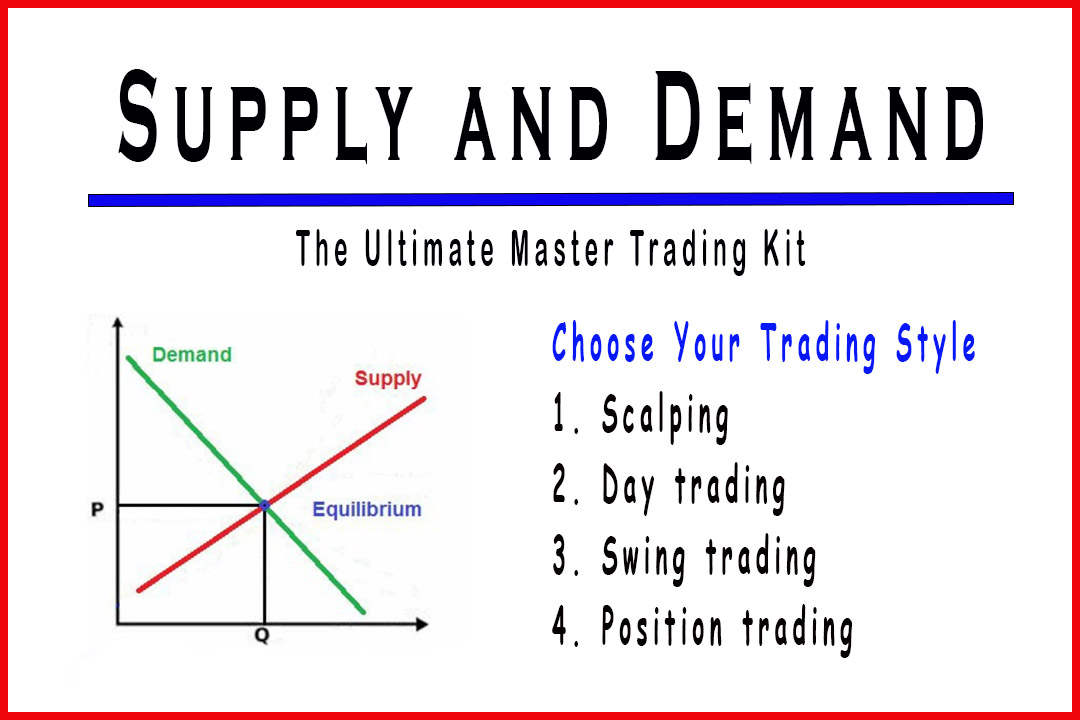

Supply and Demand Strategy - Choose Your Best Trading Style

Scalping, Day Trading, Swing Trading, Position Trading

Course: [ Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy ]

There are four main styles of trading: scalping, day trading, swing trading and position trading. The difference between these styles is based on the length of time that traders keep their trades open. Scalping traders are only holding their positions for a few seconds to a few minutes.

Choose Your Trading Style

There are

four main styles of trading: scalping, day trading, swing trading and position

trading. The difference between these styles is based on the length of time

that traders keep their trades open. Scalping traders are only holding their

positions for a few seconds to a few minutes. Day traders keep their positions

for anywhere from a few minutes to hours. While swing traders hold their

positions for a few days. Finally, position traders are holding their positions

for anywhere from a few days to several years.

Choosing

the right trading style that best suits your personality and your lifestyle can

be a difficult task, but it is absolutely necessary to your long-term success

as a professional trader.

Scalping

Scalping

is very rapid trading style, and scalpers often make trades within a very short

time. This trading style is very demanding and traders need to make immediate

trading decisions and act on it without second guess.

Being a

successful scalper requires focus, concentration and most importantly stress

management. Because they spend a great time in front of their screens looking

for short and quick opportunities, they need to be able to manage their level

of stress and keep calm no matter what the outcome is.

Day Trading

Day

trading style is suited for those who like to open and close trades within the

same day. They are often unable to sleep at night knowing that they have an

active trade that could be affected by overnight price movements.

Swing Trading

Swing

trading is compatible with people that have patience to wait for a trade and be

able to hold it overnight. So it is not suitable for those who would be nervous

holding a trade while they are away from their computer.

This

trading style requires a large stop loss and the ability to keep calm when a

trade is going through retracements.

Position Trading

Position

trading is the longest-term trading and often has trades that last for several

years. Position trading style is more suitable for the most patient, least

excited traders and has a large capital to begin with.

Choosing

a trading style requires the flexibility to know when a trading style is not

working for you, but also requires the consistency to stick with the right

trading style even when it is not performing optimally.

One of

the biggest mistakes that new traders often make is to change trading styles at

the first sign of trouble.

Constantly

changing your trading style or trading system is a sure way to catch every

losing streak. Once you are comfortable with a particular trading style, remain

faithful to it, and it will reward you for your loyalty in the long run.

Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy : Tag: Supply and Demand Trading, Forex : Scalping, Day Trading, Swing Trading, Position Trading - Supply and Demand Strategy - Choose Your Best Trading Style