Setups and Triggers

candlestick formations, pivot point analysis, candle patterns, price momentum, support and resistance level

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers ]

There are many methods you can employ to actively trade, including various mechanical trading systems and manual trading tactics.

Combining Candles and Pivots

There are

many methods you can employ to actively trade, including various mechanical

trading systems and manual trading tactics. The constant changing of market

conditions can require system traders to adapt and update the parameters for

their trading decisions. I often prefer the hands-on visual approach, which is

more of a manual method, while employing a mechanical trigger to both enter and

exit a position with a specific risk management technique. The visual approach

is aided by the use of candle charts.

The

triggers discussed in this chapter are based on the methodology developed from

my 26 years as a trader. I have continually strived to find clearer signals and

triggers for short- and even longer-term trade opportunities. I have been doing

extensive research regarding the combination of candlestick formations and

pivot points; some of the proprietary signals that I have taught traders at

seminars and in my course, I am sharing in this book. This chapter details the

triggers designed by me, based on my research joining both specific candle

patterns and pivot point analysis.

I am

going to cover three setups: (1) the high close doji (HCD), (2) the low close

doji (LCD), and (3) the jackhammer. Each one has a special set of rules by

which to initiate a trade and to exit a trade. These strategies have done well

in periods of both bullishness and bearishness, as well as in times of

heightened volatility and periods of low volatility.

This is

just a small sample of what is taught in my three-month intensive trading

school. I have been asked why I would share such high- probability trading

signals with the public. Well, I have taught these methods to many people,

including my own father and son. Just as they have different results with the

same signals, you will, too, due to the very nature of trading. Once my trading

concepts are taught by the masses, I do not believe the signals will be diluted

or absorbed in the marketplace.

I believe

not every trader will implement my methods in exactly the same way as I do. For

example, Larry Williams has his OOPS method, Mark Fishers has his method, and

Tom Demark had his method let out to the public. And all these systems, to my

knowledge, are still highly effective strategies. So I do not believe letting

you into my “black box” will hurt or dilute the signals.

