Volume Helps Find Strength of the Trend

volume indicator strategy, volume indicator in share market, volume indicator in stock market, volume indicator mt4

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 4. Momentum Changes ]

Volume helps the position trader identify the strength of the trend of the lack of conviction of market participants.

INTEGRATE VOLUME AND INDICATORS

Volume

helps the position trader identify the strength of the trend of the lack of

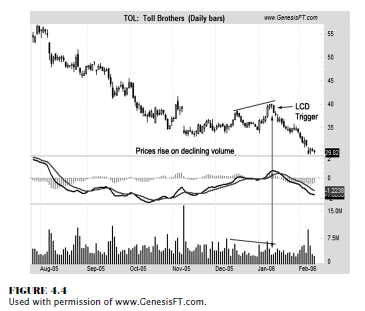

conviction of market participants. Take a look at Toll Brothers in Figure 4.4.

This stock took a complete nosedive starting in mid-July. Many thought that the

bottom was in and that a rally would take this home builder back to the highs.

Not quite so, said the volume! There was a rally attempt, but it was on lower

volume. Adding the MACD indicator shows confirmation that a price trend or

market rally would not occur. The MACD signaled a negative zero-line cross, and

the moving average components crossed as well. The low close doji trigger did

not help matters for hopeful bulls either. As the failed rally crumbled, the

downtrend resumed and volume started to increase, confirming a bear trend. The

MACD indicator continued to back that downtrend, warning traders that lower

prices would prevail.

I want to

illustrate how you can integrate volume with both MACD and stochastics so you

can see how helpful volume analysis can be to indicate overbought market

conditions.

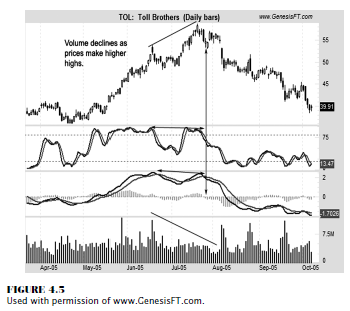

Armed

with this information, you will have an easier job identifying trading

opportunities and a less stressful time choosing a strategy. Figure 4.5 shows

Toll Brothers at its peak. It was a media darling. The housing bubble was ready

to burst; so when people say they never saw it coming, they just did not know

what to look for. The market went into a blow-off phase, which resembles the

pattern or condition that Apple Computer was in in Figure 4.2. The volume was

declining on higher prices, the MACD had a lower high, and stochastics

confirmed the bearish divergence. A low close doji pattern formed at the top

(which was within pennies of the monthly pivot resistance number). Once the

price reversal occurred, you can see how much volume picked up, confirming the

trend reversal. In fact, the average daily volume levels increased as the

downtrend materialized.

BULLS TAKE CHARGE

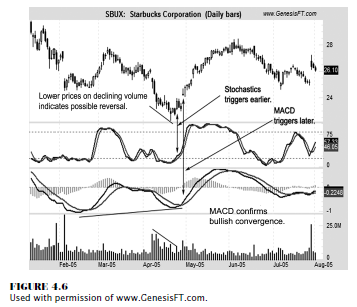

I

illustrated the relevance of volume confirming technical indicators and stated

the principles that apply to all actively traded markets, including forex or

spot currency traders. The opposite signals work for identifying bottoms in all

actively traded markets. Let’s look at one of my favorite stocks, Starbucks.

What an experience! Paying two bucks for a cup of black joe! I’ll tell you

what, if it hadn’t been for my friend Les Zieba (my coffee connection) and

Starbucks, this book would most likely never have been finished. Just on my

intake of Ventes alone writing this book, I probably added a dollar per share

to the value of this stock. In any event, let’s look at the chart in Figure

4.6. The stochastics and, more important, the MACD displayed a solid bullish

convergence, with corresponding higher lows as prices made lower lows. As the

price dipped, forming a hammer, notice how the volume levels declined. As we

discussed in Chapter 3, the MACD can trigger a signal later than stochastics

can, and here we see that occur. The point is, the volume levels were declining

on newer lows, indicating that this market was percolating—ready to reverse

higher, full steam ahead!

TRADERS NEED TO ASK MORE QUESTIONS

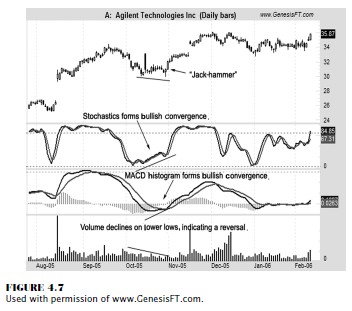

I always

like to ask myself questions about a market or a potential trading opportunity.

One such question is, If a market is so bearish, why does it not go down?

Figure 4.7 shows Agilent Technologies, a solid company that was one of the many

tech darlings that imploded. As we see, the market appears ready to decline and

fill the gaping hole called a gap between 26 and 28 in August 2005. Notice that

the chart pattern makes a lower low formed by a hammer candle. But the market

decline was on significantly lower volume. On one hand, one would think the gap

would be “filled” as prices trade back near the low end of where the gap was

created near 26 per share. But on the other hand, volume and both the MACD and

stochastics indicators worked together to indicate otherwise. Prices reversed

sharply higher based off the jackhammer pattern (we discuss this very bullish

pattern and the rules to trade it in Chapter 8). As the price of this stock

traded higher, notice the volume levels moved in the price direction, meaning

volume was increasing on increasing prices.

You can

identify overbought or oversold conditions based on a variety of methods.

Volume studies help me understand what the true strength or weakness of a trend

is.

When

prices are making what can be perceived as a “false high,” meaning a higher

high, it is accompanied on lower volume levels. When volume levels are not

moving parallel with prices, a divergence is occurring. So if prices are moving

up, we should see volume moving up. When price is going up and volume is going

down, something is wrong and I need to ask myself why. It is at this point that

I am aware that something is not internally correct with the market, especially

if the fundamentals are wildly bullish. If volume is not confirming the price

action, I should take that clue and should start looking for strategies in

which to capture a potential trend reversal opportunity, whether it is by

liquidating a long or by initiating a short position or by buying a put option

or by taking on another option strategy.

The same

holds true for the opposite condition: When prices are making a false bottom,

we have a bullish convergence or oversold condition. That situation exists and

can be spotted as the price direction is not confirmed by volume. If prices are

making lower lows, if the market is truly bearish, we should see heavy volume.

When volume levels are light and prices are declining, it is a signal that

selling pressure is drying up. Then as prices reverse higher to confirm a true

turnaround, we should see volume increase as buyers come into the market. This

is exactly what happens in Figure 4.7. In addition, using the indicators to

help spot these false bottoms will give you added confidence not only to

execute a trade but also, more important, when.

The Candlestick and Pivot Point Trading Triggers : Chapter 4. Momentum Changes : Tag: Candlestick Pattern Trading, Forex, Pivot Point : volume indicator strategy, volume indicator in share market, volume indicator in stock market, volume indicator mt4 - Volume Helps Find Strength of the Trend