The Psychology of Charts and Trading

Candlestick analysis, Candlestick pattern, Best Candlestick Pattern, Top Candlestick Ebook, Bullish Pattern, Bearish Pattern

Course: [ Uses of Candlestick Charts : Chapter 1. What Are Candlesticks ]

The idea of a chart in the first place is to illustrate where the price of a security has been. Supply and demand sets the price of something, and the chart is a graphical representation of the historical changes in supply and demand.

The Psychology of Charts and Trading

The idea

of a chart in the first place is to illustrate where the price of a security

has been. Supply and demand sets the price of something, and the chart is a

graphical representation of the historical changes in supply and demand, ie,

the historical changes in overall thinking towards the product being viewed, as

set by buyers and sellers.

Technical

analysis concerns itself with looking for trends in price, and also looking for

signs that these trends are ending or reversing. This is something that

candlesticks can do much more quickly and much more clearly than most other

technical methods.

There are

advantages and disadvantages with all types of market analysis, and within

technical analysis there are methods that react slowly to changes and therefore

don’t suit certain types of trader or analyst, whereas there are other methods

that give many more signals but tend not to be so robust. Some prefer this.

Candlesticks are often put into the latter category.

Later on

I will explore how you can add other things to your candlestick analysis to

come up with more robust trading ideas.

Overall,

the answer is to combine a few things with your candlestick charts so that you

come up with a trading strategy that suits your needs and your personality.

Some may even decide that they don’t need to use candlesticks for a specific

strategy, but instead just to give a snapshot view of the market

minute-by-minute, day by day, or week by week.

For now

the key thing to understand is that candlesticks are a graphical representation

of price movement, and therefore show the market’s thinking and sentiment, and

any changes in this thinking and sentiment that may be unfolding.

So,

technical analysis shows what the market thinks of a stock or security.

Obviously the market is the collective mass of people who are trading or

investing in any particular instrument. Therefore the price is the definitive

proxy of what the market - every type of trader involved, all bundled together

into one mass - thinks about that instrument.

Chapter summary

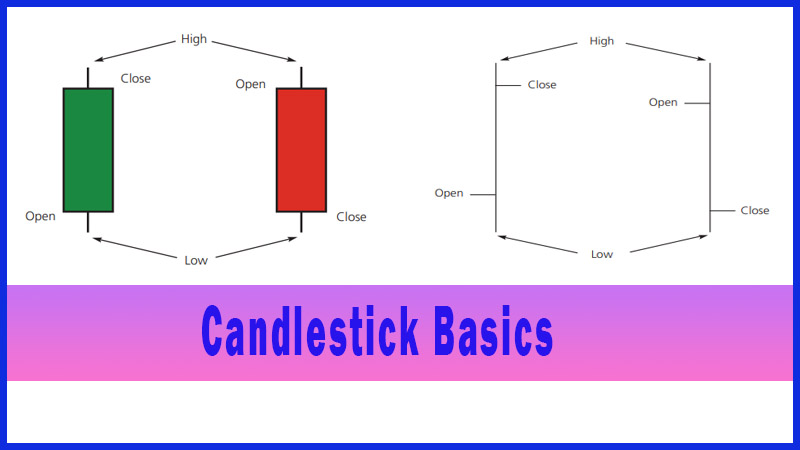

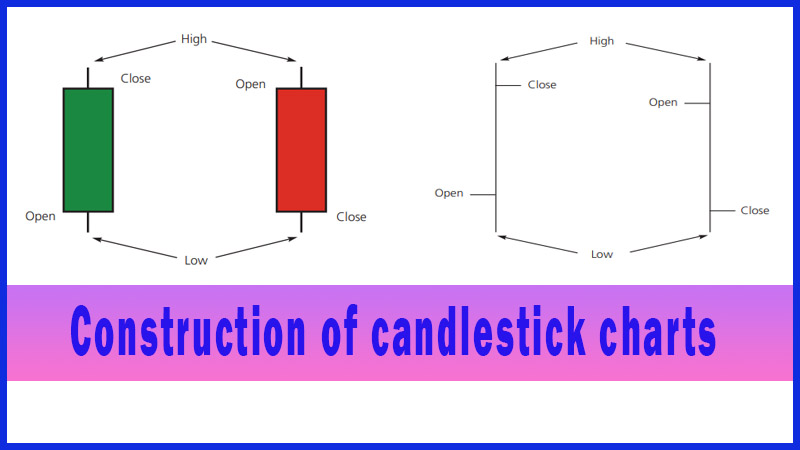

· You should now be comfortable with the construction of candlesticks, know the names of the component parts, and understand the difference between open and filled real bodies.

· A candlestick with an open (green) real body is the result of a day where the market closes above its opening price, and the open real body is the difference between the open and close.

· A filled (red) real body on a daily candlestick means the market closed below the opening price, and the filled real body is the difference between these two values.

· The line down the middle of any candlestick pattern defines the day’s range - the high to low.

· Candlesticks are designed to give you a graphical representation of the market psychology at any given moment.

Uses of Candlestick Charts : Chapter 1. What Are Candlesticks : Tag: Candlestick Trading, Forex : Candlestick analysis, Candlestick pattern, Best Candlestick Pattern, Top Candlestick Ebook, Bullish Pattern, Bearish Pattern - The Psychology of Charts and Trading