Bullish Convergence Pattern

How to trade Bullish Convergence Pattern, Market reversal Pattern, Bottom hammer pattern

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers ]

The jackhammer is a formation that seems to be present in such a situation. Therefore, it is a great method for setting up a potential buy signal once the pattern is confirmed.

Bullish Convergence Pattern

In

Chapter 4, we went over how the market price makes lower lows, but not by

significant measures, and that when prices are at oversold extremes, we should

be cautious for market reversals. We went over the market condition of bullish

convergence and how to use the stochastics and MACD indicators to confirm buy

signals when that market condition exists. The jackhammer is a formation that

seems to be present in such a situation. Therefore, it is a great method for

setting up a potential buy signal once the pattern is confirmed.

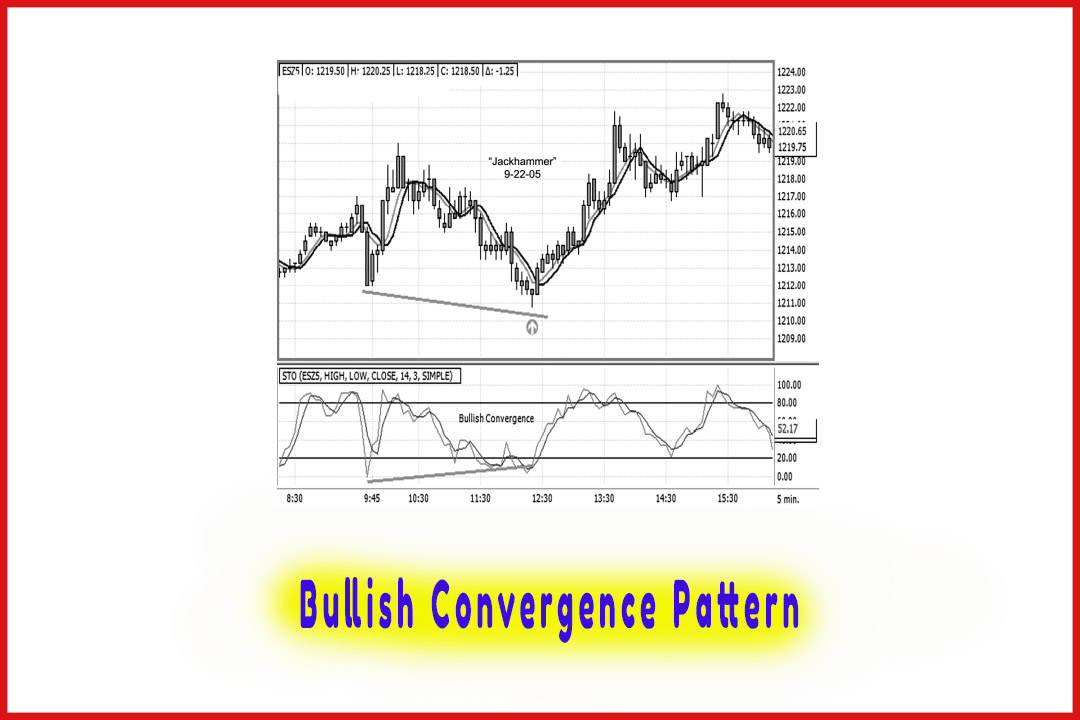

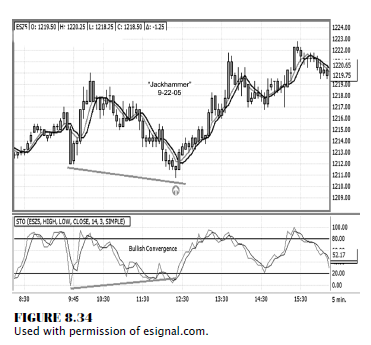

Look at

Figure 8.34, e-mini-S&P 500 futures. As you see, the midsession of the

trading day at 12:30 shows on the charts that the market takes a secondary

decline, forming that spike bottom hammer pattern. Notice that the very next

candle after the hammer is a tall engulfing candle that forms a higher high.

Prices then continue on in the sequence of higher highs, higher lows, and

higher closing highs, while continuously trading above the moving averages. If

you examine the stochastics at the bottom of the chart, notice that when the

price made a new lower low, the reading from the stochastics made a higher low,

identifying that bullish convergence existed. If you watched for the

stochastics to close back above the 20 percent line to confirm the price reversal

and the trigger to go long, you would have had a stress-free trade that

resulted in immediate returns.

