Patterns of Moving Average Convergence/Divergence (Macd) - How to USE it?

patterns of macd indicator, patterns of macd chart, What is MACD

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 3. Using Read Oscillators to Spot Overbought ]

The MACD has the same principles as far as a sell signal with what is known as bearish divergence. This is where the market price itself makes a higher high from a previous high, but the underlying MACD crossover lines make a lower high. This indicates that the second high is a “weak” high and can resort to a turnaround for a lower price reversal.

RELY ON THE PATTERNS

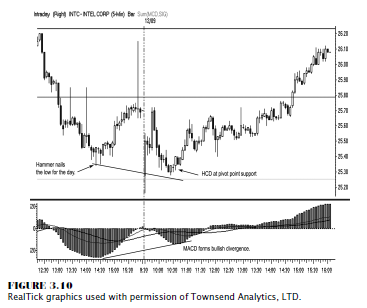

Another

method useful with the MACD indicator, and one that is more reliable for

determining a trend reversal, is to identify the pattern called bullish

convergence. This is where the market price itself makes a lower low from a

previous low, but the underlying MACD pattern makes a higher low, as shown in

Figure 3.10. This indicates that the second low is a weak, or “false,” bottom

and can resort in a turnaround for a sharp price reversal. This is similar to

stochastics; however, since it is developed from moving averages, the timing of

the shorter-term versus the longer-term moving averages can delay such a

signal. There is a high probability that MACD and stochastics work more so than

other indicators with this pattern.

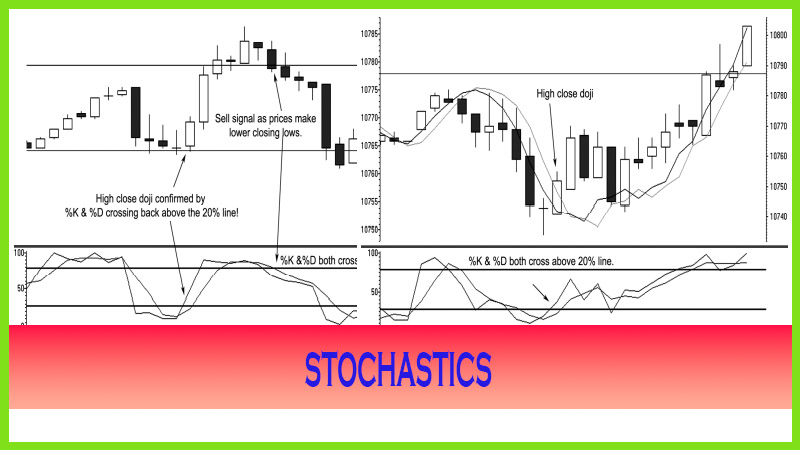

As you

can see in Figure 3.10, which is a five-minute chart on Intel, the market made

a lower low in the next trading session where the MACD histogram makes a higher

low. Notice the HCD signal. Then as the price starts to appreciate, the MACD

histogram triggers or confirms a long position with a zero-line crossover, and

the progressively higher histogram bars confirm the positive momentum right

into the close of the day. The MACD is a very useful tool as a confirming

indicator once you have entered in a position, especially by following the

histogram readings.

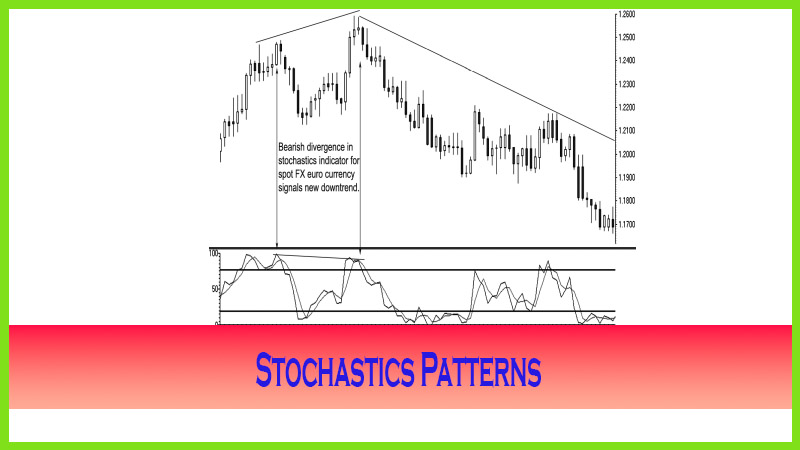

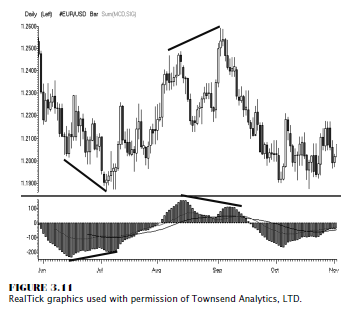

The MACD

has the same principles as far as a sell signal with what is known as bearish

divergence. This is where the market price itself makes a higher high from a

previous high, but the underlying MACD crossover lines make a lower high. This

indicates that the second high is a “weak” high and can resort to a turnaround

for a lower price reversal. In Figure 3.11, a daily chart in the FX spot euro

currency, the MACD histogram helps identify both bearish and bullish divergence

patterns.

