Volume - The Other Confirmation Measure

How to trade volume, Volume Indicators, Price movement, Fundamental analysis

Course: [ Simplified Support and Resistance : Chapter 7. Volume - The Other Confirmation Measure ]

Confirmation remains the key to SR analysis and to all other forms of price study, notably when trying to anticipate target levels. Confirmation is especially important when trading decisions are going to be made based on what appears to be going on with price.

Volume: The Other Confirmation Measure

Confirmation

remains the key to SR analysis and to all other forms of price study, notably

when trying to anticipate target levels. Confirmation is especially important

when trading decisions are going to be made based on what appears to be going

on with price.

However,

price alone does not reveal every form of confirmation. Volume and the way that

it changes is also critical in validating a breakout from SR levels. For

example, if the neckline of a head and shoulders top is broken, the technician

would expect to see an increase in volume as prices rise. This volume trend

associated with price breakout serves as a confirming indicator in establishing

the change in a trend.

Volume

analysis can also serve as an indicator that disproves what appears to be

happening in the price movement. For example, if the volume does not increase

during a breakout from SR, then what otherwise appears as solid evidence may be

considered suspect and due to some event unrelated to the stock or simply a

false indicator. For example, a broad market index such as the Dow Jones

Industrial Average may break through resistance and many stocks may breakout as

well. However, some may bid up due to crowd mentality, while others may move

higher due to improving fundamentals and institutional buying activity. While

breakouts accompanied by a substantial increase in volume are solid confirming

signals, an apparent breakout with low volume may be a false indicator, and a

retreat back to the established trading range is likely.

Volume

should change in a consistent and measurable form if it is to be considered as

confirming information. For up trends, the volume will expand in the direction

of the trend, and during pullbacks or consolidations, the volume numbers will

recede. However, if the volume reaches an unusually high level in a short

period of time, that could signal the culmination of the trend and serve as a

contrary signal. This buying or selling climax would predict a reversal.