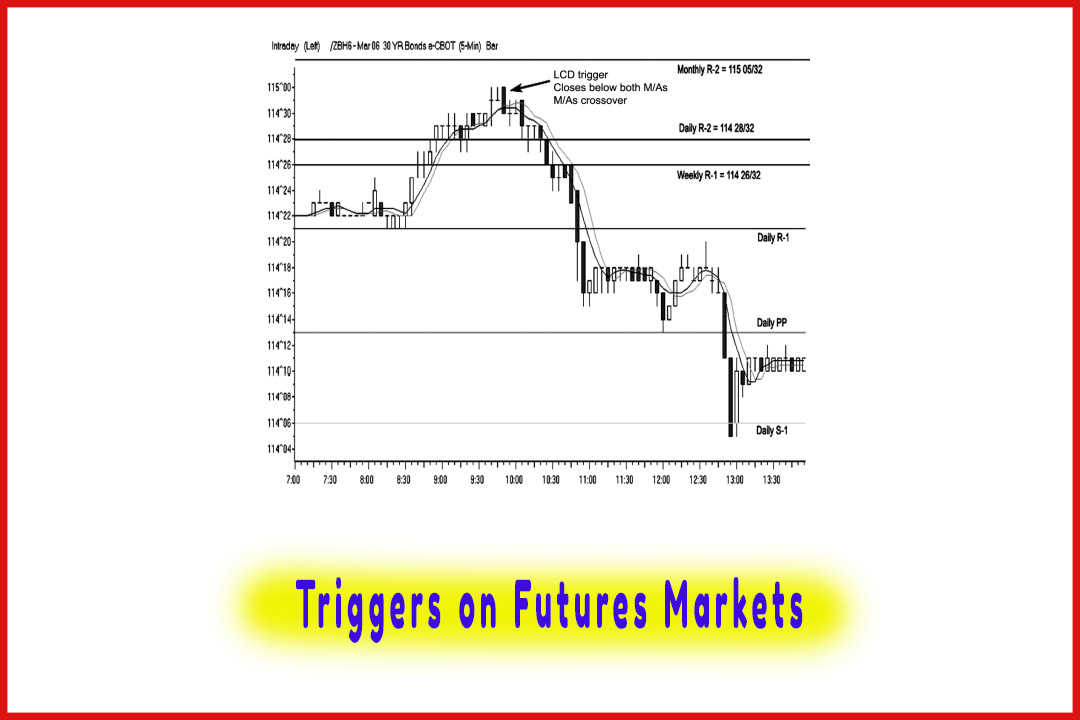

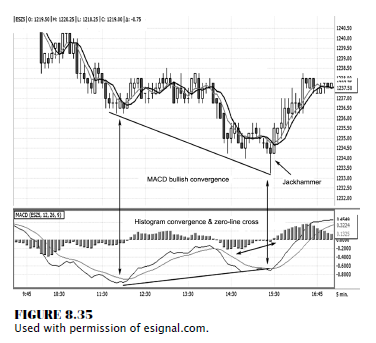

In Figure

8.35, you see another example of the e-mini-S&P, this time with the aid of

the MACD study. The jackhammer occurs past the midsession and actually closer

to the close of business. Here we see both the moving average and the histogram

components alerting us to the fact that the price action was oversold and that

a reversal was likely. The one-two combination of the jackhammer and then the bullish

engulfing pattern revealed a forthcoming price reversal.

