Trendlines with Candlestick Analysis

Candlestick analysis, Candlestick chart, Gap down Doji, Hammer signal, Best candlestick pattern, Trendline analysis

Course: [ How To make High Profit In Candlestick Patterns : Chapter 4. Candlesticks with Technical Patterns ]

Trend Lines are visually apparent levels where support or resistance has been occurring. Technical analysis is built upon the premise of identifying trends. They are one of the most important tools for both identifying a trend and confirming the existence of that trend.

Using Trendlines with Candlestick Analysis

One

of the most commonly used indicators is the trend line. Trend Lines are

visually apparent levels where support or resistance has been occurring. Technical

analysis is built upon the premise of identifying trends. They are one of the

most important tools for both identifying a trend and confirming the existence

of that trend. They are the simplest indicators to place on a chart. When

analyzing any chart, the eye can usually distinguish an area where a line could

be drawn across the bottoms or the tops.

The

basis of a trendline is that it is formed when connecting at least two points.

The more points that fall upon that line, whether actually drawn or visually

evaluated, the greater the confirmation that the trend is being affected by

that trendline. Many of the principles that are applied to other support and

resistance indicators can also be applied to trendlines.

Many

technical analysts require that a trend line be confirmed by at least three

points touching that line. A rising trend line is identified with successively

higher low-price points. The rising slope is now considered a support level.

The Bulls are in control, providing demand every time prices come back to test

the trendline. As long as the prices remain above the up trending trendline,

the uptrend is considered intact.

As

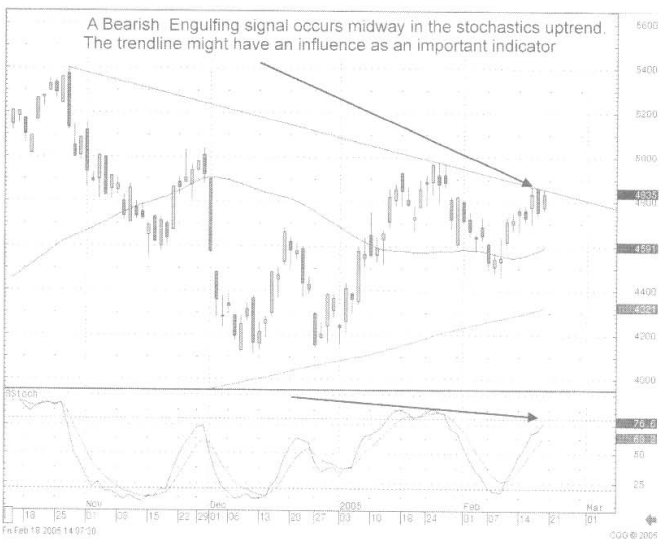

illustrated in Fig. 7, the March crude oil chart, a Bearish Engulfing signal

appeared when the stochastics still indicated more upside potential. The

trendline drawn from the top of the October high through the recent top at the

January high can now be viewed as an important resistance. The candlestick

“sell” signal provides an ‘alert’ for selling to appear at this level when the

stochastics indicated that there was still more upside to this trend.

Fig.

7, the March crude oil

Had

this trendline not been acknowledged prior to the Bearish Engulfing signal

appearing, going bade to analyze the chart after the Bearish Engulfing signal

appeared provides an additional technical parameter for evaluating what the

price of crude oil may do from this point. This is a case of using the

trend-line to add credence to a candlestick signal.

This

falling trendline acts as the resistance level. The Bears are in control,

stepping up their selling every time the price comes up to the resistance area.

As long as prices remain below the declining trendline, the downtrend is considered

to be in effect.

The

use of computers has refined the use of trendlines in recent years. The

accuracy of drawing trendlines on a computer screen is much greater than using

a pencil and a ruler on a printed chart. The width of the pencil lead versus a

slight change of angle of a manually drawn line could dramatically alter a

trend lines relevance. Today’s computer generated charts can establish a trend

line using the exact tops and bottoms of price moves. This would become very

important for those investors that were anticipating a breakout of a trendline

support or resistance level.

