Three-Wave Pattern

Best trading pattern, Top 3 trading Pattern, Top trading pattern, Best candlestick pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 4. Candlesticks with Technical Patterns ]

Prices move in patterns. This is a function of the multitude of investment criteria of the investment community. An investor places money into a position, based upon their individual investment goals.

The Three-Wave Pattern

Prices move in patterns.

This is a function of the multitude of investment criteria of the investment

community. An investor places money into a position, based upon their

individual investment goals. Whereas one investor may be buying for the

long-term, the next investor may be in the position for a short-term trade.

Whatever the reasoning for an investor to commit funds to a trade, the price

movement of any trading entity will be predicated upon the emotional sentiment

of how that price movement reacts. Simply stated, the magnitude in which a

price moves will create changes in investor sentiment.

A

price that moves up too fast for normal expectations will cause profit taking

to occur. A price that moves in a slower consistent fashion will have a

different result in investor sentiment, causing a different pattern. The fact

that prices move in patterns/waves is evident in the existence of technical

analysis. Stochastics, Fibonacci numbers, Elliot Wave theory, trendlines and a

host of other technical methods have been developed as a result of prices

moving in predictable fashions.

The

most predominant study of wave patterns comes from the Elliott Wave theory.

Over 50 years ago, R.N. Elliott observed that price movements move in a series

of dramatic patterns. He analyzed that these patterns were based upon the

natural progression of the sentiment shift in mass investor psychology These

patterns or WAVES illustrated the oscillations between investor fear and greed.

Elliott

observed various types of wave patterns. His research formulated two basic

types of wave patterns. The impulse waves, waves which moved in the direction

of the predominant trend of the market consisted of five smaller ways. The

corrective waves, waves that moved counter to the main trend consisted of

three smaller waves. Unfortunately, these two wave patterns are just the basic

wave counts. The major difficulty of Elliot wave analysis is analyzing and

correctly labeling which wave count is currently occurring. It is always

difficult to define which wave count is in progress. Wave patterns can occur

inside other wave patterns.

The

wave patterns in the Elliot Wave analysis can also have variations to the basic

wave patterns, having seven or nine wave counts. Even R.N. Elliott admitted

that with the numerous variations of wave counts that could be applied to a

trend, each trend could be analyzed differently, depending upon the initial

wave analysis. He admitted that the interpretation of the wave counts could not

always have a stringently defined set of rules.

Apparently

there are students of the Elliot Wave analysis that have been able to convert

their knowledge of how the waves perform. They can produce very good profits

for their trading programs. The one consistent factor that successful Elliot

wave analysts reveal is that to become successful at analyzing the waves

profitably takes many years of experience. This is all well and good for those

that want to spend many years in learning how to invest successfully.

For

those investors that want investment methods that can be learned and used

effectively in a much shorter period of time, there are aspects of waves that

are much easier to utilize. Using candlestick signals in a three-wave pattern

becomes much more productive. A three-wave pattern can be defined as any wave

pattern that starts from a point where a new wave or trend becomes apparent.

This approach makes the wave pattern a projection element versus an

anticipatory element.

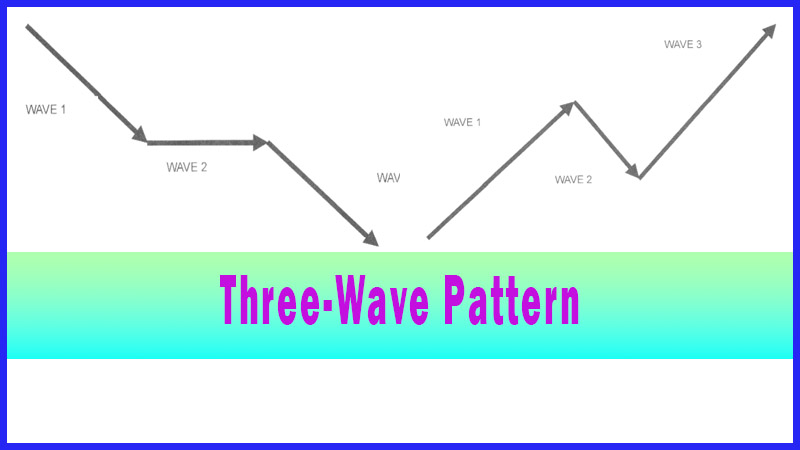

The

candlestick signals remained the main analytical tool for identifying a trend

reversal. The three-way pattern becomes a projection tool for how that new

trend may perform. A three-wave pattern has a few different identifiable moves.