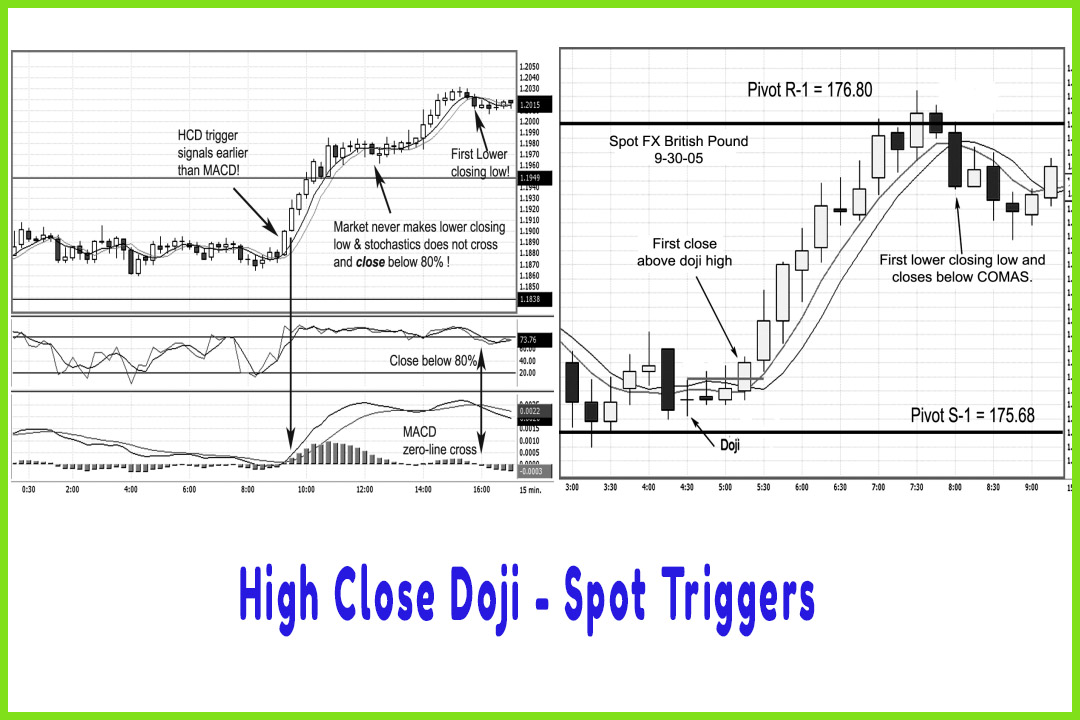

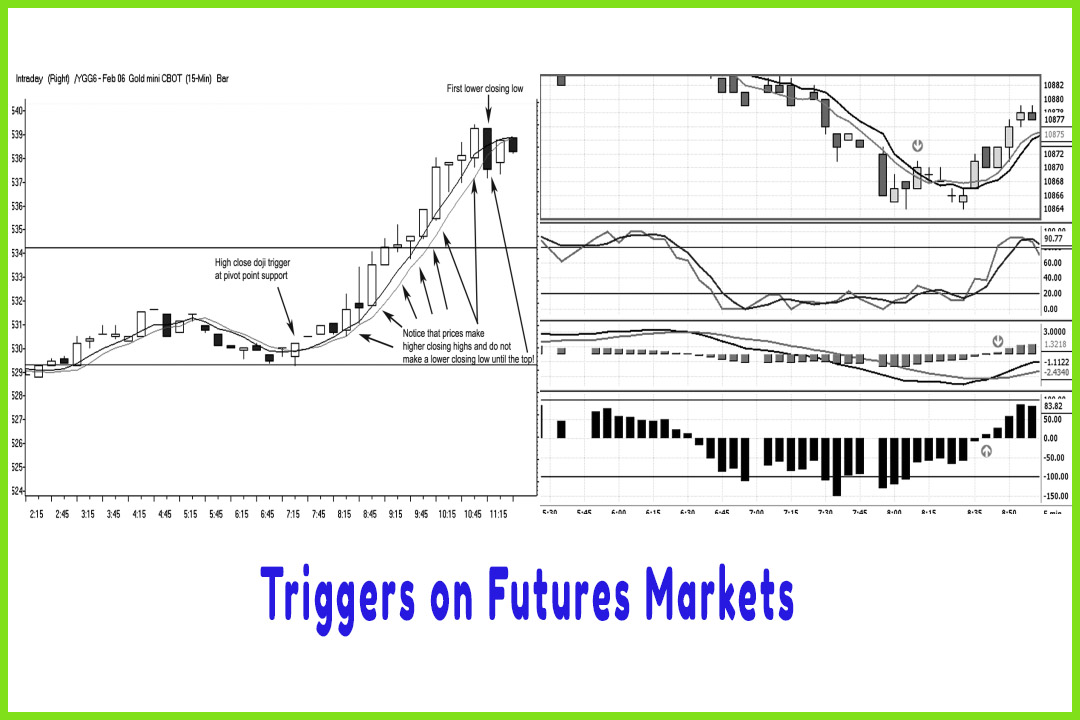

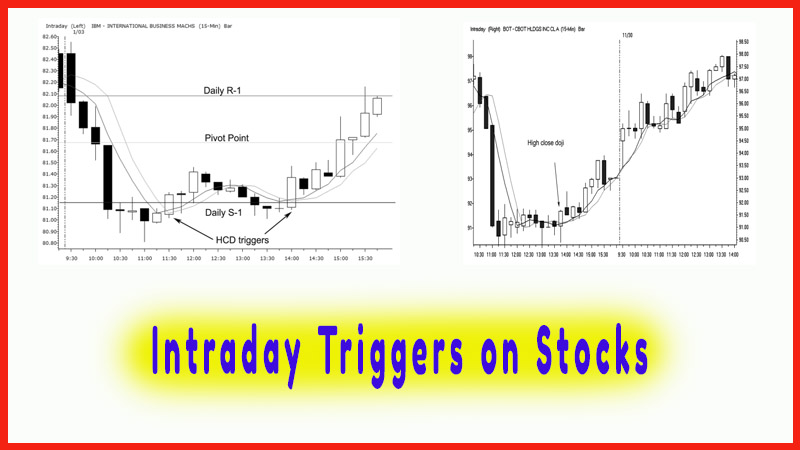

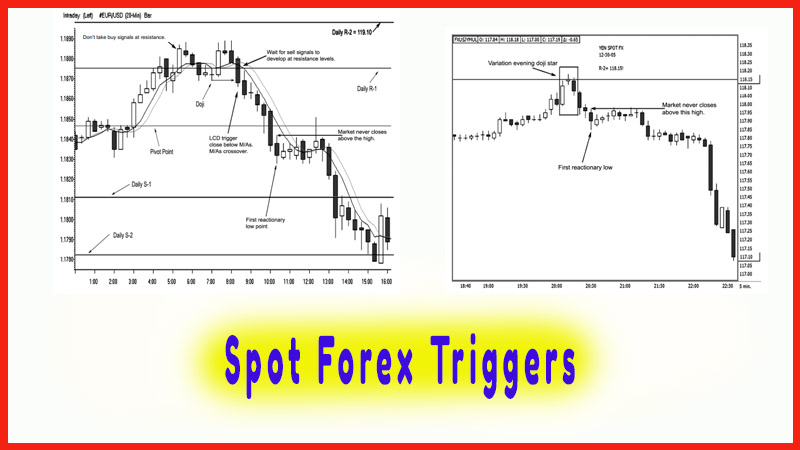

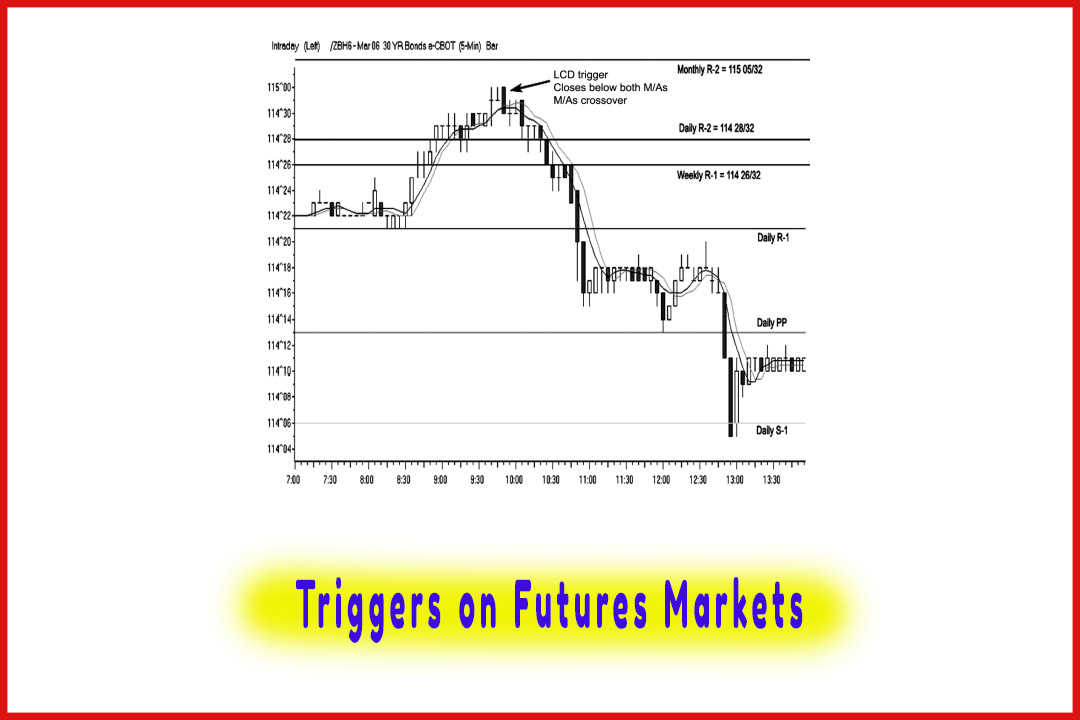

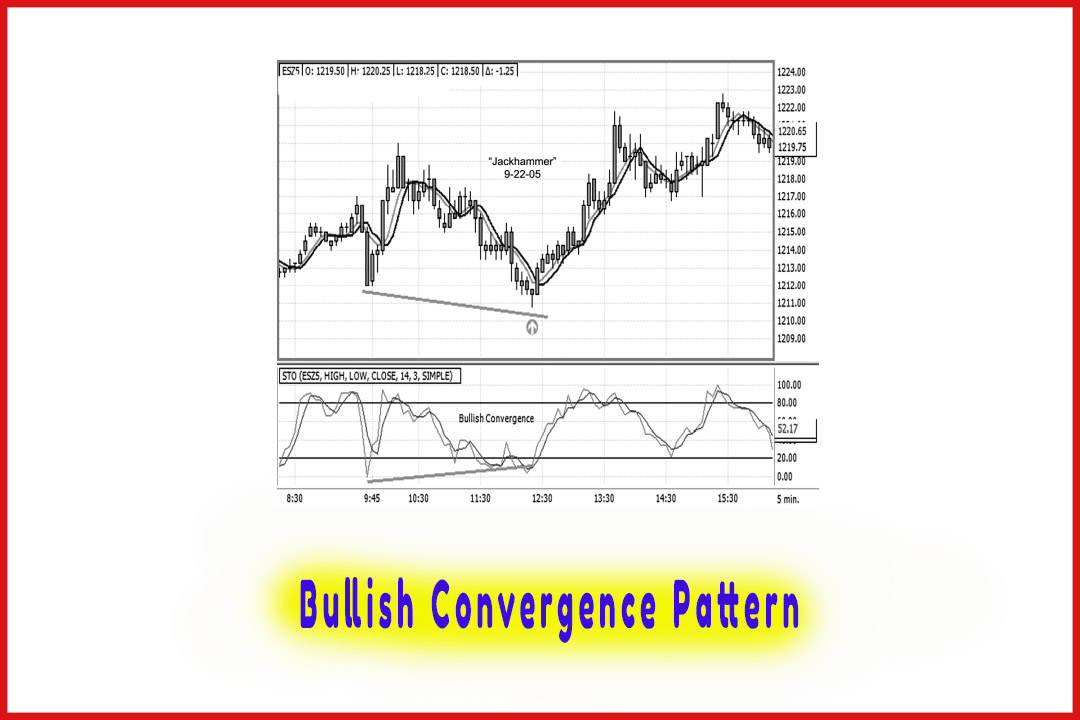

There are

various markets and various time periods in which to enter a trade, such as a

60-minute, a 15-minute, and a 5-minute time period for swing and day traders.

These signals work for futures and stocks, and they work amazingly well in the

foreign exchange (forex) markets, as you will see in the coming examples. The

premise is to help keep the trader focused on the now, to watch and study the

current price action. The candle patterns give a visual confirmation of price

momentum, and the pivot points forewarn you of what the potential turning

points are. When you combine the two methods, you have a solid trading program.

This setup may help you improve your trading performance and allow you to

develop a consistently winning trading strategy. This could be your personal

trading system that is based off proven and powerful techniques. For a moment,

I want you to envision the concept of epoxy glue: It requires two compounds.