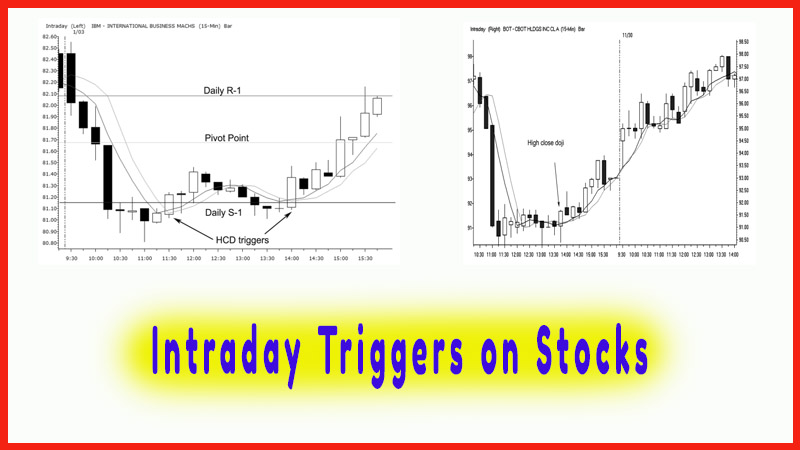

Stocks Get Jacked, Too

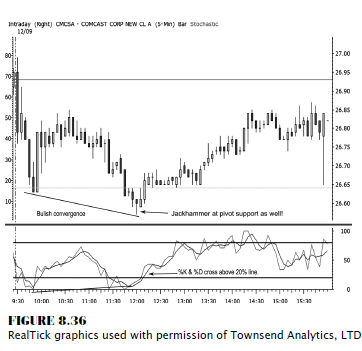

The

psychological aspect of this formation occurs in stocks as well. Believe me,

they are not immune to the ravages of human emotion. The example in Figure 8.36

is Comcast Corporation and is a great illustration of how the stochastics

indicator confirms that the jackhammer, or secondary low buy signal, was

triggered as confirmed with a bullish convergence signal. The fast stochastics

indicator shows the timing of both %K and %D closed back above the 20 percent

line, confirming a bottom was in place. The trigger to go long here is on the

close of the hammer at 26.63; and before the close at 4 p.m. (ET), the market

price is at 26.84.

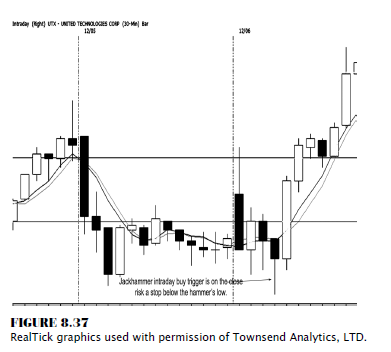

The Jackhammer’s One-Two Punch

Figure

8.37 shows a 30-minute chart on United Technologies that illustrates, depending

on the time period, that the jackhammer pattern can exist from one day to the

next, like a one-two knockout punch that attacks the stops and immediately pops

up.

Since

many traders look at the obvious low point to place their stop-loss order, as

this example shows, the jackhammer took out the prior day’s low; and then once

again, the one-two pattern develops with the hammer and then the next candle

being the tall white, or bullish, engulfing candle. This starts the immediate

price reversal, with the sequence of higher highs, higher lows, and higher

closing highs. See how the market also closes above and continuously trades

above both the moving average values.