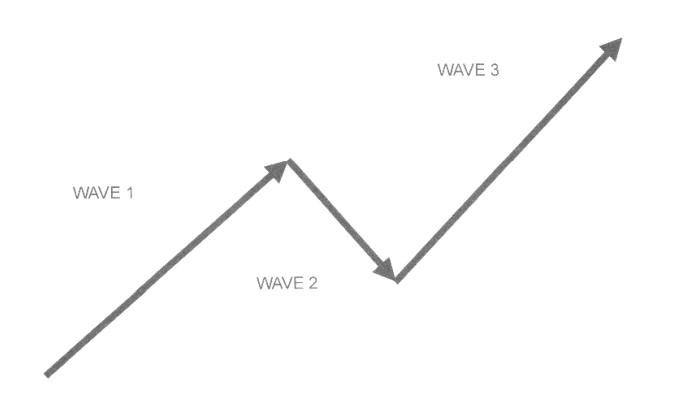

As illustrated in Fig.5-1, a trend can move up and then pullback. The third leg

of the trend now moves back up to test or exceed the previous high.

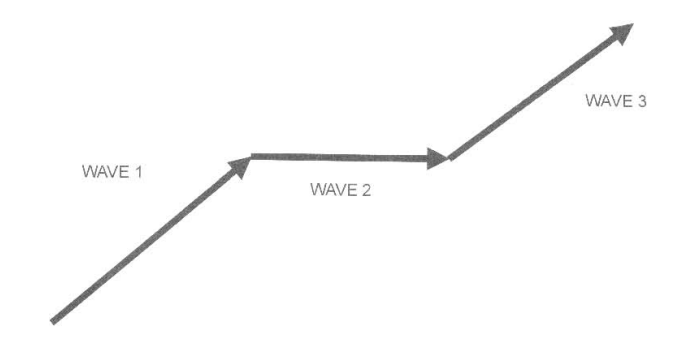

A

trend can also move up, with the following leg 2 moving sideways until leg

three begins the final leg of the pattern as seen in Fig. 5-2. This sideways

movement, once observed, can have some timing elements built into it. That

timing can be a result of the stochastics retracing to the oversold area and

curling back up. Then a candlestick ‘buy’ signal appears at the end of a flat

trading period. The end of the flat trading can also be correlated to the intersecting

of a major moving average. Most importantly being able to visually identify the

three-wave pattern set-up allows the candlestick investor to exploit the proper

timing of getting back into a trade.

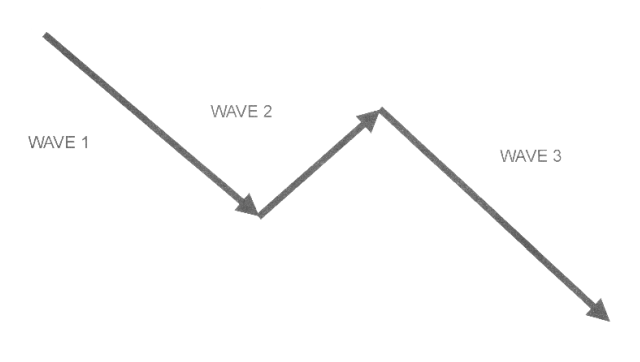

The

same analysis can be made on trends in a downward direction. A downward leg

will be followed with a bounce upwards. Then the final leg continues down to

test or breach the recent low, fig. 3.