Separately, they are not very reliable or, in fact, a very strong bonding

substance. However, when combined, a chemical reaction occurs and forms an

amazingly strong and powerful bond. Using the methods of candlesticks with

pivot points can give you that same result if you know what to look for. The

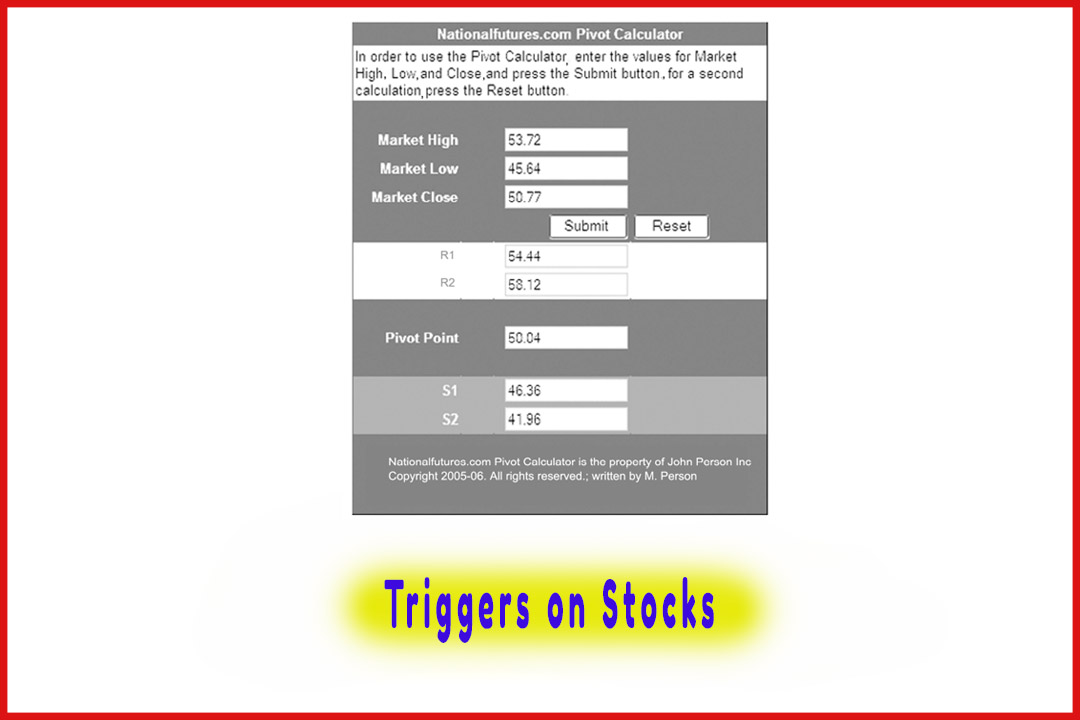

implementation of longer-term analysis using pivot points will give a trader a

fantastic means by which to anticipate a point where a trend change could

occur, thus helping a trader not only to prepare but also to act on a trade

opportunity. One can implement this setup using different time frames besides

daily analysis. You can include weekly and even monthly pivot point

calculations. This method of analysis will alert you well in advance of a

potential support and/or resistance level. In the setup process, you will

heighten your awareness to enter in a long or a short position against

predefined levels and will wait for the trigger or market signal at those

levels. It can not only help you define or identify the target area to enter

but also establish your risk objective. Another event that occurs with this

setup process is that you now can set up your orders to buy on your trading

platform with the selected contract amounts—in other words, pre-arrange the

commands on the electronic order ticket. Now all you need is confirmation so

you can pull the trigger or click the mouse to establish an entry in the market

and establish a position.

