Key Price of Support and Resistance

key price of support and resistance indicator, key price of support and resistance levels indicator mt4, key price of support and resistance levels forex, key price of support and resistance levels

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points ]

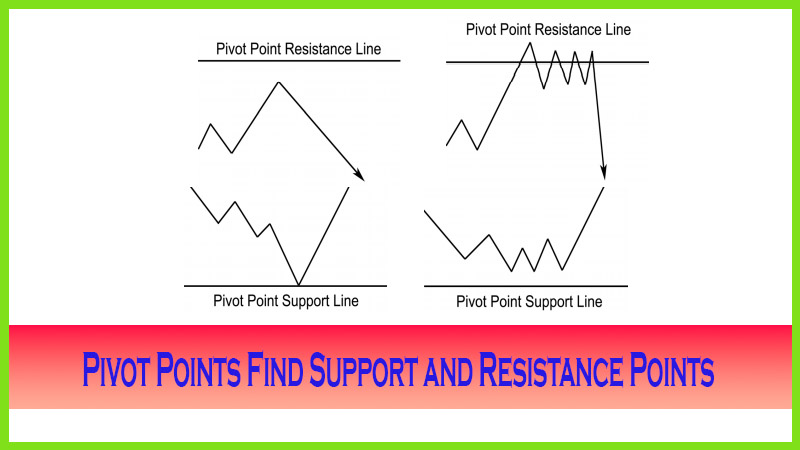

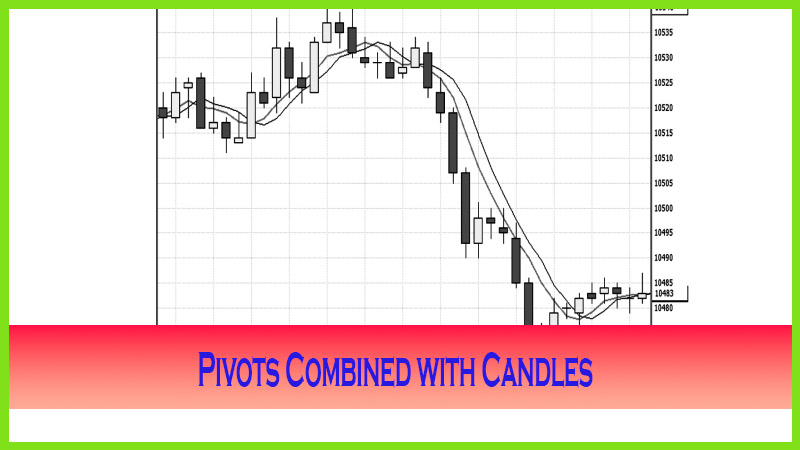

The power in using pivot point analysis is that it works in all markets that have established ranges, based on significant volume or a large group of collective participants. After all, the current market price equals the collective action of buyers and sellers.