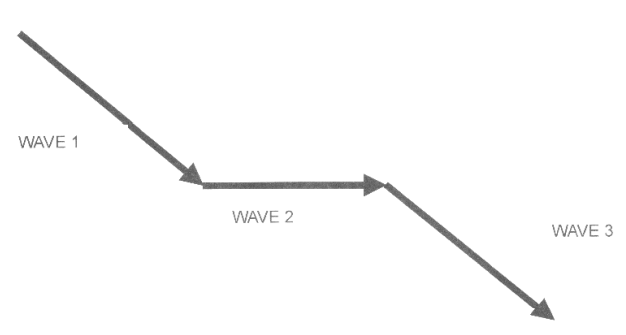

As

in the upward trend, a three-wave pattern can be a down leg, a flat trading

area, followed by the next leg to the downside as shown in Fig. 4.

Anticipating

how a wave pattern is developing provides the candlestick investor with

valuable information. It allows for the potential viewing of candlestick

signals at specific times, knowing that a leg of a wave pattern is forming.

This may seem very elementary However, with the well-established knowledge

that prices move in waves; then being prepared for a candlestick signal and a

new leg of a wave pattern creates excellent timing characteristics.

Does

a three-wave pattern always perform clearly? Not always, but often enough to

know to start looking for the next pattern. Keep in mind, the candlestick

signals are the main parameter for entry or exiting a trade. The wave pattern

is to provide a game plan for when those signals could appear. The advantage

provided by candlestick signals is the more defined reversal points. Whereas

Elliot wave analysts may want to hold a position through wave one to five, the

candlestick investor has the advantage of selling at the top of wave one, then

buying back at the end of wave two, etc. This produces much better use of the

invested funds, not losing equity during the pullbacks.

“Think simple” as my old master used to say-meaning reduce the

whole of its parts into the simplest term, getting back to first principles.

Keep

your wave count simple. Profits are not made by being able to proficiently

count wave counts. Profits are made by effectively buying at the proper time

and selling at the proper time. Utilizing candlestick signals, then evaluating

what the wave movements might be, will greatly enhance your profitability.

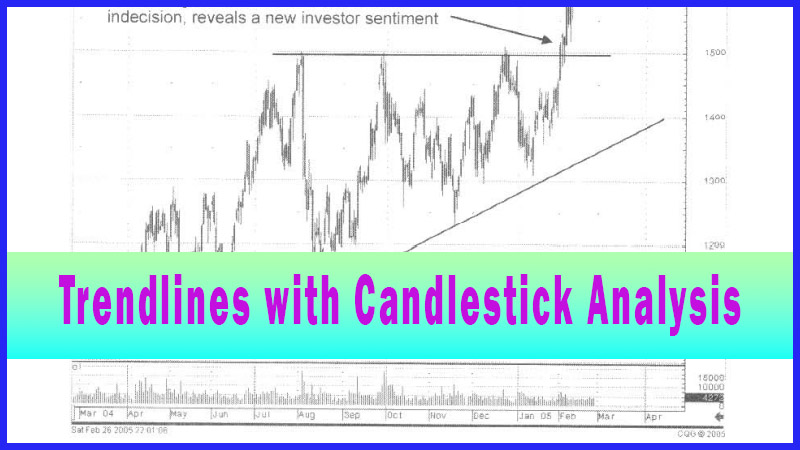

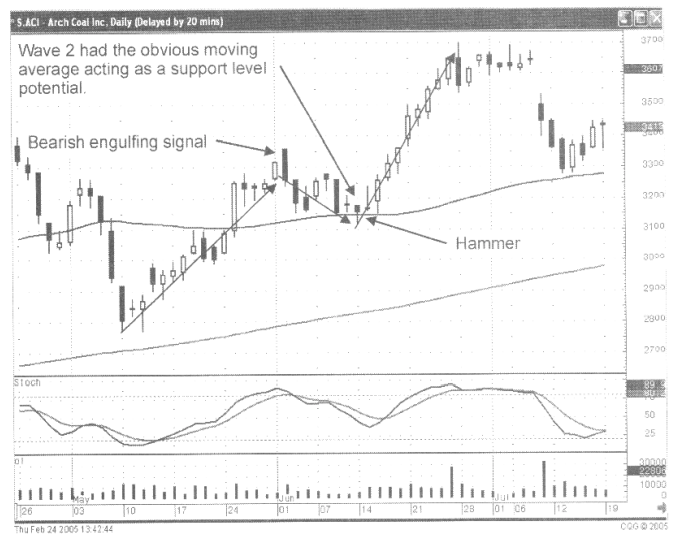

Fig.