The

strength of a trend becomes a function of how many times prices bounce back up

above the trendline. As mentioned, a trendline can start by drawing a line

between two points and extending that line into the future. If that trend is to

continue, then future prices should support or resist at that line. That

becomes the primary basis for trend analysis. The candlestick signals dramatically

increase the evaluation potential at the support or resistance line. Where most

investors are “anticipating” a result at that trendline, the candlestick

analyst can get an immediately clear picture of what investor sentiment is

doing at the trendline. This not only provides valuable investment information,

it provides that information much earlier than what other investors are able to

glean from the trading at that level.

The

disadvantage of using trendline analysis on its own is the different

interpretations of which trendline is most relevant. Establishing that a

trendline can be formed by two, three, and more points being used to develop a trendline,

there is the possibility that different combinations of those points can create

a short-term trend, medium-term trend, or long-term trend. The question now

becomes which trendline is providing the correct analysis for support and resistance.

Utilizing the candlestick signals assists in recognizing which trend-line is

the prominent trendline.

Developing

a trading strategy utilizing the candlestick signals at the trend lines becomes

much more decisive. If a trendline is anticipated to be acting as a support,

and that is being confirmed by a candlestick buy signal, purchasing the trading

entity at that level produces a couple quick distinctions. The candlestick

signal allows the investor to enter a trade at a highly opportune time. It also

provides a logical stop loss strategy. If the buy signal occurs on a trendline,

implying that the uptrend is going to continue from that point, then prices

immediately coming back down through the trendline, the support level, alerts

the investor to close out the position immediately. This should not be a

difficult concept. If the indicators that had been working previously appear to

work once again but immediately reverse and fail, then a major support level

has been breached, immediately indicating the buying that showed support is not

present where it is supposed to be seen.

Fig.

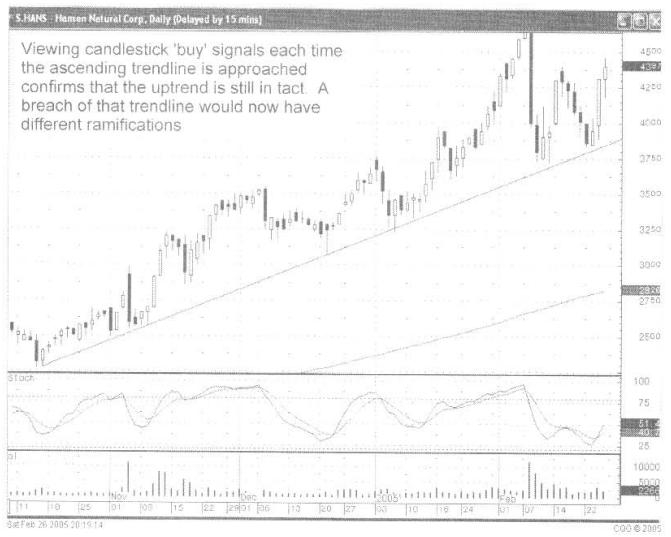

8, The Hansen Natural Corp. chart illustrates an ascending trendline. After two

or three times of coming back to a level that appears to be in a straight line,

the eye can start to visually detect what would appear to be a trendline

forming.

Fig.

8, The Hansen Natural Corp

Drawing

a line from those points now becomes a potential target for each pullback that

occurs. Being that the visual analysis is easy for most investors to perceive,

a trendline becomes an important technical factor. As viewed in the Hansen

Natural chart, any future pullbacks to the trendline become an obvious spot to

watch for candlestick signals. Having the mental image of where support might

occur and being able to visually recognize candlestick buy signals allows the

candlestick analyst to make better decisions for entering a trade.

Trendlines

can be developed by using points in the past that all appear to be lining up.

If a number of points line up from two different time frames or more, the chart

might have different trendlines that could be relevant. Which one of those

trendlines should be heeded? The candlestick signals make the answer very easy.

