Build Your Trading Plan

General Trading Rules, What are the benefits of using a trading plan, How to Trade Supply and Demand

Course: [ Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy ]

A Trading plan doesn’t guarantee absolute success. It only helps you stay focused and avoid costly mistakes. By documenting the process, you learn what works and what does not, and after the market closes you can reevaluate your performance and easily pinpoint where you went wrong.

Build Your Trading Plan

“Fail to plan and you plan to fail” - Those

who are serious about being successful traders should follow these words.

Writing a

trading plan doesn’t guarantee absolute success. It only helps you stay

focused and avoid costly mistakes. By documenting the process, you learn what

works and what does not, and after the market closes you can reevaluate your

performance and easily pinpoint where you went wrong.

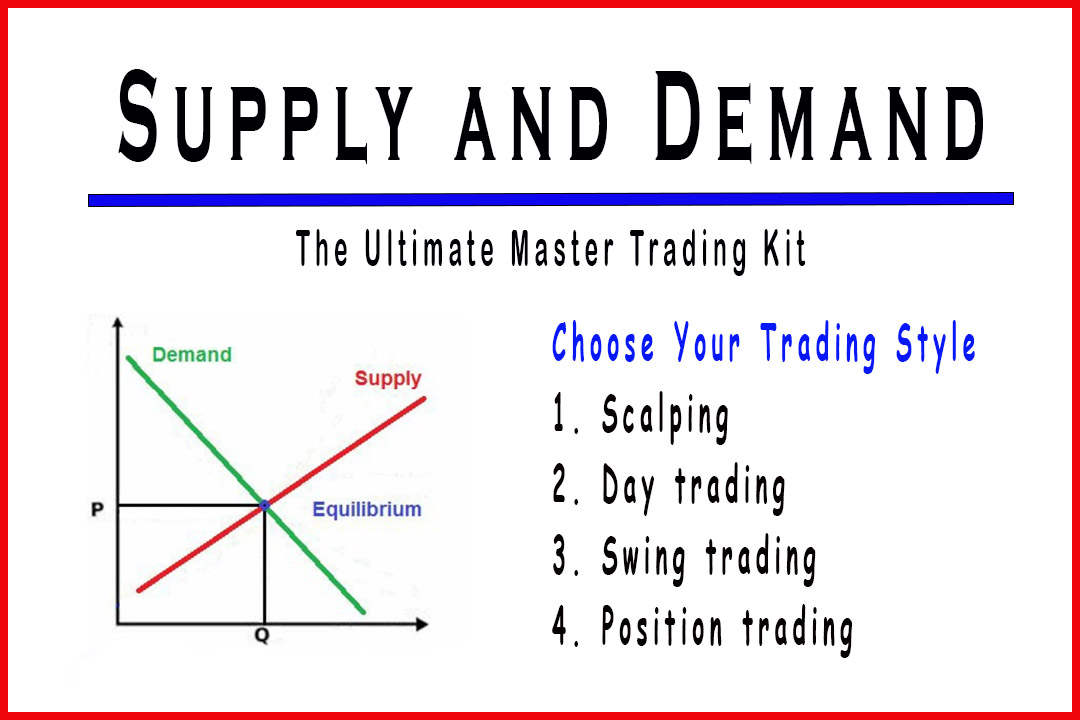

Each

trader should write their own trading plan, including personal trading styles and

goals. Using someone else’s trading plan doesn’t mean it will work for you too.

A trading

plan is a set of guidelines and rules that defines your trading activity. It

can be quite handy when you have to make quick and wise trading decisions.

General Trading Rules:

·

Write down your reasons for

trading and the long-term goals that you aim to achieve. This will help you

stay focused and organized.

·

Keep a trading journal or a

trading log with all your trading activities. It is critical in planning a

long-term strategy to be able to view your past and present trades and also

which markets you are been exposed to.

·

Good money management is an

important element of any trading plan. You need to have a set of rules for

managing your money, especially your risk exposure.

Key Questions:

·

What is your motivation for

trading?

·

What is your attitude to risk?

·

How much time can you give to

trading?

·

What is your level of knowledge?

What are the benefits of using a trading plan?

The

financial market can be volatile at times, and it is at these moments that you

could be prone to erratic trading behaviors that could cost you all your

capital. A trading plan is a vital point of reference in these situations,

because you have taken time to elaborate a plan B in case plan A fails, and

therefore, all you have to do is execute your trading plan that you already

have established in advance. Act according to your plan, rather than make bad

decisions on the spot.

Many

traders fail to keep a trading log or a trading journal. It should contain a

record of all your trading activities with a section where you write your

comments. You can use it to get an overview of your trading history and easily

identify success and mistakes made along the way.

No

trading plan is complete without including your risk-reward tolerance. By

quantifying this in advance, you can assess whether a trade is too risky or

not. Your risk-per-trade scale could be like this:

·

Low risk 1 -2% of total equity,

·

Medium risk 2-5% of total equity,

·

High risk 5% or more of total

equity,

A trading

plan can be a constant reminder of your capabilities and your limitations.

Having a written plan is extremely useful for a trader to know when and where

to enter and exit the market, to stay disciplined and loyal to your trading

guidelines.

Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy : Tag: Supply and Demand Trading, Forex : General Trading Rules, What are the benefits of using a trading plan, How to Trade Supply and Demand - Build Your Trading Plan