VOLUME PRICE CONFIRMATION TOOL AND TREND INDICATOR

Price momentum indicator, Trend finder indicator, confirm market price extremes

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 4. Momentum Changes ]

The principles are the same and apply to all three markets. Remember that a good trader has a reason for entering a trade.

VOLUME IS THE BEST PRICE CONFIRMATION TOOL AND TREND INDICATOR

In

Chapter 1, we went over the basic rule structure for volume analysis. But how

can we apply that to help confirm market price extremes? This is actually

fairly simple, if you know what to look for. That is what this section is

designed for. It does not matter what market you are trading, whether it be

stocks, futures, or forex. The principles are the same and apply to all three

markets. Remember that a good trader has a reason for entering a trade. A great

trader waits until the signal triggers and then acts on that signal. Just

because a market goes up and is “too high” in value does not mean it is going

down, at least not until the signals are present. Market price extremes are

generally a reflection of high volatility; and with high volatility comes

increased market participation or action, and that action is measured or

reflected by high volume.

OVERBOUGHT MARKET CONDITION— A DEAD GIVEAWAY

If you drop a boulder off a cliff, it falls at a speed that

is much greater than the speed of the boulder being pushed up a hill. That is

the analogy of what happens when a bull market or uptrend stretches too far too

fast, or is “overbought.” So we look for these types of conditions in which to

ride the price direction if we are looking to establish a short position or we

want to exit a long position before the boulder falls. Using volume analysis in

con-junction with indicators is a powerful tool to help you determine whether a

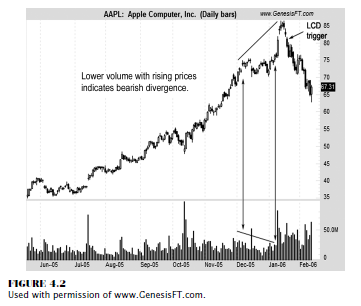

market price trend may continue. Look at Figure 4.1. This chart on Amazon is

a dead giveaway that the price appreciation was unsustainable; as we see, the

market moved from a bullish trend to a consolidation phase with higher highs.

However

the volume levels were declining, giving a direct clue that the price advance

was unsustainable. When combined with the low close doji pattern, which we will

disclose in Chapter 8, and a shooting star, there was no reason to stay long

this market. Notice that as prices started to depreciate, the volume increased,

which reflected sellers’ active participation, which attracted more selling.

THE “COMEBACK” KID STOCK

In

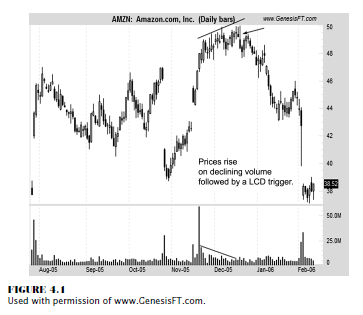

Figure 4.2, we see one of the greatest success stories in 2005 for any company,

Apple Computer. It just could do no wrong, except when the price of the stock

advanced too far too fast, culminating in an overbought unsustainable price extreme.

The fundamentals were quite rosy, as

holiday sales were through the roof on iPods and accessories. You want to talk

about a racket; this company has products on top of products that accessorize

the accessories, none of which are inexpensive. What a gold mine! Holiday sales

were strong, and the market blasted off. In fact, notice the gap up, then

notice the gap down, leaving what we technicians call an island top. (This

formation is covered in Technical Trading Tactics on page 75.) It also formed

the low close doji pattern. It really is the volume that helped confirm the

market’s overbought condition. As prices broke out of the sideways pattern,

from a high near 75 as it went onward to over 85, see the volume decline

showing fewer market participants wanting to join the price advance. As the

sell-off materialized, like a boulder falling off a cliff, more participants

started selling as volume increased, signaling a strong price reversal.

BLOW-OFF TOPS ON VOLUME SPIKES

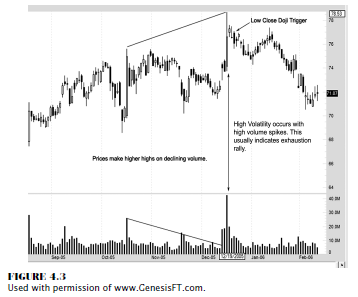

Volume

levels help confirm the true strength of a price move if the market

demonstrates a price increase. If volume does not confirm the market’s new

assigned value, something is wrong and a price reversal is imminent. Volume is

also a great indicator of blow-off tops, or what is called an exhaustion rally.

Volume spikes or surges can and do indicate price reversals, especially after a

price advance on declining volume is preceded by a lack of price

follow-through. As we study the chart in Figure 4.3, you see that the huge

price advance is accompanied with abnormal or heavier than usual volume. You

would anticipate that a breakout to sharply higher levels would occur. The high

volatility reflects the increased volume levels; and as the next time frame

shows, there is no follow-through to back the price advance. This is a clear

sign of a price reversal. The low close doji trigger also seals the deal that

this was simply a one-day wonder rally that failed, and a price reversal was to

be expected.

The Candlestick and Pivot Point Trading Triggers : Chapter 4. Momentum Changes : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Price momentum indicator, Trend finder indicator, confirm market price extremes - VOLUME PRICE CONFIRMATION TOOL AND TREND INDICATOR