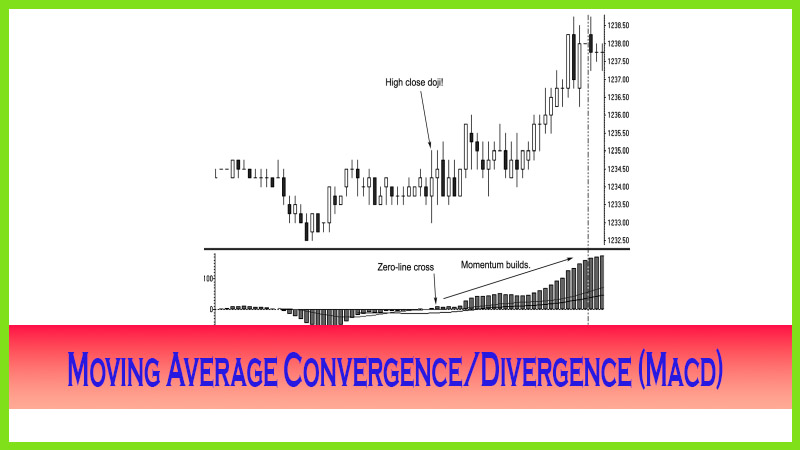

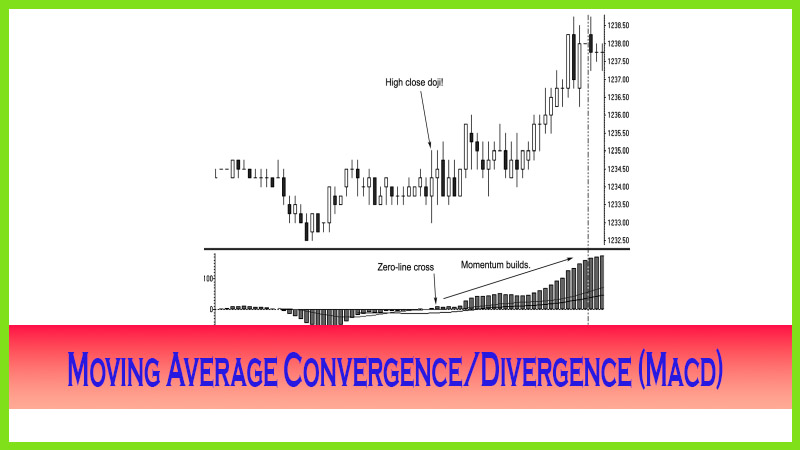

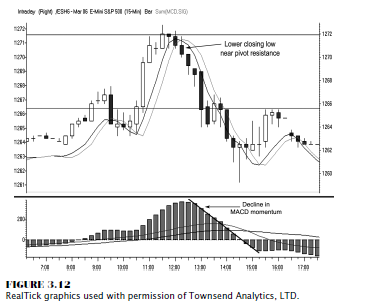

One other

useful method in using MACD is to follow as stated the direction of the

histogram bars to help confirm a turn or a change in trend. Figure 3.12 shows

the price advance in the e-mini-S&P as the market closes in on a pivot

point resistance level, and the market moves from a bullish condition as prices

move higher or in an overbought state and the histogram readings start to

expand over 300.

As the

market price conditions change, as the close is below the open, and as the

market makes the first lower closing low, especially near the pivot resistance

line, the histogram bars start rolling down or making lower highs as well. In a

weak or down-trending market, the bars should also be making lower highs; and

in this case, they are confirming a sell signal from the change in market

condition as well as the moving average crossover as prices trade under the

moving average lines. This last example is what we will be going over in later

chapters as we combine pivot point analysis with candle patterns.

SUMMARY

In

conclusion, all oscillators, indicators, and most moving average studies will

give confirmation when a market shifts direction; and knowing these signals

will help you identify a trading opportunity. They also will help give you a

clue when a market is in an extreme price condition, described as being

overbought and oversold. Therefore, as a trader, you need something that gives

you a better idea of entering a trade. The next few chapters will reveal ways

by which you will learn how to identify shifts in momentum before looking at an

indicator as confirmation. Impossible, you say? Well, there are certain

patterns such as the high close doji, the jackhammer candle pattern, a low

close doji, or the shooting star formation that, when up against a projected

pivot support or resistance line, will alert you to a trade entry faster than

using these traditional indicators. When I introduce you to the concept of

using a pivot point moving average component as was used in Figure 3.12, then

you will see how it is possible.

The Candlestick and Pivot Point Trading Triggers : Chapter 3. Using Read Oscillators to Spot Overbought : Tag: Candlestick Pattern Trading, Forex, Pivot Point : patterns of macd indicator, patterns of macd chart, What is MACD - Patterns of Moving Average Convergence/Divergence (Macd) - How to USE it?