5-5, the Arch Coal Inc chart illustrates a three-wave pattern. Wave 2, the pullback

in early June has a clear support level probability, the 50-day moving average.

The Bearish Engulfing signal forming on June 2 becomes the obvious sell signal

as the stochastics have finally climbed into the overbought area.

The

50-day moving average becomes the obvious target. That target experiences some

indecisive candlestick signals at mid-June. The Doji/Harami, a small hammer

that goes below the 50-day moving average, then closes above the 50-day moving

average, and the Inverted Hammer/Doji, all trading at the 50-day moving

average, provides a visual evaluation that the Bears are having a difficult

time pushing the price below that level. The buying confirmation the following

day provides an excellent trade entry indicator. The low for that day also

touched the 50-day moving average before revealing that the Bulls had stepped

in.

Fig.5-5

Arch Coal Inc.

These

signals, followed by a bullish trading day, caused the stochastics to turn up,

and provide a good visual picture of investor sentiment. This becomes a ‘buy5

area when analyzing that leg-three of a three-wave pattern could be developing.

The analysis becomes the anticipation that if there is no resistance at the

recent high, a good strong move could be occurring from these levels. The

upside potential is good. The downside risk is minimal. A close below the 50-

day moving average from this point would be the ‘stop.’

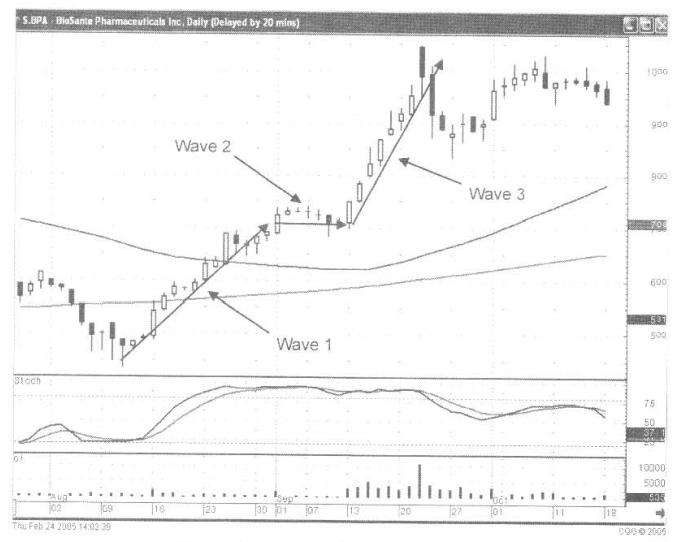

Fig. 5-6, The Biosante Pharmaceuticals Inc. chart demonstrates a three- wave pattern with a sideways movement. The series of Doji illustrate that although the buying had stopped; the selling pressure was not overwhelming. An investor may not want to sit through this period, having money exposed to a possible pullback. However, the bullish candle after the final Doji reveals which way investor sentiment wants to go after a flat trading period of indecision. If the position had been closed during the Doji, then buying back upon seeing the new buying strength, becomes a good decision anticipating that the third-leg of a three-wave pattern is starting.

Fig. 5-6, The Biosante Pharmaceuticals Inc

Being able to analyze a sideways movement, after viewing a series of Doji, allows for an intelligent decision to be made. The end of the series of Doji was going to either reveal investors selling, creating a top, or a bullish signal would begin the formation of a three-wave pattern.

In

either case, an investment decision could be made with a high probability

outcome. This analysis is nothing more than being mentally prepared for what

could occur. Having been mentally prepared creates the opportunity to take

advantage of the next price move. The execution of the next trade can be done

quickly and decisively.

How To make High Profit In Candlestick Patterns : Chapter 4. Candlesticks with Technical Patterns : Tag: Candlestick Pattern Trading, Forex : Best trading pattern, Top 3 trading Pattern, Top trading pattern, Best candlestick pattern - Three-Wave Pattern