If you

know what to look for, trading for a living is a great opportunity; but with

opportunity comes responsibility. Prior to entering a trade, you should have

your “pregame” setup, complete with your market analysis and rules for entering

a trade. Certain rules should start with the techniques covered in this book so

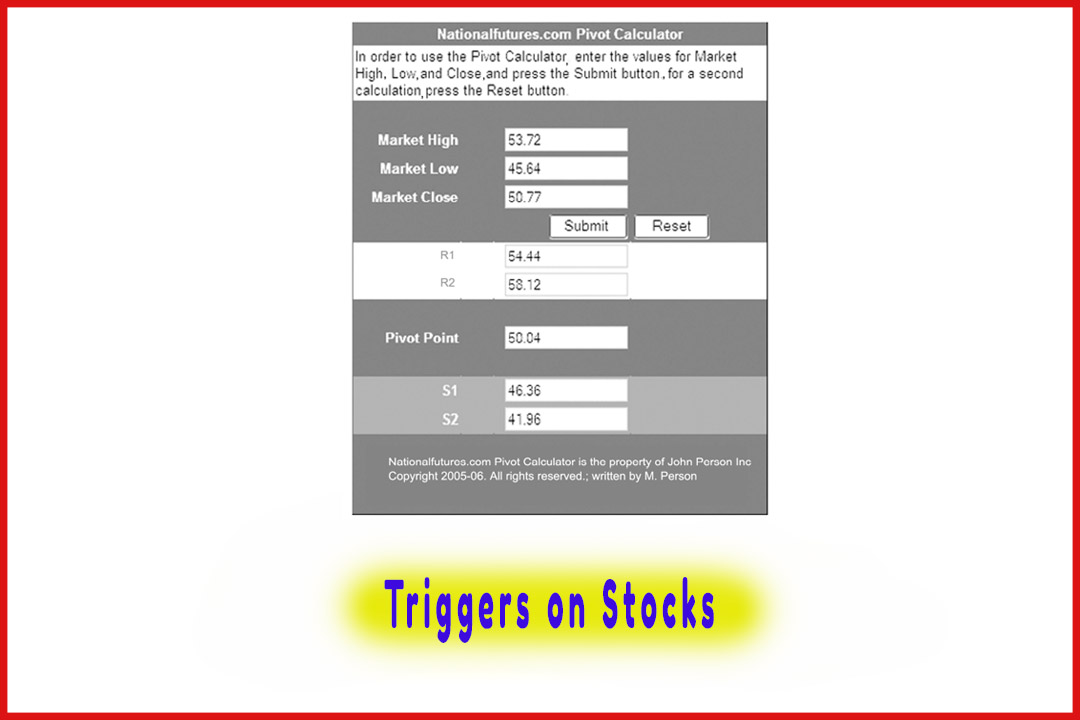

far, which include:

- Identifying what the market condition is—overbought or oversold bullish, bearish, or neutral.

- Identifying the levels that the pivot points lines are at, using the various time frames—monthly, weekly, and daily periods.

- Setting up your charting software parameters with these specific pivot points moving average values.

- Experimenting with variation settings on your own.

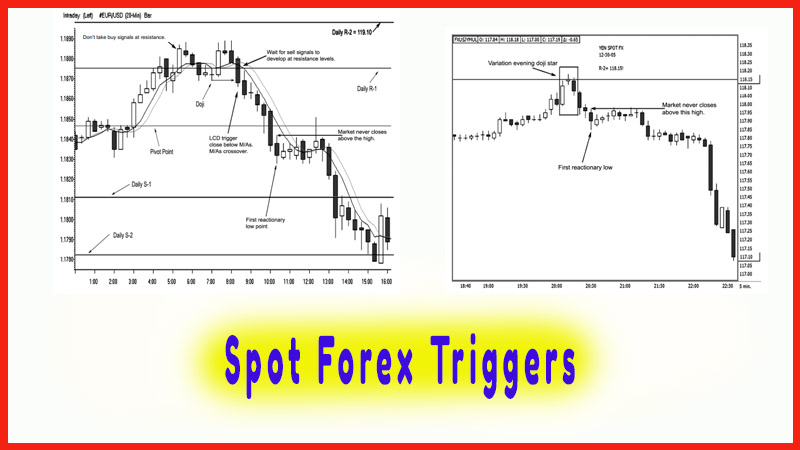

Then you

need to watch and identify when and at what price points the dojis, hammers,

and shooting stars develop. Knowledge of these items will arm you with critical

information that can help provide protection from overtrading as well as from

adverse moves and such pitfalls as reacting on emotions rather than on actual

trading signals.