If there is more than one trendline to be considered, then the candlestick

signals will help identify which trendline has importance. This is just a simple

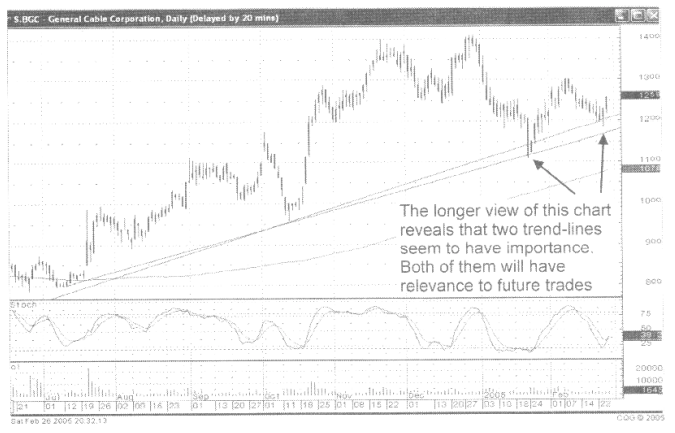

function of seeing where a candlestick “buy’ signal has formed. Fig, 9, The

General Cable Corp. chart illustrates a couple of trendlines that have been

created from previous bottoms. Which trendline will work effectively for the

period we are looking at right now? The signals will tell you which trendline

should be currently considered.

As

seen in the General Cable Corp. chart, during an expanded time frame, there are

two trendlines that appear to act as support levels.

Fig,

9, The General Cable Corp. long-term chart

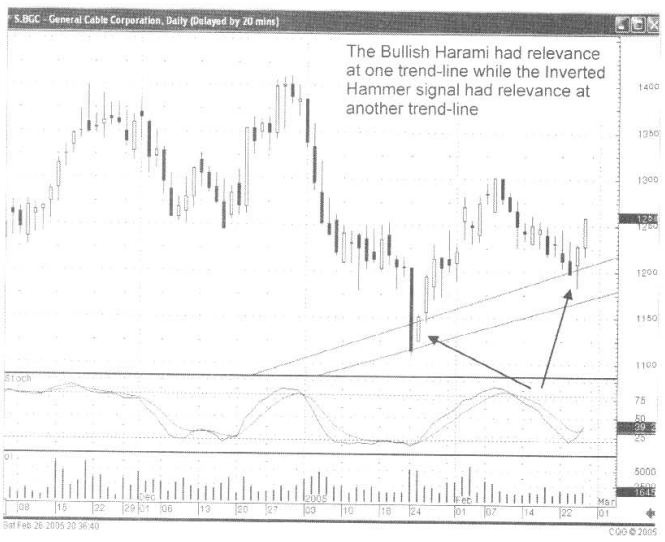

Once

the long-term chart, Fig.10, has established important trendlines, the analysis

of what to do currently is better visualized by shortening the timeframe of the

chart. This better illustrates what is currently occurring in the price pattern.

Fig, 10, The General Cable Corp. Short-term chart

Making

the chart bigger for better visualization, it can be clearly seen which

trendline is affecting the current price. In this case, the Inverted Hammer is

being confirmed at the upper trendline.

This

may seem very elementary, but it is what is occurring at trendline levels that

are being observed by many investors. The candlestick signals confirm

immediately what is happening at an observed level.

