Mind of the Market from Candlestick

Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns

Course: [ Uses of Candlestick Charts : Chapter 2. The State Of Mind Of The Market from candlestick ]

Pattern recognition is a cornerstone of technical analysis. Western practitioners have been spotting things like Dow Theory signals, and all sorts of patterns with names like Rounded Bottom and Head & Shoulders, for years.

What Candles Tell Us About The State Of Mind Of The Market

Marabuzo v Doji Candles

Pattern

recognition is a cornerstone of technical analysis. Western practitioners have

been spotting things like Dow Theory signals, and all sorts of patterns with

names like Rounded Bottom and Head & Shoulders, for years. This is why

viewing candlestick charts can be an easy transition for technical analysts,

because it’s a similar practice: you look for recurring patterns, and use the

assumption that price patterns repeat themselves, so similar behaviour will be

seen after these price patterns when they occur in the future.

Let’s

begin our journey into pattern recognition of candlestick charts.

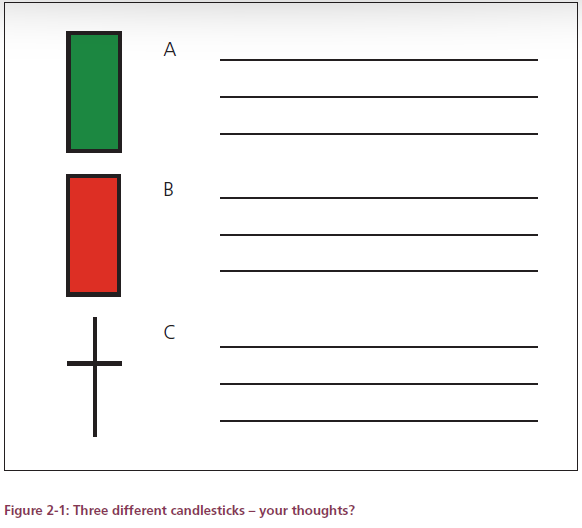

Look at

the three candlesticks in the following figure, and in the space next to them

jot down what happened to give us such a shaped candle.

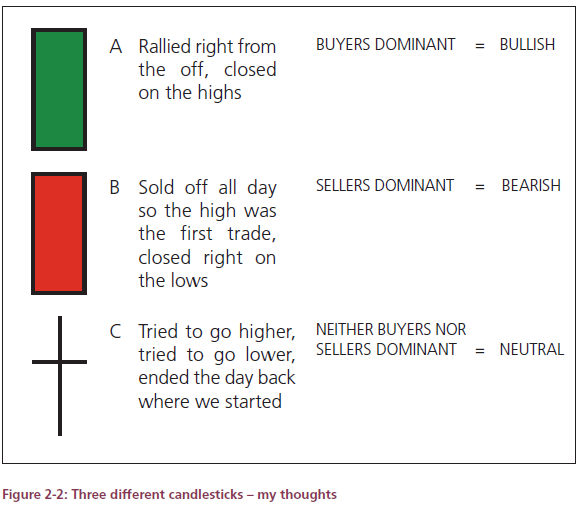

Hopefully

you jotted down something along these lines:

In

candlestick A the market rallied from the first trade, and closed on the day’s

high.

In

pattern B traders spent all day selling off. The high was the first trade of

the day, and the low was the last trade.

In

pattern C the market opened and closed at the same price, having tried to move

higher then lower (or vice versa) over the course of the day.

The next

step is to think about the state of mind of the market on each of these very

different sessions, and in turn we can get a feel for market sentiment, at

least for that particular session.

Some

simple assumptions can now be made. If the buyers were still active on the

close of candlestick A, is it likely that they may still want to buy some more

tomorrow when the market re-opens? If they were buying as the market closed it

could be argued that they haven’t finished. It was only the market closing that

stopped them from buying more.

If the

sellers were active and dominant right up until the last second of trading on

candlestick B, are they suddenly going to disappear into the ether when things

start again the next day? Unlikely!

On day C

no one could make up his or her mind. For a while the bulls were winning, but

then the sellers appeared, and the market sold off. But this selling didn’t

last, and by the close the market was right back where it started. If the

buyers and sellers were equal to each other either confusion reigned supreme

over the session, or indifference led to a “nothing” day.

Or it

could have been an almighty ding-dong dust up between buyers and sellers, but

no one won in the end - the equivalent of a boxing match being tied after 12

bruising rounds.

In

candlestick analysis most patterns are given a name, and the three patterns we

have looked at are no exception.

The first

two are sessions where there is a strong push in one direction.

A

candlestick with a long real body and very little in the way of shadows is

called a Marabuzo.

Marabuzo

is the Japanese word for “shaven head”, so it’s descriptive of the look of the

candlestick; with very little shadow showing up - it definitely can look like a

candle that’s had a severe haircut!

In my

research I’ve come across a couple of alternative spellings, the most common

being Marubozu. I have also come across this being described as “formed with

only two prices” which is quite clever, when you look at the formation of these

patterns.

A bullish

Marabuzo is a strong conviction day in favour of the buyers: a big open

candlestick.

A bearish

Marabuzo is a candlestick that’s mostly made up of filled real body: bearish

domination.

This sort

of session is the purest form of continuation pattern, as an assumption can be

made (as mentioned earlier) that the market will carry on in the same direction

after such a strong conviction day.

Our third

candlestick has no real body at all, due to the fact that the market opened and

closed at almost exactly the same level.

A candlestick

with no (or a very small) real body is known as a Doji.

We will

look at the Doji candlestick in more detail in the next chapter, because it is

a powerful reversal pattern.

In a

strong uptrend the buyers are dominating almost daily. If you suddenly get a

Doji day this means the bulls didn’t dominate - if you take the day as a whole,

they were totally matched by the bears; hence the market ended up back where it

started. This is a change from what went on before.

The same can be said for a Doji that appears in a down trending market: a Doji shows that the bears may be struggling to sustain their push to lower prices, and therefore a reversal may be occurring.

Uses of Candlestick Charts : Chapter 2. The State Of Mind Of The Market from candlestick : Tag: Candlestick Trading, Forex : Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns - Mind of the Market from Candlestick