P 500

index (SPX) and short the one-month call option on that index at the nearest

out-of-the-money strike price. As each option expires, the net gain or loss is

registered, and the next month’s option is written. (For more information on

the details of the BXM, visit the BXM micro site at www.CBOE.com.) Like most

other major market indexes, the BXM is designed to emulate a passive

(unmanaged) return against which portfolio managers can gauge their performance

on actively managed accounts. In addition, perhaps even more importantly, the

BXM allowed the investing world to see how a passive call-writing strategy

performs over time with the buy and hold strategy on the underlying index

itself. When originally introduced, the BXM has been calculated back to June 1988,

when Standard & Poors began tracking the dividends on the S&P 500

Index. The returns of the S&P 500 Index (or more accurately, the S&P

Total Return index which has the dividends reinvested) were then compared with

those of a basic covered writing program (as represented by the BXM) over more

than a decade prior to launching the BXM. The results created a stir among

professional investment managers who spend their lives searching for ways to

produce competitive returns with less risk.

As expected, the BXM outperformed the

S&P index in years where the S&P was down or had single digit returns,

and underperformed versus the S&P during years when the S&P performance

was strongly positive. The BXM also lowered the volatility in monthly performance

by about one-third over the S&P. The biggest news of all, however, was that

the lower volatility did not come at the expense of long-term return, as people

tended to expect. Instead, returns over the 13.5-year period came within 0.2

percentage points of the S&P 500 returns for that entire period (13.88

percent for BXM versus 14.07 percent for the S&P)—a remarkable showing for

a strategy that lowers risk.

Bear in mind that these results provide

a very broad benchmark of what a basic mechanical covered writing program can

do compared with the buy- and-hold approach. Your portfolio is unlikely to be

anywhere near as diverse as the S&P 500. Also, the BXM assumes a

mechanically implemented program using one-month at-the-money calls only,

without any rolling, and it doesn’t take into account transaction costs or

taxes. Nevertheless, the BXM clearly demonstrates that although the returns

from covered writing may be lower than those stocks that are capable of

producing during a given period, they are commensurate with the returns stocks

actually generate over the long term—with a substantial reduction in

volatility. Thus, it provides an important affirmation of the long-term

validity of covered writing.

Since 2002, the BXM has continued to

perform in line with the prior 13 years, and the CBOE added a related index

(BXY) that utilizes a slightly more out-of-the-money call each month. As one

would expect, the BXY will perform better than BXM in up markets and not as

well in down markets. A chart of the results from 1988 through 2010 for both

BXM and BXY versus the S&P is shown in Figure 3.4. At this point in time,

both the BXM and

FIGURE 3.4 Comparison of BXM, BXY, and

SPTR

BXY are outperforming the S&P for

the 22-year period, no doubt helped by the lackluster performance of the

S&P during the last 10 years.

Summing Up Covered Writing

Chapter 4 discusses the various ways to

implement covered call writing. But before we go there, we thought we’d

summarize the basic pros and cons of the strategy.

Advantages

- Lower volatility. Whatever the underlying instrument, covered call writing on it will lower the volatility. The BXM has been shown to have approximately one-third less month-to-month volatility on the S&P 500 Index when writing an ATM call option each month.

- Similar long-term performance compared with buy-and-hold. The reduction in volatility (as shown for the BXM) does not reduce the long-term performance of a straight buy-and-hold strategy on the same underlying instrument.

- Modest short-term downside protection. ATM or OTM covered writing provides modest downside protection in the short term while still allowing some upside potential. ITM call writing can provide greater short-term protection, but will allow very little, if any, upside.

- Easily modified. Covered call writes are easily closed or modified once implemented by executing an offsetting transaction.

- Generates income. Call writes generate cash flow on holdings that can be withdrawn, used to purchase other investments, or compounded.

- Flexible use. Call writes can be used intermittently or as an ongoing strategy.

- Used in more complex strategies. Call writing is often used in more complex strategies to help offset the price of other options (discussed further in Chapter 7).

- Disadvantages

- Limited upside. Upside potential is capped for the duration of the option, unless the option is closed or rolled.

- Partial protection. Call writing only protects the downside risk of the underlying instrument to the extent of the option premium received.

- Requires attention. Effective covered writing requires monitoring positions more closely and potentially executing follow-up transactions.

- False security. Call writing can provide a false sense of security for those who do not embrace the fact that the underlying stock position still has substantial risk.

- Introduces additional behavioral considerations. Call writing may result in a loss on the option sold. Even though the gain on the stock would be greater, taking a loss on the option is sometimes emotionally difficult. (This is discussed further in Chapter 4.)

OPTIONS FOR VOLATILE MARKETS : Chapter 3: The Basics of Covered Call Writing : Tag: Options : Stock, Strike Price, Expiration, Volatility, Interest Rates, Strategy, Institutional - Major Factors Affecting Call-Writing Returns

Options |