SUMMARY

The

method of market analysis described in this book is designed so you will be

educated on the importance of developing your personal trading system and so

you can apply the techniques on a consistent basis, which will allow you to

make decisions in a mechanical and non-emotional way. Common mistakes that

traders make are not testing a strategy and not making a logical determination

of whether the strategy is viable for their trading style. Many traders adopt a

new strategy, trade with it, and immediately start tweaking different

components of the strategy. The best approach that I have found in trading is

to establish trading rules and to test those rules until an outcome is

determined based on a reasonable number of trades. Also, I have several

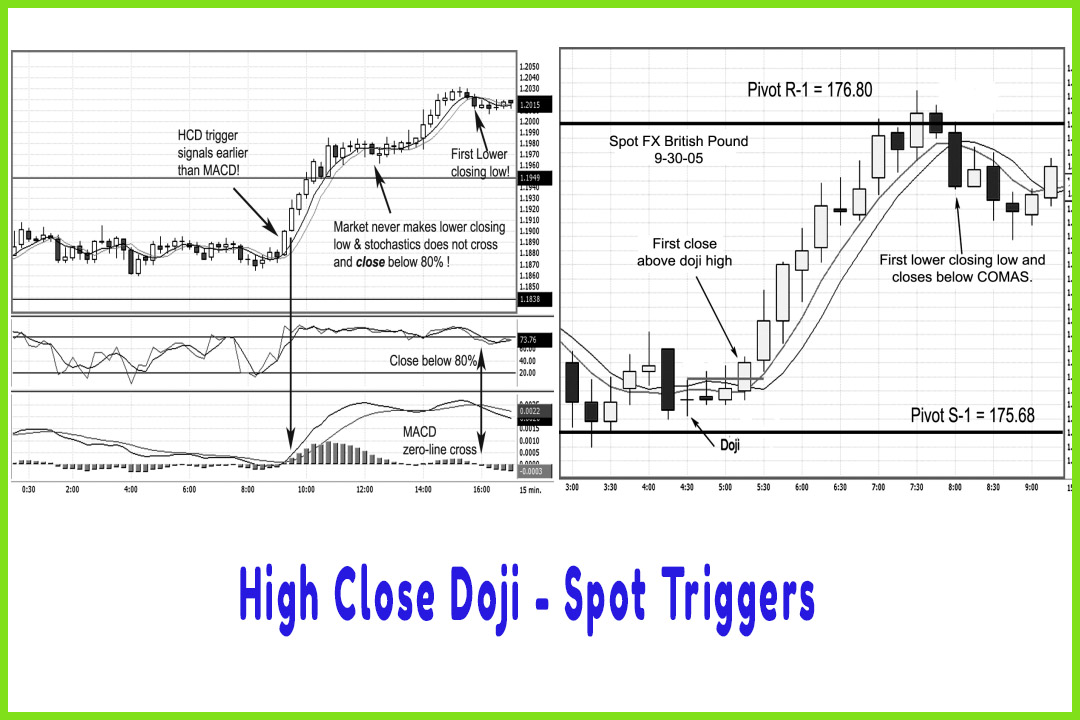

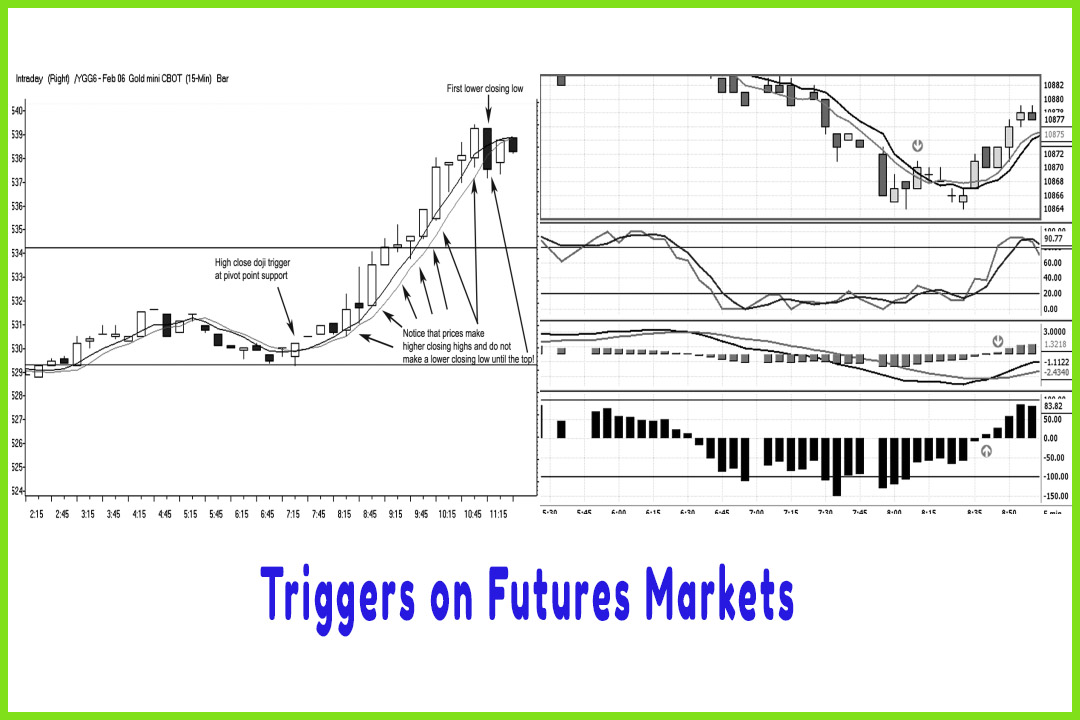

different trading strategies for different markets or conditions. The high

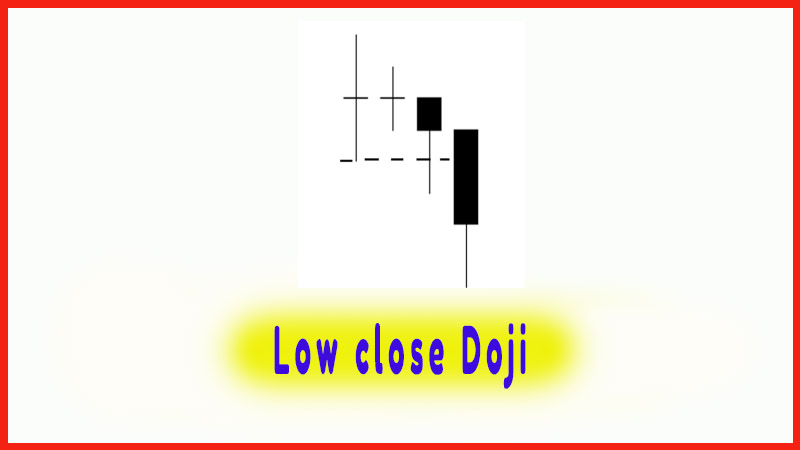

close doji, the low close doji, and the jackhammer patterns are just a few of