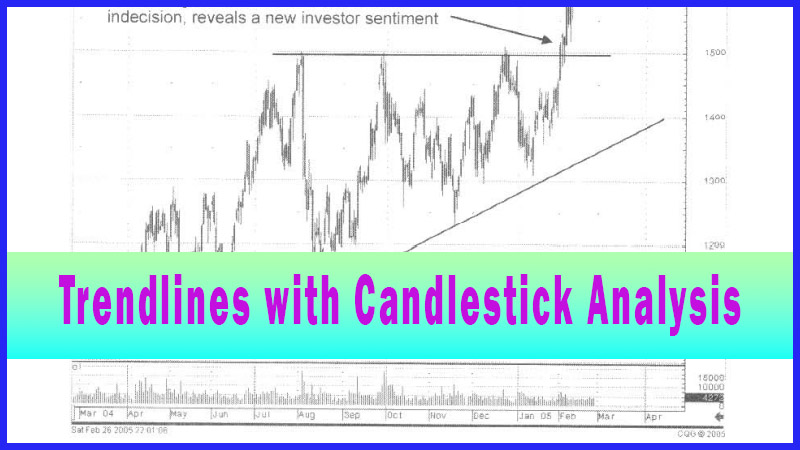

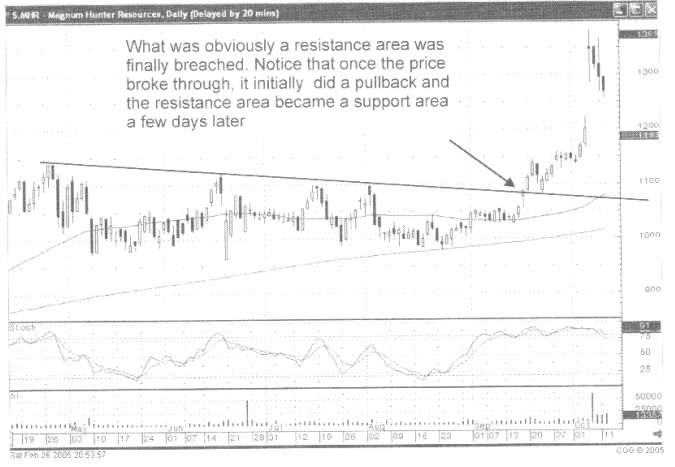

Trendlines

also become important factors when acting as resistance levels. Fig. 11, The

Magnum Hunter Resources chart provides a simple illustration of what occurs

every time prices approached a specific trendline. It became apparent that

every time a peek was reached in June, July, and August, candlestick sell

signals appeared. Mid-September revealed candlestick formations that did not

show weakness at the trendline. This becomes important information for the

candlestick investor. The fact that a bullish candle formation breaches what

had obviously been a resistance trendline reveals that there is new investor

sentiment.

A

bullish breakthrough as revealed by the candle formations demonstrates that the

trendline resistance has now become a non-factor. If this position was

purchased, based on bullish candle signals forming at important moving averages,

the decision process should be to take profits at the obvious resistance level.

That decision now becomes different once the resistance level is broken. Simply

stated, the lack of a candlestick ‘sell’ signal where a ‘sell’ signal is expected

provides a new evaluation.

Fig.

11 Magnum Hunter Resources

If

trendlines are creating obvious formations, such as pennant formations or

ascending triangles, etc., then a breakout from those patterns can be better

analyzed when viewing the candlestick formations. This is not a complex procedure.

This is using the simple visual analysis of investor sentiment at previous

levels that would indicate buying and selling.

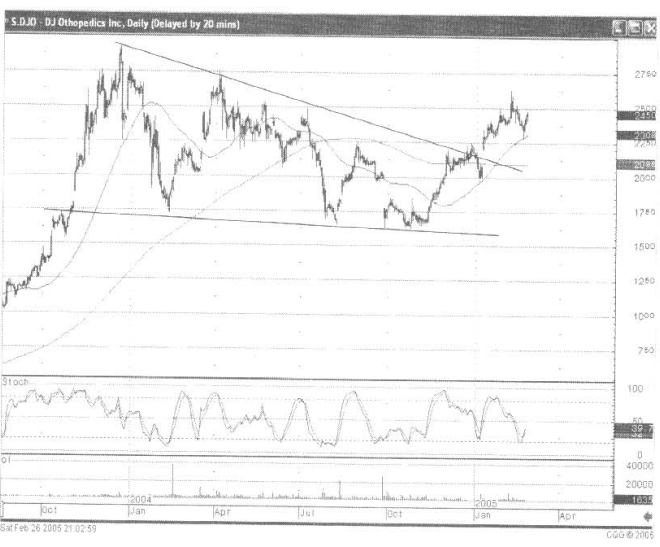

Fig.