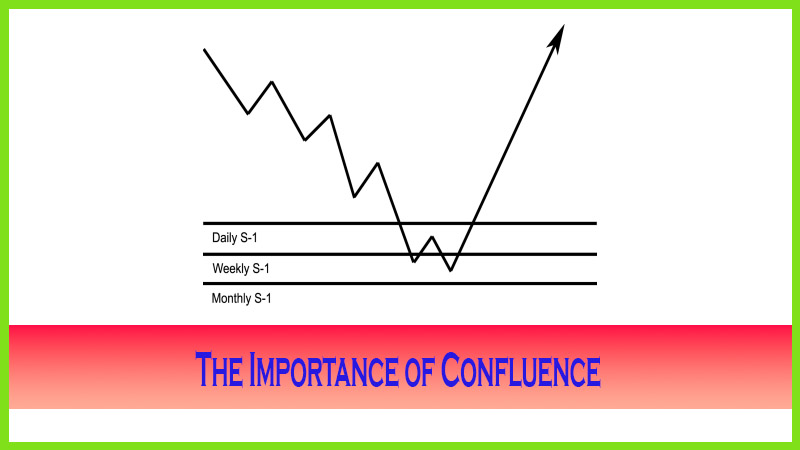

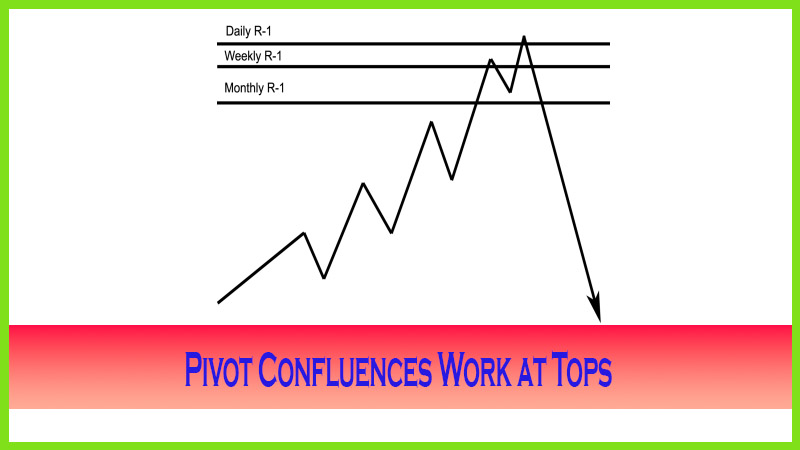

Determine Key Price Support and Resistance Areas and the Importance of Confluence

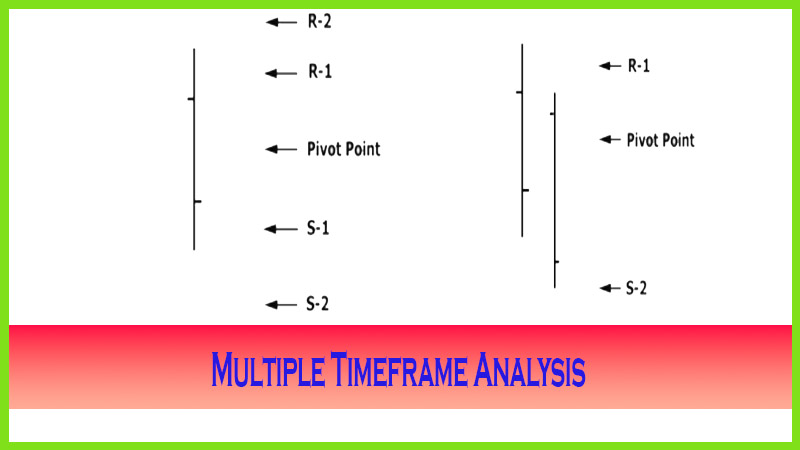

This

chapter is the heart and soul of the book. It will explain the methodology of

pivot point analysis from “A to Z,” or should I say “R- 3.” This chapter will

describe in full detail the principles behind the mathematical calculations and

the rationale behind the psychological impact that drives traders to make

decisions around these predicted support (S) and resistance (R) levels. I will

break this chapter into separate sections to explain how pivot points can be

used for short- and longer-term stock trading; how it applies to futures

trading, especially when day trading stock index futures; and finally how it

applies to the spot foreign exchange (forex) markets. Each investment vehicle has

its own nuances, such as trading session hours, time periods in which volume

flows change, contract sizes, and decimal point placement so that you know how

to correctly calculate the pivot point levels. You need to know the foundation

of the methodology of pivot point analysis first, so you will know how to then

apply it to the specific markets of interest that you are trading.

The power

in using pivot point analysis is that it works in all markets that have

established ranges, based on significant volume or a large group of collective

participants. After all, the current market price equals the collective action

of buyers and sellers. Pivot point analysis is a robust, time- tested, and,

best of all, testable form of market analysis; that is, you can back-test to

see the accuracy of this trader’s tool’s predictive analysis. The really

unbelievable aspect of pivot point analysis is who uses it. In fact, many

traders feel compelled not to learn about it because it seems complicated. I

will dispel that myth. Other traders who had read my previous book felt that

since I had mentioned futures, rather than equities or forex, pivot analysis

did not apply to those specific markets. The truth is that many leading

educators in the field of forex and stock trading have either bought my

advanced trading course or attended one of my live two-day trading seminars and

now share these methods. These are the same techniques I will explain and teach

in the following chapters and reveal in the accompanying CD (compact disc).

Remember

I explained previously that as a trader you have the right and the obligation

to understand everything there is about trading. You need to have a good

understanding of game theory. Many traders today use a “black box” method,

which is run by algorithm means, that triggers trades automatically. You must

understand what goes into building a trading system and how it triggers the

automatic reaction when a market price hits at or near a specific level. You

are competing not just against fellow traders, but against institutions and

major investment groups as well as savvy computer experts, who have a method

for removing the emotional element from trading. So what are these levels, and

why do we see major reactions or reversals from these mysterious points on the

charts?.

The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points : Tag: Candlestick Pattern Trading, Forex, Pivot Point : key price of support and resistance indicator, key price of support and resistance levels indicator mt4, key price of support and resistance levels forex, key price of support and resistance levels - Key Price of Support and Resistance