my proprietary setups that I watch for meeting these conditions.

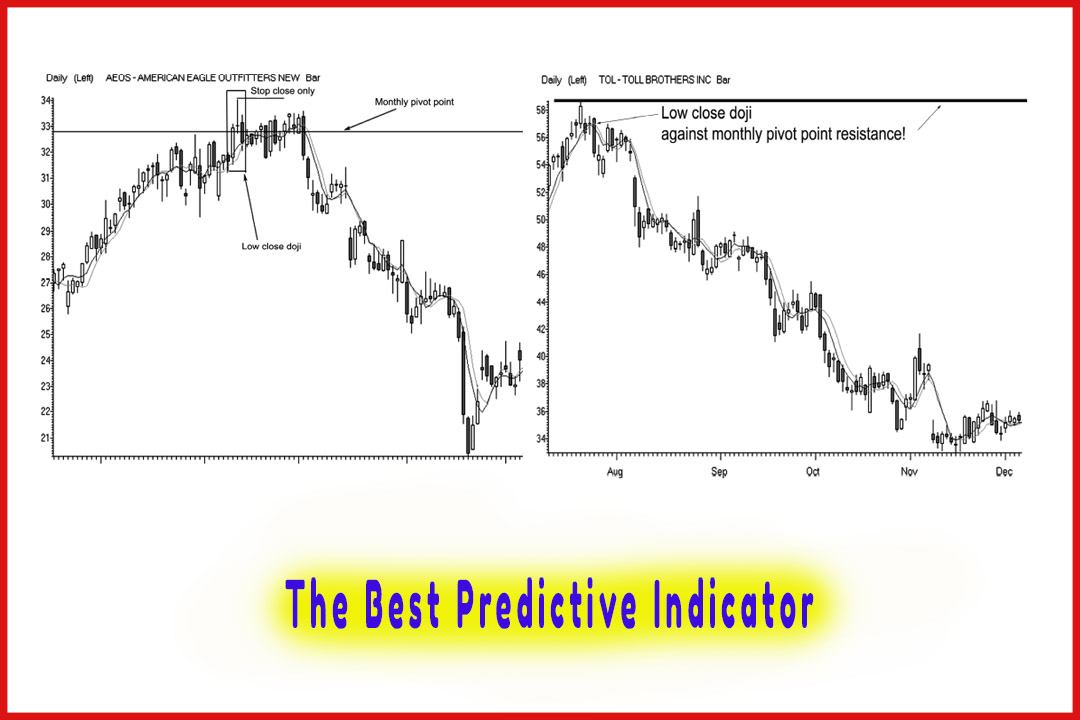

If you

are in a declining market, once an apparent bottom occurs near a pivot point

support target, watch for the high close doji or the jack hammer pattern to

develop. In a rising trend, once the market trades at or near a projected pivot

point resistance, watch for a low close doji or a shooting star pattern. These

specific patterns can be added to your personal toolbox of setups or used

exclusively as a day trading plan. By understanding the current market

conditions (uptrend, downtrend, or sideways), you can heighten your awareness

of specific patterns that can be applied to that trading environment. All that

is left after entering a position is risk and trade management, which is the

focus of the next chapter.

The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to trade Bullish Convergence Pattern, Market reversal Pattern, Bottom hammer pattern - Bullish Convergence Pattern