12 The DJ Orthopedics Inc. chart illustrates a Triangle formation that is

breached to the upside. When viewing the longer term chart, it becomes relatively

clear- that there is a triangle pattern forming. If those trendlines are

brought forward into a shorter term chart, the analysis is easy to formulate

once one of those trendlines is breached.

Fig.

12 DJ Orthopedics Inc. long term chart

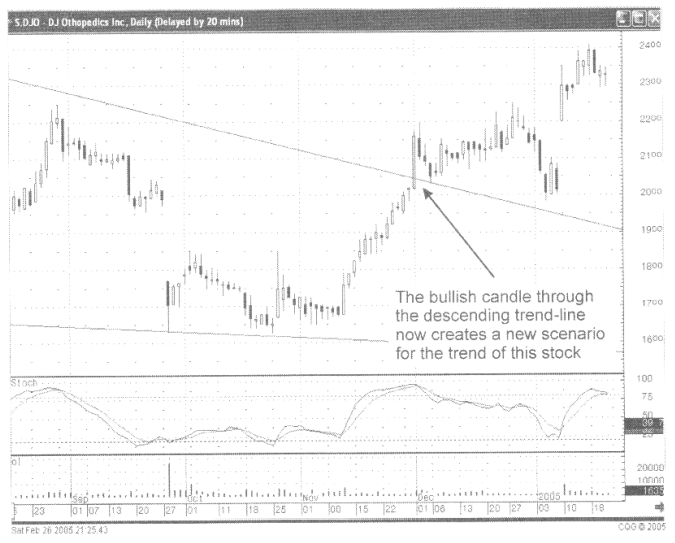

In

the short-term chart Fig. 13 (following page), it becomes apparent with the

large bullish candle that the trendline is now no longer a resistance level.

The fact that the Bulls pushed through that trendline with great force reveals

important information. That information now creates a new evaluation of what

the trend might be for the future of this stock. Although a sell signal was created

the day after the break through, with a Bearish Harami, a pullback stopped at

what had been the resistance trendline, with it now becoming a support level.

The fact that the trading was now above descending trendline should bring a

different evaluation into this stock. The candlestick signals are still the most

relevant factors for trading decisions, but the overall trend analysis will

have changed.

Fig.

13 DJ Orthopedics Inc. Short term chart

Keep

in mind, when everybody is watching to see what will happen at important

technical levels, the candlestick analyst has the advantage of immediately

seeing what the investor sentiment is doing at those levels.

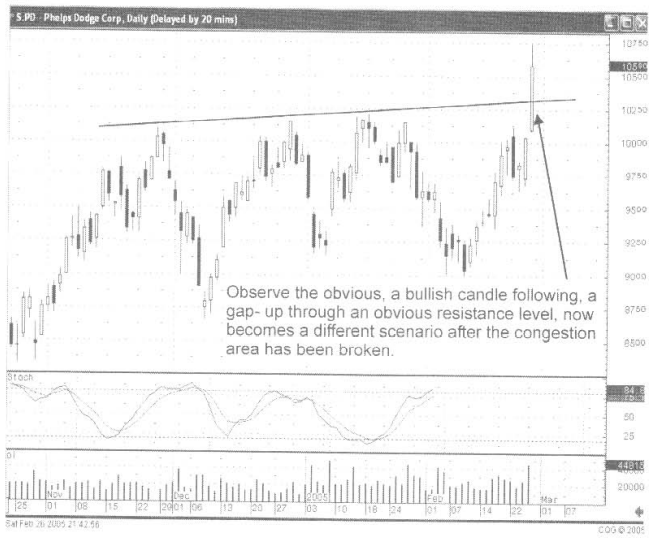

Fig.14,

The Phelps Dodge Corp. chart reveals a bullish candle that broke out through

what had been a resistance trendline. The bullish candle of the previous day,

followed by a bullish candle with a gap up becomes very revealing. What is the

future of the price of this stock? Who knows! But the evaluation of this price

move now becomes different, knowing that a trend line resistance congestion

area has now been broken.

Fig.14,

The Phelps Dodge Corp.