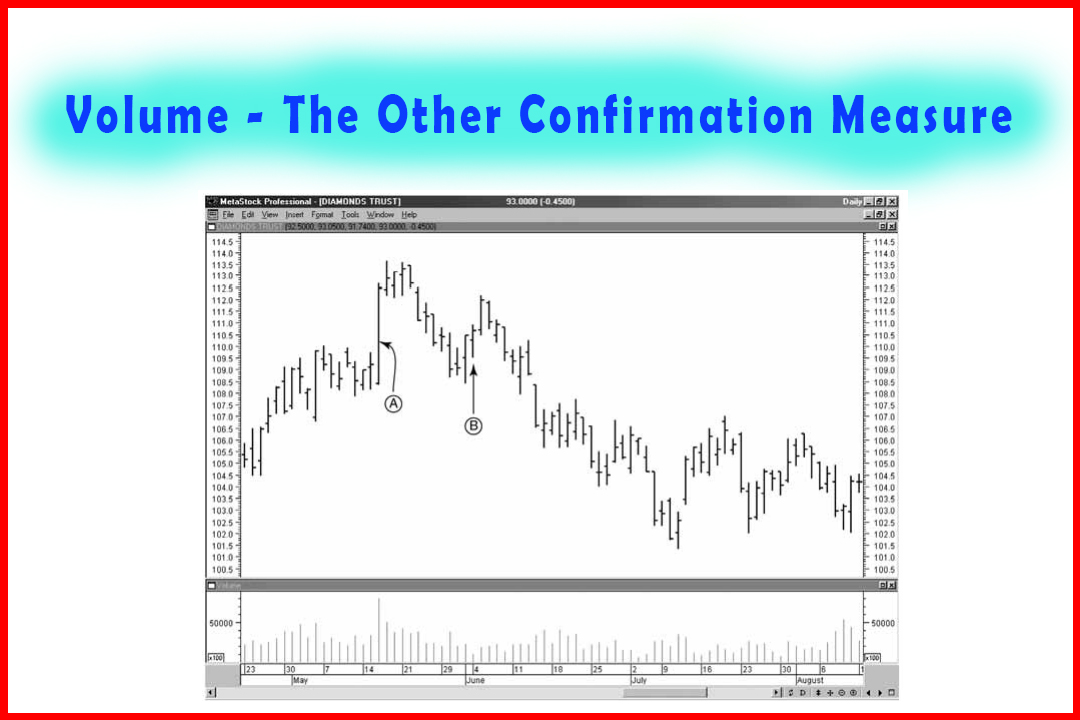

A

bottom may take the shape of a two-step process forming a major support level

and involving changes in volume. A bottom formation took place in Diamonds

(DIA), in March of 2001 shown in Figure 7-1. The first leg was a climatic

sell-off. Here, institutional investors liquidated their long positions at

Point A. Next, the market rallied as short position holders took profits. The

rally stalled, and the price retreated back down to the low, retesting the

first bottom. During this decline, the volume did not expand, indicating that

there were no more sellers in response to the lower prices (Point B). Technicians

call this a sold out market. The major support level was established at the

heavy volume day. At this

Figure 7-1

point,

the market has discounted all of the negative figure 7-1 fundamental and

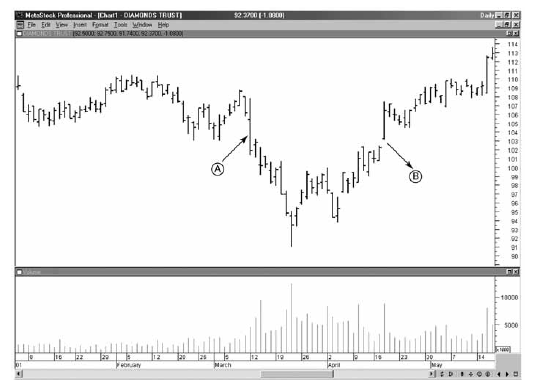

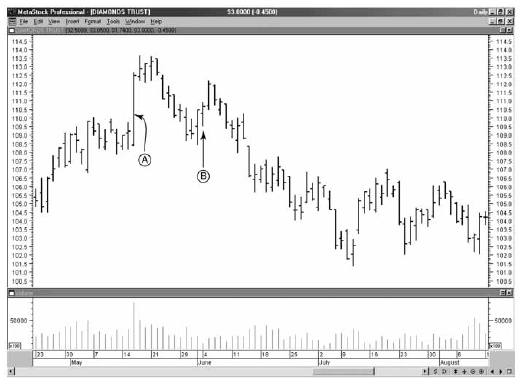

formed a major support level. A market top started with a buying climax (Figure

7-2, Point A). Here, the news had been positive, and more and more buyers

jumped onto the trend.

Profit-taking

caused a decline in price, retracing 38% to 50% of the previous rally. After

this, the price began to advance, retesting the first major resistance level,

but this time volume did not rise as higher prices were paid (Point B). This

anemic retest of the previous high indicated that everyone who could have

bought was already long. Resistance was set one day after the big volume day,

and a second, lower resistance level followed. Any negative news at that point

would have caused profit-taking. If the news had been negative, the likelihood

of a major

Figure 7-2

the top

was high. Major resistance had been established on the charts.

Volume Indicators

Technicians

have developed a host of volume-based indicators to confirm a breakout of SR

levels. The most common is the on-balance volume indicator (OBV) developed by Joe

Granville.1 This is the running

sum of the cumulative volume weighted by whether the market closes up or down

for the day. If the market closes up, then the entire day's volume is added to

the previous day's OBV value. If the market closes down, then the entire day's

volume is subtracted from the previous day's OBV value. Traders look for the

OBV line to confirm breakouts and the trend. Thus, if the market breaks out of

a trading range, then the OBV line should break out as well. As an even

stronger indicator, the OBV may lead and, thus, anticipate the price breakout.