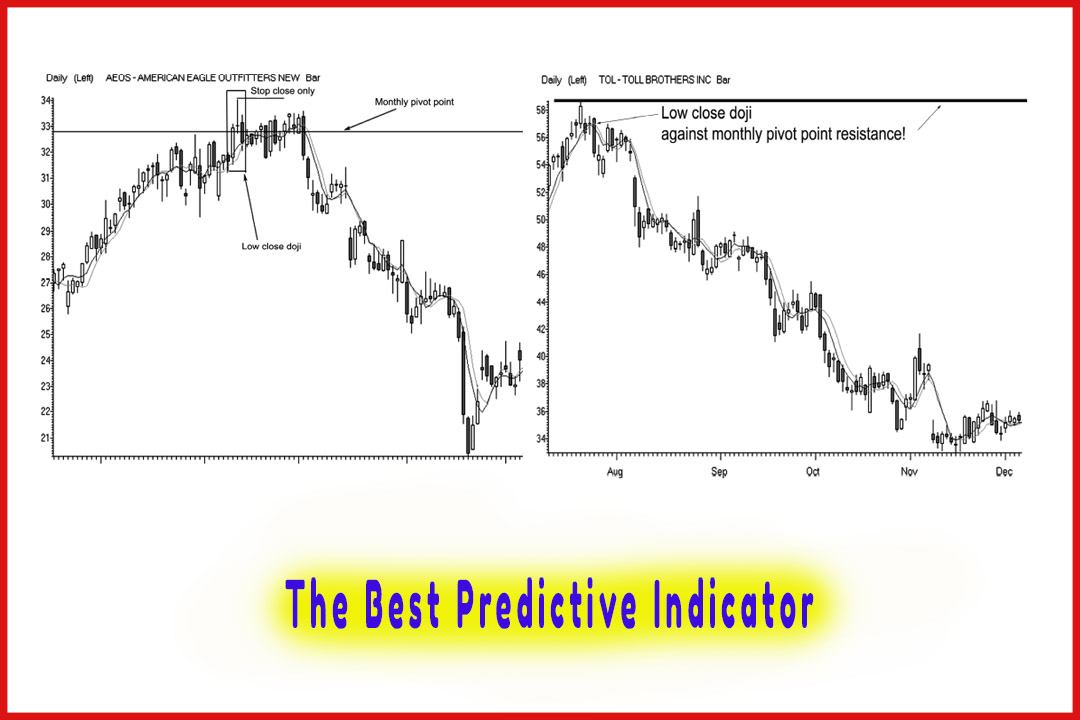

In

Chapter 7, we covered the importance of dojis and the statistical relevance of

why I look for them at pivot point support targets. The primary importance in

the study of the doji at a pivot is to understand that the doji indicates

indecision and is a significant sign that changes are coming. In candle

patterns, the morning doji star is one of the most reliable reversal formations

that a trader can identify.

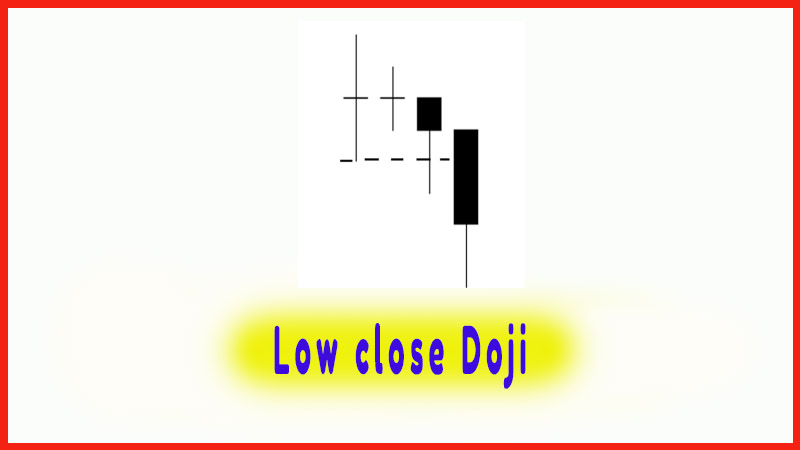

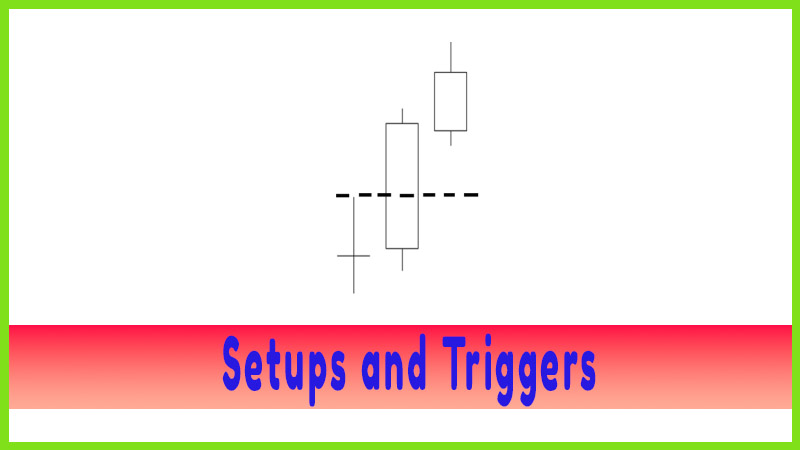

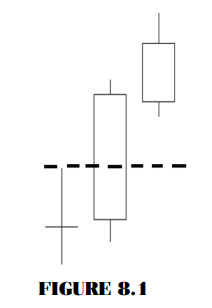

The

problem is that there are about 12 variations, making it hard to write code to

program in a trading software package. However, the main component about the

doji is the trigger indicating when the next time period’s close is higher than

the doji’s high. This can be a subtle change by just two PIPs in forex or ticks

in futures. It cannot be at the exact high of the doji; rather, it needs to

close above the doji high. This is a very important point, so make sure you are

crystal clear on it. Figure 8.1 demonstrates the definition of a close above

the doji high.

The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers : Tag: Candlestick Pattern Trading, Forex, Pivot Point : candlestick formations, pivot point analysis, candle patterns, price momentum, support and resistance level - Setups and Triggers