Trendlines

can be used to analyze what candlestick signals “might” be occurring in the

near future. As seen in Fig. 5-15, the Wamaco Group Co. chart, the price move

has become extended up to one of the obvious trend lines. The price closed

remarkably close to that trendline on a big bullish candle day. This alerts the

candlestick investor to a couple of possibilities. Seeing strength, the

following day should reveal that the next trendline might be the target. A

weaker open on the following day may reveal this trendline as the resistance

level. A Bearish Harami would signify that the buying had stopped. This,

occurring at that trendline, would be more confirmation to take profits.

Fig.

15 Wamaco Group Corp.

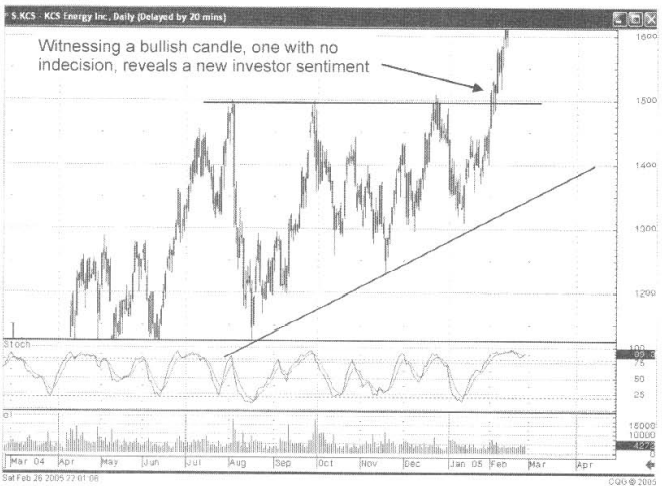

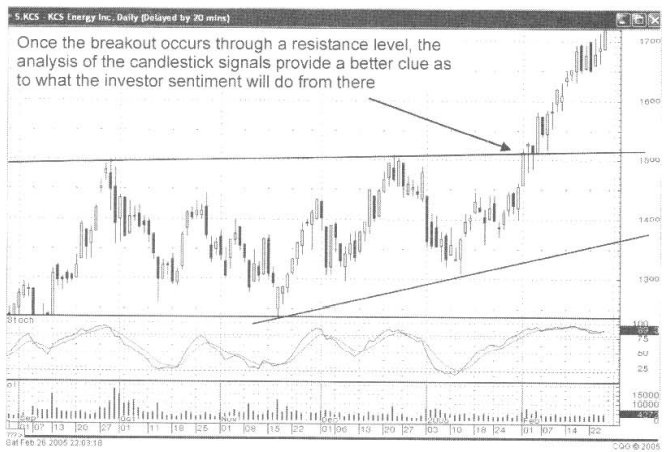

An

ascending triangle chart, as seen in Fig. 16, the KCS Energy Inc. chart

provides important information. The trendlines being drawn across the top and

the bottom of the trading pattern should reveal the simple patterns in which

that this stock characteristically trades. Once that trading pattern has been

breached, a new evaluation can be made for the price movement. Having the

advantage of knowing that the trend is now in a new stage of development, in

this case a bullish move, the use of candlestick signals becomes more effective.

They can be used knowing that an uptrend is in progress. The potential of the

trend should continue until a definite candlestick ‘sell’ signal appears. Or a

pullback could occur, testing the recent resistance level. Having the knowledge

of what could potentially happen after a breakout allows the use of candlestick

signals to enhance the probabilities of being in the correct direction of the

trade. This is nothing more than putting the probabilities more into the investors

favor.

Fig.

16, the KCS Energy Inc. chart Long Term

Fig.

17, the KCS Energy Inc. chart Short Term

How To make High Profit In Candlestick Patterns : Chapter 4. Candlesticks with Technical Patterns : Tag: Candlestick Pattern Trading, Forex : Candlestick analysis, Candlestick chart, Gap down Doji, Hammer signal, Best candlestick pattern, Trendline analysis - Trendlines with Candlestick Analysis