Once in an up trend, the OBV line should steadily rise as the price trends

higher. If the OBV line begins to diverge, tracing out lower highs while the

market is making new highs, a reversal of the trend is anticipated.

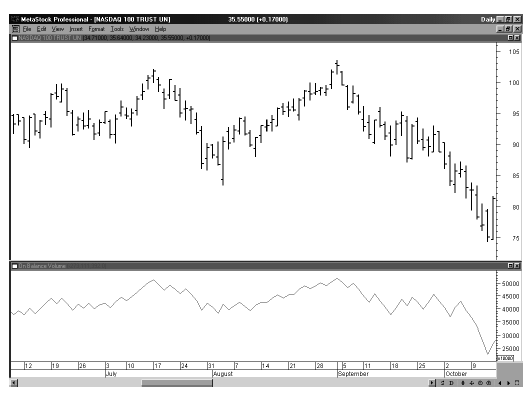

For

market tops, when prices break, a key support line the OBV line should also

break. It is an even stronger indicator if the OBV trend precedes the price. A

down-trending OBV line indicates that more volume is occurring on down-closing

days than on up-closing days. If the price continues to trade

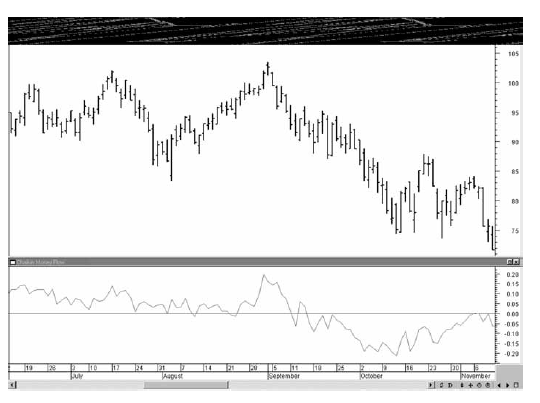

Figure 7-3

within

its trading range, the OBV line may predict the direction that the price can be

expected to move in the coming breakout. Figure 7-3 is the Nasdaq 100 Trust

(QQQ). The daily chart edged to a new high in September, but the OBV Line

stopped at the previous high. Next, as the QQQ began to work lower, the OBV

line broke through support before the same move in price, a good example of the

OBV leading. One problem with the OBV indicator is the price may close down

just a few cents for the day, causing all of that day's volume to be subtracted

from the OBV line. The calculation is an all-or-nothing without weight being

given for volume variations. The accumulation/distribution line2 is

another indicator that weights the volume by the percentage placement of the

closing price relative

Figure 7.4

to

the day's range, and then adds that adjusted volume number to the previous

day's accumulation/ distribution line. This indicator takes into account where

the market is closing each day and tracks volume accordingly. Most technicians

view the accumulation/distribution line as superior to the OBV line based on

the weighted volume. The accumulation/distribution line was improved further by

taking the sum of the weighted volume over the applicable period and dividing

it by the total volume. Figure 7-4 illustrates a positive reading that confirms a

breakout above resistance.

Summary

The

level of volume accompanying a breakout below support or above resistance

provides confirmation of the breakout, or a lack of corresponding volume

increases serves as an indicator that those breakouts are false and will

retrace. The addition of volume-based indicators vastly improves the

technician's ability to accurately predict price movement.

Remember,

though, that the forward-looking analysis of price and volume serves only to

improve your outcome, not to completely eliminate risk. We have to accept the

reality that the whole purpose of this study is to improve our predicting and

analytical skills. The next chapter summarizes modern trends in the science of

SR.

Simplified Support and Resistance : Chapter 7. Volume - The Other Confirmation Measure : Tag: Support and Resistance, Forex : How to trade volume, Volume Indicators, Price movement, Fundamental analysis - Volume - The Other Confirmation Measure